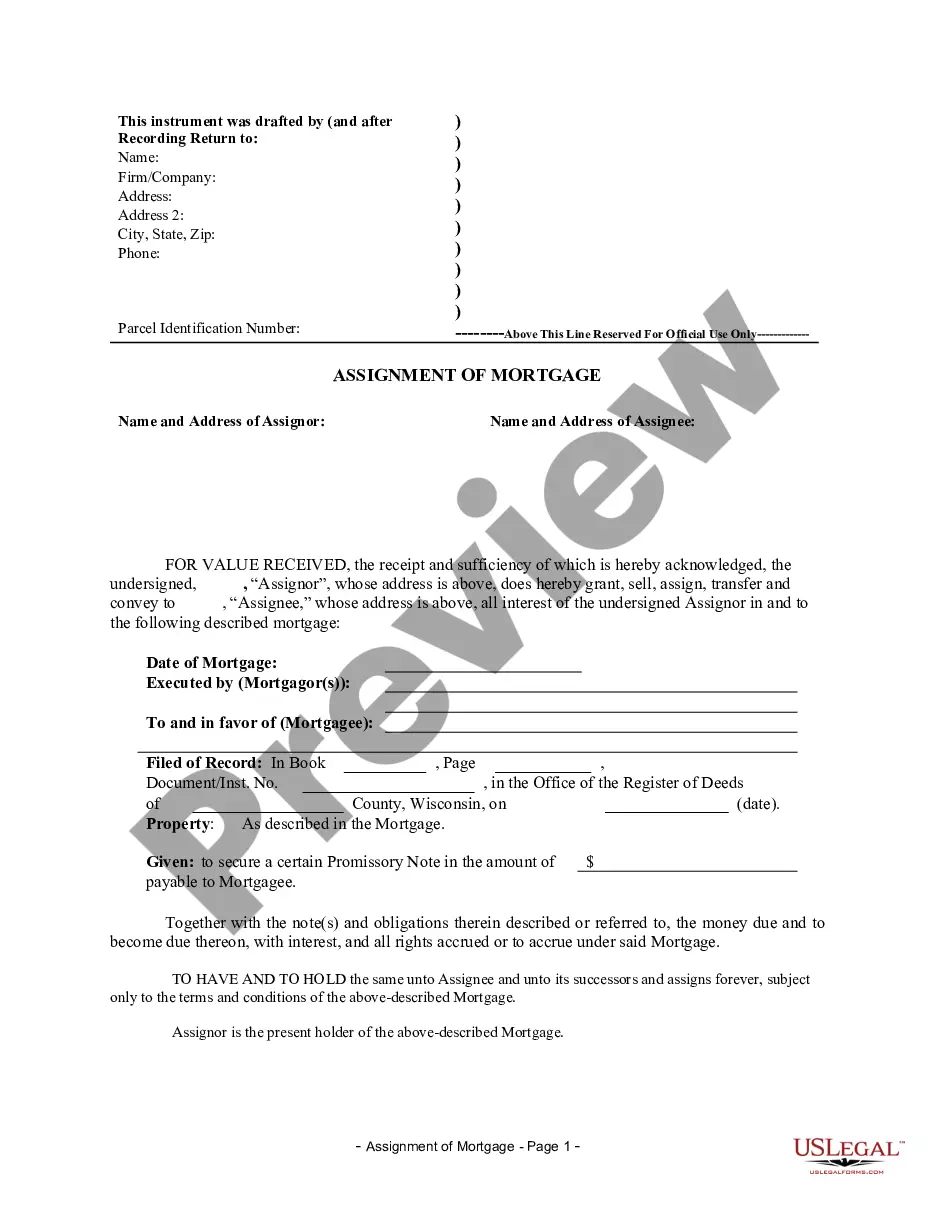

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

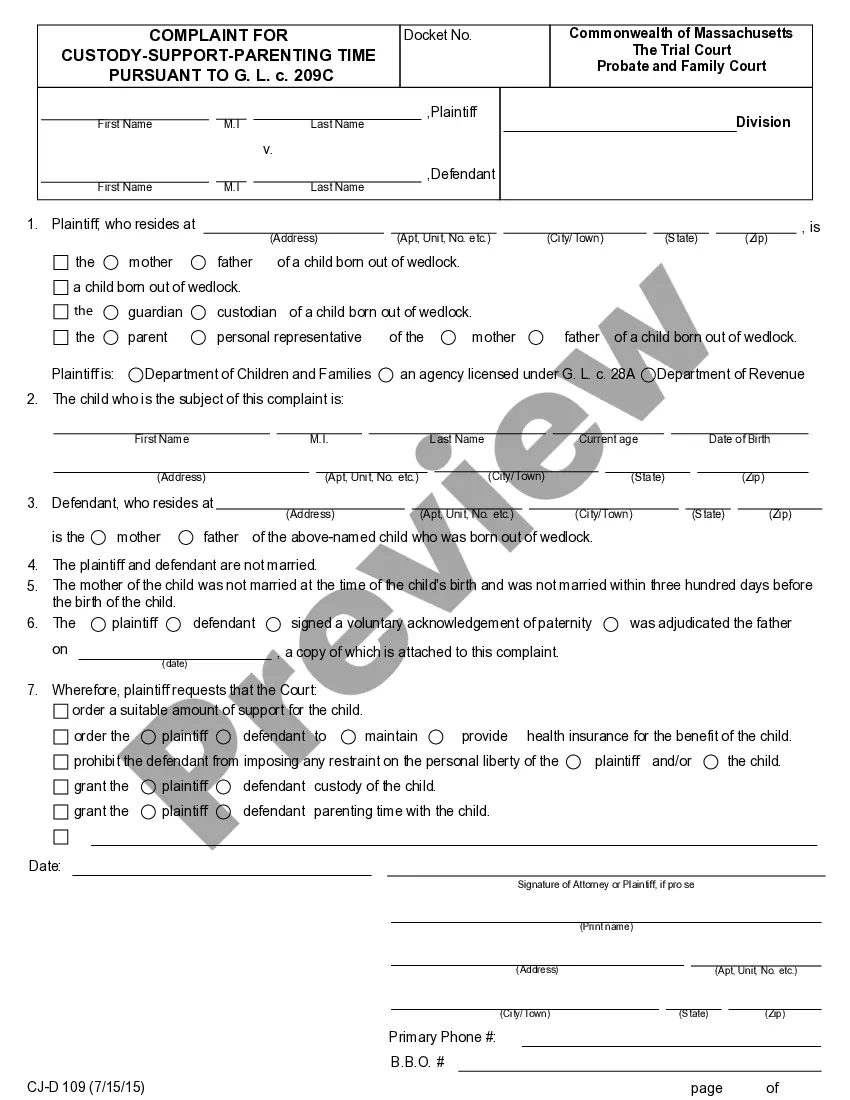

A Minnesota Notice of Default under Security Agreement in the Purchase of a Mobile Home serves as a formal legal notification to the buyer (mortgagor) in the event of default or breach of the security agreement. This document outlines the consequences of default and the rights and obligations of both the buyer and the seller (mortgagee). Key elements within a Minnesota Notice of Default under Security Agreement include: 1. Parties involved: The notice typically begins by identifying the buyer and seller involved in the mobile home purchase agreement. It includes their legal names and addresses. 2. Date of default: The notice specifies the exact date on which the buyer defaulted on their obligations as outlined in the security agreement. 3. Details of default: The notice elaborates on the specific breaches committed by the buyer, such as failure to make mortgage payments on time, failure to maintain insurance coverage, or other violations of the security agreement terms. 4. Cure period: The notice includes a cure period, which is the provided timeframe within which the buyer can rectify the default. It outlines the necessary actions the buyer must take to cure the default, such as making overdue payments or fulfilling any outstanding obligations. 5. Consequences of default: The Minnesota Notice of Default explains the possible consequences the buyer may face if they fail to cure the default within the specified cure period. These consequences may include repossession of the mobile home by the seller, legal actions to recover outstanding amounts, and potential damage to the buyer's credit rating. 6. Amount owed: The notice includes a detailed breakdown of the outstanding amounts owed by the buyer, including the principal, interest, late fees, and any other charges accrued due to default. 7. Contact information: The notice provides the necessary contact information for the seller or their legal representative, making it easier for the buyer to communicate regarding the default and cure process. Different types of Minnesota Notice of Default under Security Agreement in the Purchase of Mobile Home can arise based on the specifics of the default or the state's laws. Some potential variations include: 1. Monetary default: This occurs when the buyer fails to make timely mortgage payments or any other financial obligations outlined in the security agreement. 2. Insurance default: If the buyer fails to maintain the required insurance coverage on the mobile home, it may constitute an insurance default under the security agreement. 3. Maintenance default: The buyer may breach the security agreement by failing to uphold their responsibility to properly maintain the mobile home, resulting in damage or depreciation. 4. Violation of terms: This type of default encompasses any breach of the terms and conditions set forth in the security agreement, aside from monetary, insurance, or maintenance defaults. It is crucial for both the buyer and seller to understand the implications and consequences of a Minnesota Notice of Default under Security Agreement. Seeking legal advice and understanding one's rights and obligations can help navigate this potentially arduous process.