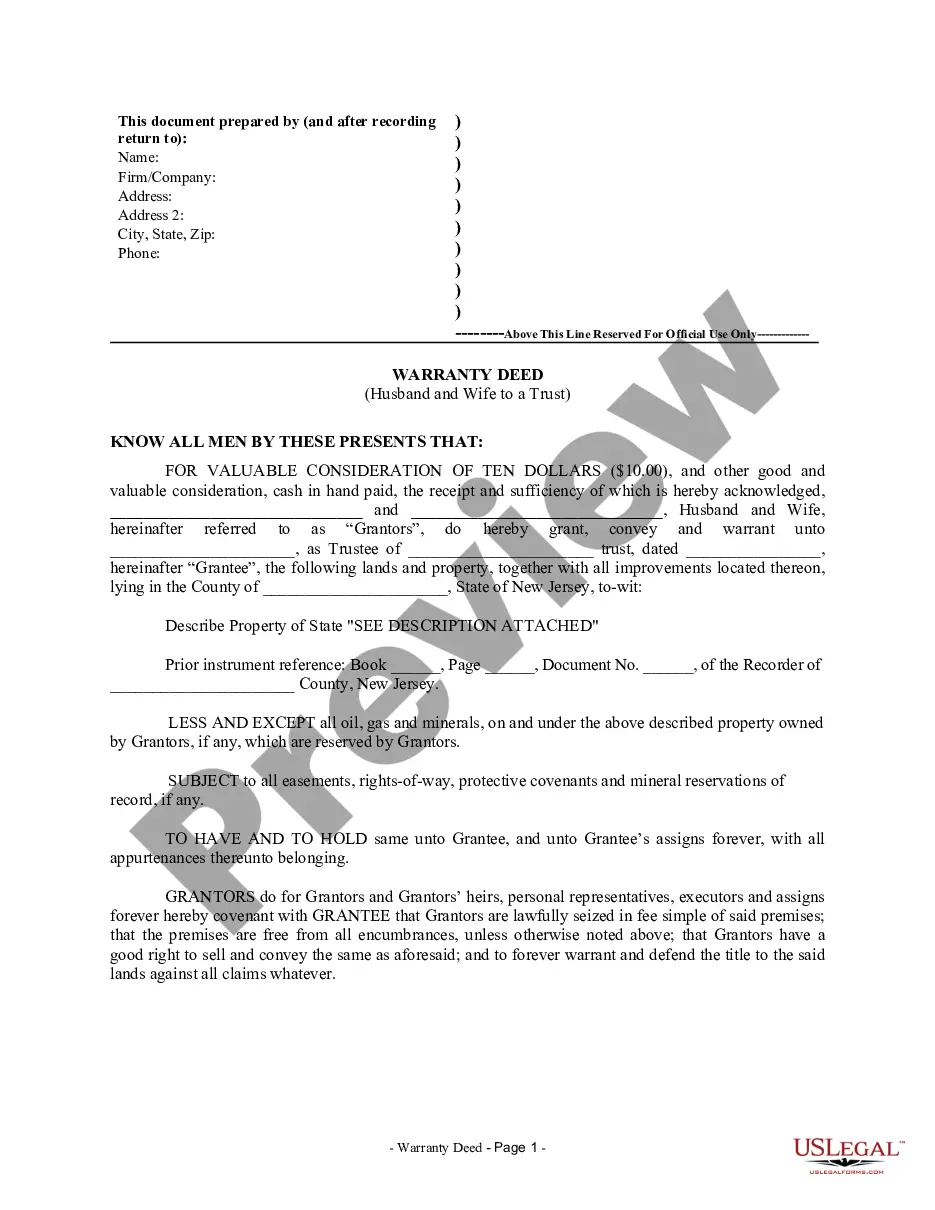

New Jersey Warranty Deed from Husband and Wife to a Trust

Description

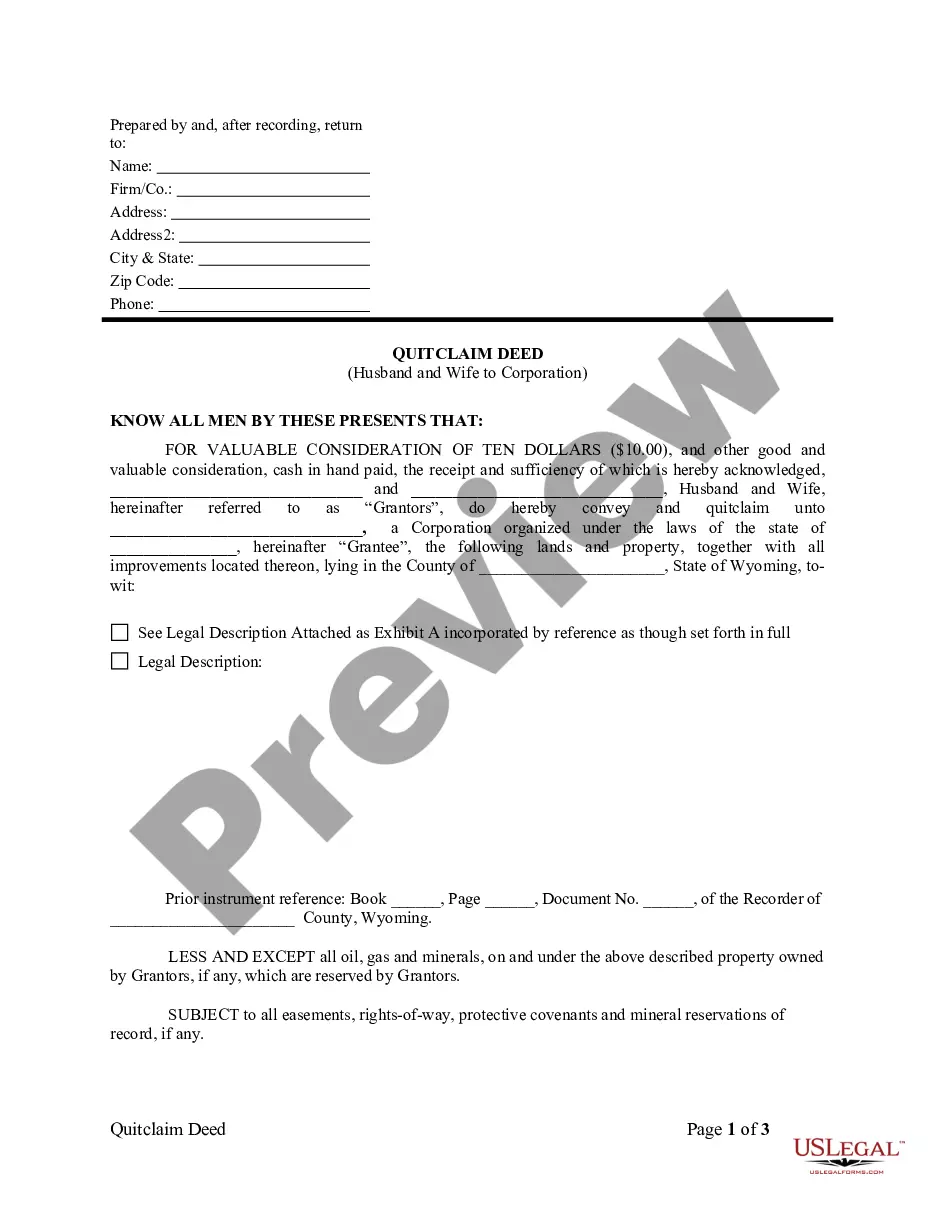

How to fill out New Jersey Warranty Deed From Husband And Wife To A Trust?

US Legal Forms is really a unique system where you can find any legal or tax template for filling out, including New Jersey Warranty Deed from Husband and Wife to a Trust. If you’re sick and tired of wasting time seeking perfect samples and spending money on document preparation/attorney service fees, then US Legal Forms is exactly what you’re trying to find.

To enjoy all the service’s benefits, you don't need to download any application but just select a subscription plan and sign up your account. If you have one, just log in and look for an appropriate sample, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Warranty Deed from Husband and Wife to a Trust, have a look at the recommendations below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the example and read its description.

- Simply click Buy Now to reach the register webpage.

- Choose a pricing plan and carry on registering by entering some info.

- Pick a payment method to complete the registration.

- Save the file by selecting the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are unsure concerning your New Jersey Warranty Deed from Husband and Wife to a Trust template, speak to a lawyer to review it before you send out or file it. Start hassle-free!

Form popularity

FAQ

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

1Retrieve your original deed.2Get the appropriate deed form.3Draft the deed.4Sign the deed before a notary.5Record the deed with the county recorder.6Obtain the new original deed.

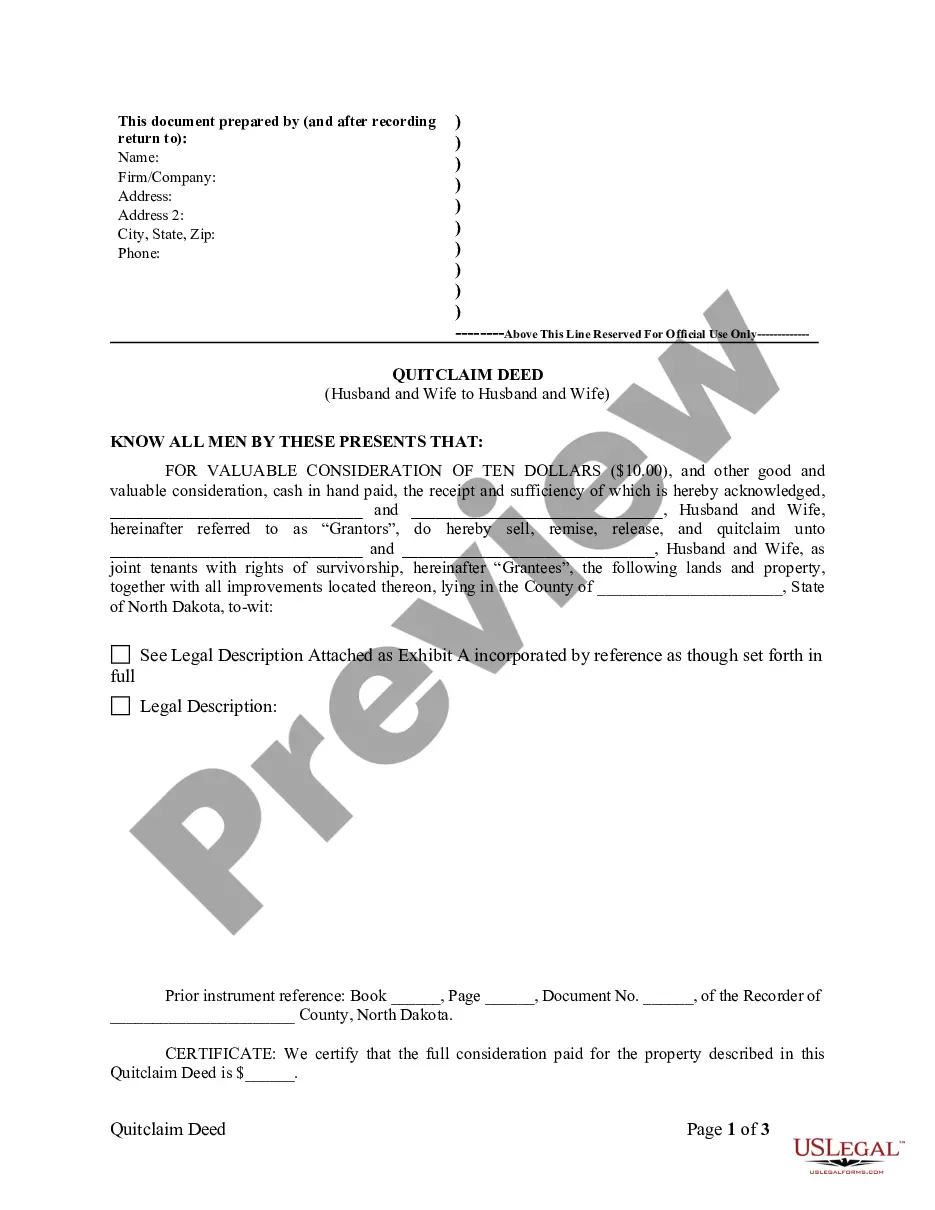

1Discuss property ownership interests.2Access a copy of your title deed.3Complete, review and sign the quitclaim or warranty form.4Submit the quitclaim or warranty form.5Request a certified copy of your quitclaim or warranty deed.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Draft and Execute the Transfer Document. Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission. Amend the Operating Agreement. Have LLC Members Sign a Resolution Accepting Transfer.

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A trust can be used to run a business. But because it is not a legal entity, the trustee undertakes the business activities on behalf of the trust. A trustee can be an individual or a company we recommend a corporate trustee.

Bypass Trusts Couples can set up a living trust, including ownership of an LLC, as a "bypass." In this type of trust, the surviving spouse is guaranteed support from the trust and its assets, including an LLC, for his or her lifetime, but all assets and income go to the trust on the death of the second spouse.