Texas Satisfaction, Cancellation or Release of Mortgage Package

What is this form package?

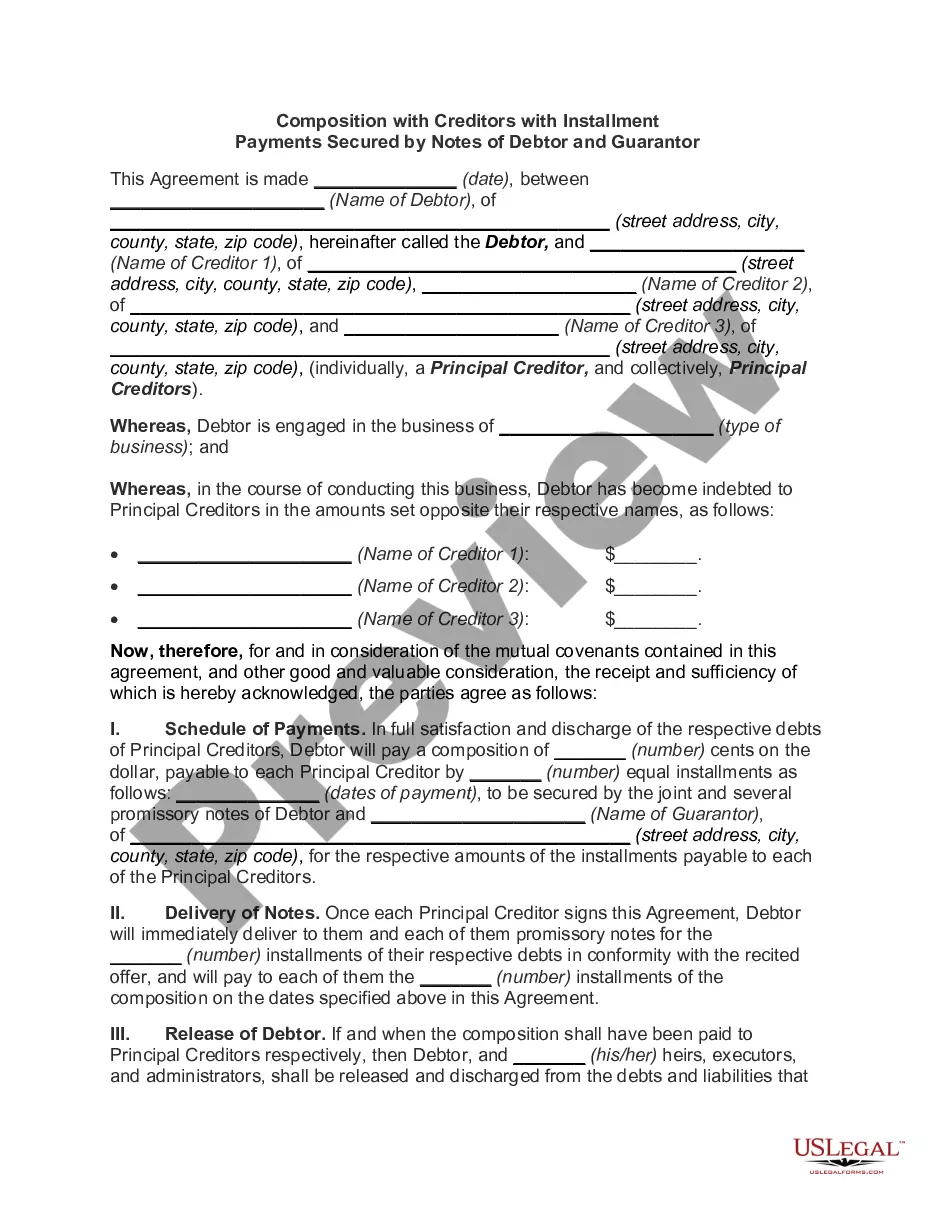

The Texas Satisfaction, Cancellation or Release of Mortgage Package is designed to provide you with all the necessary forms and letters to formally release a mortgage on real estate in Texas. This package stands out because it includes specific forms that are compliant with Texas laws and can be used by both individuals and corporations to ensure proper legal release of a mortgage or deed of trust.

Documents contained in this package

When this form package is needed

This package should be used when a mortgage or deed of trust has been paid off, and the borrower needs to complete the legal process of releasing the property from the lien. It is essential in cases where:

- The mortgage has been settled, and formal confirmation is required.

- The property is being sold, and the new owner requires assurance that there are no outstanding liens.

- A borrower needs to notify relevant parties about the status of their mortgage.

Who needs this form package

- Homeowners looking to release a mortgage or deed of trust.

- Corporations that wish to cancel a mortgage on a property they own.

- Real estate professionals handling transactions involving satisfied mortgages.

- Individuals who need a formal notice to provide to borrowers about mortgage satisfaction.

How to prepare this document

- Review the included forms thoroughly to ensure you understand their purpose.

- Identify the type of form you need based on whether the release is by an individual or a corporation.

- Fill in the required information, including dates, parties involved, and property details.

- Include necessary signatures as indicated in the forms, ensuring compliance with notary requirements if applicable.

- Send relevant letters to the appropriate parties, such as the recording office and the borrower.

Do documents in this package require notarization?

Notarization is required for one or more forms in this package. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide accurate property descriptions in the satisfaction forms.

- Not obtaining the required notarizations for certain forms.

- Forgetting to send or failing to send the satisfaction letters to the appropriate parties.

- Using outdated forms that do not comply with current Texas law.

Advantages of online completion

- Convenience of downloading forms for immediate access.

- Editable formats allow for easy completion on your computer, ensuring accuracy.

- Drafted by licensed attorneys, highlighting reliability and legal compliance.

Looking for another form?

Form popularity

FAQ

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.