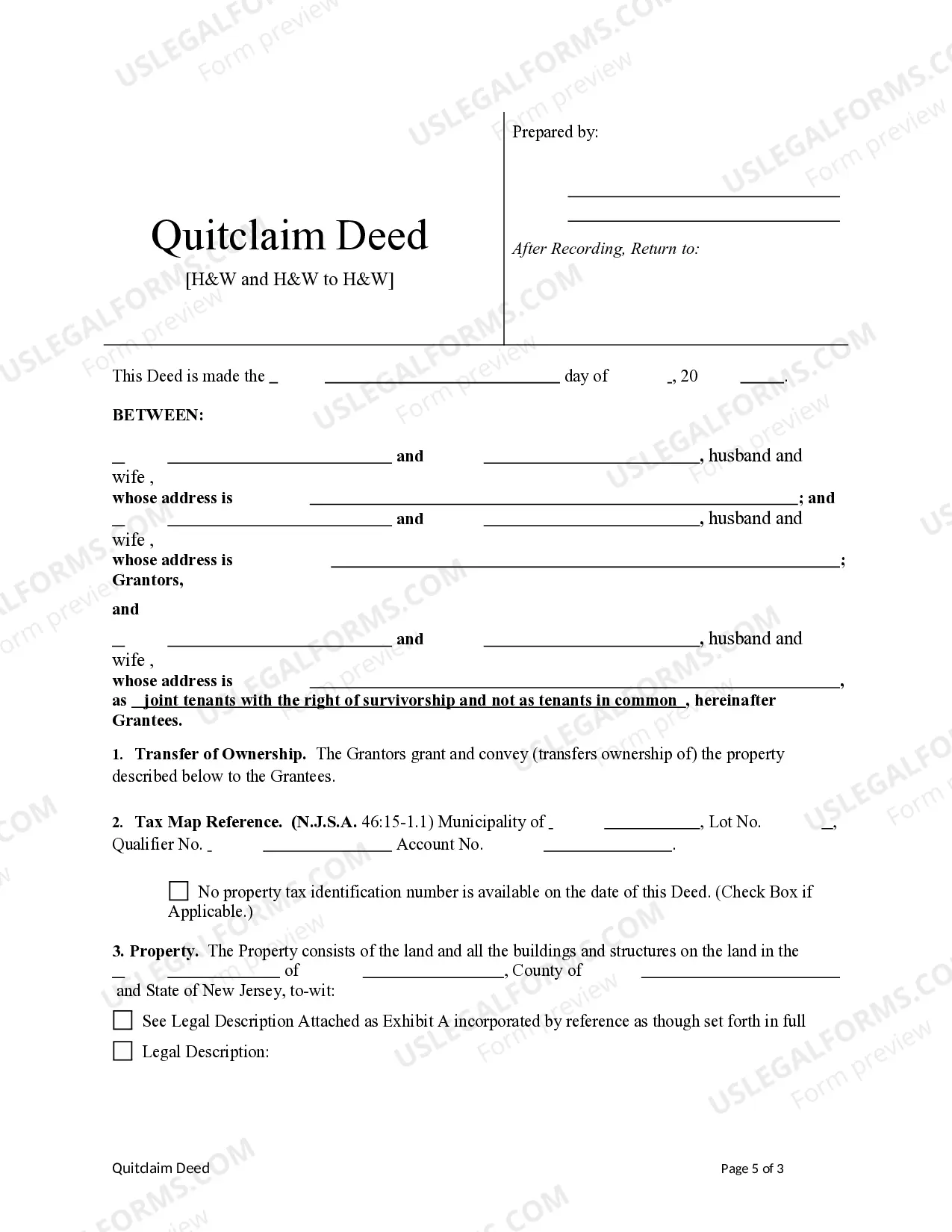

This form is a Quitclaim Deed where the Grantors are Husband and Wife and Husband and Wife and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees. This deed complies with all state statutory laws.

New Jersey Quitclaim Deed from a Husband and Wife and Husband and Wife to a Husband and Wife

Description

How to fill out New Jersey Quitclaim Deed From A Husband And Wife And Husband And Wife To A Husband And Wife?

US Legal Forms is a special platform to find any legal or tax form for completing, such as New Jersey Quitclaim Deed from a Husband and Wife and Husband and Wife to a Husband and Wife. If you’re tired of wasting time seeking ideal samples and paying money on record preparation/lawyer fees, then US Legal Forms is exactly what you’re looking for.

To reap all of the service’s advantages, you don't have to download any software but just choose a subscription plan and sign up your account. If you already have one, just log in and look for a suitable sample, download it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Quitclaim Deed from a Husband and Wife and Husband and Wife to a Husband and Wife, check out the instructions listed below:

- Double-check that the form you’re taking a look at applies in the state you need it in.

- Preview the form and read its description.

- Click on Buy Now button to access the sign up page.

- Select a pricing plan and continue signing up by entering some information.

- Choose a payment method to finish the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, complete the document online or print it. If you are unsure regarding your New Jersey Quitclaim Deed from a Husband and Wife and Husband and Wife to a Husband and Wife template, contact a legal professional to review it before you decide to send or file it. Start hassle-free!

Form popularity

FAQ

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

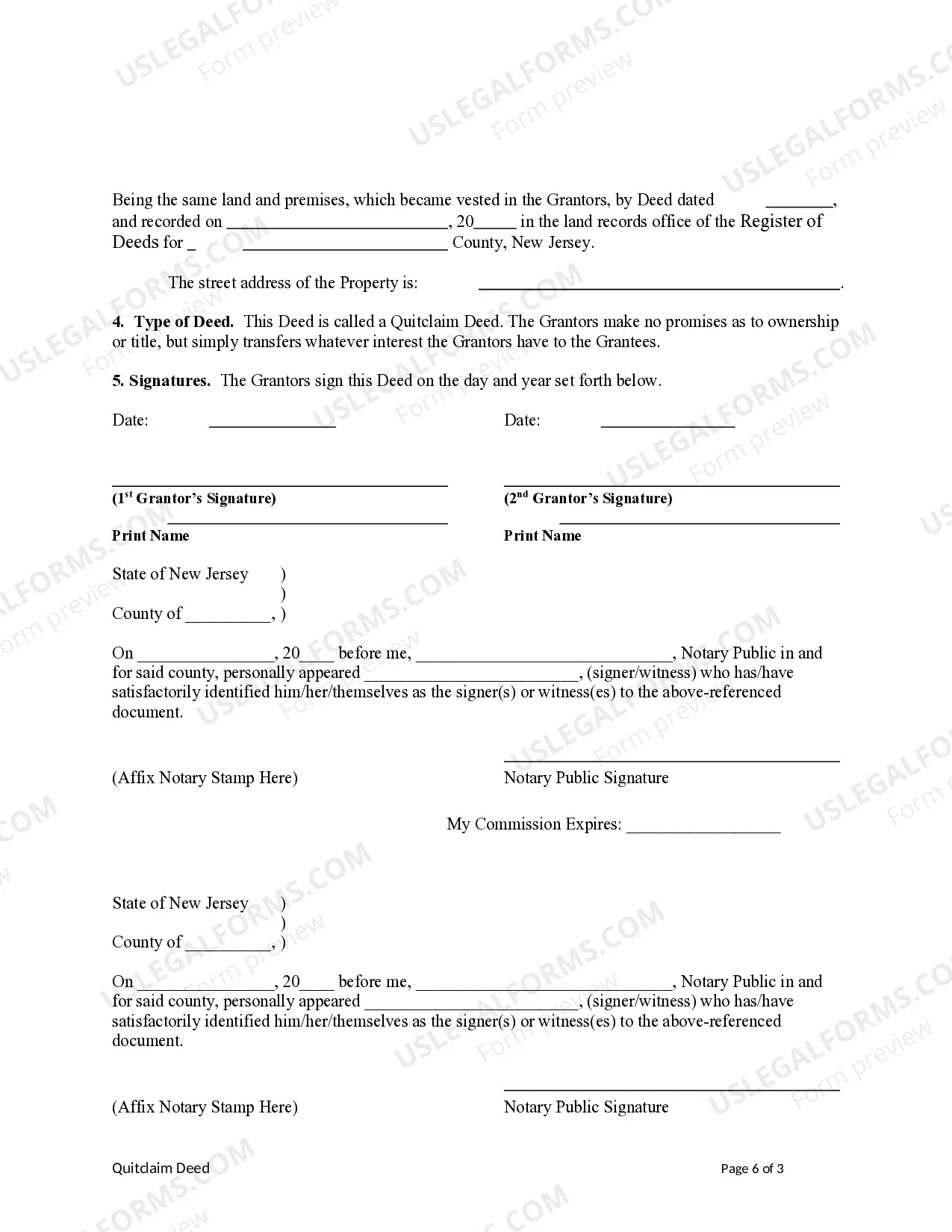

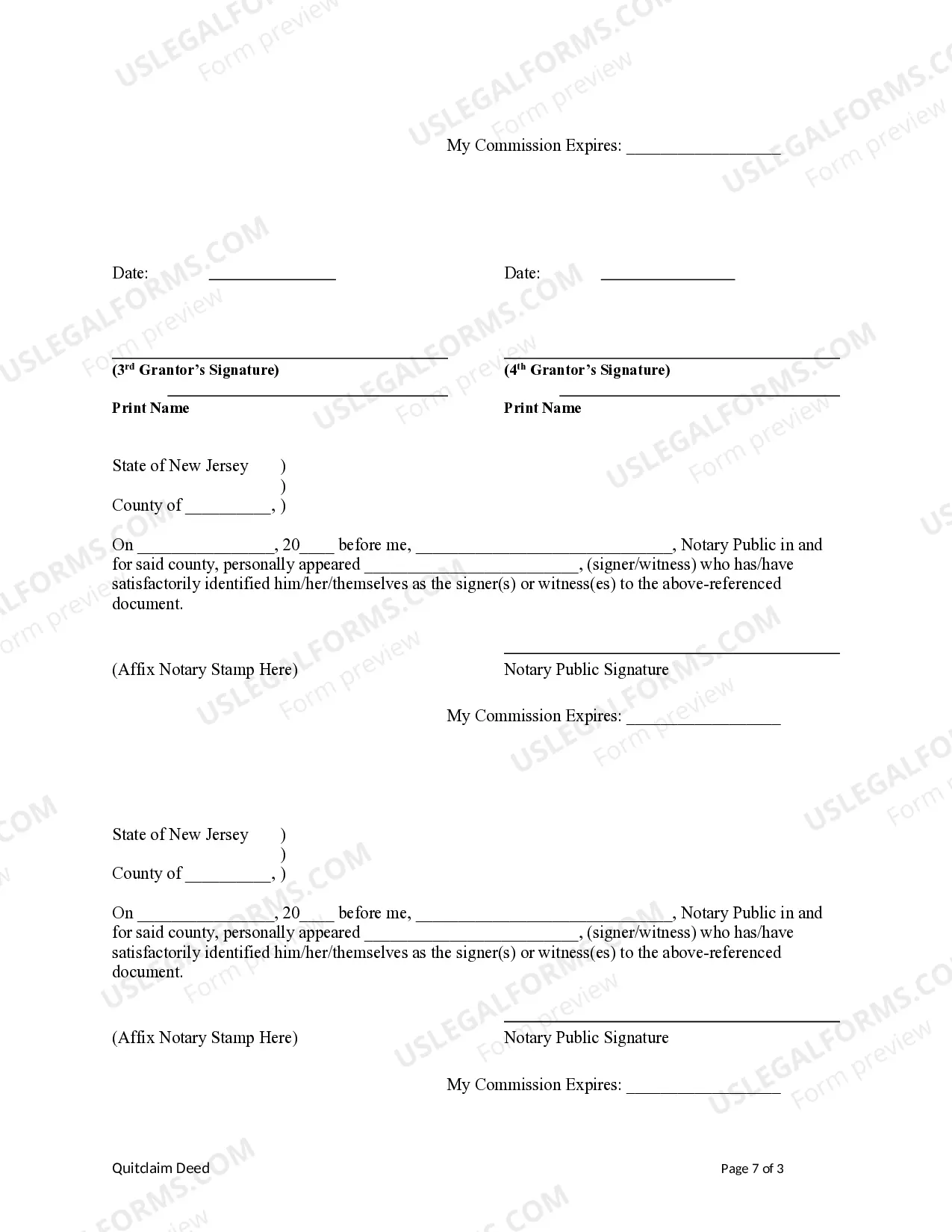

Signing - According to New Jersey law, the quit claim deed must be signed by the seller of the property in the presence of a Notary Public. Recording - All quit claim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

A New Jersey (NJ) quitclaim deed allows a property owner (or grantor) to release their ownership rights to a purchaser (or grantee).A quitclaim deed is different from a warranty deed, which warrants to the purchaser that the property owner has (and is conveying) legal title to the property.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

They are commonly used to add/remove someone to/from real estate title or deed (divorce, name changes, family and trust transfers). The quitclaim deed is a legal document (deed) used to transfer interest in real estate from one person or entity (grantor) to another (grantee).