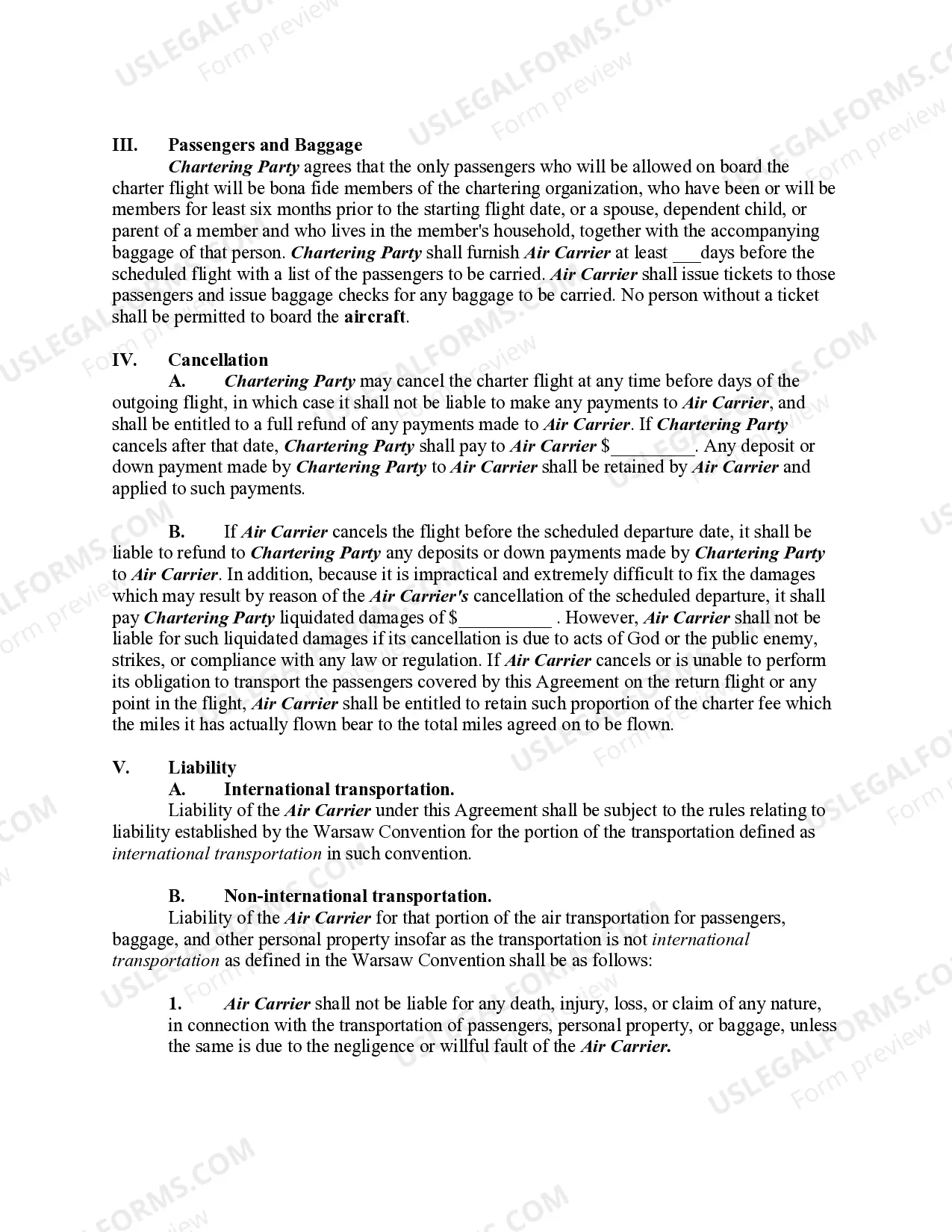

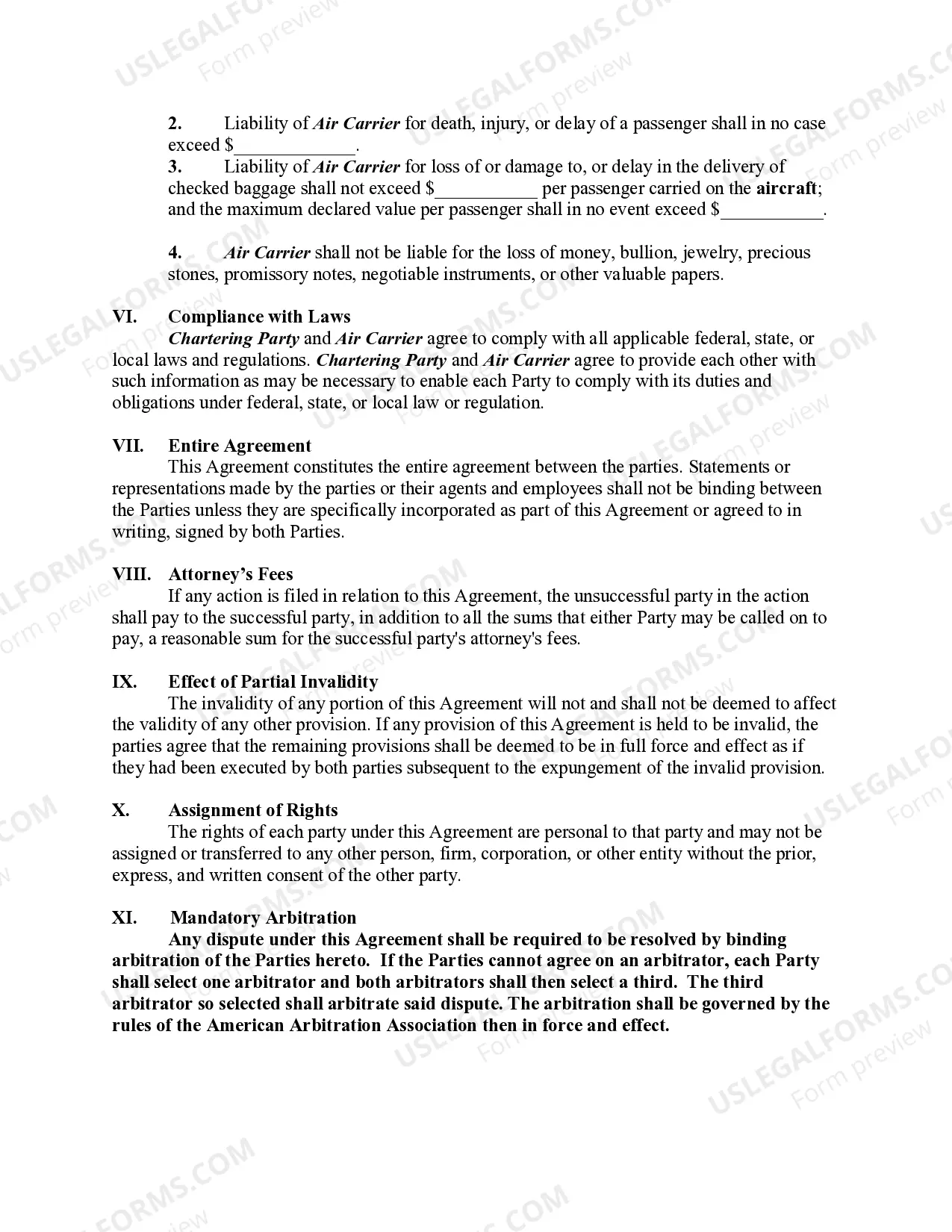

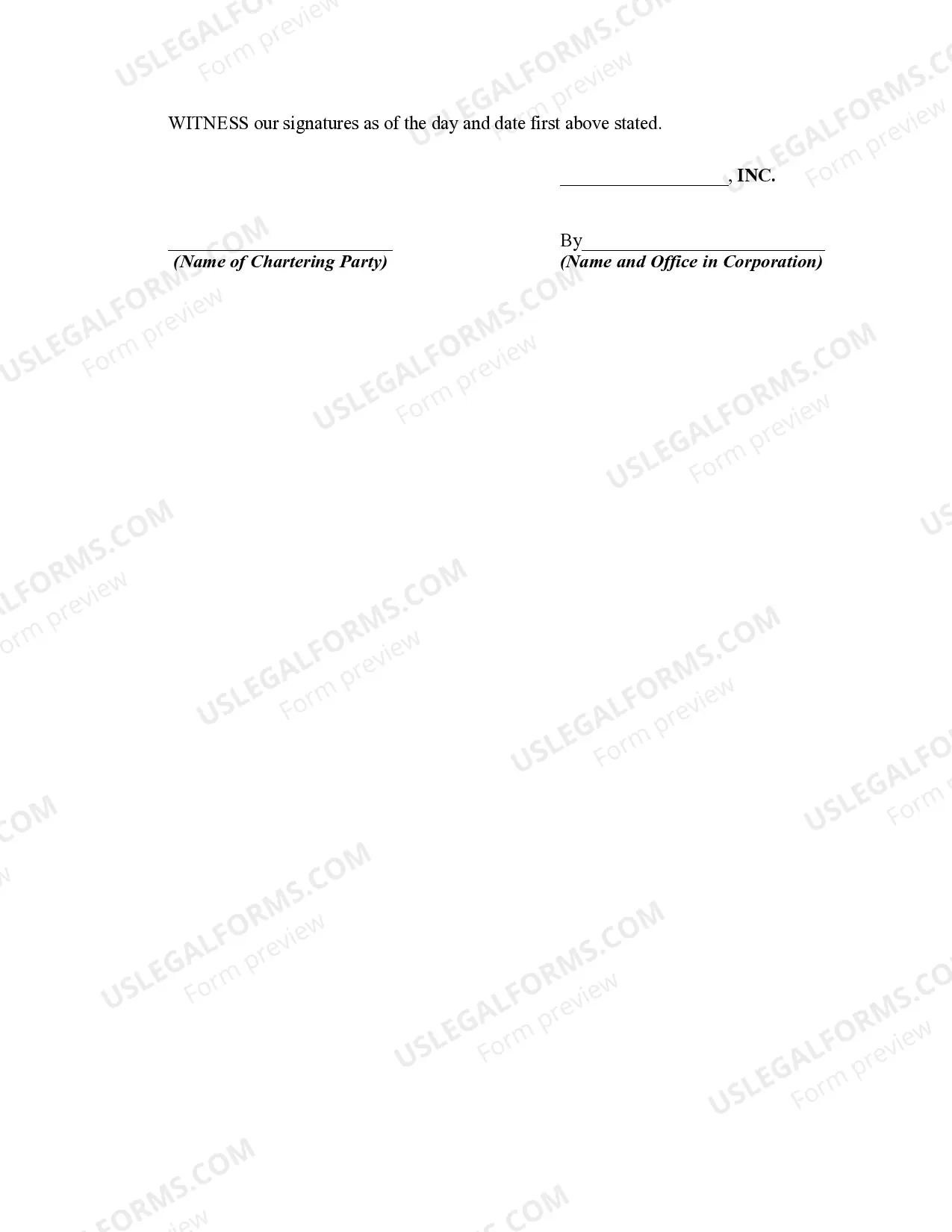

Nebraska Agreement to Charter Aircraft

Description

How to fill out Agreement To Charter Aircraft?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the most recent versions of forms such as the Nebraska Agreement to Charter Aircraft in just a few minutes.

If you already have a membership, Log In to download the Nebraska Agreement to Charter Aircraft from the US Legal Forms library. The Download button will be visible on every form you review. You can access all previously saved forms in the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Edit. Fill in, modify, print, and sign the downloaded Nebraska Agreement to Charter Aircraft. Every design you added to your account does not expire and belongs to you indefinitely. So, if you want to download or print another copy, simply visit the My documents section and click on the form you need.

- Ensure that you have selected the correct form for your city/county.

- Click the Review button to check the content of the form.

- Examine the form details to confirm you have chosen the appropriate form.

- If the form does not meet your criteria, use the Search section at the top of the screen to find the one that does.

- If you are content with the form, confirm your choice by clicking the Buy now button.

- Next, select the payment plan you desire and provide your details to create an account.

Form popularity

FAQ

In Nebraska, construction labor is generally considered taxable when it involves the installation or repair of tangible personal property. Contracting services, however, can vary based on specific circumstances and the nature of the work. If you’re part of a construction project that requires travel, a Nebraska Agreement to Charter Aircraft can streamline your logistics.

Nebraska Form 13 is primarily a certificate for exemption from sales tax for specific purchases. It is imperative for businesses and entities that qualify to submit this form to benefit from tax exemptions. Having a good grasp of this form is beneficial when handling expenses related to a Nebraska Agreement to Charter Aircraft.

Nebraska Form 13 is a declaration form used to maintain transparency in sales and use tax matters. It helps businesses and individuals standardize their reporting for tax-exempt transactions. If you’re chartering a flight under a Nebraska Agreement to Charter Aircraft, understanding Form 13 may be crucial for managing related expenses.

Form 13 serves an essential role in Nebraska for tracking and reporting sales and use tax. Specifically, it is used to claim an exemption or to document tax-exempt purchases. When dealing with costs and coordination for a Nebraska Agreement to Charter Aircraft, utilizing this form correctly can help avoid unnecessary tax liabilities.

To request an extension for Nebraska income tax, you will need to use Form 4868, which grants you an automatic six-month extension. This form must be filed by the original due date of your tax return. Understanding the implications of this extension can significantly impact your financial planning, especially if you're in the process of managing a Nebraska Agreement to Charter Aircraft.

Certain services are exempt from sales tax in Nebraska, including those related to education, healthcare, and certain nonprofit activities. Additionally, specific services provided to government entities also enjoy tax-exempt status. If you're arranging travel under a Nebraska Agreement to Charter Aircraft, such exemptions could apply depending on your purpose and destination.

In Nebraska, numerous services incur sales tax. This includes services related to telecommunications, the repair of tangible personal property, and labor for installing or maintaining tangible personal property. However, it’s crucial to understand that services not explicitly listed as taxable may not incur sales tax. To navigate these regulations effectively, consider a Nebraska Agreement to Charter Aircraft if you're traveling for business.

Yes, charter flights fall under the category of general aviation. General aviation includes all flights that are not conducted by commercial airlines or military aircraft. The Nebraska Agreement to Charter Aircraft facilitates this process by outlining the terms and conditions of charter services. Understanding this framework helps passengers know their rights and responsibilities while enjoying the benefits of flying privately.

A plane charter is a service that allows individuals or organizations to rent an aircraft for a specific period or journey. This service provides numerous benefits, such as avoiding crowded terminals and reducing travel time. Opting for a Nebraska Agreement to Charter Aircraft guarantees that the charter process is well-defined and meets your travel expectations.

Aircraft chartering refers to the process of hiring an aircraft for personal or business travel without actually owning it. This service provides flexibility, convenience, and access to numerous aircraft types for various travel needs. By securing a Nebraska Agreement to Charter Aircraft, clients can enjoy a tailored travel experience, accommodating their preferences and schedules.