Oklahoma Agreement for Sale of Assets of Corporation

Description

How to fill out Agreement For Sale Of Assets Of Corporation?

If you need to obtain, create, or generate legal document templates, consider using US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and efficient search feature to find the documents you require.

A selection of templates for business and personal purposes is categorized by types and states, or keywords.

Every legal document template you purchase is yours to keep permanently. You can access every form you downloaded with your account. Go to the My documents section and select a form to print or download again.

Complete and retrieve, and print the Oklahoma Agreement for Sale of Assets of Corporation using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Oklahoma Agreement for Sale of Assets of Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Oklahoma Agreement for Sale of Assets of Corporation.

- You can also access forms you have previously downloaded under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

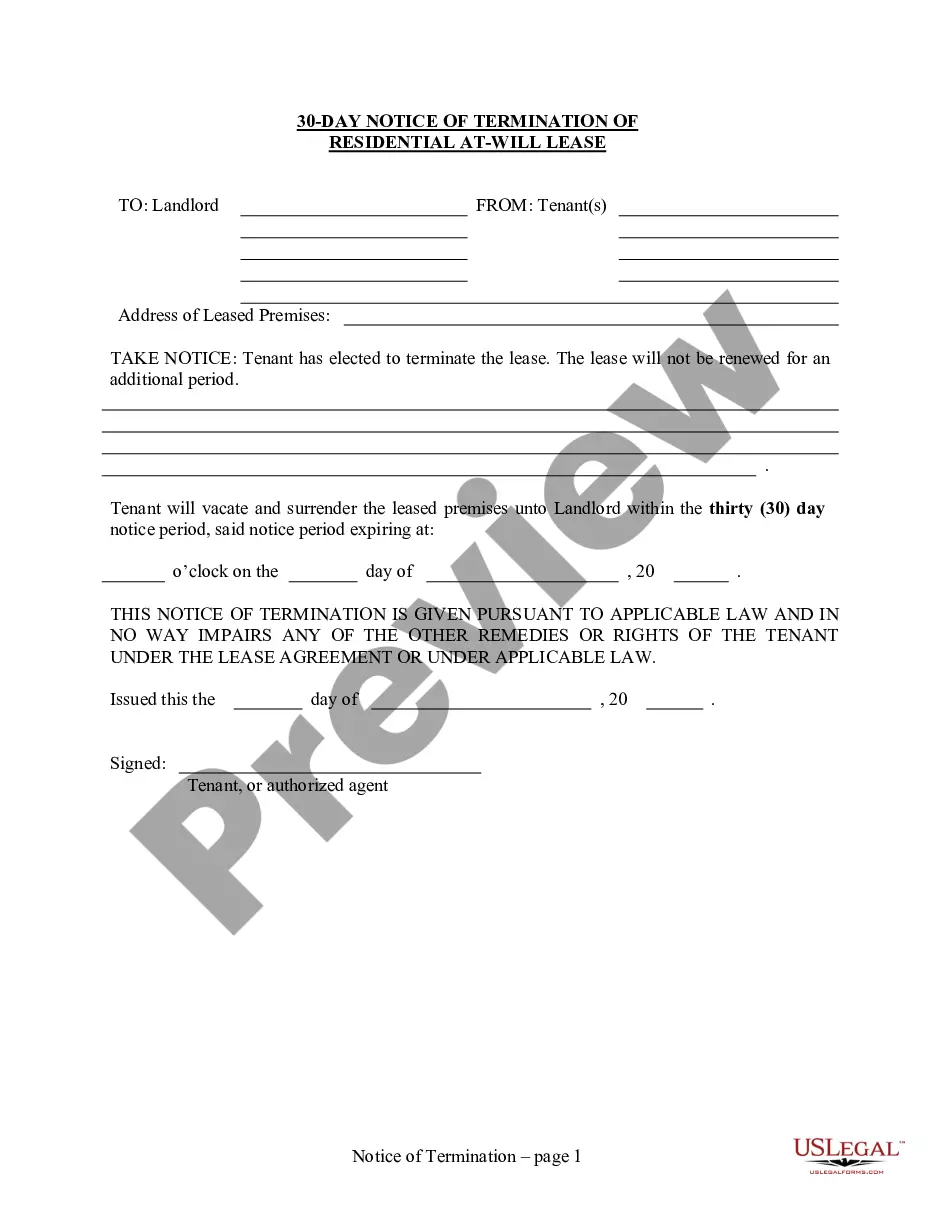

- Step 2. Use the Preview feature to review the content of the form. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field located at the top of the screen to find other forms in the legal form format.

- Step 4. After finding the form you desire, click on the Get now button. Select the pricing plan you prefer and provide your details to register for the account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the purchase.

- Step 6. Locate the template in the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Oklahoma Agreement for Sale of Assets of Corporation.

Form popularity

FAQ

Writing a contract to buy a house involves several key steps. First, you need to clearly identify the parties involved, including the buyer and seller. Next, outline the property description and any terms related to the sale, such as payment amounts and deadlines. Utilizing the Oklahoma Agreement for Sale of Assets of Corporation can provide you with a structured template that ensures you cover all necessary legal points, protecting both parties in the transaction.

A valid contract for the sale of land in Oklahoma must meet certain legal requirements. First, it needs to have an offer and acceptance, clearly outlining the terms involved. Additionally, the parties must have the legal capacity to enter the agreement, and the contract must be in writing to be enforceable under the Oklahoma Agreement for Sale of Assets of Corporation. Using platforms like USLegalForms can help you draft a valid contract that meets all local regulations, ensuring your transaction proceeds smoothly.

Selling an LLC in Oklahoma involves several steps, starting with conducting a valuation of the business. You need to draft an Oklahoma Agreement for Sale of Assets of Corporation to clearly outline the terms of the sale, including assets, liabilities, and any existing contracts. Once the agreement is prepared, all members must consent to the sale. Proper documentation will facilitate a seamless transfer of ownership.

To sell business assets, first identify the assets that you wish to sell and evaluate their market value. Utilize an Oklahoma Agreement for Sale of Assets of Corporation to ensure compliance with legal requirements and streamline negotiations. Engage with potential buyers, and once terms are agreed upon, finalize the sale with the appropriate documentation. This process will help you achieve a smooth transaction.

Selling off business assets can streamline operations or raise capital. Start by conducting an inventory of all assets and valuing them appropriately. You might find that using an Oklahoma Agreement for Sale of Assets of Corporation simplifies the selling process, as it outlines the details and legalities needed to complete the sale. Engaging interested buyers will also be essential to find the right market for your assets.

Writing off business assets involves recognizing a decrease in their value, usually for tax purposes. You should assess the fair market value of the assets and determine if they are no longer usable or have depreciated significantly. Once you confirm this, document the loss in your financial records and use an Oklahoma Agreement for Sale of Assets of Corporation to formalize the transaction. This can provide clarity and possibly tax benefits.

To sell ownership of a corporation, you must first agree on the terms of the sale between you and the buyer. This process typically involves drafting an Oklahoma Agreement for Sale of Assets of Corporation. You will need to ensure that all liabilities are disclosed and that any necessary approvals are obtained from shareholders or board members. Finally, transfer the ownership shares to the buyer and complete any required documentation.

Writing a business sale agreement involves detailing the specifics of the sale, such as the business name, assets, and liabilities. Clearly outline payment terms, any contingencies, and transitional support post-sale. Using a detailed resource like the Oklahoma Agreement for Sale of Assets of Corporation can guide you through the necessary legal requirements, ensuring a smooth transaction.

To write an easy agreement, focus on clarity and brevity. Clearly state the purpose of the agreement, the parties involved, and the specifics of the arrangement. A straightforward approach, such as utilizing the Oklahoma Agreement for Sale of Assets of Corporation, can help streamline your process and ensure that the agreement is both effective and legally sound.

To write an agreement between a buyer and a seller, start by clearly identifying both parties and the items involved in the transaction. Specify the terms, including payment details, delivery timelines, and any warranties or guarantees. Using a template like the Oklahoma Agreement for Sale of Assets of Corporation can simplify this process and ensure you cover all necessary legal aspects.