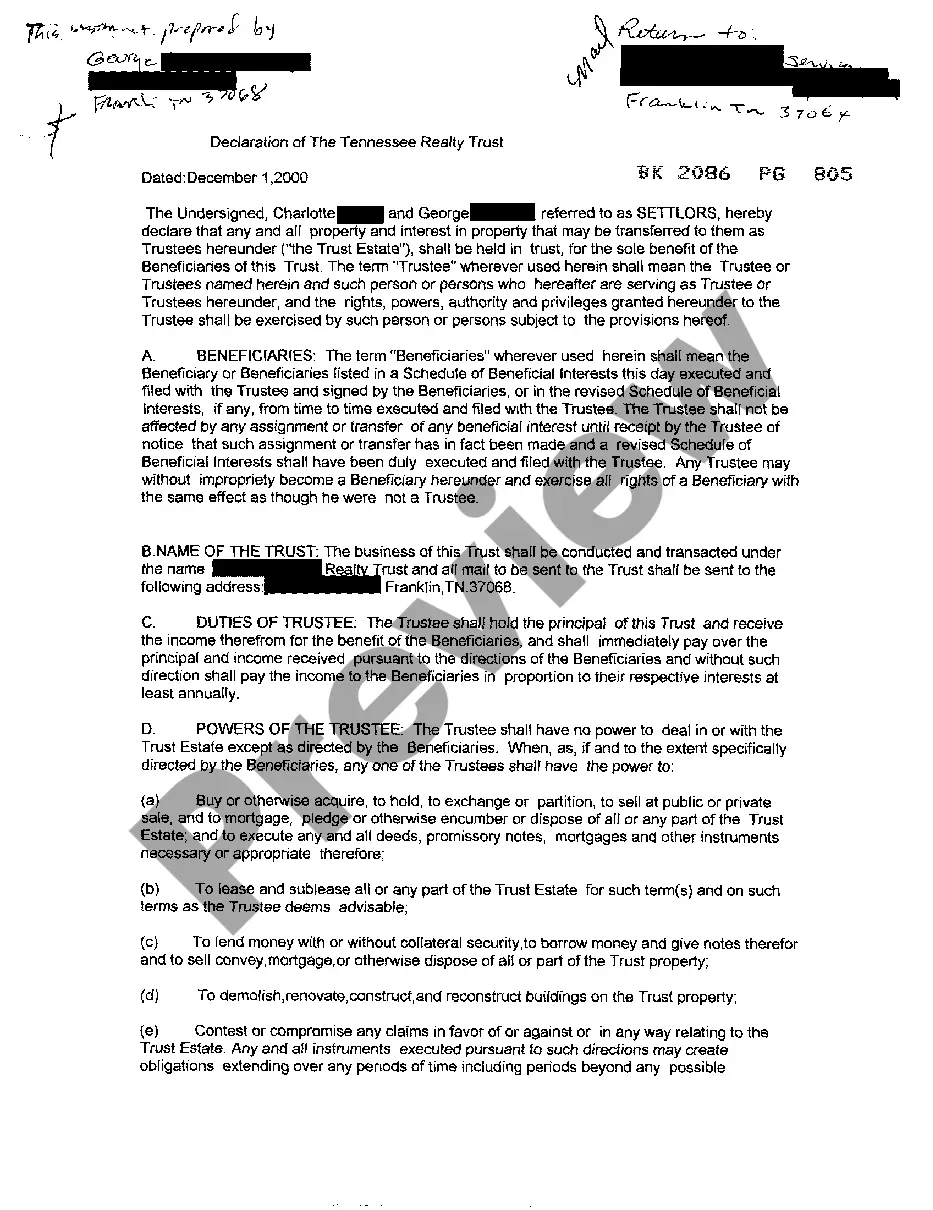

Tennessee Declaration of Realty Trust

Description

How to fill out Tennessee Declaration Of Realty Trust?

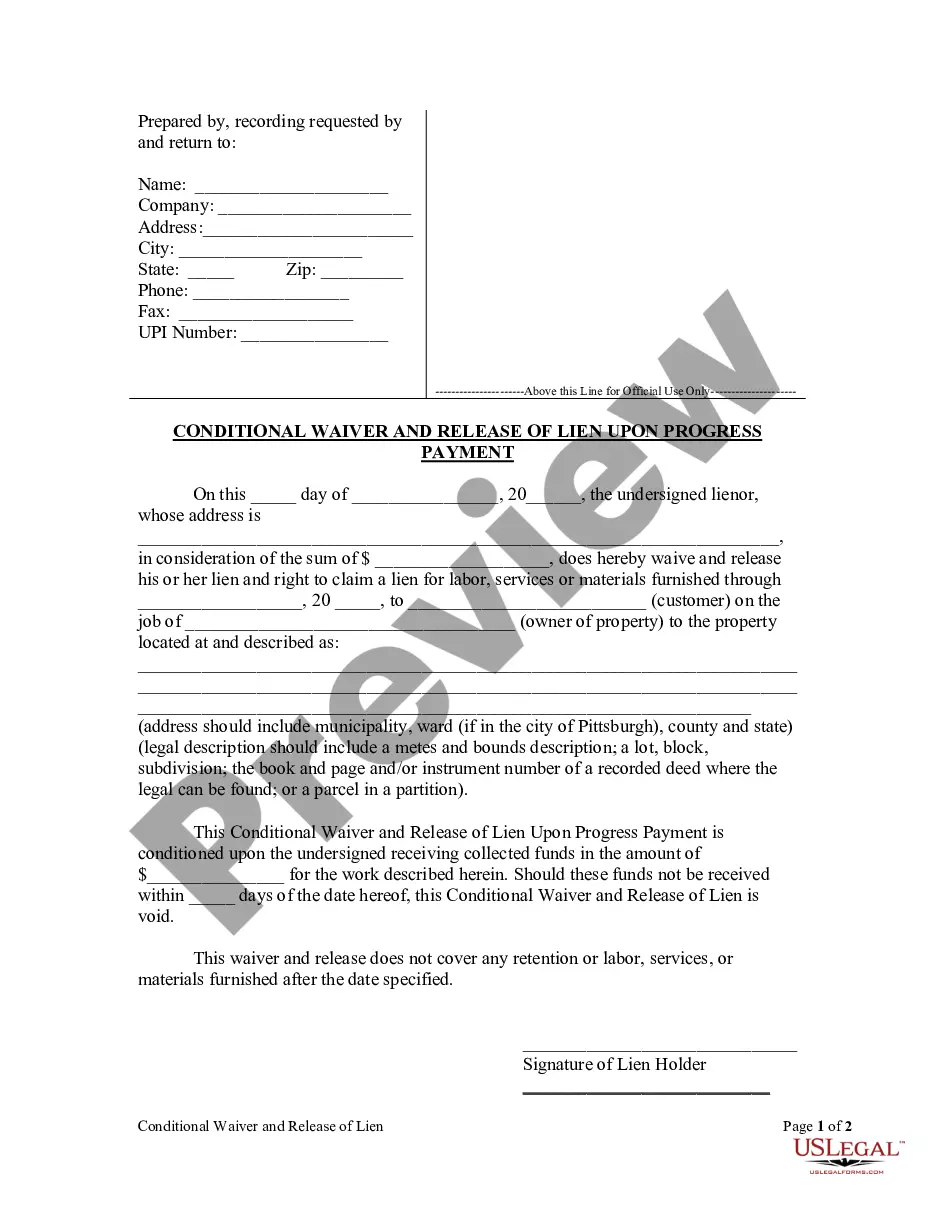

Access to top quality Tennessee Declaration of Realty Trust samples online with US Legal Forms. Prevent hours of wasted time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get over 85,000 state-specific authorized and tax samples that you can save and complete in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Find out if the Tennessee Declaration of Realty Trust you’re considering is suitable for your state.

- See the sample utilizing the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Choose a favored format to save the document (.pdf or .docx).

You can now open the Tennessee Declaration of Realty Trust example and fill it out online or print it and do it yourself. Think about sending the papers to your legal counsel to make certain everything is filled in correctly. If you make a mistake, print and complete sample again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

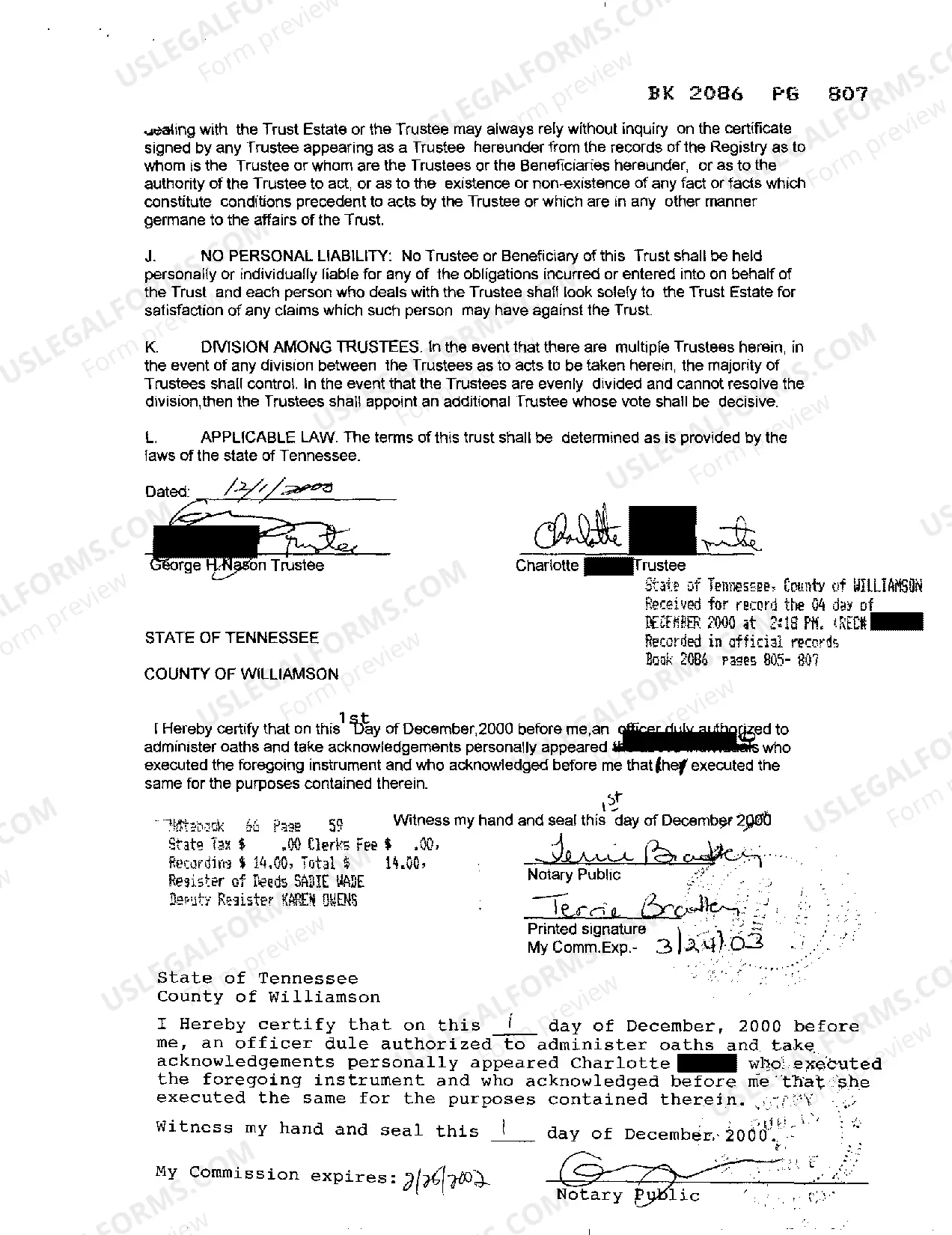

If you are the sole Trustee of the Trust, the document used to create it is called a declaration of trust. If the there is an additional Trustee, the document used to create the trust is called a trust agreement.

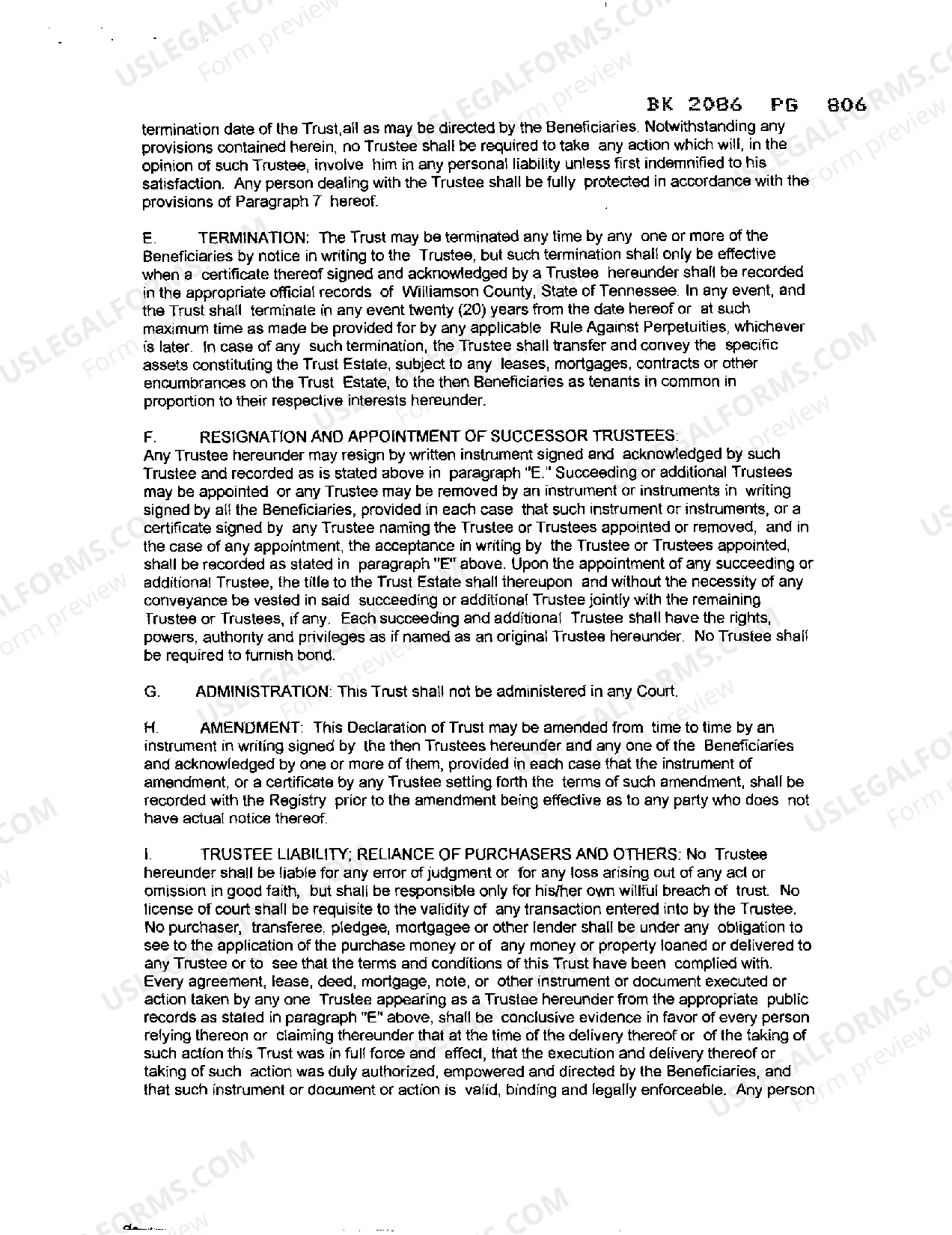

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

What's included in a Declaration of Trust will depend on your individual circumstances. It can include: How much each person contributes to the deposit, and how much will be repaid to them. What percentage of the property each person will own, and how the money will be split if the property is sold.

As a legally binding document, the declaration of trust cannot be ignored when coming to a conclusion as to how much you should receive either on being bought out or after a sale of the property. It does not allow either of you to change your minds about how you will divide the money from the property.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

Placing an investment account with a named beneficiary in a trust does not negate the original beneficiary designation.This can cause confusion among the trust beneficiaries as to why the investment accounts are not included in with the trust assets. An unhappy beneficiary could take the matter to the probate court.

A Declaration of Trust (also known as a Deed of Trust) is a legally binding document in which the legal owners of the property declare that they hold the property on trust for the beneficial owners and sets out the shares in which the beneficial interests are held.