Tennessee Purchase Invoice

Description

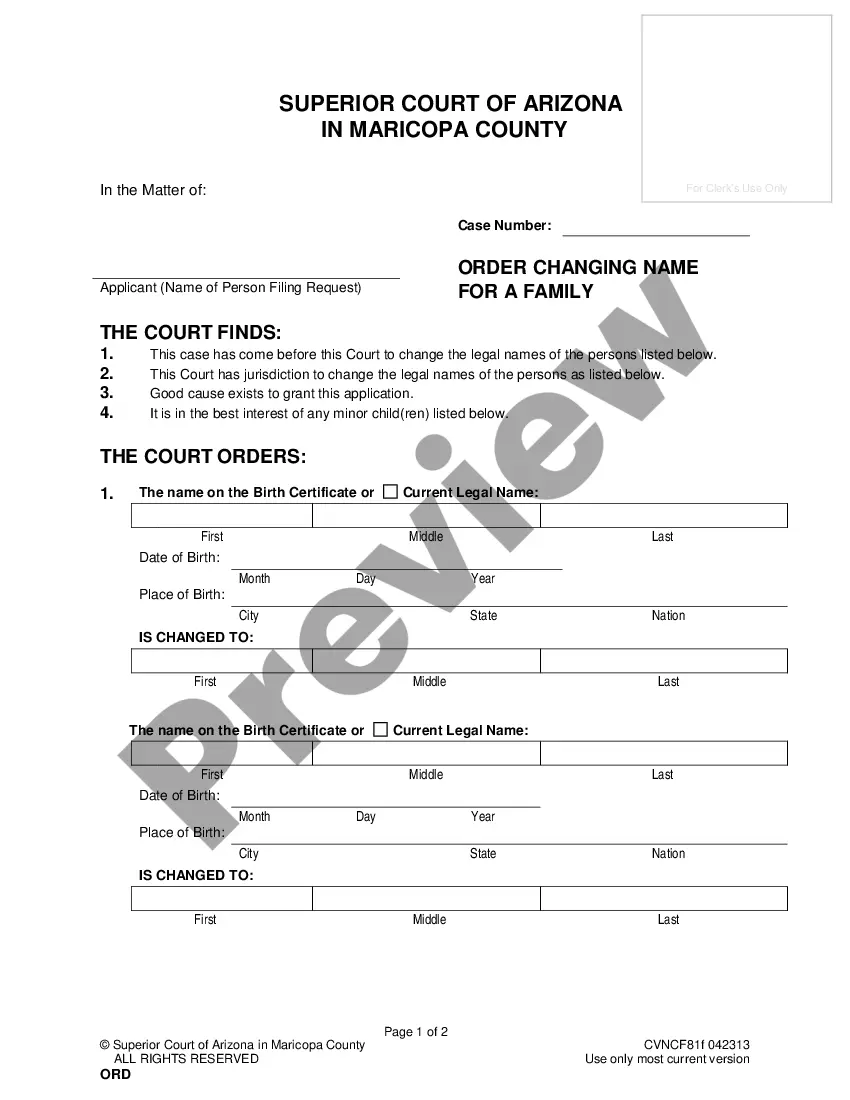

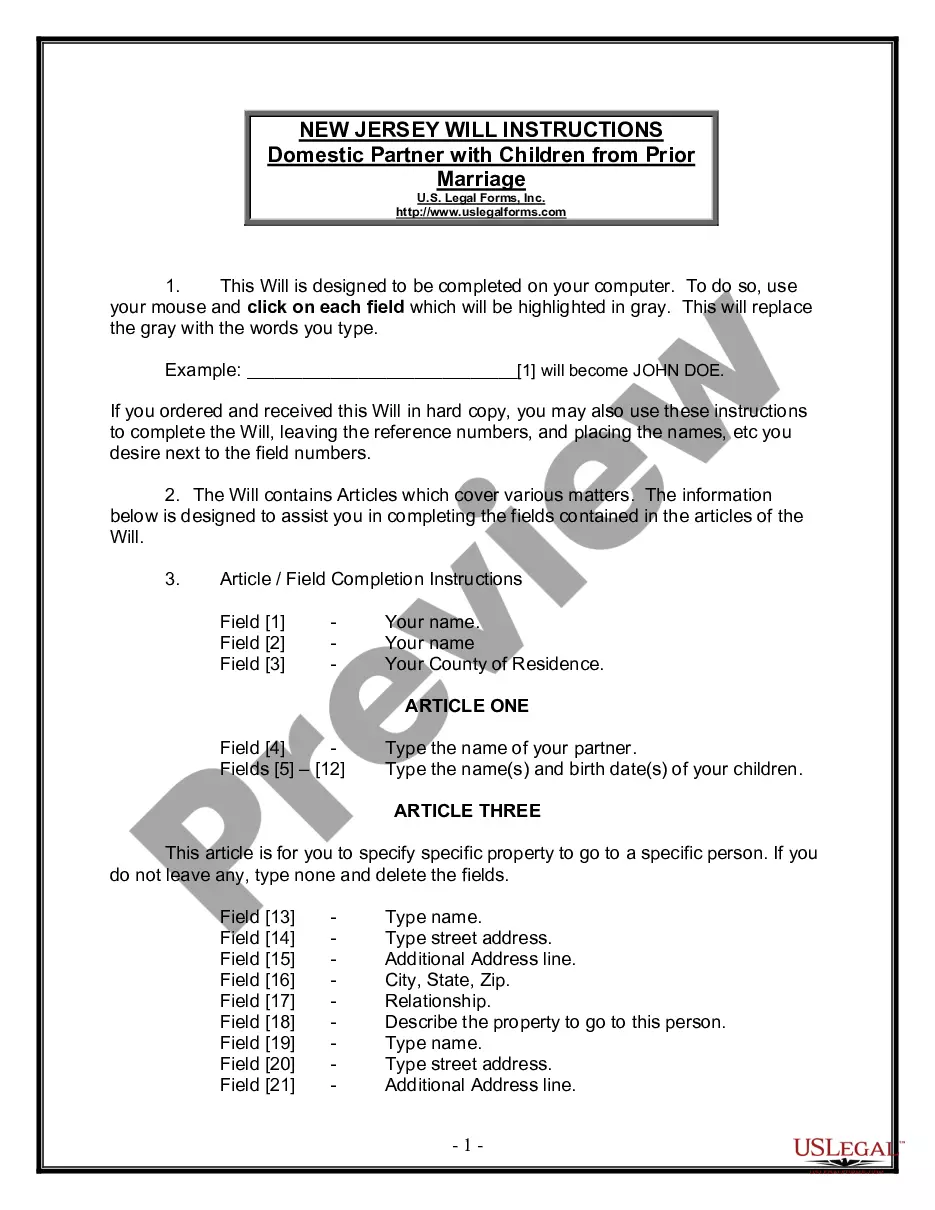

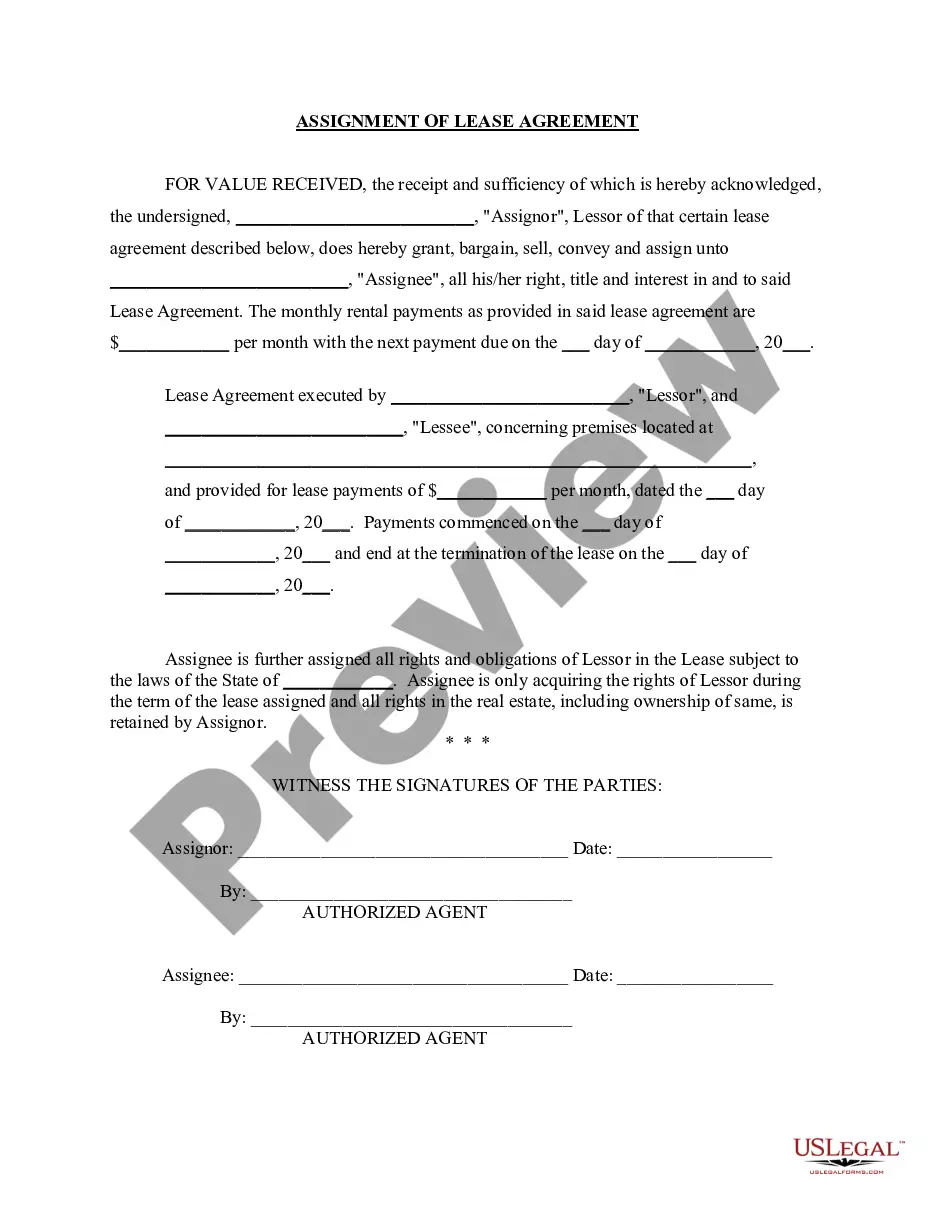

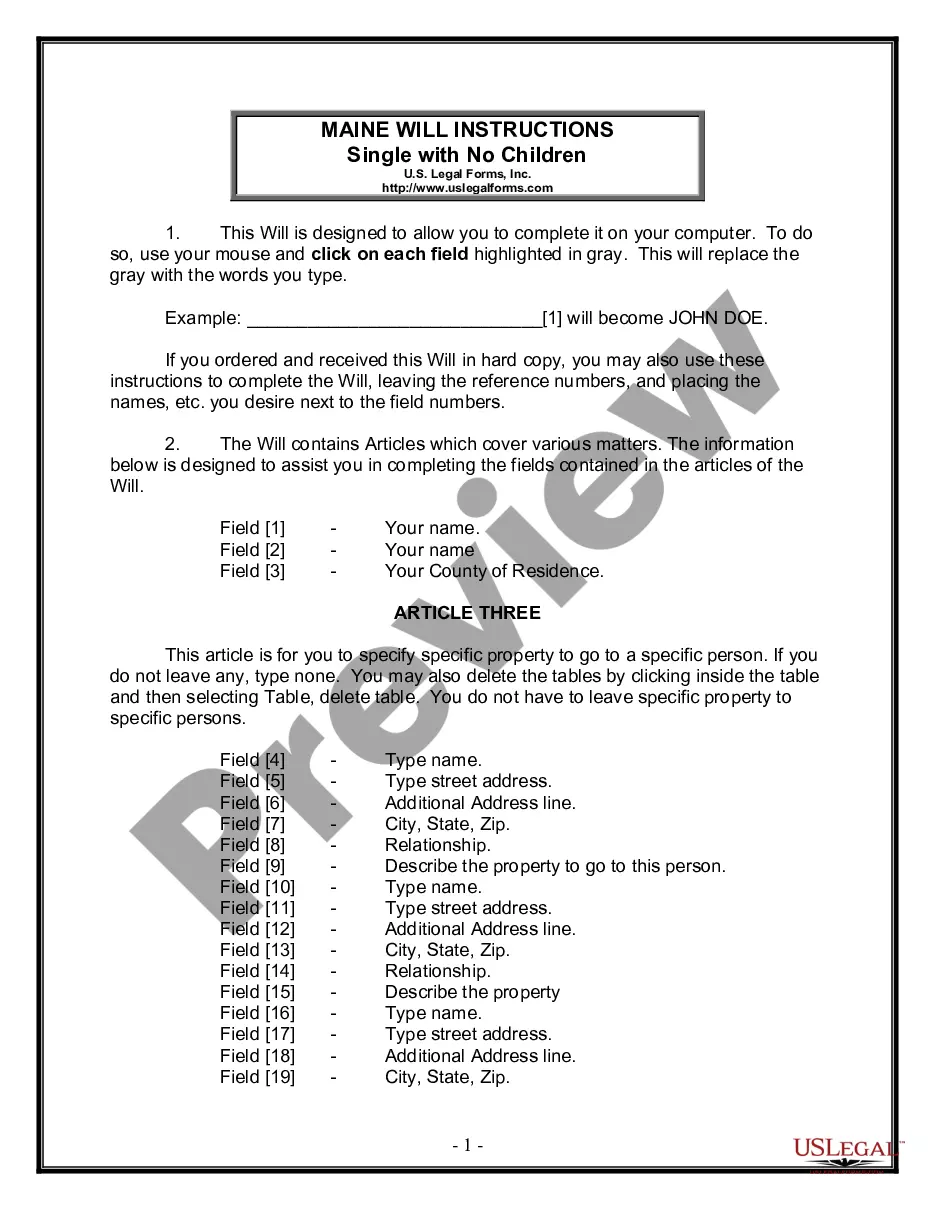

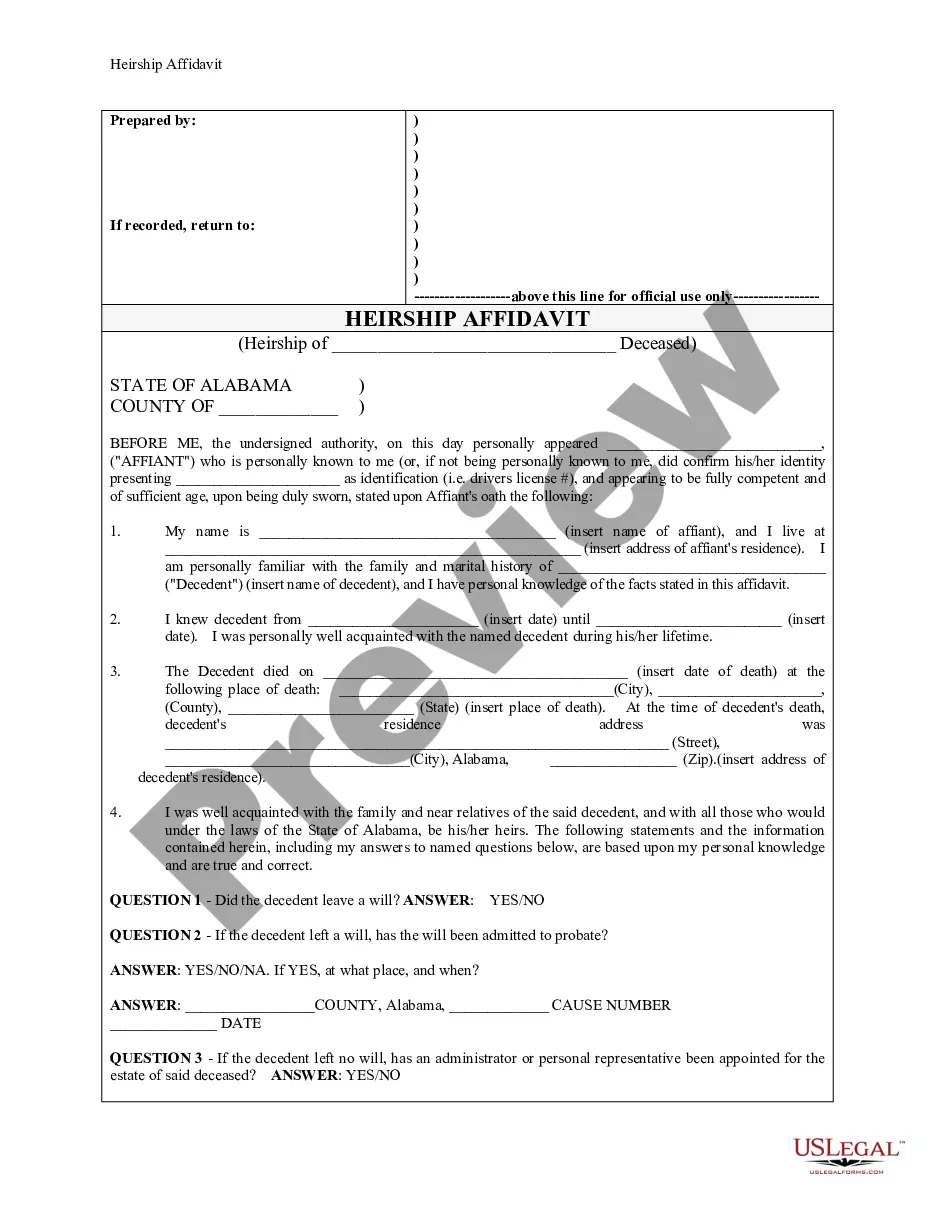

How to fill out Purchase Invoice?

You can spend significant time online looking for the authentic document template that meets the local and national requirements you seek.

US Legal Forms offers thousands of authentic forms that have been examined by experts.

You can easily download or print the Tennessee Purchase Invoice using our service.

If available, utilize the Review button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- After that, you may complete, modify, print, or sign the Tennessee Purchase Invoice.

- Every authentic document template you purchase is yours forever.

- To obtain another copy of a purchased form, visit the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for the county/city of your choice.

- Read the form description to confirm you have selected the right document.

Form popularity

FAQ

Tennessee has a 4% tax on food items, specifically, food that's not served as a ready-to-eat meal. Some local governments add taxes on top of that.

Tangible personal property, taxable services, amusements, and digital products specifically intended for resale are not subject to tax. Retail sales to the federal government or its agencies and the State of Tennessee or a county or municipality within Tennessee are not subject to tax.

You can draft a bill of sale for a car or other vehicle by hand in Tennessee, and it does not need to be notarized. Just be sure your vehicle bill of sale contains the following information: The buyer's and seller's names, contact information, and signatures. The make, model, and year of the vehicle.

The 11 origin-based states are: Arizona, California, Illinois, Mississippi, Missouri, New Mexico, Ohio, Pennsylvania, Tennessee, Texas, Utah and Virginia. California is mixed: City, county and state sales taxes are origin-based, while district sales taxes (supplementary local taxes) are destination-based.

All individuals, as well as businesses operating in the state, must pay use tax when goods are purchased from outside the state of Tennessee and brought or shipped into the state and the seller did not collect sales tax on the purchase.

Is a Bill of Sale required for selling a car in Tennessee? No, a bill of sale is not required for private car sales in Tennessee. However, it's still a good idea to have one the provide legal protection to both the buyer and the seller.

Generally, the sales tax applies to the retail sale of tangible personal property and certain services such as lodging services, telecommunications services and installation and repair of tangible personal property.

If you purchase goods in a state with a higher sales tax rate and pay the other state's sales tax, you would not owe any use tax in Tennessee on those goods.

As of May 2019, Tennessee is an origin-based state. This means you're responsible for applying the sales tax rate determined by the ship-from address on all taxable sales.

Tennessee enacted a second tax holiday in 2020 for restaurant purchases. That has been expanded for 2021, and virtually all non-alcohol grocery and dining purchases are tax-free from a.m. on Friday, July 30 to p.m. on Thursday, Aug 5.