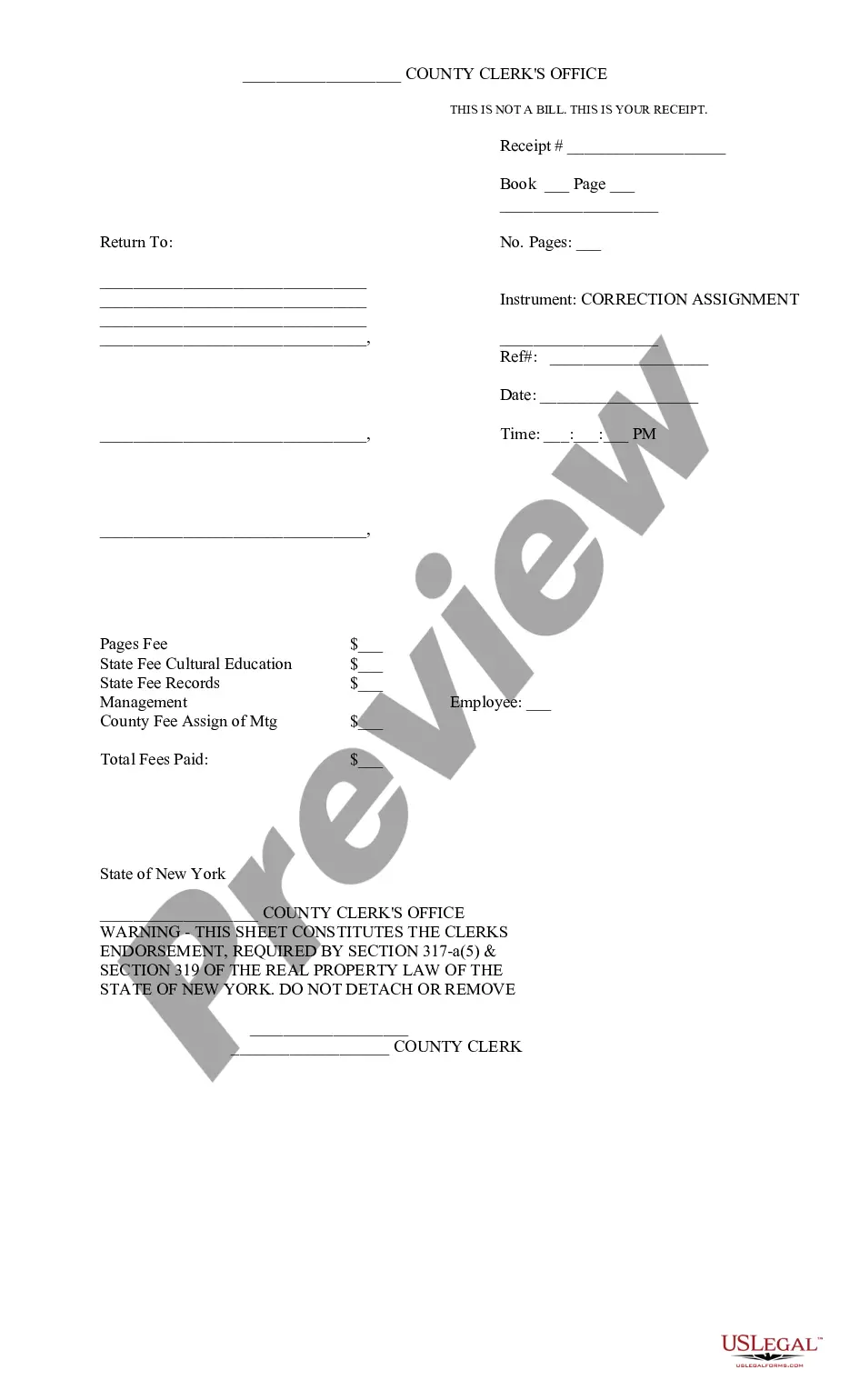

New York Corrective Corporate Assignment of Mortgage

Description

How to fill out New York Corrective Corporate Assignment Of Mortgage?

In terms of completing New York Corrective Corporate Assignment of Mortgage, you most likely visualize a long process that consists of choosing a ideal sample among a huge selection of very similar ones and then needing to pay out a lawyer to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and select the state-specific form within clicks.

In case you have a subscription, just log in and then click Download to have the New York Corrective Corporate Assignment of Mortgage template.

If you don’t have an account yet but want one, keep to the step-by-step manual listed below:

- Make sure the file you’re saving applies in your state (or the state it’s required in).

- Do it by reading the form’s description and through visiting the Preview option (if offered) to view the form’s content.

- Click Buy Now.

- Select the appropriate plan for your financial budget.

- Join an account and select how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Professional lawyers work on creating our samples so that after saving, you don't need to bother about enhancing content outside of your individual details or your business’s information. Join US Legal Forms and receive your New York Corrective Corporate Assignment of Mortgage sample now.

Form popularity

FAQ

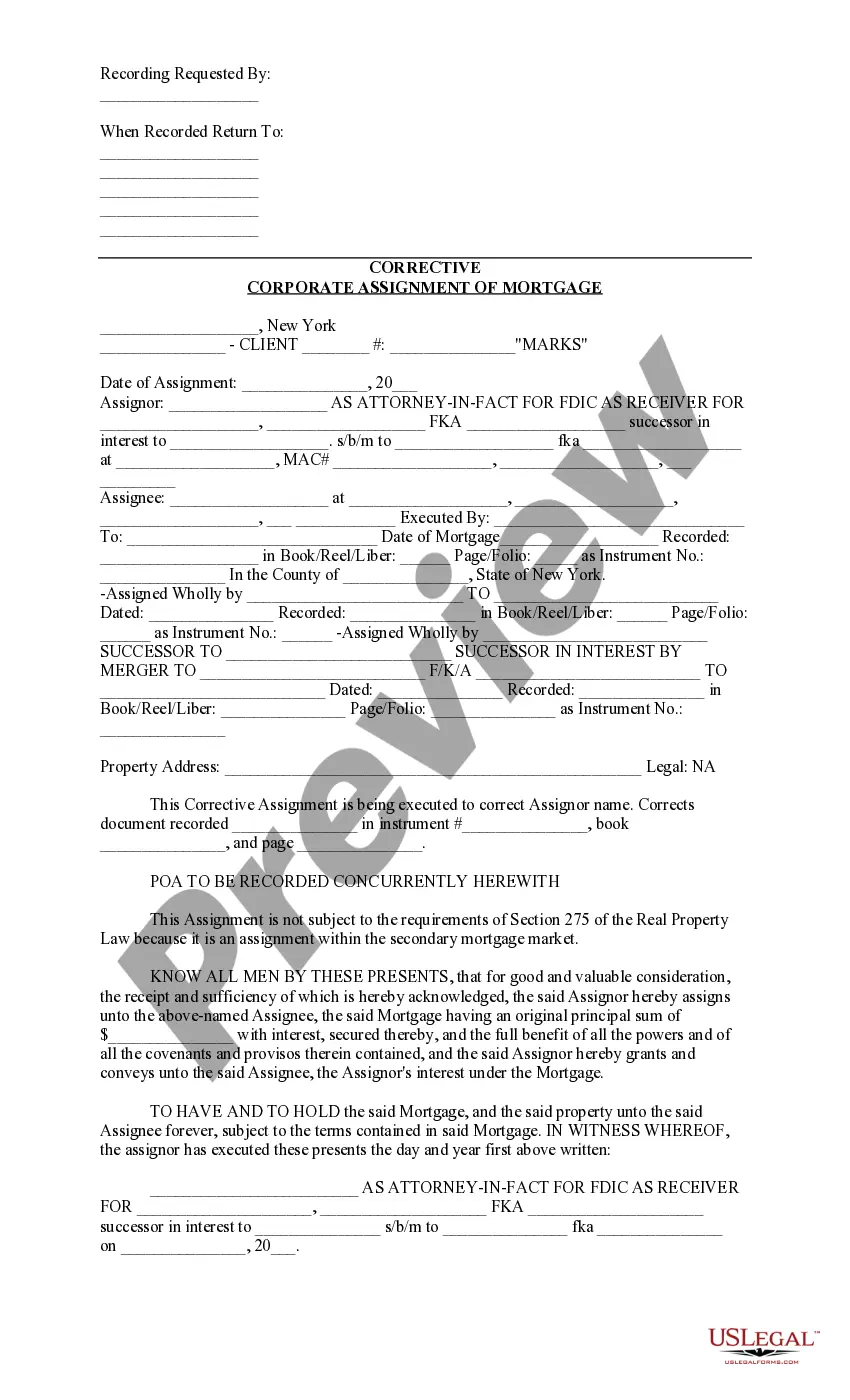

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

No. If MERS was not named as the original mortgagee on the security instrument at the time of closing, you can assign the mortgage to MERS after closing.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

The servicer of a MERS-registered loan has the legal authority to discharge the mortgage on behalf of MERS because, as a member of MERS, authority was granted to their officers through a corporate resolution. The person authorized to sign discharges is sometimes referred to as a certifying officer by MERS.

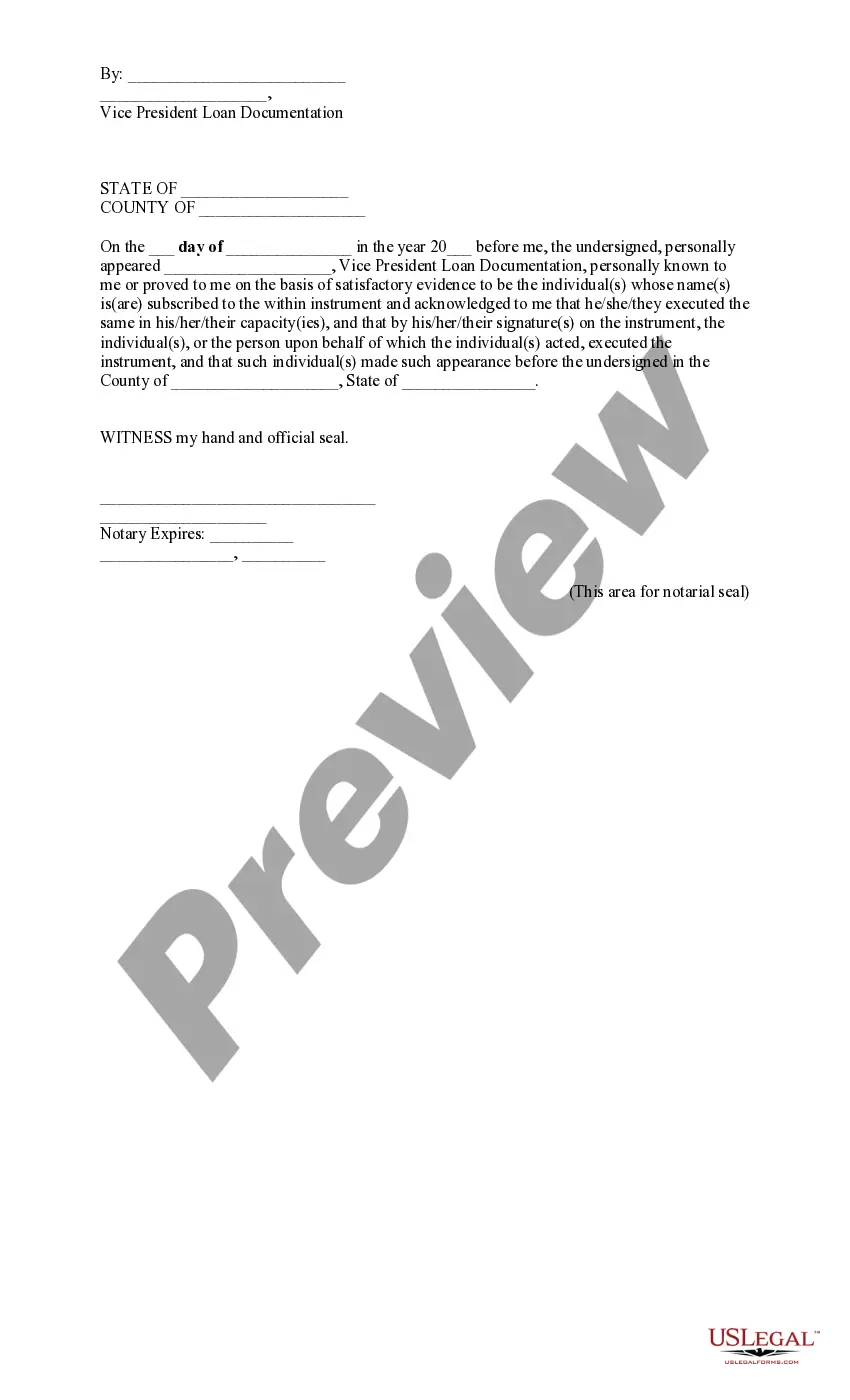

You will need to sign a promissory note and a mortgage or trust deed.The document should be signed and dated by the borrower, and you will need to file or record the document at the local recorder of deeds office or other office responsible for the filing of real estate documents.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.