Revocation of Transfer on Death Deed - Beneficiary Deed - Mississippi

Definition and meaning

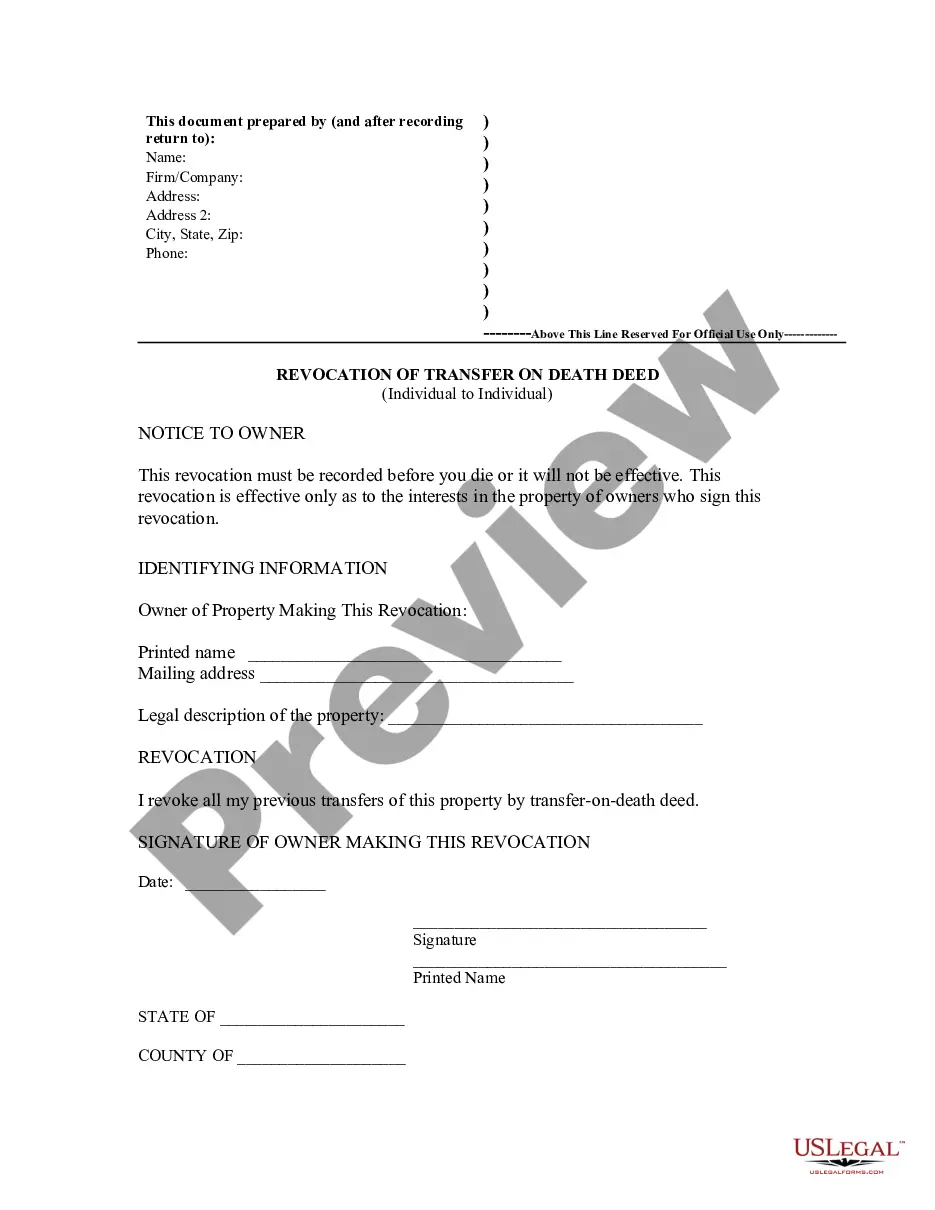

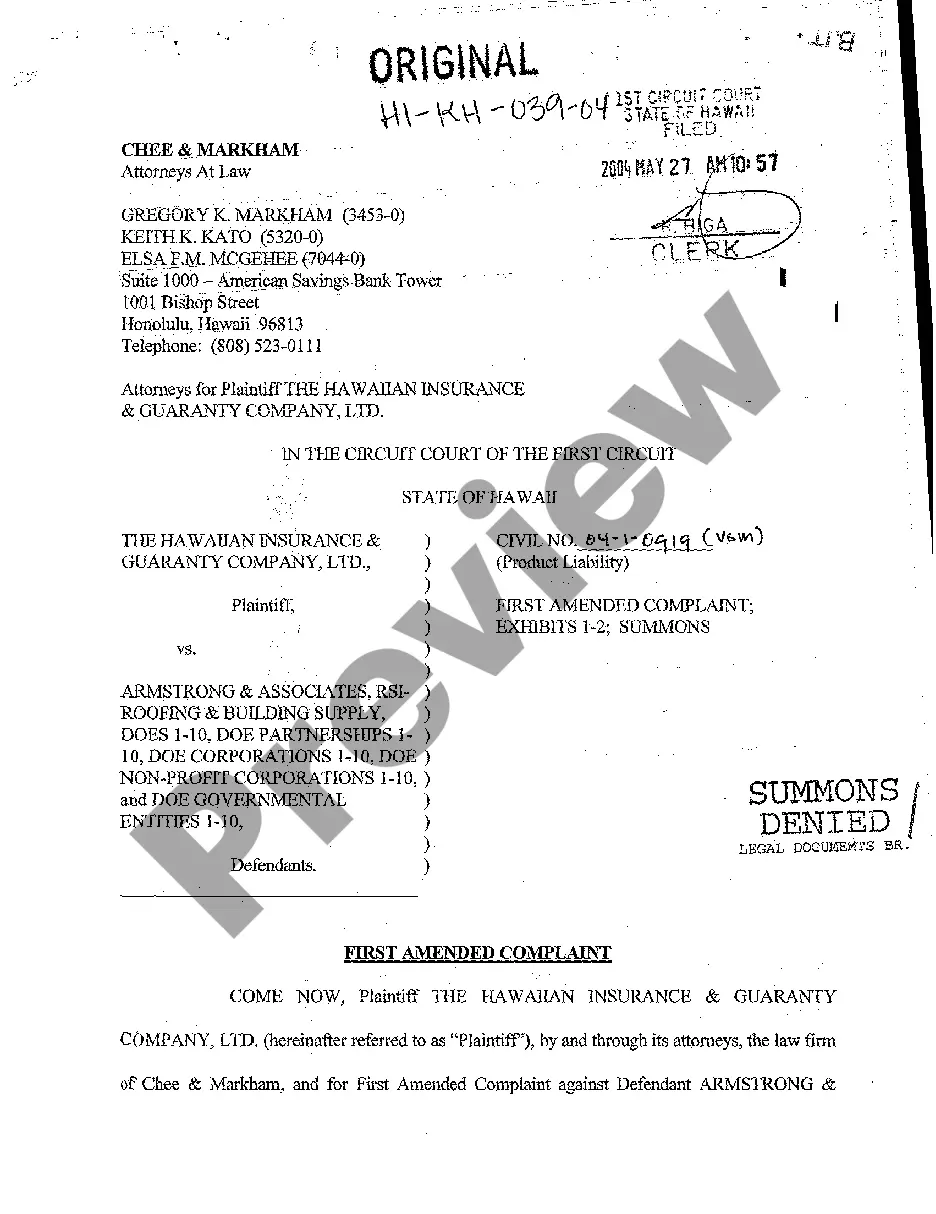

The Revocation of Transfer on Death Deed, also known as a Beneficiary Deed, is a legal document that allows an individual to revoke a previously executed transfer on death deed in Mississippi. This deed enables property owners to designate beneficiaries who will receive their property upon their death without the need for probate. Revoking this deed means that the property will no longer transfer automatically to the designated beneficiary, allowing the owner to change their intentions regarding inheritance.

How to complete a form

To complete the Revocation of Transfer on Death Deed, follow these steps:

- Provide your full name and address as the owner of the property.

- Include a legal description of the property as stated on the original transfer on death deed.

- Clearly state your intention to revoke all previous transfers by signing the document.

- Have the document notarized to ensure it is legally valid.

Who should use this form

This form is suitable for any property owner in Mississippi who has previously executed a transfer on death deed and wishes to revoke it. It is particularly useful for individuals who no longer wish to transfer their property to designated beneficiaries or who want to change their estate plans. Consulting with a legal professional is recommended to ensure that all implications are understood before proceeding.

Legal use and context

The Revocation of Transfer on Death Deed is a specific legal tool used in Mississippi property law. Under state law, a transfer on death deed allows individuals to bypass the probate process. However, circumstances may arise where an owner decides that a revocation is necessary, such as changes in personal relationships or the desire to alter estate planning decisions. Understanding how and when to use this form is crucial for effective estate management.

What to expect during notarization or witnessing

When you prepare to notarize your Revocation of Transfer on Death Deed, you should expect the following:

- You will present the completed document to a licensed notary public.

- The notary will verify your identity and ensure you understand the document's contents.

- After signing in the presence of the notary, they will affix their official seal to the document to validate it.

It's important to ensure that the notarization occurs before you pass away, as the revocation will not be effective if it is recorded after death.

Common mistakes to avoid when using this form

When executing the Revocation of Transfer on Death Deed, keep in mind these common pitfalls:

- Failing to provide the legal description of the property.

- Not having the document notarized, which can render it invalid.

- Not recording the revocation before death, making it ineffective.

- Overlooking state-specific requirements that may apply.

Form popularity

FAQ

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

A beneficiary deed is generally used for avoidance of probate, although it may be used to remove a particular property from a probate estate.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.