Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

How to fill out Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

Aren't you sick and tired of choosing from hundreds of templates every time you need to create a Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft? US Legal Forms eliminates the wasted time countless Americans spend browsing the internet for appropriate tax and legal forms. Our skilled group of attorneys is constantly modernizing the state-specific Templates library, to ensure that it always offers the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription should complete simple actions before being able to get access to their Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft:

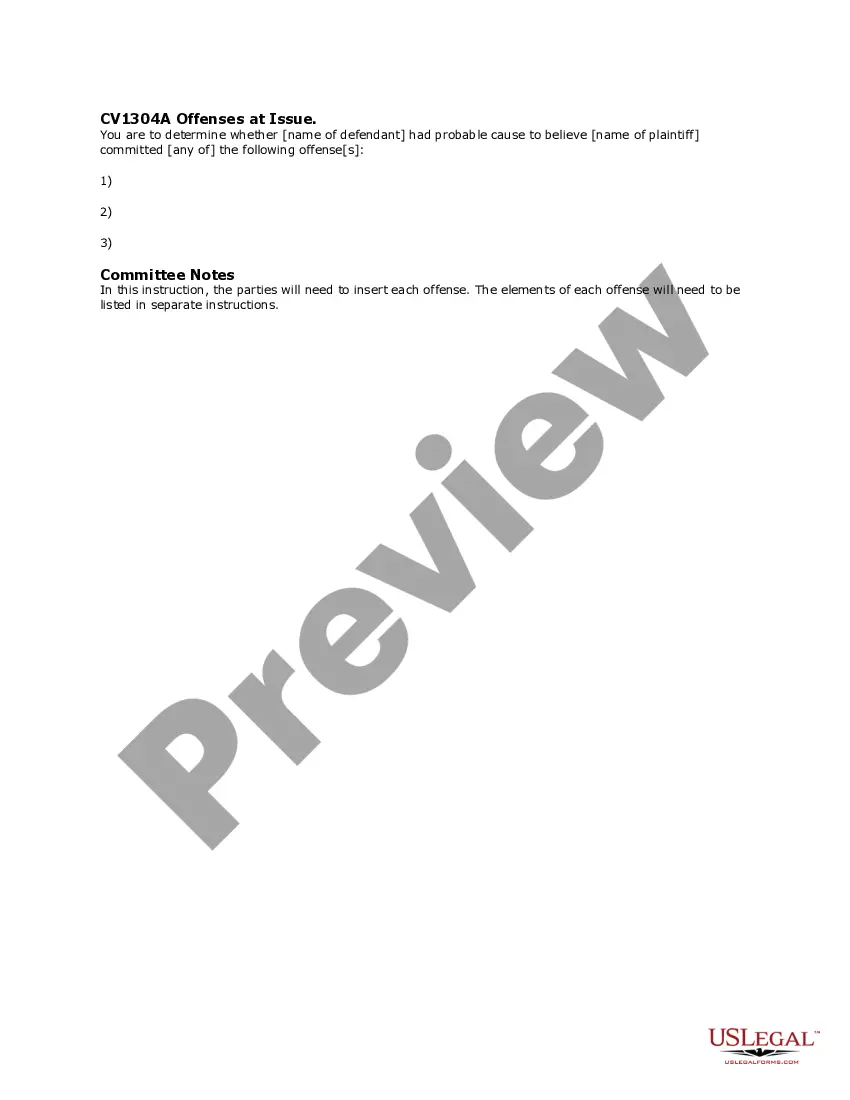

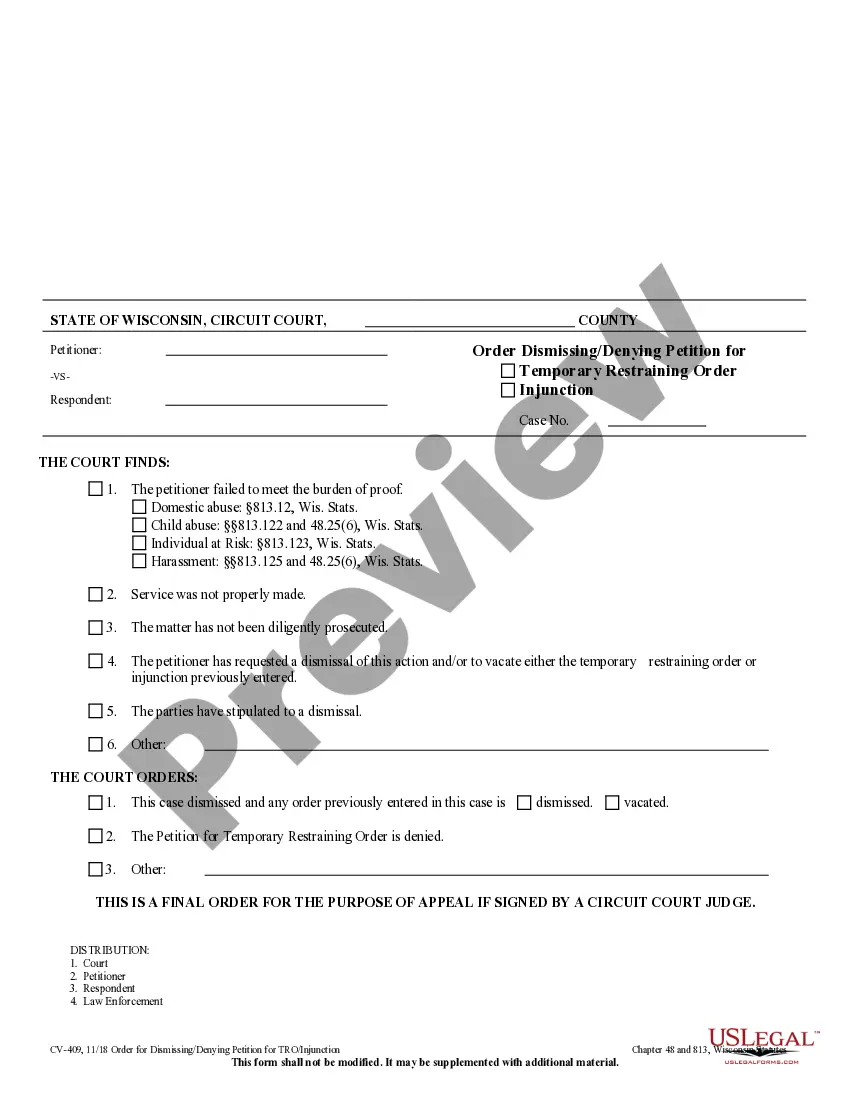

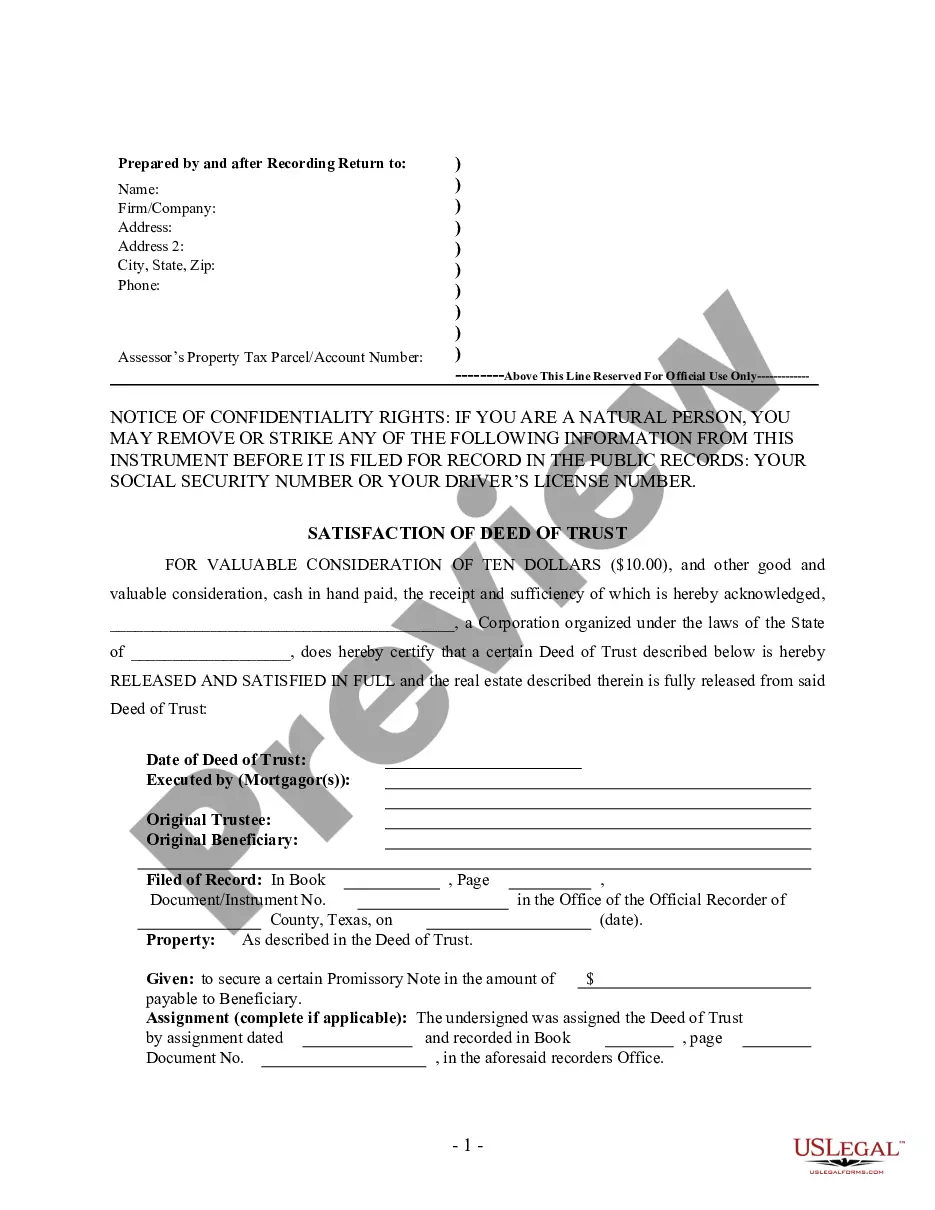

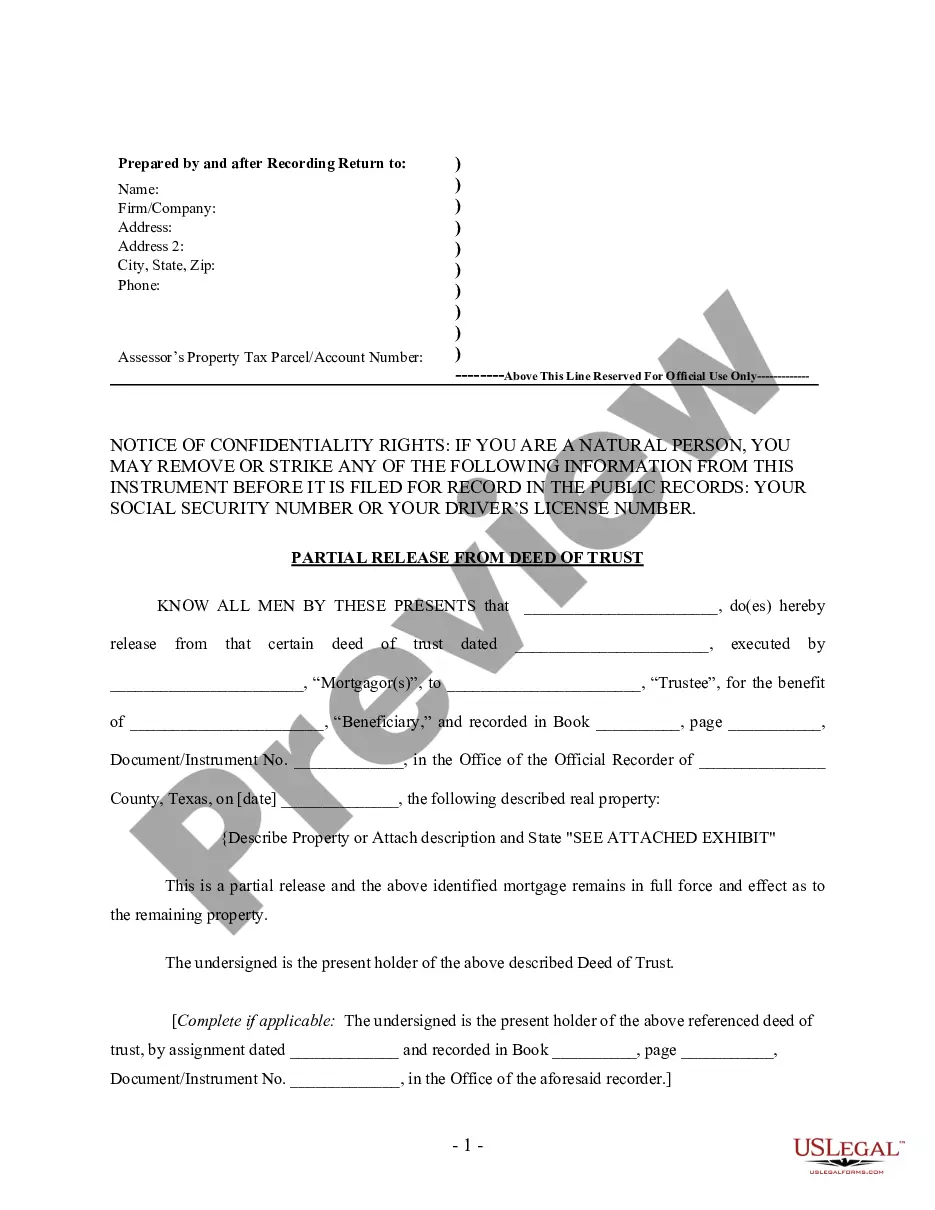

- Make use of the Preview function and read the form description (if available) to ensure that it is the proper document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate sample for your state and situation.

- Use the Search field on top of the webpage if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a required format to finish, print, and sign the document.

When you’ve followed the step-by-step instructions above, you'll always be able to sign in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft samples or any other legal documents is easy. Get started now, and don't forget to examine your examples with certified attorneys!

Form popularity

FAQ

A 609 letter is a method of requesting the removal of negative information (even if it's accurate) from your credit report, thanks to the legal specifications of section 609 of the Fair Credit Reporting Act.

Option 1: Online. You can upload the documentation verifying your identity online along with your request to have the alert removed. Option 2: Mail. You can mail your request to Experian along with copies of documentation verifying your identity.

You may be able to have your identity theft charges dropped if: You didn't obtain use a person's information unlawfully If you did not obtain or use someone else's personal information unlawfully, you are not guilty of identity theft.

The Identity Theft Affidavit you filed with the FTC; Government-issued photographic ID (such as a state ID card or driver's license); Proof of your home address (like a utility bill or rent agreement); Proof of the theft (bills from creditors or notices from the IRS); and.

Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. Check your bank account statement. Get and review your credit reports.

Equifax. Equifax.com/personal/credit-report-services. 800-685-1111. Experian. Experian.com/help. 888-EXPERIAN (888-397-3742) TransUnion. TransUnion.com/credit-help. 888-909-8872.

Send this letter to each of the 3 Credit Bureaus: Dispute Letter to a Credit Bureau. If someone opened a new account in your name, send this letter to the company: If someone misused one of your existing accounts, send this letter to the company:

Step 1: Call the companies where you know fraud occurred. Call the fraud department. Step 2: Place a fraud alert and get your credit reports. Place a free, one-year fraud alert by contacting one of the three credit bureaus. Step 3: Report identity theft to the FTC.

The act of disputing items on your credit report does not hurt your score. However, the outcome of the dispute could cause your score to adjust. If the negative item is verified to be correct, for example, your score might take a dip.