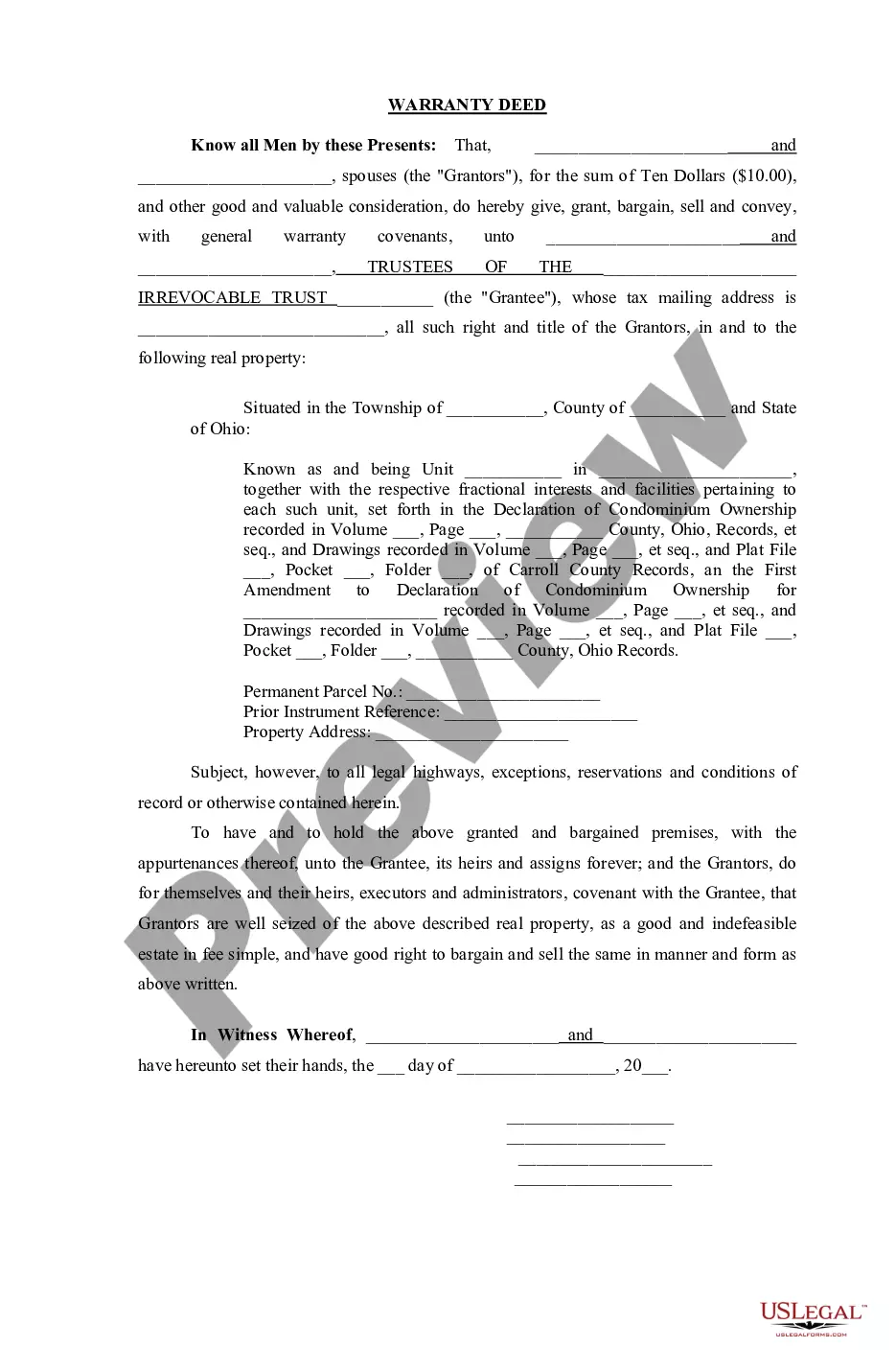

Ohio Warranty Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Ohio Warranty Deed?

In terms of filling out Ohio Warranty Deed, you almost certainly visualize an extensive process that consists of choosing a appropriate sample among hundreds of very similar ones then needing to pay out an attorney to fill it out for you. In general, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific template within just clicks.

In case you have a subscription, just log in and click Download to have the Ohio Warranty Deed form.

In the event you don’t have an account yet but want one, follow the point-by-point manual below:

- Be sure the document you’re downloading applies in your state (or the state it’s needed in).

- Do this by reading through the form’s description and also by clicking on the Preview option (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Pick the suitable plan for your financial budget.

- Join an account and select how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the document on your device or in your My Forms folder.

Skilled lawyers draw up our templates so that after saving, you don't need to bother about enhancing content outside of your individual details or your business’s information. Be a part of US Legal Forms and get your Ohio Warranty Deed sample now.

Form popularity

FAQ

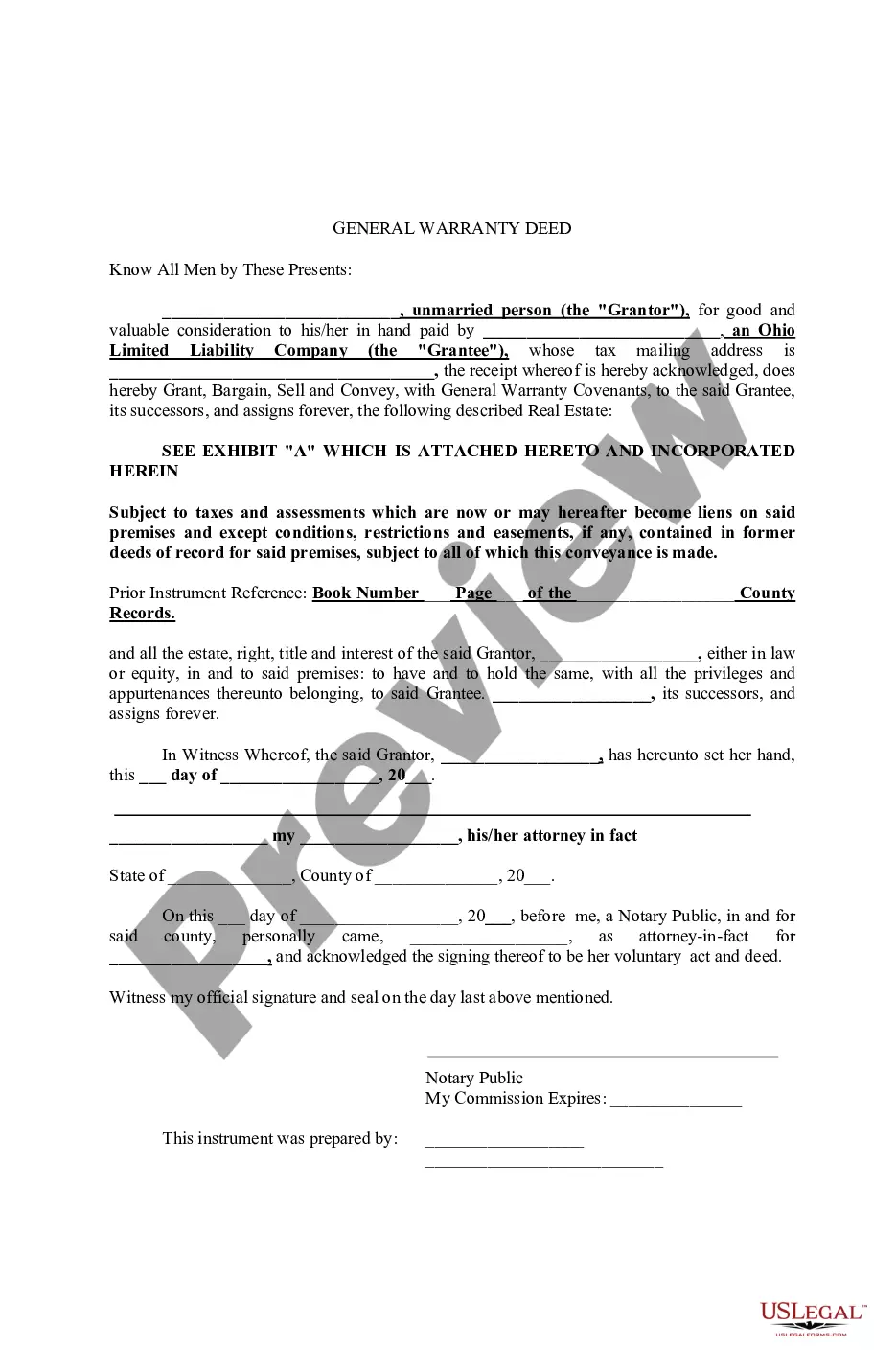

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.It is even possible that the Grantor does not have any title or ownership interest at all!

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

When a will and a deed both transfer the same piece of property, typically the deed will trump. This is not because deeds automatically override a will, but because a deed is designed to take effect immediately after the grantor delivers it to the grantee, whereas a will does not take effect immediately.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating