This form is a Grant Deed or General Warranty Deed where the grantors are two individuals and the grantee is an individual. Grantors convey and warrant the described property to grantee. This deed complies with all state statutory laws.

Texas Grant Deed - Two Individuals to One Individual

Description

How to fill out Texas Grant Deed - Two Individuals To One Individual?

Get access to high quality Texas Grant Deed - Two Individuals to One Individual templates online with US Legal Forms. Steer clear of days of misused time searching the internet and lost money on files that aren’t updated. US Legal Forms gives you a solution to exactly that. Find around 85,000 state-specific legal and tax samples that you can download and submit in clicks within the Forms library.

To receive the sample, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Texas Grant Deed - Two Individuals to One Individual you’re considering is suitable for your state.

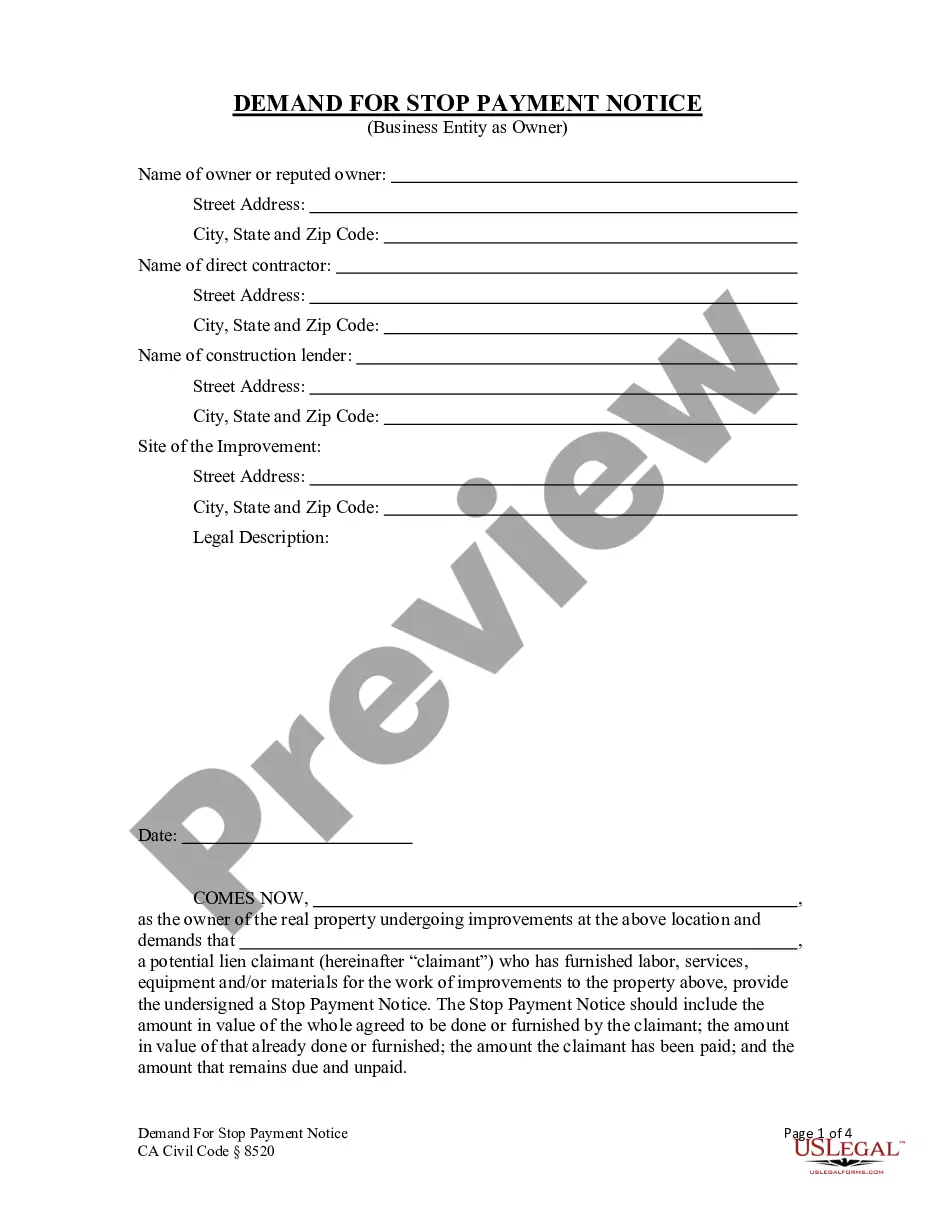

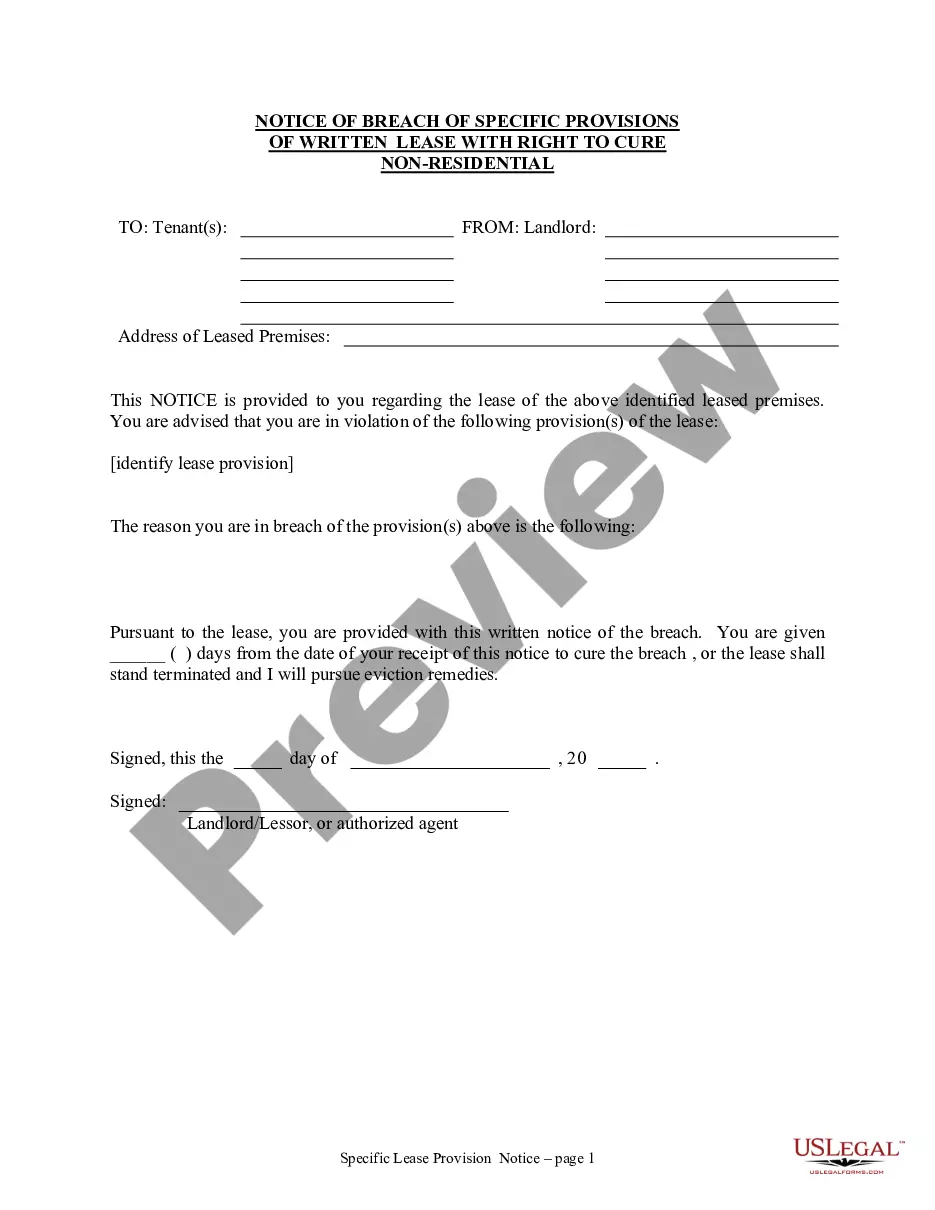

- View the form utilizing the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to register.

- Pay by card or PayPal to complete creating an account.

- Choose a preferred file format to download the document (.pdf or .docx).

You can now open the Texas Grant Deed - Two Individuals to One Individual example and fill it out online or print it out and get it done yourself. Take into account giving the papers to your legal counsel to make certain everything is filled in appropriately. If you make a error, print and fill application once again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and access far more forms.

Form popularity

FAQ

Print a grant deed from an online source. Sign the document in the presence of a notary public. Take the deed to the recorder's office in the county where the property is located.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

Grantor's name. Grantee's name and address. Description of grantee (ex: unmarried man, husband and wife, joint tenants) Person who requested grant deed. Address of real estate that is being transferred. Legal description of property (lot number) Original title order number for property.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

In most states you can file a disclaimer or deed of disclaimer that says specifically you were placed in title without your knowledge or consent and disclaim the deed.

In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.

The deed and any related agreements should be filed in the land records of the county where the property is located. The county clerk will require a recording fee. Recording fees can vary, but usually range from $11.00 to $30.00 for the first page and $4.00 for each additional page.

In all fifty states, a deed must be signed and acknowledged by the grantor. Additional signatures may also be required, such as a grantee's signature, witnesses, a notary public, and the document preparer.

Today's question is is it possible to deed real estate to someone without them knowing it? Strictly speaking, the answer is no. Because it does not meet the acceptance element of a valid deed transfer. Us lawyers must learn to speak in elements because it governs everything that we do.