Oregon Depreciation Schedule

Description

How to fill out Depreciation Schedule?

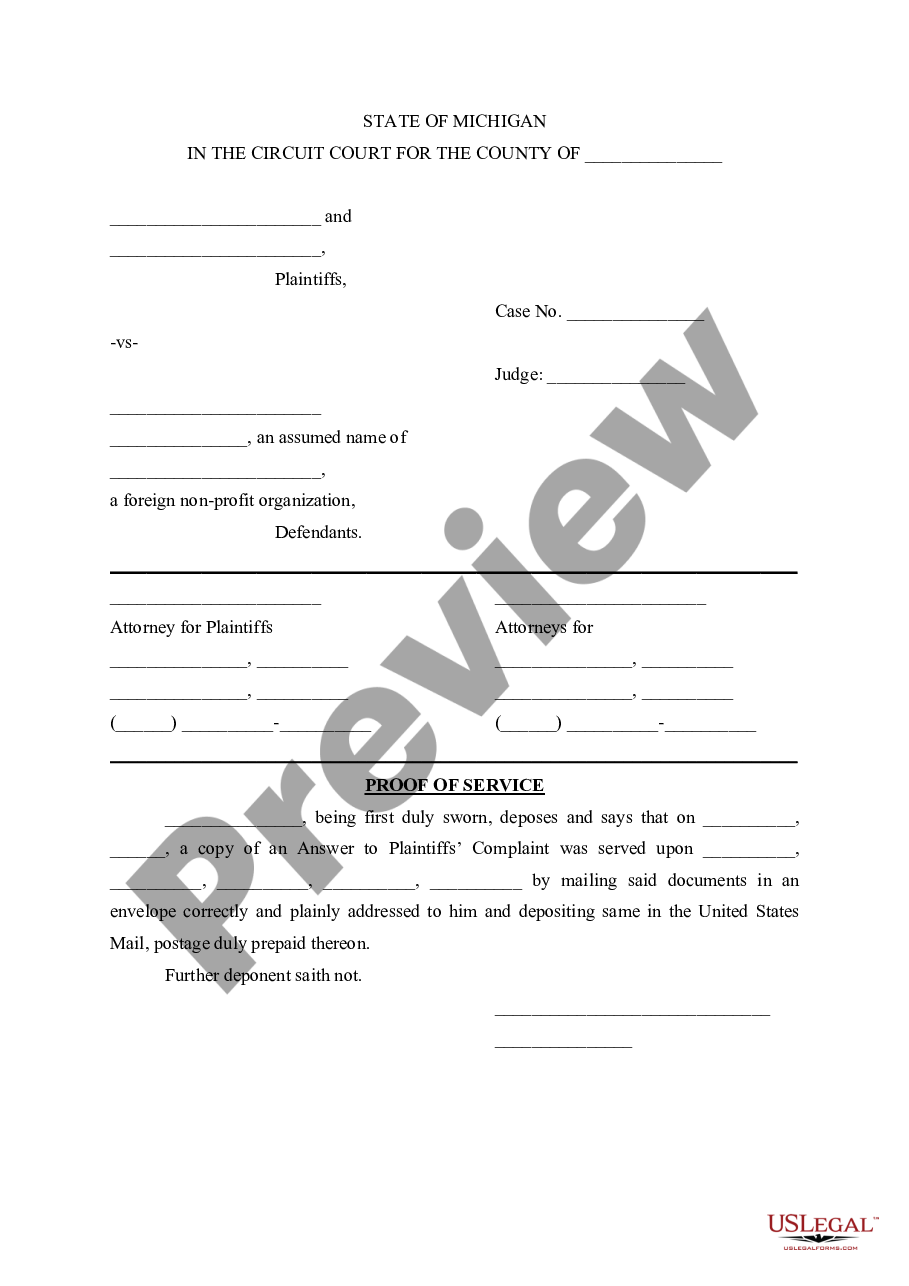

Locating the appropriate legal document template can be rather challenging. Of course, there are numerous templates accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website.

The platform offers a vast collection of templates, including the Oregon Depreciation Schedule, suitable for business and personal purposes. All the forms are verified by experts and comply with federal and state regulations.

If you are already registered, sign in to your profile and click the Download button to acquire the Oregon Depreciation Schedule. Use your account to search for the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you desire.

US Legal Forms represents the largest repository of legal documents where you can find various document templates. Utilize the service to download professionally crafted papers that adhere to state requirements.

- First, ensure you have selected the correct form for your jurisdiction/county. You can view the document using the Preview button and review the form description to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the suitable form.

- Once you are confident that the document is accurate, click on the Buy now button to purchase the form.

- Select the pricing plan you prefer and provide the necessary details. Create your account and complete your transaction using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

- Fill out, modify, and print, then sign the acquired Oregon Depreciation Schedule.

Form popularity

FAQ

A depreciation schedule charts the loss in value of an asset over the period you've designated as its useful life, using the accounting method you've chosen. The point of having a depreciation schedule is to give you the ability to track what you've already deducted and stay on top of the process.

MACRS usually follows the straight line or double declining method. IRS Publication 946 determines each asset's useful life and explains all the depreciation and amortization rules and regulations. Sole proprietorships and single-member LLCs deduct depreciation when they fill out Schedule C on Form 1040.

For bonus depreciation purposes, eligible property is in one of the classes described in § 168(k)(2): MACRS property with a recovery period of 20 years or less, depreciable computer software, water utility property, or qualified leasehold improvement property.

Schedule C FilersEnter the depreciation deduction on Schedule C, Line 13, Depreciation and section 179 expense deduction (not included in Part III). Attach Schedule C and Form 4562 to your Form 1040.

Credits that reduce only your federal basis will cause a dif2011 ference in depreciation for Oregon. This will be the only cause for a difference in depreciation for corporations. Oregon didn't adopt changes made to IRC Section 168(k) (bonus depreciation) or to any expensing limits under IRC Section 179 for this period.

Depreciation commences as soon as the property is placed in service or available to use as a rental. By convention, most U.S. residential rental property is depreciated at a rate of 3.636% each year for 27.5 years. Only the value of buildings can be depreciated; you cannot depreciate land.

It was scheduled to go down to 40% in 2018 and 30% in 2019, and then not be available in 2020 and beyond. The Tax Cuts and Jobs Act, enacted at the end of 2018, increases first-year bonus depreciation to 100%. It goes into effect for any long-term assets placed in service after September 27, 2017.

States that have adopted the new bonus depreciation rules:Alabama.Alaska.Colorado.Delaware.Illinois.Kansas.Louisiana.Michigan.More items...

The Oregon basis for depreciation is generally the lower of the federal unadjusted basis or the fair market value. The federal unadjusted basis is the original cost before any adjustments. Adjustments include: reductions for investment tax credits, depletion, amortization, or amounts expensed under IRC Section 179.

The Oregon basis for depreciation is generally the lower of the federal unadjusted basis or the fair market value. The federal unadjusted basis is the original cost before any adjustments. Adjustments include: reductions for investment tax credits, depletion, amortization, or amounts expensed under IRC Section 179.