Missouri Check Request

Description

How to fill out Check Request?

Have you ever been in a location where you often require documents for business or personal reasons nearly every workday.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

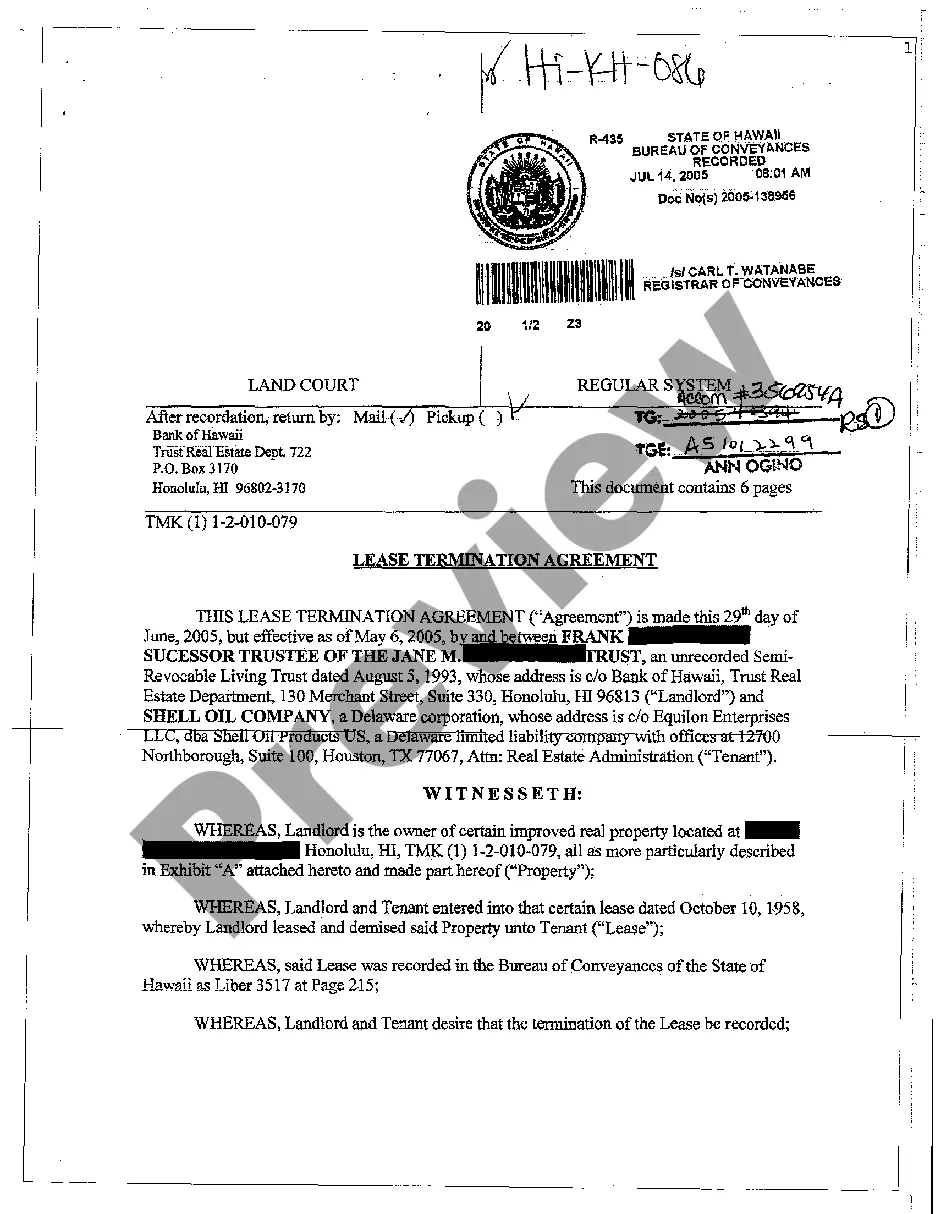

US Legal Forms offers thousands of form templates, including the Missouri Check Request, designed to fulfill state and federal regulations.

Once you find the correct form, click Purchase now.

Choose the payment plan you want, fill in the necessary information to create your account, and complete your order with your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Missouri Check Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn't what you are looking for, use the Search field to find the form that fits your requirements and needs.

Form popularity

FAQ

MAKE CHECK PAYABLE TO MISSOURI DEPARTMENT OF REVENUE. MAIL FORM MO-1040V AND PAYMENT TO THE MISSOURI DEPARTMENT OF REVENUE, P.O. BOX 371, JEFFERSON CITY, MO 65105-0371.

MAKE CHECK PAYABLE TO MISSOURI DEPARTMENT OF REVENUE. MAIL FORM MO-1040V AND PAYMENT TO THE MISSOURI DEPARTMENT OF REVENUE, P.O. BOX 371, JEFFERSON CITY, MO 65105-0371.

IndividualsInclude a copy of your notice, bill, or payment voucher.Make your check, money order, or cashier's check payable to Franchise Tax Board.Write either your FTB ID, SSN, or ITIN, and tax year on your payment.Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.23-Sept-2021

Louis Refund? It is a Form used when part of the previous year's state refund is in your federal income. So if you entered a 1099-G in your federal 1040 for a state refund you received last year, this forms subtracts it out for the state return.

How Income Taxes Are CalculatedFirst, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k).Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.More items...?

Age 65 and Over Tax Exemptions for Missouri (AGEXMMO29A647NCEN) FRED St.

1. The Missouri adjusted gross income of a resident individual shall be the taxpayer's federal adjusted gross income subject to the modifications in this section.

Your check or money order (U.S. funds only), payable to the Missouri Department of Revenue, should be mailed to the Department of Revenue, P.O. Box 385, Jefferson City, MO 65105-0385. By submitting payment by check, you authorize the Department to process the check electronically upon receipt. Do not postdate.

Form MO-A - 2020 Individual Income Tax Adjustments.

The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.