Certificate of Trust for Mortgage

Definition and meaning

A Certificate of Trust for Mortgage is a legal document that confirms the existence of a trust and its terms. It specifically certifies that a trustee holds property in trust and outlines the authority of the trustee to manage and convey property. This document is essential when dealing with mortgages, as it serves to verify that the trustee has the power to handle real estate transactions on behalf of the trust.

Key components of the form

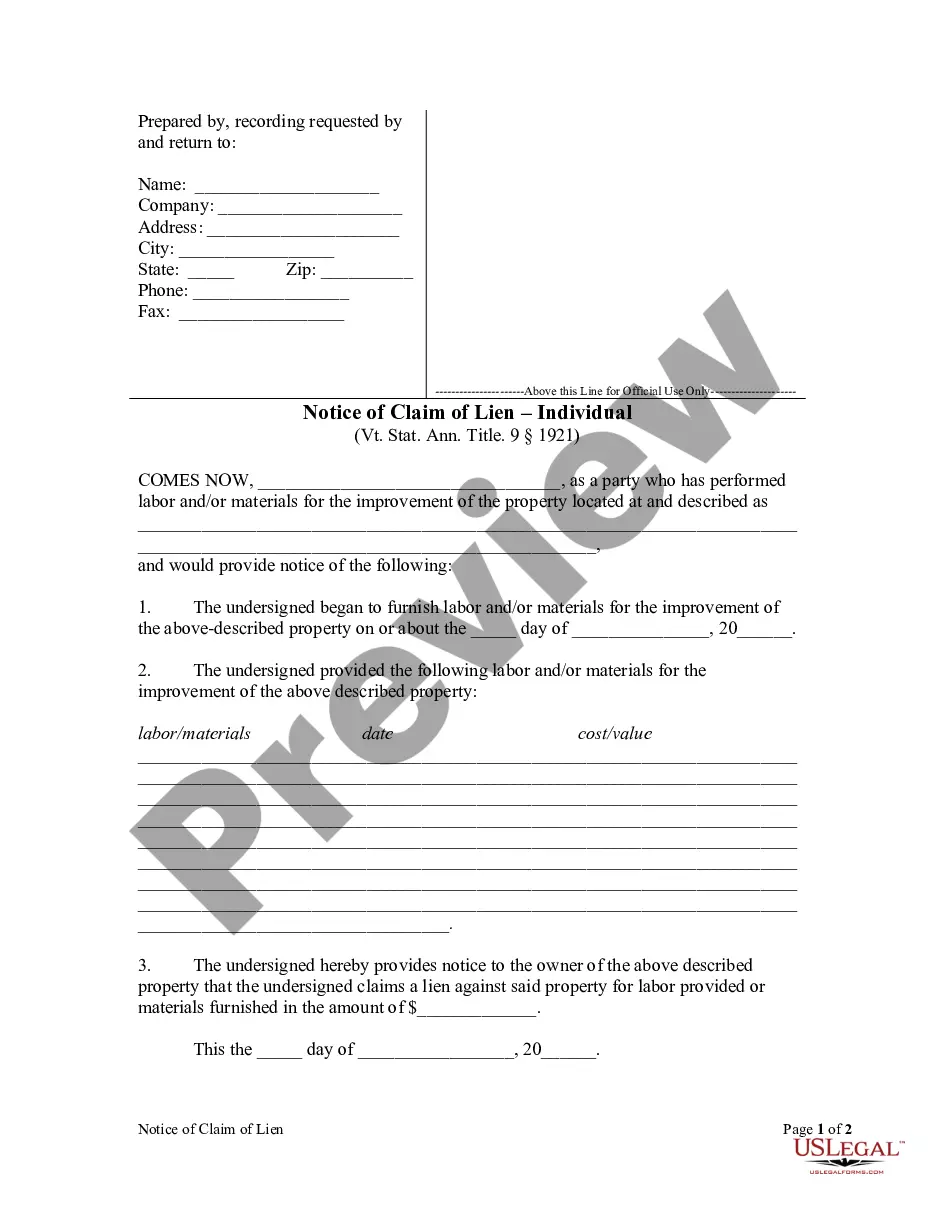

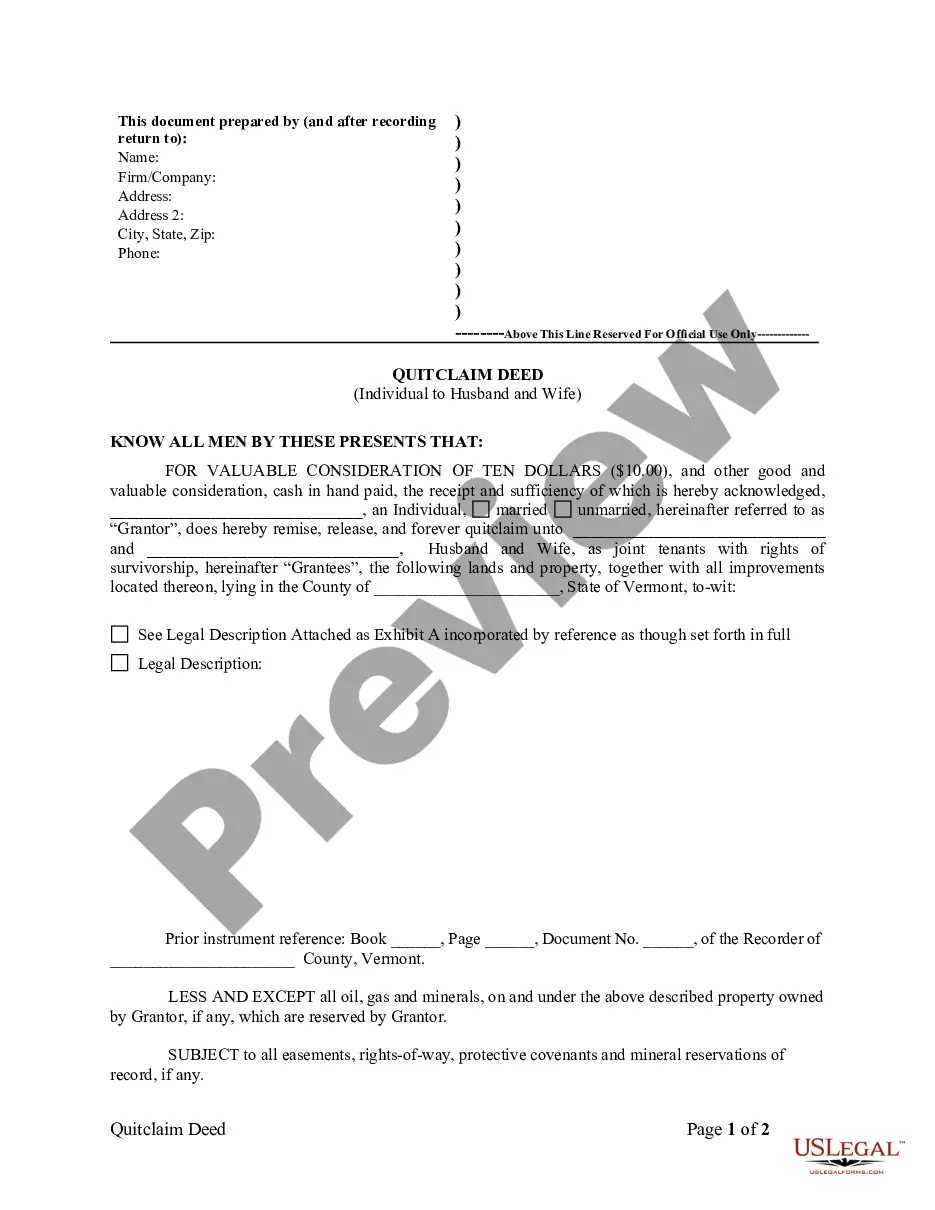

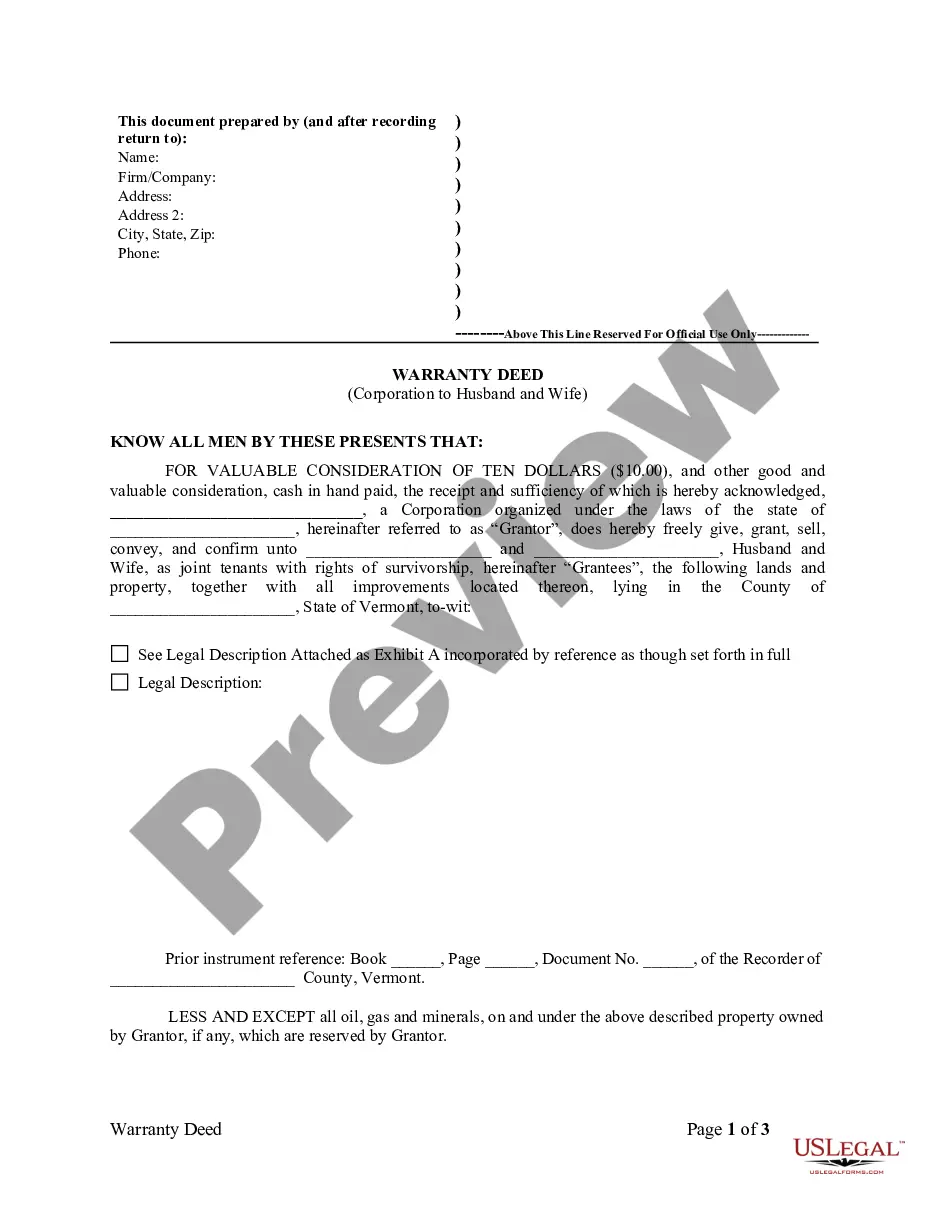

The Certificate of Trust for Mortgage typically includes several key elements that must be accurately completed:

- Name of the Trust: This identifies the specific trust involved in the transaction.

- Date of the Trust Instrument: This indicates when the trust was established.

- Grantor and Trustee Information: Names and addresses of the grantor(s) and trustee(s) are essential for clarity.

- Legal Descriptions of Properties: Detailed descriptions of any real property held in trust.

- General Powers of the Trustee: A statement of the powers entrusted to the trustee in managing the trust's assets.

- Governing Laws: Identification of the state laws that govern the trust.

How to complete a form

Completing a Certificate of Trust for Mortgage requires attention to detail. Here are the steps to ensure accurate completion:

- Begin by entering the name of the trust.

- Specify the date of the trust instrument.

- Provide names and addresses of all grantors and trustees, ensuring all details are correct.

- Include the legal descriptions of any real properties involved in the trust.

- Detail the powers assigned to the trustee for managing trust property.

- Sign and date the certificate in the presence of a notary public to finalize the document.

Who should use this form

The Certificate of Trust for Mortgage is particularly useful for trustees, who are responsible for managing property held in trust. It is also relevant for grantors who wish to establish a trust for asset management and estate planning. Additionally, lending institutions may require this document to ensure that the trustee has the authority to mortgage or sell the property held in trust.

Common mistakes to avoid when using this form

To ensure the validity of the Certificate of Trust for Mortgage, it’s important to avoid these common mistakes:

- Failing to include complete and accurate information about the trust, grantors, and trustees.

- Omitting legal descriptions of the properties, which can render the document incomplete.

- Not having the certificate notarized, which is essential for legal validation.

- Ignoring state-specific requirements, which may vary for trust documents.

What to expect during notarization or witnessing

When you take the Certificate of Trust for Mortgage for notarization, expect the following process:

- The notary will review the document to ensure all required fields are filled out correctly.

- You will need to present valid identification to the notary.

- The notary will witness your signature and then apply their official seal to the document, verifying its authenticity.

- Make sure to keep copies of the notarized certificate for your records.

Form popularity

FAQ

The Trust Certification gives the generalities of the Trust and is completed and signed by all acting Trustees in the presence of a Notary Public, under penalty of perjury. What does the Trust Certification state?A statement that that the Trust has not been revoked, modified, or amended in any manner.

Yes, trust agreements are private documents.Among other things, the law provides that a summary of the terms of a trust (a/k/a Certificate or Certification of Trust) should contain: name and date of the trust; the identity of the settlor (a/k/a trustor, grantor or trust-maker);

A living trust (also known as family trust or revocable trust) will be able to obtain a mortgage from a conventional lender such as a bank or credit union. Because the original trustee(s) who created the trust are still alive, they will be able to apply and sign for the mortgage against the property within the trust.

Notarized Copy and Certified Copy are used interchangeably.A certified copy does not verify the authenticity of the original document, only that the copy is a true copy of what appears to be an original document to the Notary Public. Of course, Certified Copies can only be made of documents that are original.

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

Create the certificate of trust Sign the living trust in front of a notary public to notarize it. In case your spouse or partner made the trust together, you both need to sign the certification. If one has died, the surviving part can make a certification.

Trusts are private documents and they typically remain private even after someone dies. The only way to obtain a copy of the Trust is to demand a copy from the Trustee (or whoever has a copy of the documents, if not the Trustee).

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.