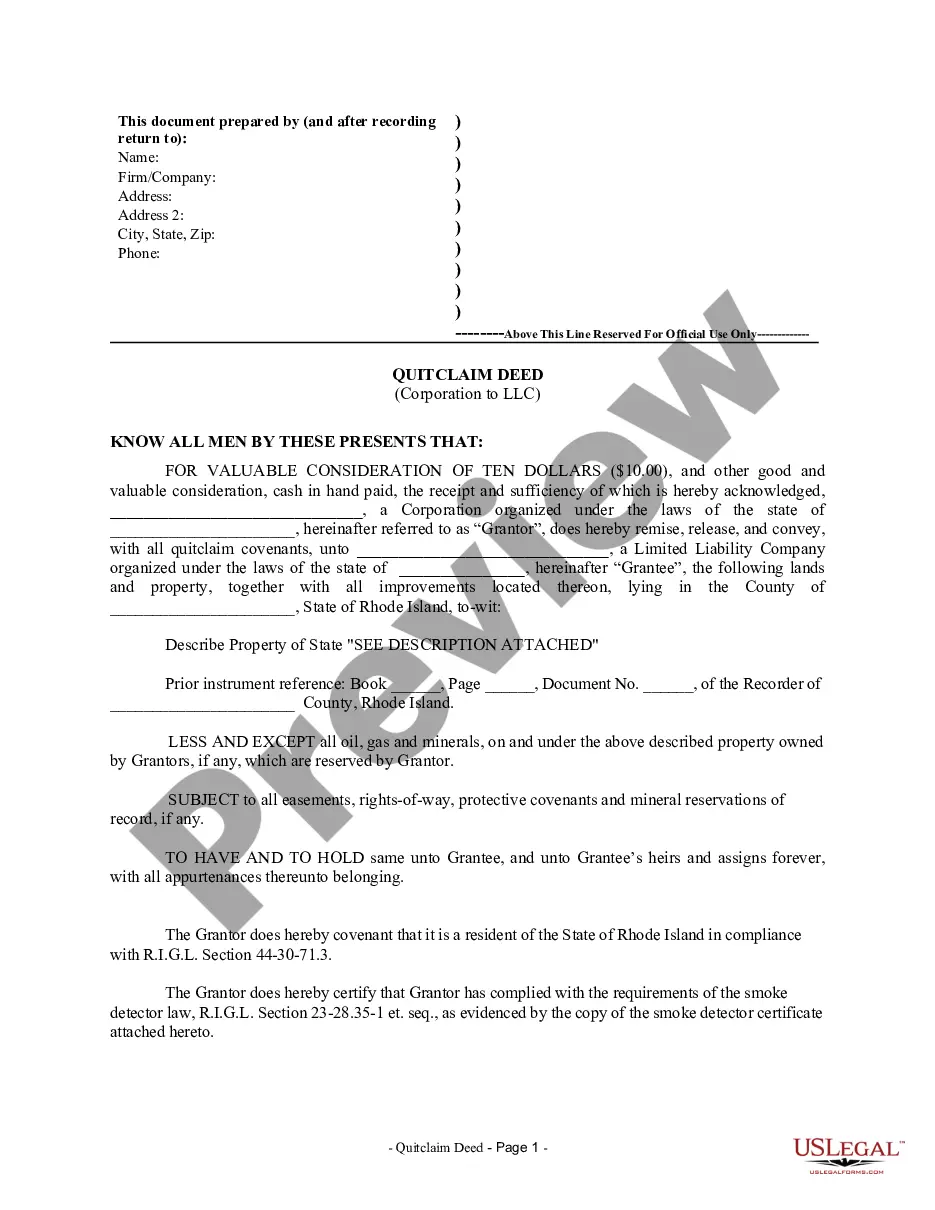

Rhode Island Quitclaim Deed from Corporation to LLC

Definition and meaning

A Rhode Island Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of real property ownership from a corporation to a limited liability company (LLC). This type of deed is commonly used in real estate transactions where the grantor (the corporation) relinquishes any claim to the property in favor of the grantee (the LLC) without providing any warranties of title. The quitclaim deed specifically conveys only the interest the grantor has in the property at the time of the transfer.

How to complete a form

Completing the Rhode Island Quitclaim Deed involves several essential steps:

- Start by filling in the name of the corporation as the Grantor and the name of the LLC as the Grantee.

- Specify the state and county where the property is located.

- Provide a detailed description of the property, referencing a separate document if necessary.

- Ensure the Grantor verifies compliance with local laws, including smoke detector requirements.

- Have the form signed by an authorized officer of the corporation in the presence of a notary public.

Once completed, the deed must be recorded with the local County Recorder's office to finalize the ownership transfer.

Legal use and context

Quitclaim deeds serve various purposes in real estate law. In Rhode Island, this type of deed is often used to transfer property quickly and without the complexity of a warranty deed. It is particularly beneficial when the Grantor and Grantee have an established relationship, as it minimizes legal formalities and expedites the transfer process. However, it is essential to note that using a quitclaim deed does not guarantee the property is free from liens or other claims.

Who should use this form

The Rhode Island Quitclaim Deed from Corporation to LLC is suitable for corporations looking to transfer real estate holdings to their formed or existing LLCs. This form is ideal for business owners and investors who seek to streamline their property ownership structure or make changes to their organizational framework without the extensive requirements of a warranty deed. Individuals not familiar with real estate transactions are also encouraged to consult a legal professional before using this form.

Key components of the form

Understanding the critical components of the Rhode Island Quitclaim Deed is vital for effective usage. Major elements include:

- Identification of Parties: Clearly defines both the Grantor (the corporation) and Grantee (the LLC).

- Property Description: A detailed account of the property being transferred, including any relevant legal descriptions.

- Consideration: A nominal value, such as ten dollars, to formalize the transaction.

- Notarization: Signatures must be notarized to validate the deed legally.

Each component must be thoroughly filled out to ensure the validity of the deed.

Common mistakes to avoid when using this form

When preparing a Quitclaim Deed, several common pitfalls can lead to errors or legal complications:

- Failing to provide a complete property description can lead to disputes or claims against the property.

- Neglecting to notarize the form may invalidate the deed.

- Improperly identifying the parties involved can result in legal challenges.

- Not adhering to state-specific requirements could lead to noncompliance.

To avoid these mistakes, consider reviewing the document with a legal expert before submission.

Form popularity

FAQ

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.