Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual

Definition and meaning

The Ohio Transfer on Death Designation Affidavit is a legal document that allows property owners to designate a beneficiary who will receive their real property upon their death. This form ensures that ownership transfers directly to the designated individual without the need for probate, simplifying the process for both the owners and the beneficiary.

How to complete a form

To fill out the Ohio Transfer on Death Designation Affidavit, follow these steps:

- Begin by entering your names as the current property owners.

- Provide the legal description of the property, including the specific address and parcel number.

- Clearly designate your transfer on death beneficiary by providing their full name and address.

- If applicable, choose an alternative beneficiary in case the primary beneficiary passes away before the owners.

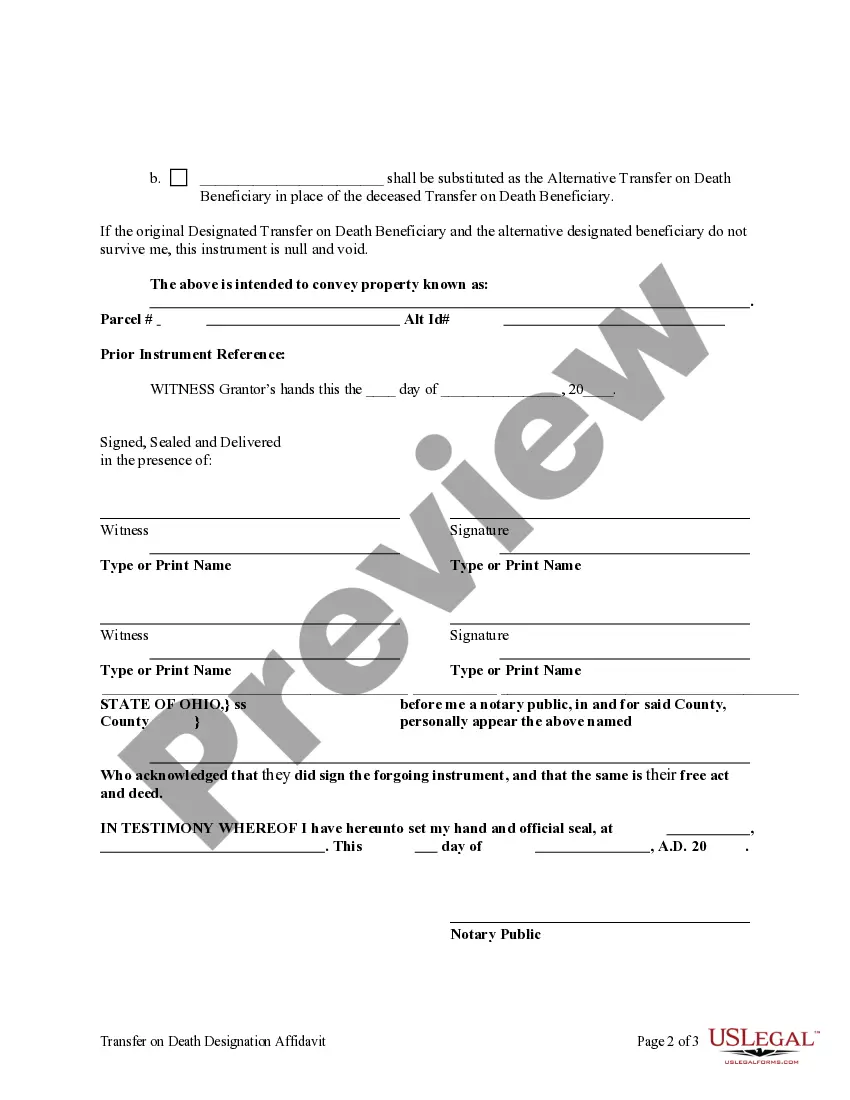

- Sign and date the document in the presence of witnesses and a notary public.

Key components of the form

The key components of the Ohio Transfer on Death Designation Affidavit include:

- Owner Information: Names and details of the property owners.

- Property Description: A detailed legal description of the property, including address and parcel number.

- Beneficiary Designation: The designated transfer on death beneficiary's name and address.

- Alternative Beneficiary: Provisions for naming an alternate beneficiary in case the primary beneficiary predeceases the owners.

- Witness and Notary Sections: Spaces for signatures and notary acknowledgment to validate the document.

Who should use this form

The Ohio Transfer on Death Designation Affidavit is ideal for property owners who wish to simplify the transfer of their real estate after their death. Couples or partners who co-own property can use this form to designate an individual beneficiary for their property, ensuring a smooth transfer without going through probate. This form is suitable for anyone looking to clearly outline their wishes regarding property inheritance.

Benefits of using this form online

Utilizing the Ohio Transfer on Death Designation Affidavit online offers several advantages:

- Accessibility: Users can access and complete the form conveniently from their homes.

- Drafted by Professionals: The form is prepared by licensed attorneys, ensuring legal compliance and accuracy.

- Easy to Follow: Online forms typically include step-by-step instructions, reducing confusion.

- Time-Saving: Download and fill out the form at your own pace, avoiding lengthy office visits.

What to expect during notarization or witnessing

When finalizing the Ohio Transfer on Death Designation Affidavit, it must be witnessed and notarized. You can expect the following:

- Witnesses: At least two individuals must observe the signing of the document. They will also sign as witnesses.

- Notary Public: A notary public will confirm the identities of the signers and their voluntary action in signing the document.

- Document Signing: All involved parties should sign the affidavit in the presence of witnesses and the notary.

Form popularity

FAQ

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

In Ohio, a Survivorship Deed is used to convey title to real estate to two or more people as joint tenants with rights of survivorship. Upon the death of an owner, the property passes to the surviving owner(s). A Survivorship Deed is commonly utilized to convey property to spouses.

If the deeds to the property are unregistered, it is possible to place a death certificate with the deeds, but it's advisable to register the title with the Land Registry at this point. Once this has been done, the property will then be registered in the name of the surviving joint owner.

A TOD Designation Affidavit is an effective upon death deed showing the clear intent of the owner of real property to directly transfer the ownership of the real property upon the owner's death to whomever the owner designates by name.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

Survivorship Deeds contain special language that enables the property to transfer to the surviving owner(s) upon the deceased owner's death.A Transfer-On-Death Designation Affidavit allows the owner of Ohio real estate to designate one or more beneficiaries of the property.