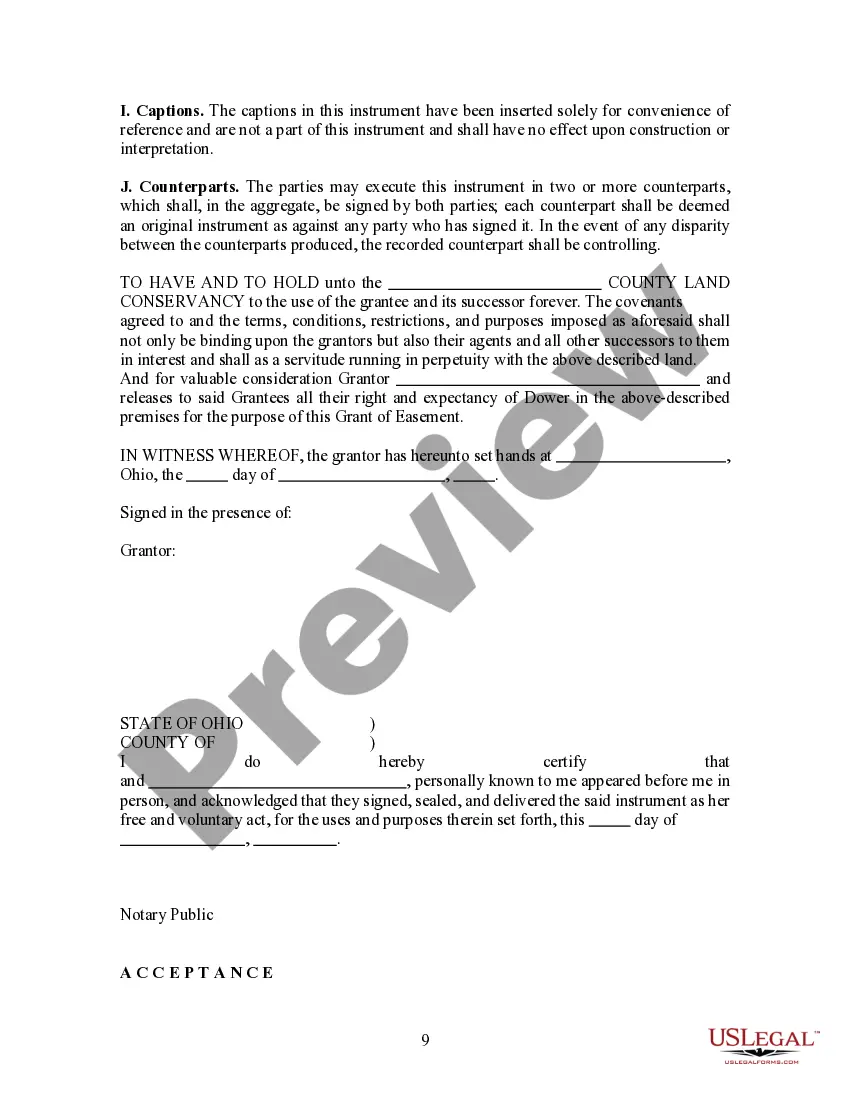

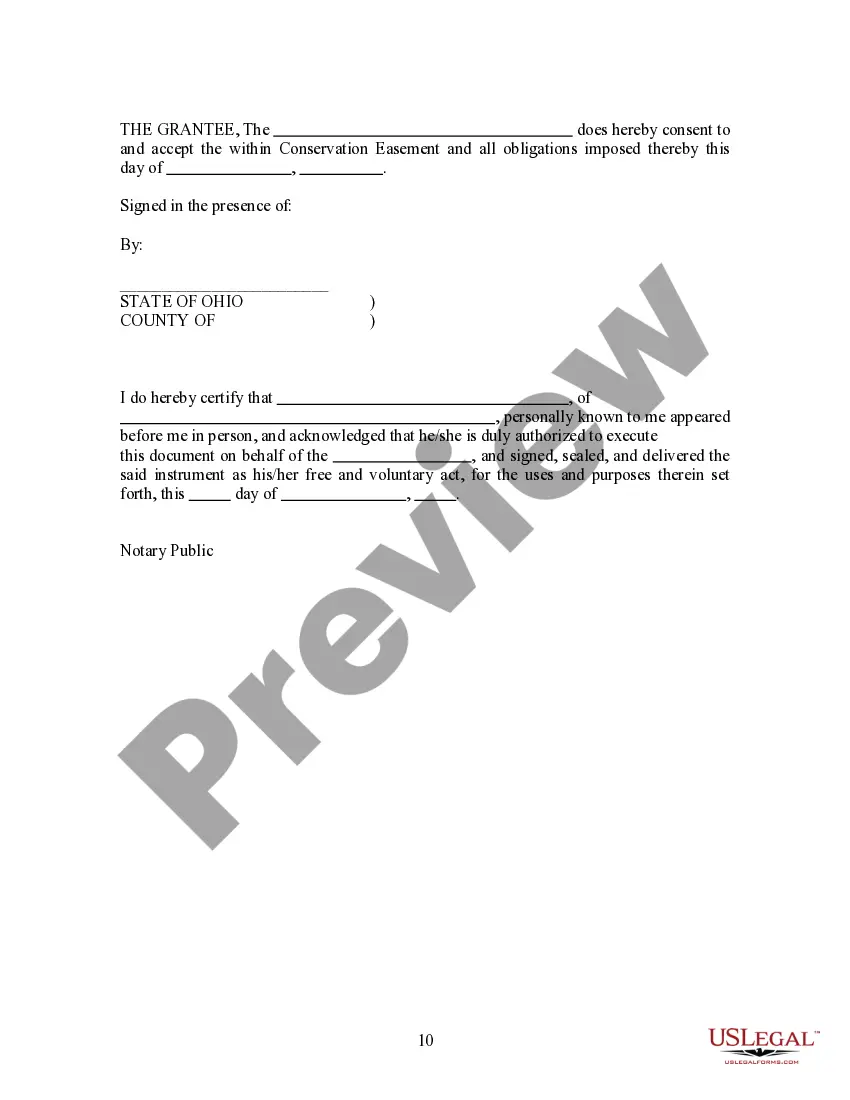

This Conservation Easement is used to preserve the natural and aesthetic value of the property.

Ohio Conservation Easement

Description

How to fill out Ohio Conservation Easement?

Among countless free and paid samples that you get on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they are skilled enough to deal with what you need these to. Always keep relaxed and make use of US Legal Forms! Discover Ohio Conservation Easement samples developed by skilled lawyers and avoid the costly and time-consuming process of looking for an lawyer and then having to pay them to write a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are trying to find. You'll also be able to access your previously acquired templates in the My Forms menu.

If you’re utilizing our platform for the first time, follow the instructions listed below to get your Ohio Conservation Easement easily:

- Ensure that the file you see applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another template utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you have signed up and bought your subscription, you can utilize your Ohio Conservation Easement as often as you need or for as long as it stays active in your state. Change it in your favored editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

In a conservation easement, a landowner voluntarily agrees to sell or donate certain rights associated with his or her property often the right to subdivide or develop and a private organization or public agency agrees to hold the right to enforce the landowner's promise not to exercise those rights.

Conservation easement tax deduction The value of the donation of a conservation easement is considered a charitable deduction for income tax purposes. The deduction is up to 50% of the donor's charitable contribution base (adjusted gross income, less net operating loss carryback) for the taxable year.

When a conservation easement is placed on a property, it typically lowers the property's value for federal estate tax purposes and may decrease estate tax liability. Therefore, easements may help heirs avoid being forced to sell off land to pay estate taxes and enable land to stay in the family.

One big advantage of buying a home or land with an easement is that it could result in major savings. Conservation land is restrictive by nature, and that's often a big sticking point for buyers. But if you're willing to deal with those restrictions, it could be a good way to buy land or property on the cheap.

If a conservation easement is voluntarily donated to a land trust or government agency, and if it benefits the public by permanently protecting important conservation resources, it can qualify as a charitable tax deduction on the donor's federal income tax return.

Conservation easements are a great idea, in theory. Here's the way they work. Basically, if you are willing to donate your property for the public good, and that donation reduces the value of your property, you get to take a tax deduction equal to the reduction in the value of your property.

When you create a conservation easement, you may lose access to certain rights. While you'll likely retain certain surface rights like farming and ranching, development is almost always limited.