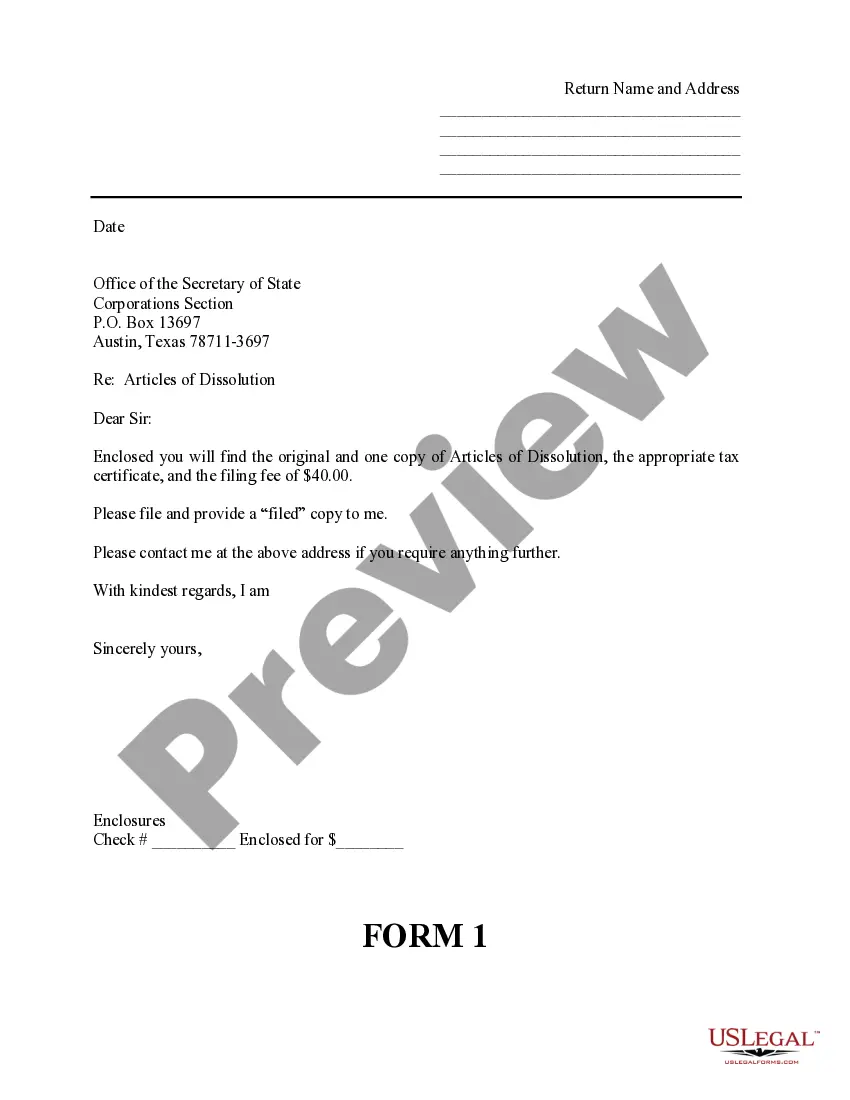

The dissolution package contains all forms to dissolve a LLC or PLLC in Texas, step by step instructions, addresses, transmittal letters, and other information.

Texas Dissolution Package to Dissolve Limited Liability Company LLC

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

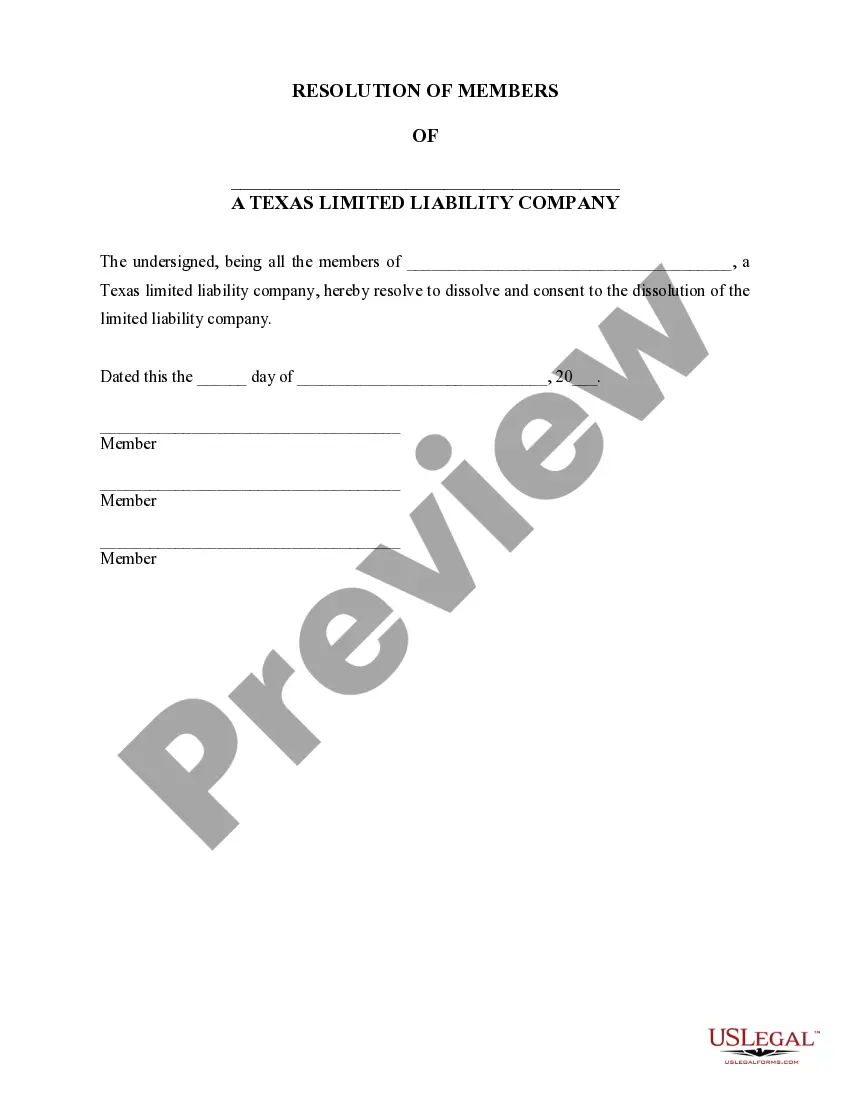

Texas Dissolution Package to Dissolve Limited Liability Companies (LLC) refers to the set of documents and procedural steps required for legally terminating a Limited Liability Company (LLC) in the state of Texas. This involves compliance with state regulations and may include documents such as Articles of Dissolution, Certificate of Termination, and final tax clearances.

Step-by-Step Guide

- Secretary of State Filing: Submit the Certificate of Termination to the Texas Secretary of State, including the completion of Form 651.

- Tax Clearance: Obtain tax clearance from the Texas Comptroller of Public Accounts to ensure all tax obligations are met.

- Notifying Creditors: Notify all known creditors about the dissolution and settle outstanding debts.

- Distribution of Assets: Distribute remaining assets among members according to the LLCs operating agreement.

- Close Accounts: Close all bank accounts and cancel any licenses or permits.

Risk Analysis

- Legal Risks: Failure to properly dissolve an LLC can lead to continued financial and legal obligations, including taxes and lawsuits.

- Financial Risks: Inadequate asset distribution might lead to disputes among members or claims from creditors.

- Reputation Risks: Mishandling the dissolution process can damage the business reputation and that of its members.

Key Takeaways

- Ensure compliance with Texas state requirements to effectively dissolve an LLC.

- Properly closing all financial and legal obligations can prevent future liabilities.

- Dissolution of an LLC is not just a legal requirement but also a critical step in minimizing risk.

How to fill out Texas Dissolution Package To Dissolve Limited Liability Company LLC?

Get access to high quality Texas Dissolution Package to Dissolve Limited Liability Company LLC templates online with US Legal Forms. Steer clear of hours of lost time looking the internet and lost money on documents that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific legal and tax forms you can save and complete in clicks within the Forms library.

To find the example, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Check if the Texas Dissolution Package to Dissolve Limited Liability Company LLC you’re looking at is appropriate for your state.

- Look at the form using the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay by card or PayPal to finish making an account.

- Select a favored format to save the file (.pdf or .docx).

Now you can open up the Texas Dissolution Package to Dissolve Limited Liability Company LLC template and fill it out online or print it and get it done by hand. Think about giving the papers to your legal counsel to be certain things are completed appropriately. If you make a mistake, print and complete sample again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and get far more samples.

Form popularity

FAQ

Methods to Dissolve Your California LLC Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement.File a Certificate of Dissolution and a Certificate of Cancellation with the California Secretary of State.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee. The form can be filed online. If you'd like to save yourself some time, you can hire us to dissolve your LLC for you.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.