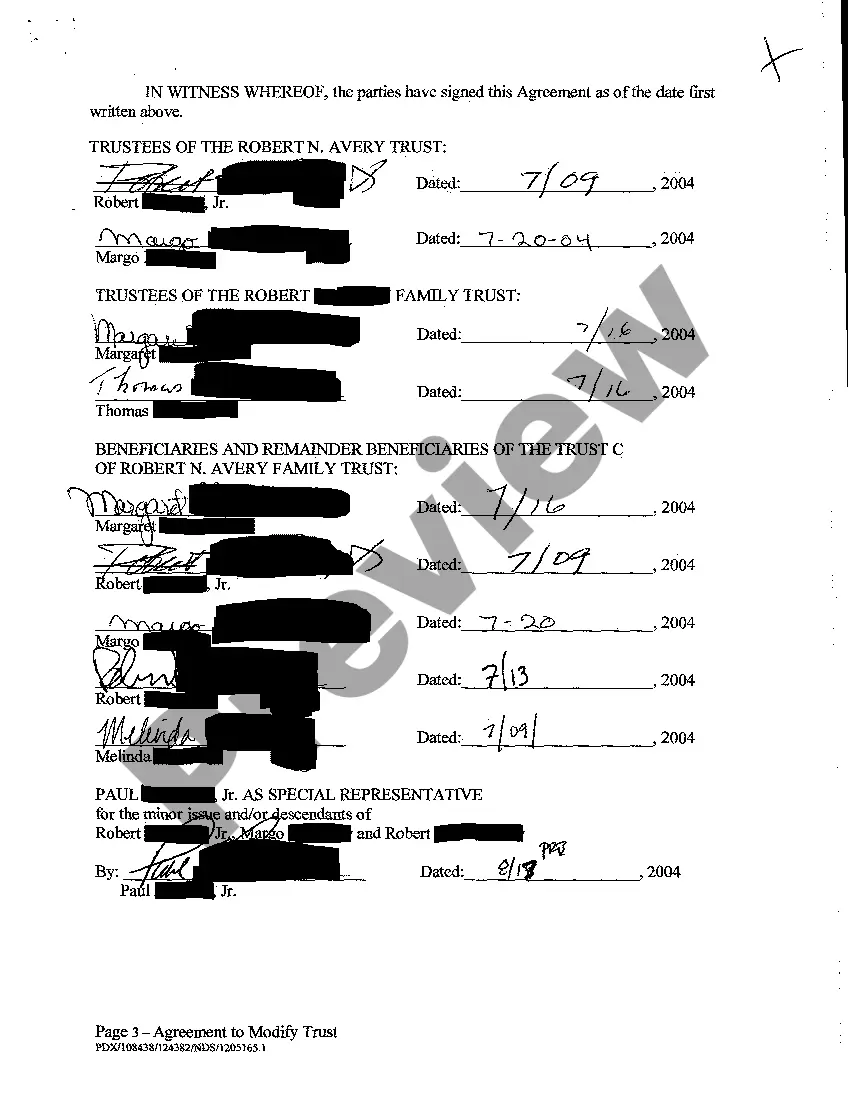

Oregon Filing of the Agreement to Modify Trust

Description

Key Concepts & Definitions

A03 Filing of the Agreement to Modify Trust: Refers to a specific administrative procedure under United States law for amending the terms of a trust document. This may include aspects like the beneficiaries, trustees, terms, or operation of the trust.- Modify Trust: The process of making changes to the terms of a trust agreement, which may be irrevocable or revocable depending on the trust type.

- Estate Planning: The preparation of tasks that serve to manage an individual's asset base in the event of incapacitation or death. Estate planning includes the bequest of assets to heirs and the settlement of estate taxes.

- Irrevocable Trust: A type of trust where its terms cannot be modified, amended, or terminated without the permission of the grantor's named beneficiary or beneficiaries.

Step-by-Step Guide

- Review the Original Trust Agreement: Understand the existing stipulations and determine what modifications are needed.

- Consult with an Estate Planning Attorney: Professional advice is crucial, especially in complex scenarios involving irrevocable trusts or significant assets like real estate.

- Draft the A03 Filing Agreement: Create a document that outlines all proposed changes to the trust.

- Notify all Parties Involved: Required in many states, informing all beneficiaries and related parties about the intended changes can be critical.

- File the Agreement in Relevant Courts or with a Trustee: Depending on the jurisdiction, like Portland, Oregon, this might involve court proceedings or simply a trustee's approval.

- Record Changes for Future Reference: Documenting these amendments may be important for future estate planning and administration.

Risk Analysis

- Legal Disputes: Improper filing or insufficient notification to relevant parties can lead to disputes or legal challenges.

- Financial Implications: Changing the structure of a trust can potentially alter tax liabilities and financial benefits.

- Failure to Comply with State Laws: Each state, including specifics like in landlord-tenant agreements or small business considerations, may have different requirements for filing and enforcing modifications to a trust.

Common Mistakes & How to Avoid Them

- Neglecting State-Specific Rules: Each state can have differing laws regarding trust modification. For example, in Portland, Oregon, there are specific statutes governing trust amendments.

- Failing to Consult Legal Professionals: Trust law can be complex, particularly regarding irrevocable trusts and estate planning. Professional advice is essential.

- Inadequate Documentation: Failure to properly document amendments or the agreement itself can lead to future disputes or an inability to enforce the new terms.

Case Studies / Real-World Applications

- In Portland, Oregon, a small business owner successfully modified an irrevocable trust to address new real estate acquisitions, ensuring more efficient tax handling and legacy planning.

- A property owner in a landmark landlord-tenant case utilized a trust modification to restructure property management roles and responsibilities, leading to improved tenant relations and property values.

How to fill out Oregon Filing Of The Agreement To Modify Trust?

The work with papers isn't the most easy process, especially for people who rarely deal with legal paperwork. That's why we recommend utilizing accurate Oregon Filing of the Agreement to Modify Trust templates made by skilled attorneys. It allows you to eliminate problems when in court or dealing with official organizations. Find the files you want on our site for top-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file webpage. Right after downloading the sample, it’ll be stored in the My Forms menu.

Users without an activated subscription can easily create an account. Use this short step-by-step guide to get the Oregon Filing of the Agreement to Modify Trust:

- Make sure that the document you found is eligible for use in the state it’s required in.

- Verify the document. Use the Preview feature or read its description (if available).

- Buy Now if this form is the thing you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these simple steps, it is possible to fill out the form in a preferred editor. Recheck filled in information and consider asking a legal professional to examine your Oregon Filing of the Agreement to Modify Trust for correctness. With US Legal Forms, everything gets easier. Try it out now!

Form popularity

FAQ

Power of trustee to modify or revoke The trustee's power also comes from the trust agreement. As such, the agreement must expressly confer on the trustee the power to revoke or modify the trust, otherwise the trustee has no power to alter the terms of the trust.

To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument.

In most cases, a trustee cannot remove a beneficiary from a trust.However, if the trustee is given a power of appointment by the creators of the trust, then the trustee will have the discretion given to them to make some changes, or any changes, pursuant to the terms of the power of appointment.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

The best way to find a trust is to ask the person who created it or the person who manages it. If the trust owns real estate, then a deed to the trust has probably been recorded in the county where the real estate is.

Like a will, a living trust can be altered whenever you wish. One of the most attractive features of a revocable living trust is its flexibility: You can change its terms, or end it altogether, at any time. If you created a shared trust with your spouse, either of you can revoke it.

Can an irrevocable trust be changed? Often, the answer is no. By definition and design, an irrevocable trust is just thatirrevocable. It can't be amended, modified, or revoked after it's formed.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated. A material purpose of the trust no longer exists.

A nonjudicial settlement agreement is a contract between the beneficiaries of a Trust that can modify the terms of the Trust and provide an effective and cost-efficient manner to resolve disputes regarding the terms of the Trust while avoiding the need for litigation.