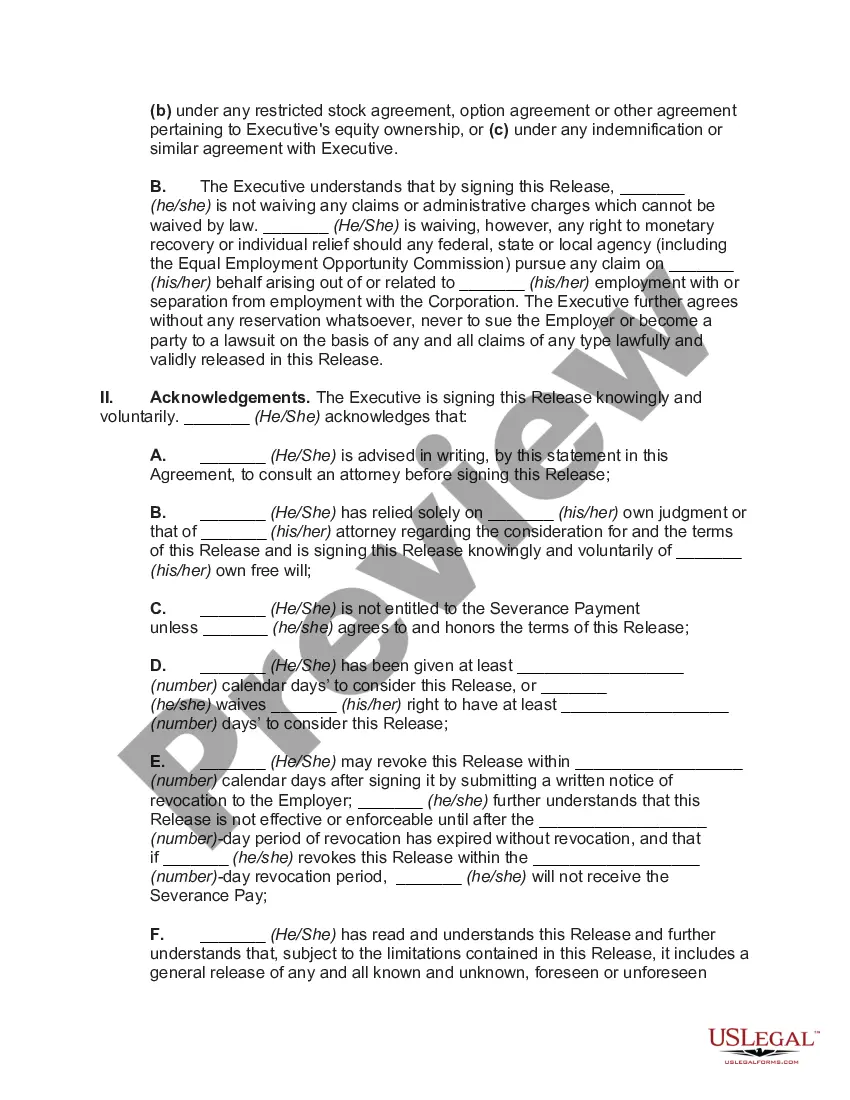

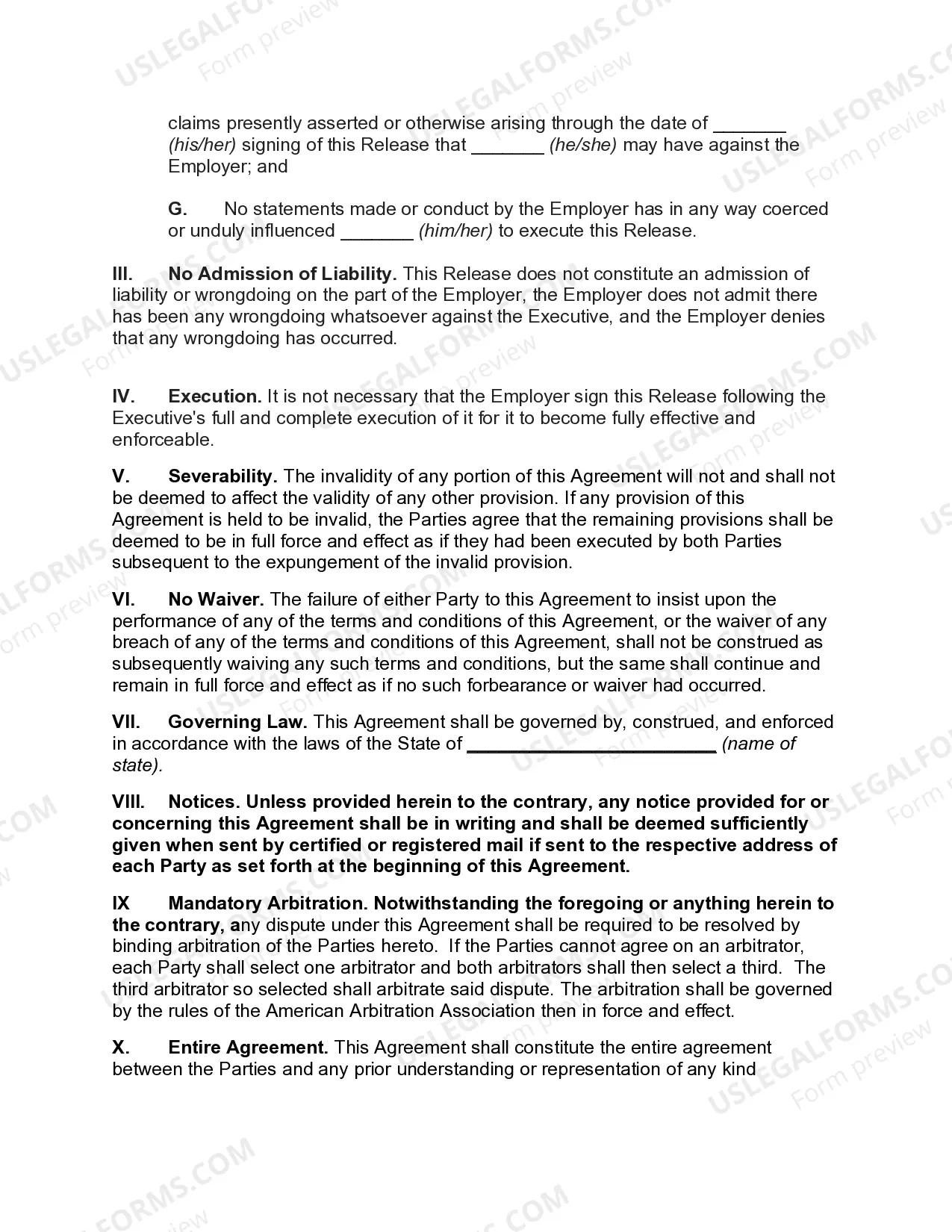

Texas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits

Description

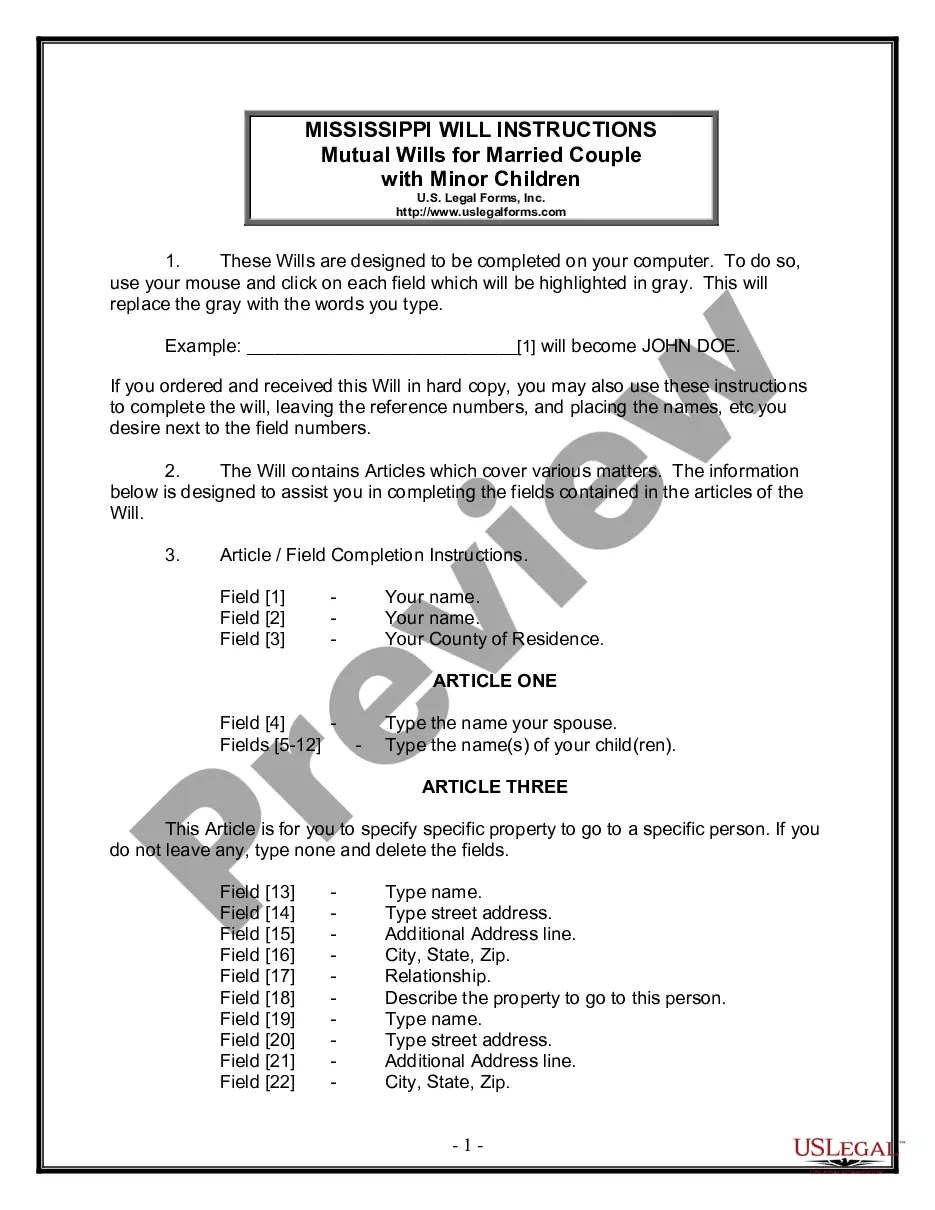

How to fill out Release Of Corporate Employer By Executive Upon Termination In Consideration Of Severance Pay And Benefits?

Choosing the best legitimate file template can be quite a battle. Of course, there are plenty of templates accessible on the Internet, but how would you discover the legitimate develop you require? Utilize the US Legal Forms web site. The assistance provides 1000s of templates, for example the Texas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits, that you can use for business and personal needs. Each of the varieties are checked out by pros and meet up with state and federal needs.

In case you are previously authorized, log in to the account and click on the Down load switch to get the Texas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits. Make use of account to look throughout the legitimate varieties you possess acquired formerly. Check out the My Forms tab of the account and obtain one more copy in the file you require.

In case you are a new consumer of US Legal Forms, listed here are simple directions for you to stick to:

- Initial, make certain you have selected the appropriate develop for your town/area. You may check out the form using the Review switch and browse the form outline to guarantee it will be the best for you.

- When the develop will not meet up with your needs, take advantage of the Seach field to obtain the appropriate develop.

- Once you are sure that the form is suitable, click on the Purchase now switch to get the develop.

- Pick the rates strategy you desire and enter in the essential info. Create your account and purchase the order with your PayPal account or Visa or Mastercard.

- Pick the data file structure and download the legitimate file template to the gadget.

- Full, modify and print out and indicator the attained Texas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits.

US Legal Forms will be the greatest collection of legitimate varieties that you can find various file templates. Utilize the service to download professionally-created documents that stick to express needs.

Form popularity

FAQ

Typical severance packages offer one to two weeks of paid salary for every year worked. You usually have 21 days to accept a severance agreement, and once it's signed, you have seven days to change your mind.

Under the Texas Payday Law, severance pay is not owed unless it is promised in a written policy. Be sure to understand the difference: Most employers designate any post-employment wages paid to ex-employees as severance pay.

Is severance pay taxable? Yes, severance pay is taxable in the year that you receive it. Your employer will include this amount on your Form W-2 and will withhold appropriate federal and state taxes.

According to Section 207.049 of the Texas Unemployment Compensation Act, severance pay is defined as dismissal or separation income paid on termination of the employment in addition to the employee's usual earnings from the employer at the time of termination.

Under the Texas Payday Law, severance pay is not owed unless it is promised in a written policy. Be sure to understand the difference: Most employers designate any post-employment wages paid to ex-employees as severance pay.

Though sometimes used interchangeably, termination pay and severance pay are not the same thing. While all employees of three months or longer with a company are entitled to termination pay (in place of notice) upon dismissal, not everyone is entitled to severance pay.

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Severance pay is a sum of money an employee is eligible to receive upon job separation. You may have a company policy to pay severance pay. Texas law prohibits individuals from qualifying for unemployment benefits while receiving certain types of severance pay.

Only a written severance pay obligation is enforceable under the Texas Payday Law. It is not the same as wages in lieu of notice, which is a post-termination payment that the employer has never previously obligated itself to give.