Definition and meaning

The Complaint for Wrongful Repossession of Automobile and Impairment of Credit is a legal document filed by a person who believes that their automobile was wrongfully seized by a creditor. This form outlines the circumstances surrounding the repossession and details the damages incurred due to the creditor’s actions, including any negative impacts on the individual’s credit rating.

How to complete a form

To complete the Complaint for Wrongful Repossession of Automobile and Impairment of Credit, follow these steps:

- Begin by filling in the court information at the top of the form.

- Clearly state your name and contact details as the Plaintiff.

- Provide the name of the Defendant along with any relevant business details.

- Detail the car's description, including year, make, and model, and include the date of repossession.

- Document all financial impacts you experienced as a result of the repossession, including any cash payments made to recover your vehicle.

- List any emotional distress or community embarrassment caused by the wrongful repossession.

- Sign and date the form to verify its accuracy before submission.

Who should use this form

This form is intended for individuals who have had their vehicles repossessed unjustly, specifically if they believe the repossession was conducted improperly or without proper notice. If you have faced credit impairment as a direct result of the wrongful repossession, this form may be suitable to seek legal recourse against the party responsible.

Legal use and context

The Complaint for Wrongful Repossession of Automobile and Impairment of Credit is used in civil court to assert your rights against a creditor who has seized your vehicle. It is important in establishing legal grounds for your claim and addressing any damages incurred, including emotional and financial losses. This form represents your formal complaint to the court, initiating legal proceedings against the defendant.

Key components of the form

The following are vital components of the Complaint for Wrongful Repossession of Automobile and Impairment of Credit:

- Caption: The heading indicating the court name, case number, and names of the plaintiff and defendant.

- Facts of the case: A narrative outlining the sequence of events leading to the repossession.

- Claims for relief: Clearly defined claims detailing the damages you are seeking.

- Signature block: Area for the plaintiff and their attorney to sign, confirming the information provided.

Common mistakes to avoid when using this form

When completing the Complaint for Wrongful Repossession of Automobile and Impairment of Credit, be cautious of the following common mistakes:

- Failing to provide complete and accurate personal information.

- Not including key details about the vehicle and repossession.

- Omitting damages or emotional distress claims.

- Signing without verifying all information is correct.

What documents you may need alongside this one

In addition to the Complaint for Wrongful Repossession of Automobile and Impairment of Credit, consider gathering the following documents:

- Any correspondence with the creditor regarding the repossession.

- Proof of ownership of the automobile, such as the title.

- Records of payments made towards the vehicle.

- Documentation of any financial losses, such as repair costs or lost wages.

Aren't you sick and tired of choosing from countless templates each time you need to create a Complaint for Wrongful Repossession of Automobile and Impairment of Credit? US Legal Forms eliminates the wasted time countless Americans spend exploring the internet for perfect tax and legal forms. Our professional crew of lawyers is constantly changing the state-specific Forms library, to ensure that it always offers the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription should complete a few simple steps before having the capability to get access to their Complaint for Wrongful Repossession of Automobile and Impairment of Credit:

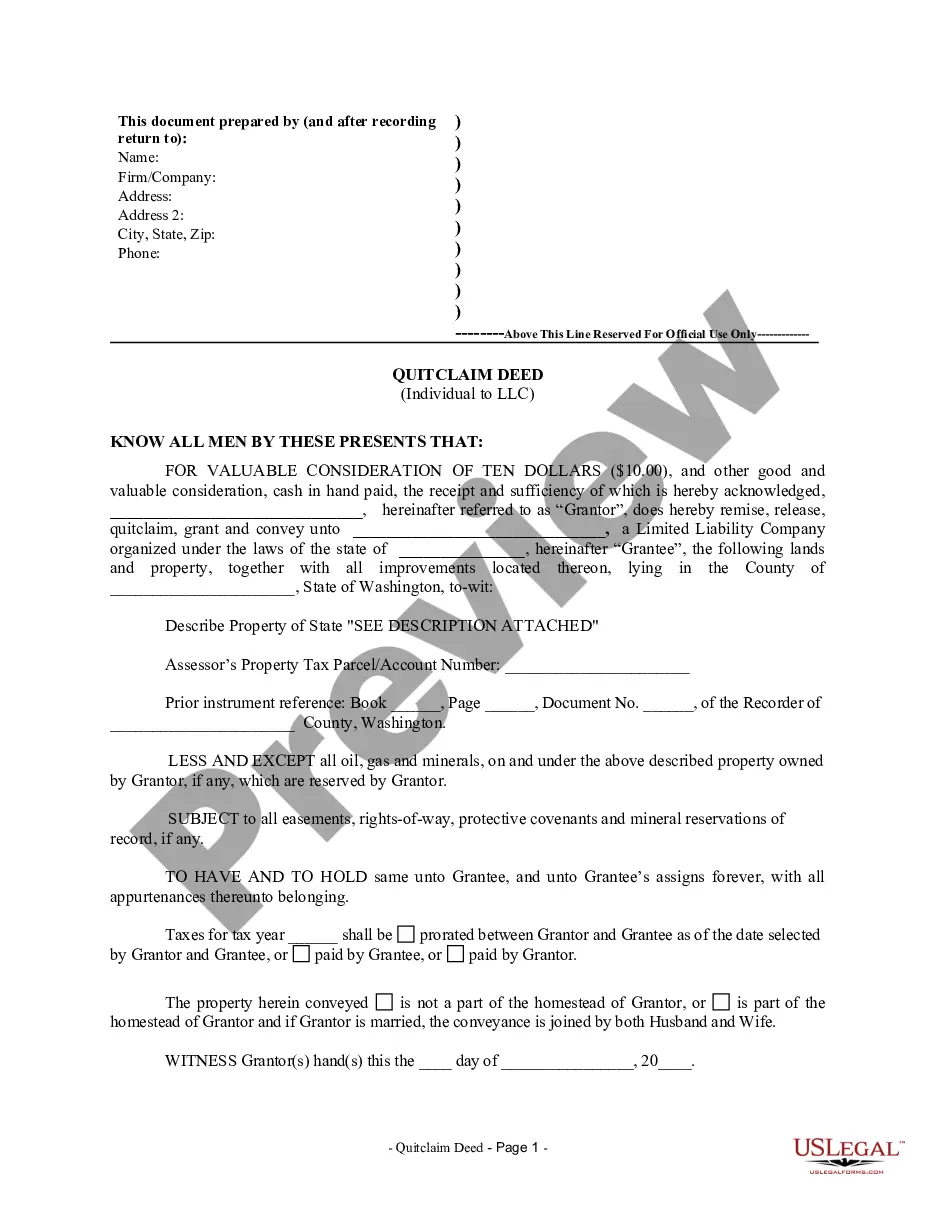

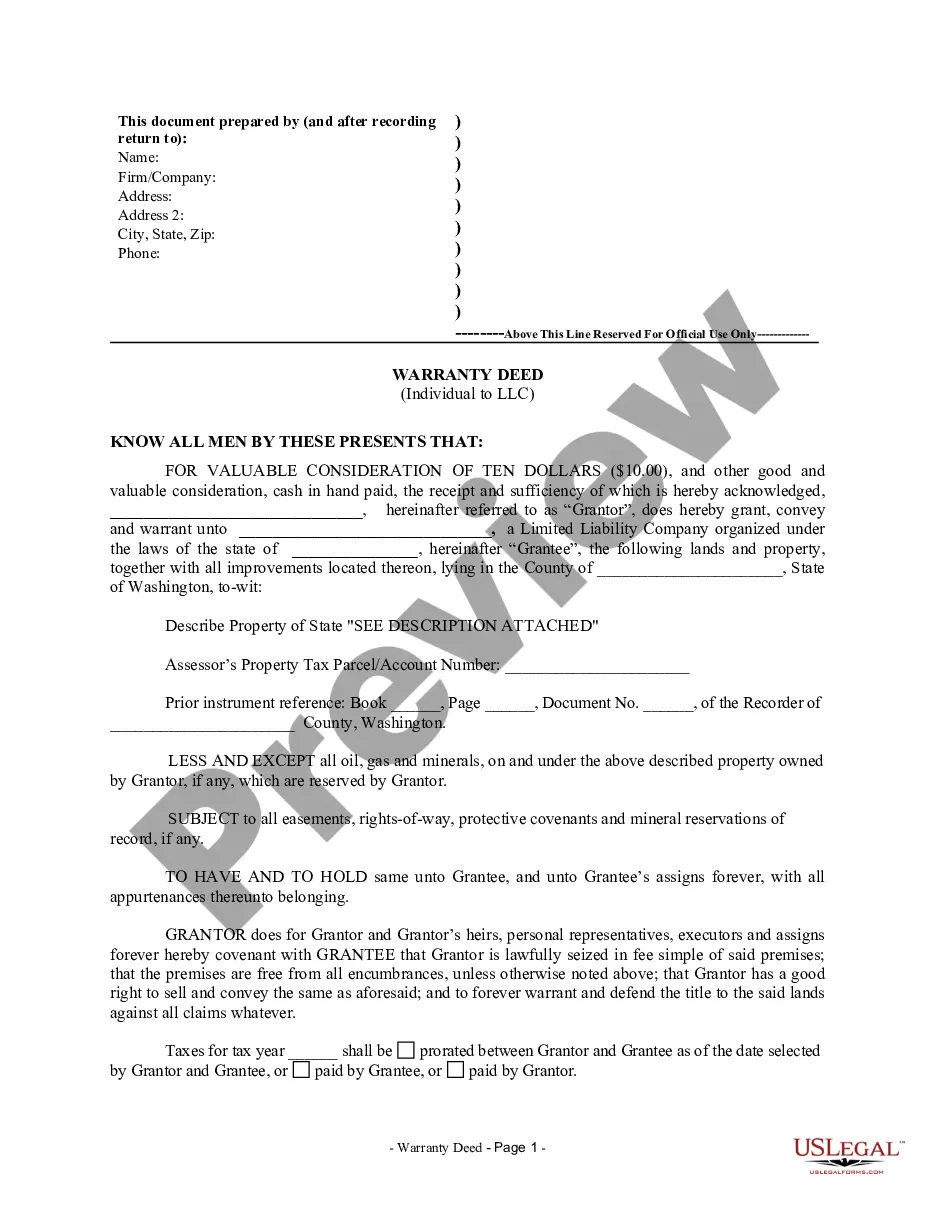

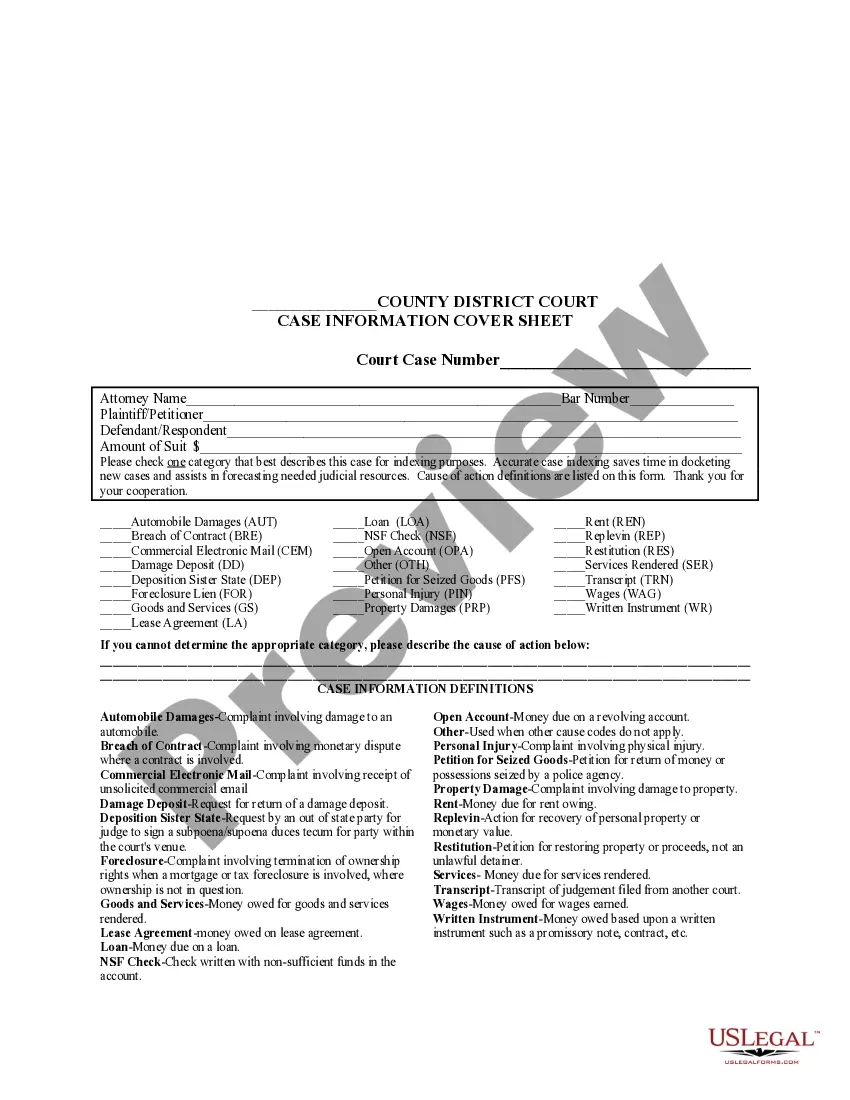

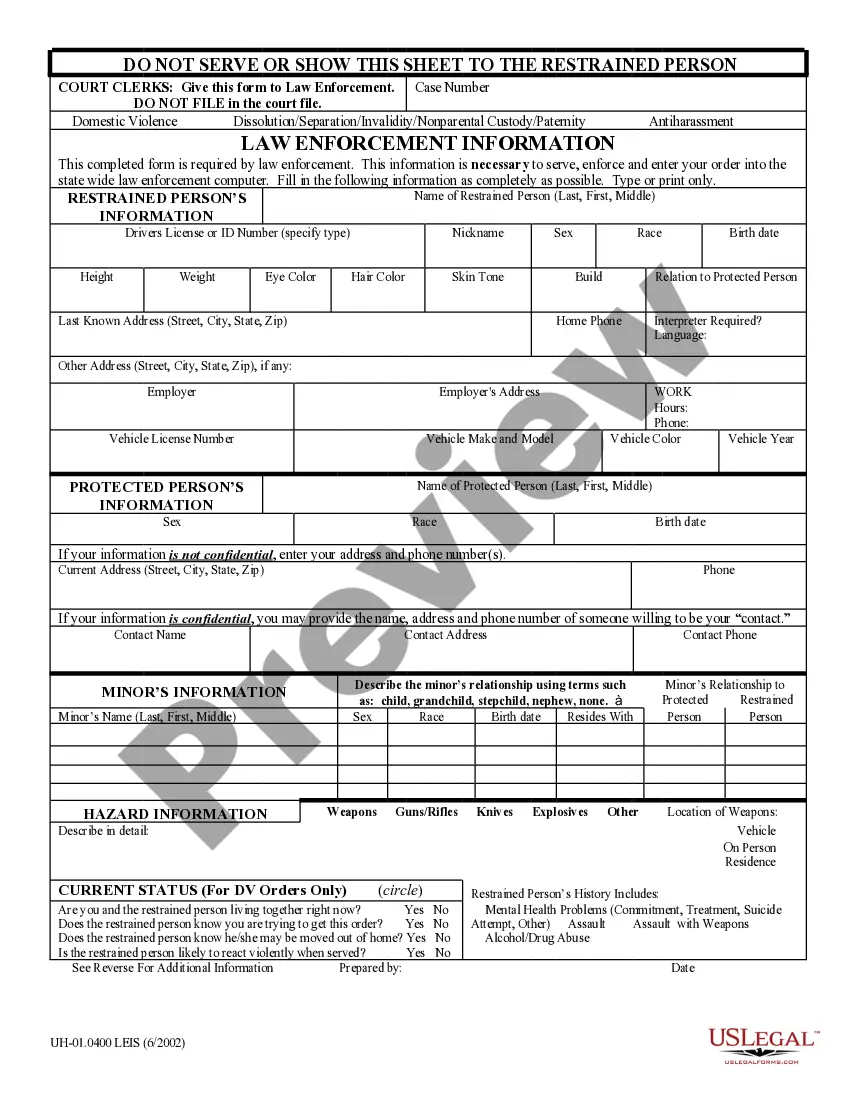

- Use the Preview function and look at the form description (if available) to make sure that it is the best document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct sample to your state and situation.

- Use the Search field at the top of the site if you need to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a required format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever file you need for whatever state you require it in. With US Legal Forms, completing Complaint for Wrongful Repossession of Automobile and Impairment of Credit samples or any other official files is easy. Begin now, and don't forget to recheck your samples with accredited attorneys!