South Carolina Assignment of Profits of Business

Description

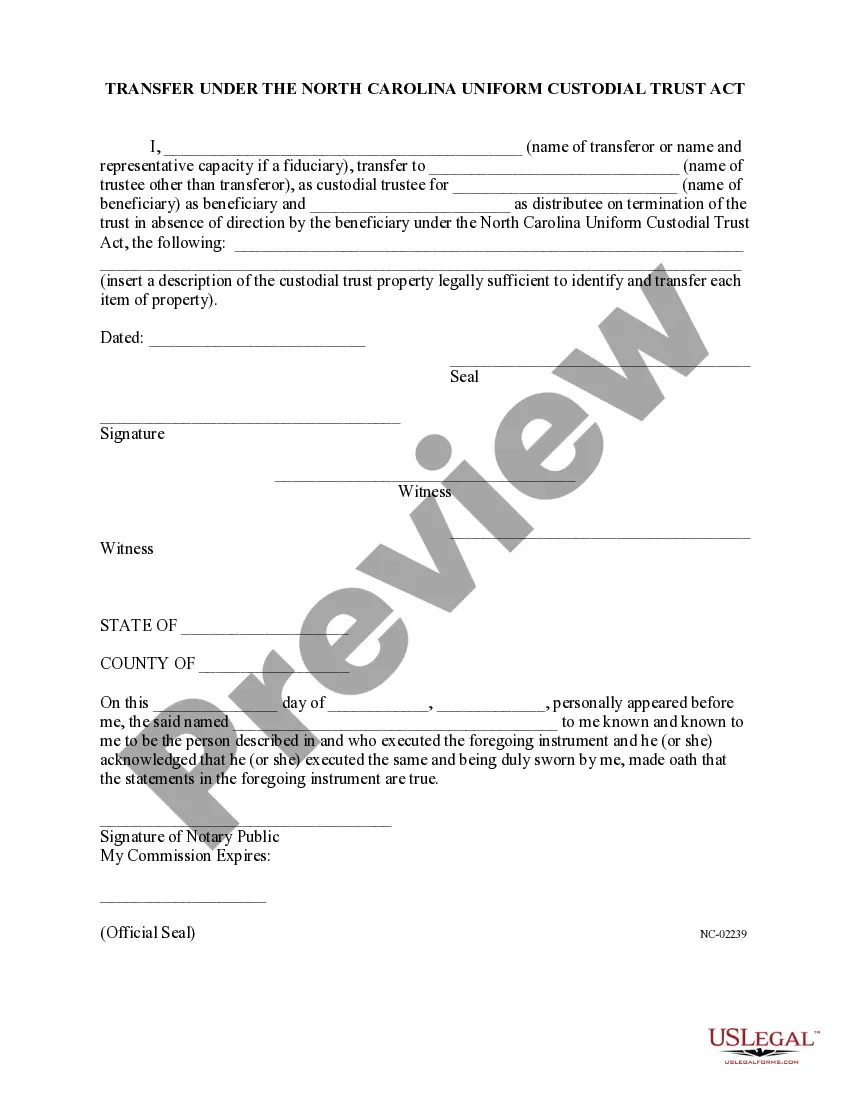

How to fill out Assignment Of Profits Of Business?

If you aim to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the finest selection of legal forms, available online.

Take advantage of the site's straightforward and convenient search to retrieve the documents you require.

Countless templates for both business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are unhappy with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document format.

Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and provide your details to register for the account.

- Utilize US Legal Forms to access the South Carolina Assignment of Profits of Business within just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to find the South Carolina Assignment of Profits of Business.

- You may also reach forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to inspect the form's details. Be sure to read the description.

Form popularity

FAQ

Reporting S Corporation Payroll and Distributions Payroll amounts will be reported on your Form 1120S. Distributions are reported and filed on an 1120S and your personal tax return.

Essentially, an S corp is any business that chooses to pass corporate income, losses, deductions, and credit through shareholders for federal tax purposes, with the benefit of limited liability and relief from double taxation.1 Some 30 million business owners include business profits on their personal income tax

S corporations: S corps are pass-through taxation entities. They file an informational federal return (Form 1120S), but no income tax is paid at the corporate level. The profits/losses of the business are instead passed-through to the business and reported on the owners' personal tax returns.

The total S corporation income (or loss) that you show on Schedule E is included on your personal Form 1040 on the line for income from rental real estate, royalties, partnerships, S corporations, trusts, etc.

Unlike most other states, South Carolina does not require LLCs to file an annual report.

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).

LLC (taxed as an S corporation) or a shareholder in an S corporation: The LLC member's, or S corporation shareholder's, pro-rata share of profits of the business isn't considered earned income, even if it's not distributed to the owner; rather, it's considered a return on investment and is taxed at the respective

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

South Carolina Business ComplianceThe South Carolina Secretary of State doesn't have any requirements for an annual report, but businesses must file annual returns with the Department of Revenue. If these filings become delinquent, the Secretary of State could dissolve your company.

Annual Report for South Carolina LLCsThe fee is $25 (made payable to the Secretary of State) and Form CL-1 must be filed within 60 days of your LLC being formed.