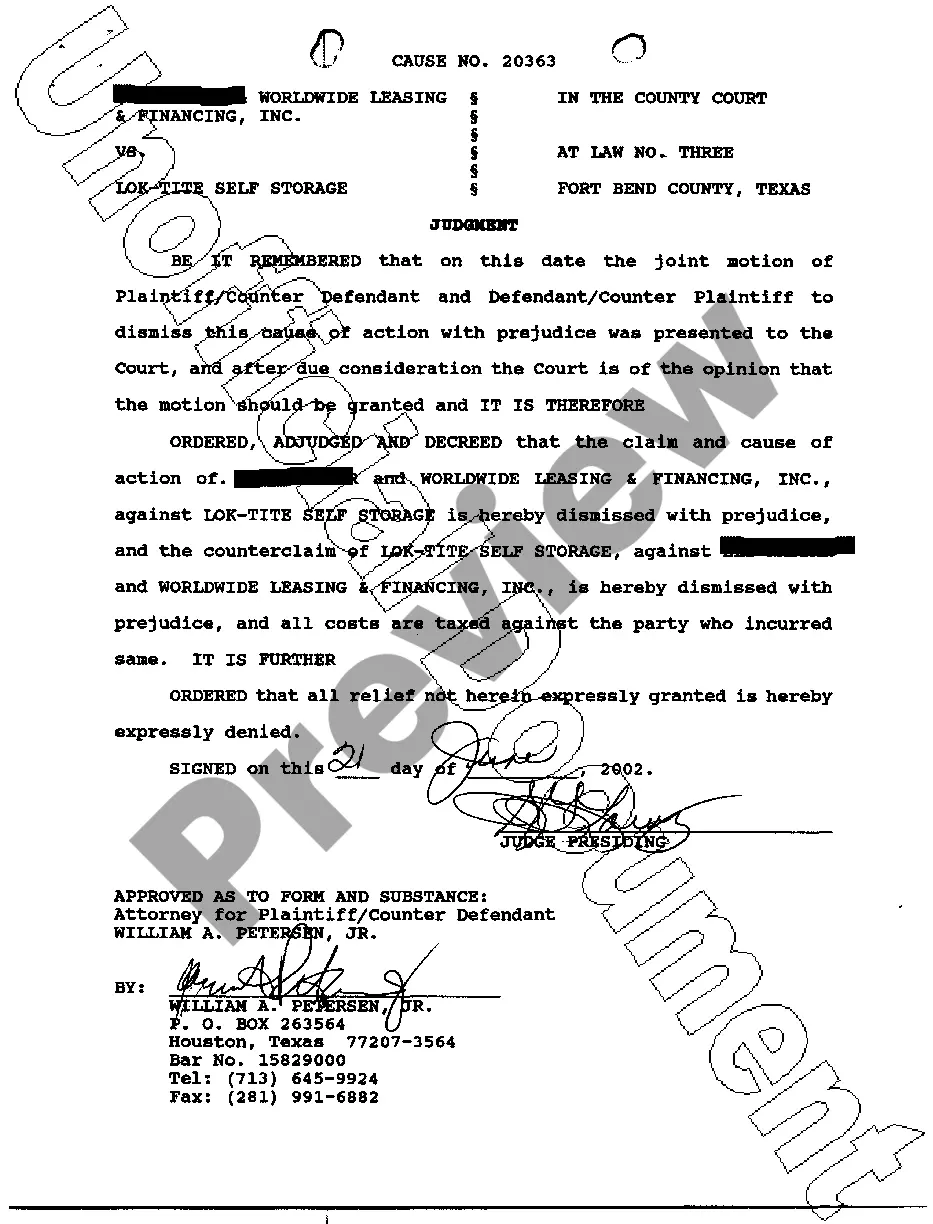

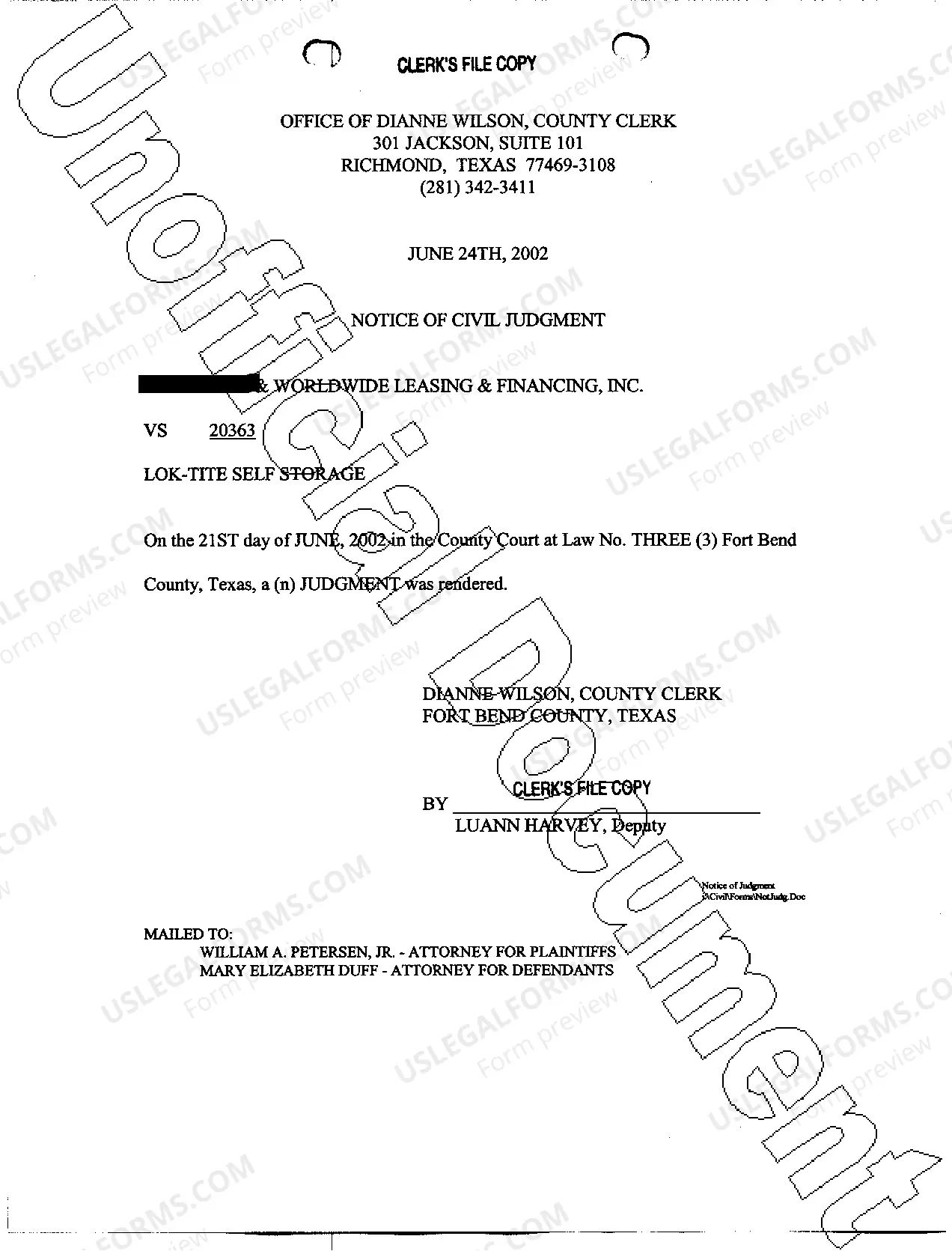

Texas Judgment

Description

How to fill out Texas Judgment?

Access to high quality Texas Judgment forms online with US Legal Forms. Avoid days of lost time browsing the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific legal and tax templates that you can save and complete in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The file will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Verify that the Texas Judgment you’re looking at is appropriate for your state.

- See the form making use of the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Pick a preferred file format to download the file (.pdf or .docx).

Now you can open up the Texas Judgment example and fill it out online or print it out and get it done by hand. Consider sending the papers to your legal counsel to make sure all things are filled out correctly. If you make a error, print and complete sample again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and access much more samples.

Form popularity

FAQ

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

Find the judgment creditor. Create a hardship letter. Negotiate. Write a Release of Judgment (RoJ) Transfer Money and Get Release of Judgment (RoJ) Signed. File Release of judgment (RoJ) in the correct county.

First, the creditor must obtain a judgment in court that requires the debtor to pay the amount owed and any interest due on that amount. The creditor must then request and receive an Abstract of Judgment that can be filed with the County Clerk in the areas in which the debtor maintains property.

In a case saying someone owes money, the judgment usually says that the defendant owes money to the plaintiff and must pay it back with other fees and interest added. When a creditor gets a judgment against a debtor, the creditor has to take steps to get the judgment paid. This is called execution.

After the judgment is rendered, you may obtain an Abstract of Judgment which you may file with the County Clerk in Travis County or any county in which the judgment debtor has real property. The fee is $5.00 and there is an additional recording fee for the County Clerk at the time you file the abstract.

Keep in mind that if you do NOT pay the judgment: The amount you owe will increase daily, since the judgment accumulates interest at the rate of 10% per year. The creditor can get an order telling you to reimburse him or her for any reasonable and necessary costs of collection.

Do Judgments Expire in Texas? Judgments issued in Texas with a non-government creditor are generally valid for ten years but they can be renewed for longer.

Once you have a judgment against you, creditors can garnish your bank account in Texas. They do this with a Writ of Garnishment. They cannot garnish your wages but once you deposit your paycheck into the bank they can freeze your account with a valid judgment.

What Happens After a Judgment Is Entered Against You? The court enters a judgment against you if your creditor wins their claim or you fail to show up to court. You should receive a notice of the judgment entry in the mail. The judgment creditor can then use that court judgment to try to collect money from you.