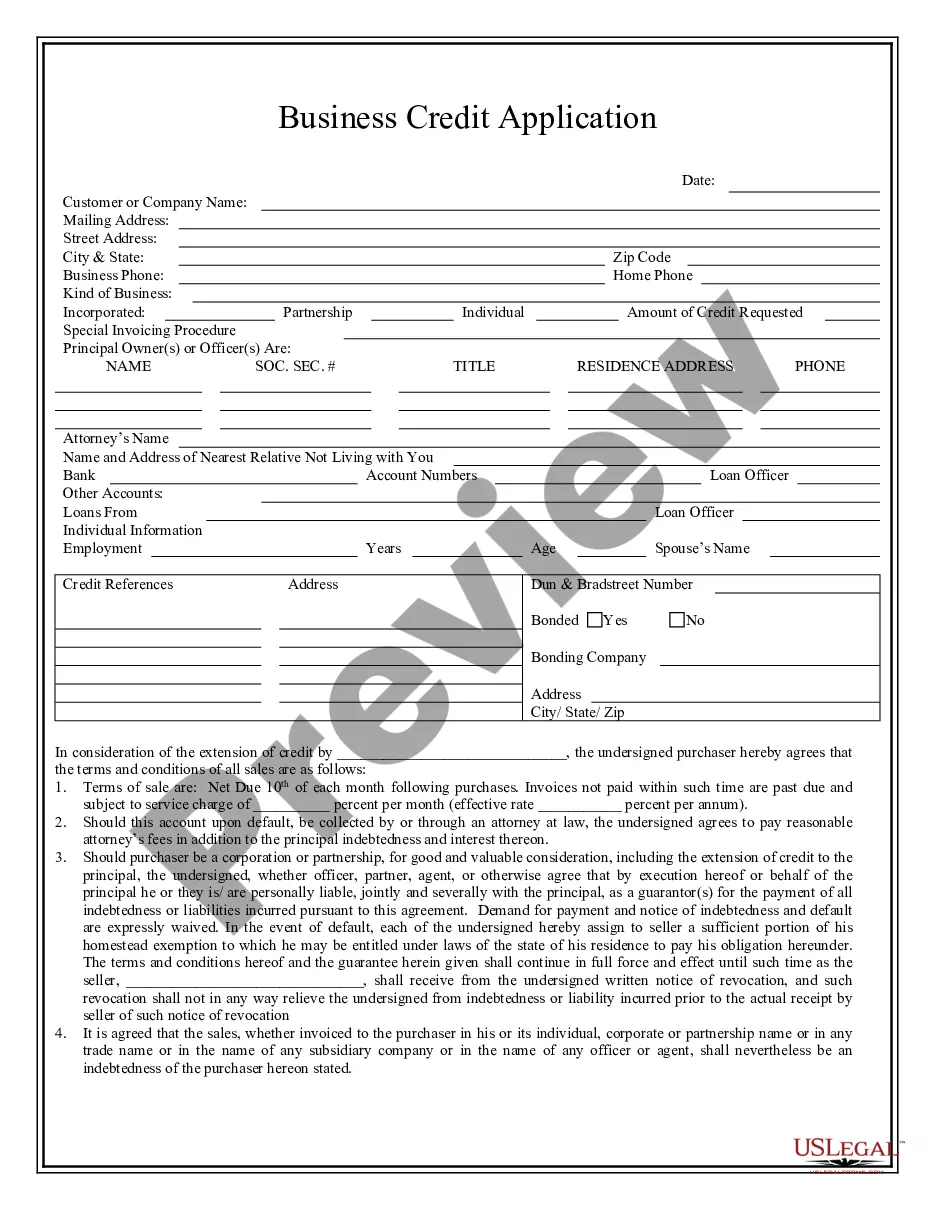

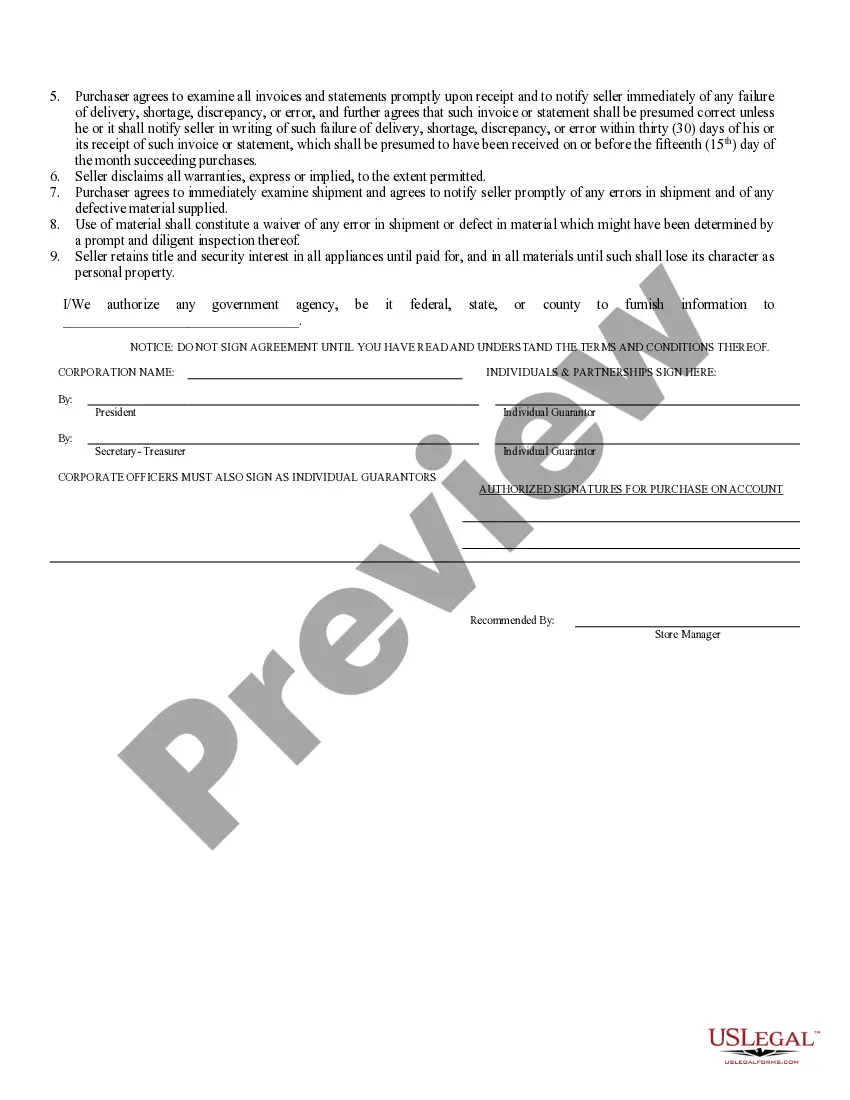

Michigan Business Credit Application

Description

How to fill out Michigan Business Credit Application?

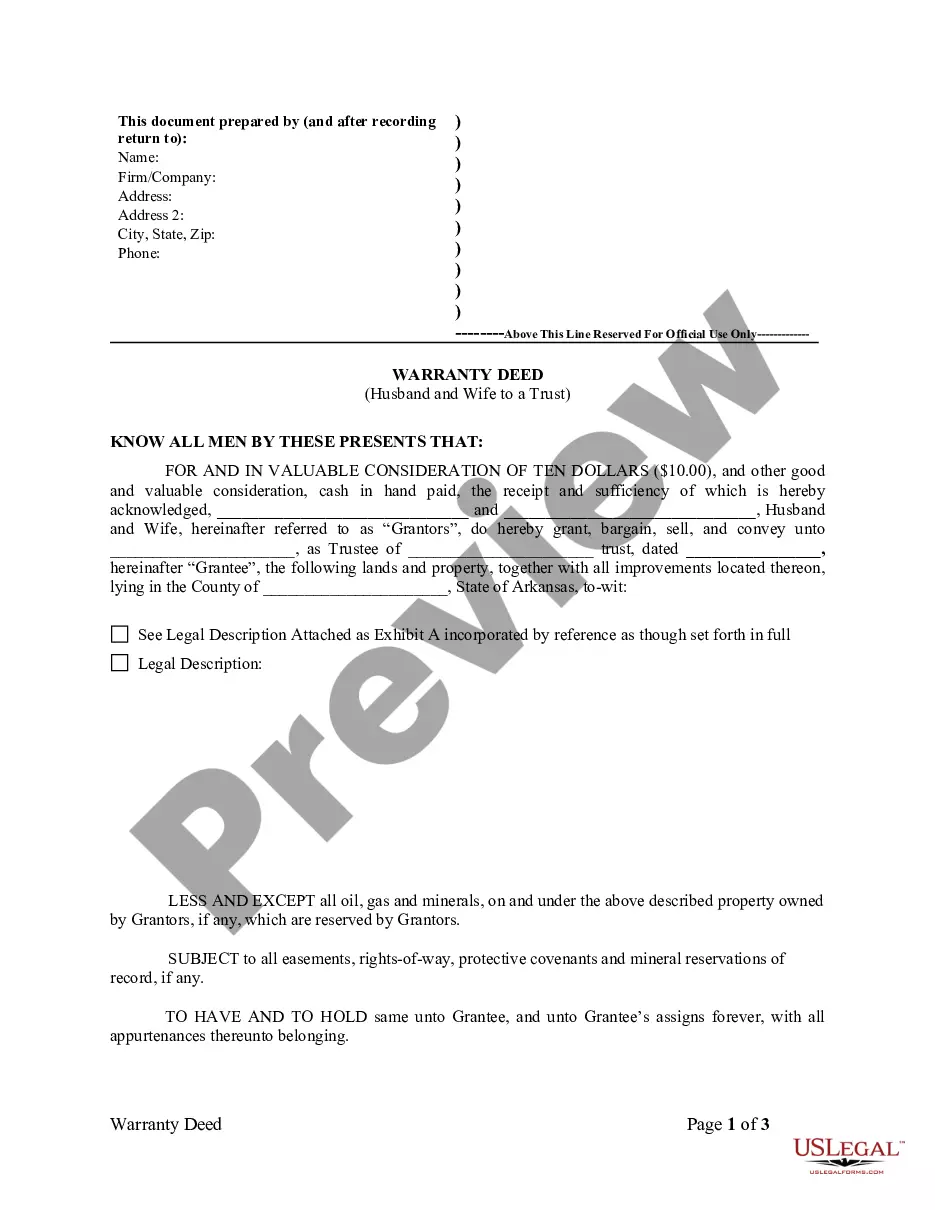

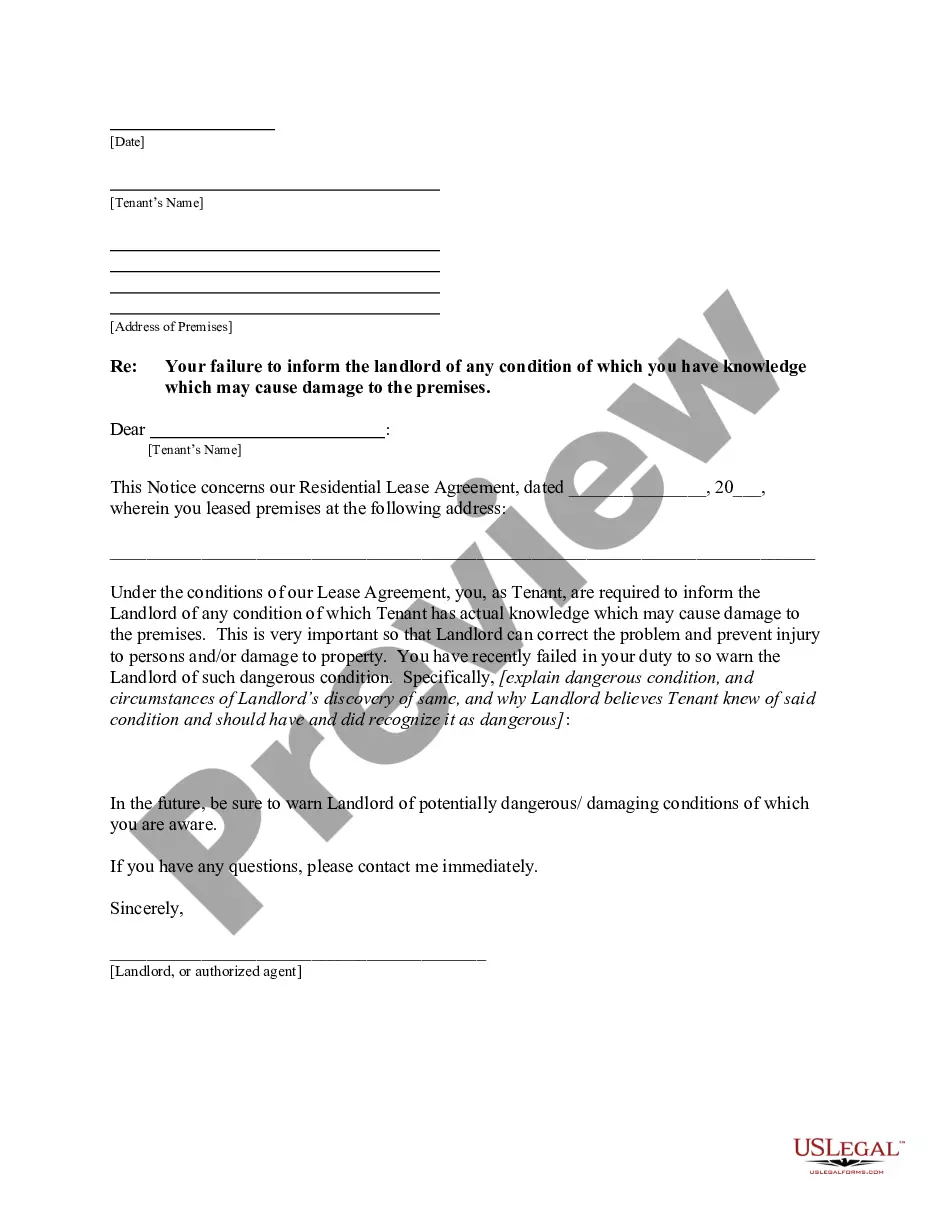

Get any form from 85,000 legal documents such as Michigan Business Credit Application online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you already have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Business Credit Application you would like to use.

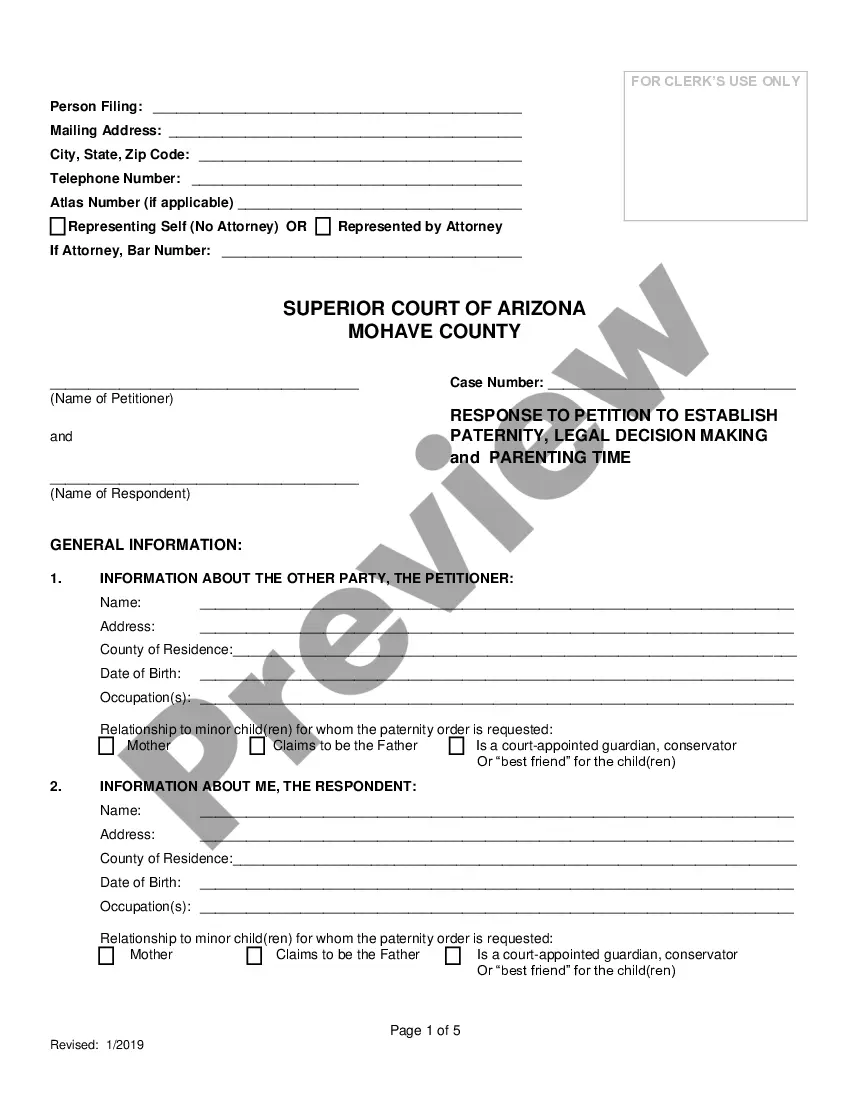

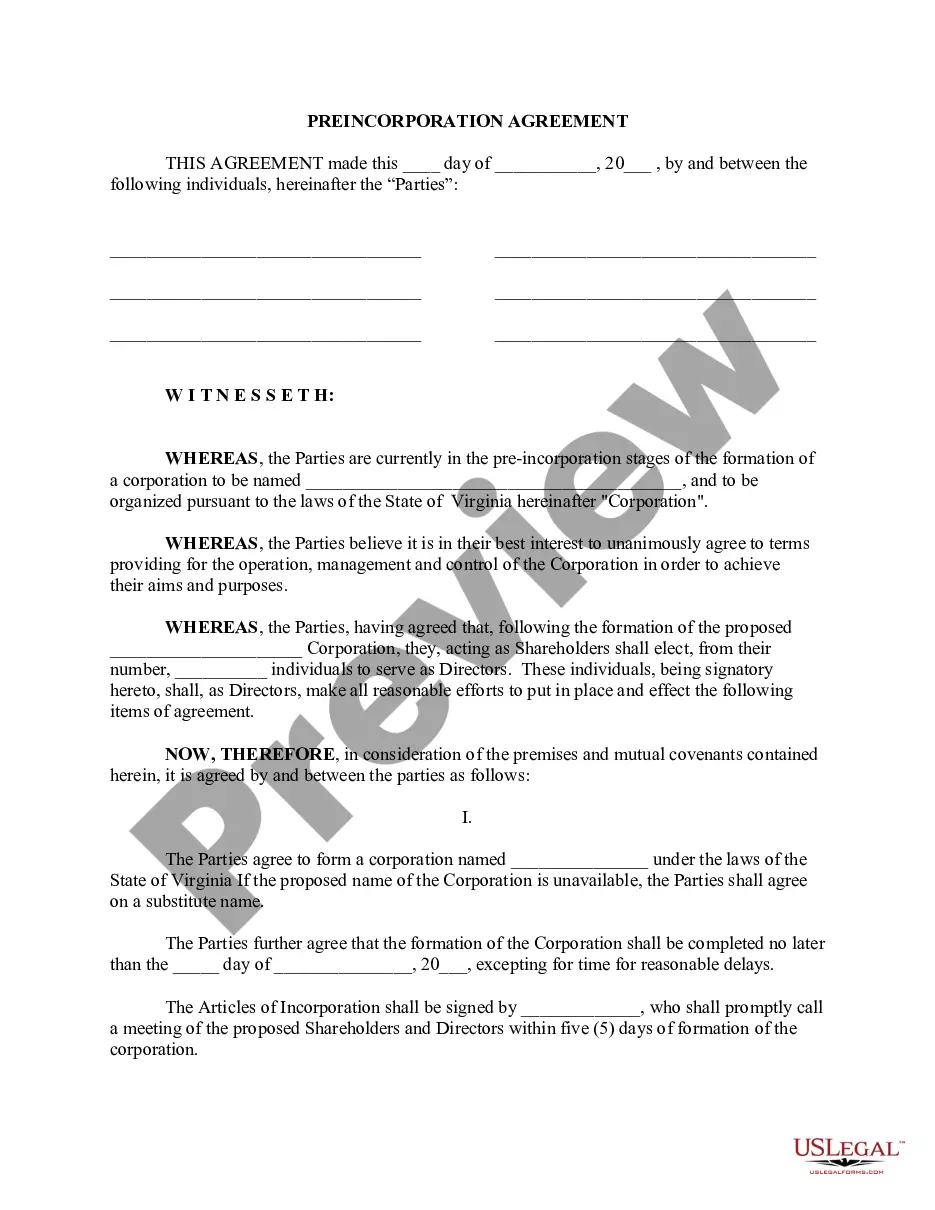

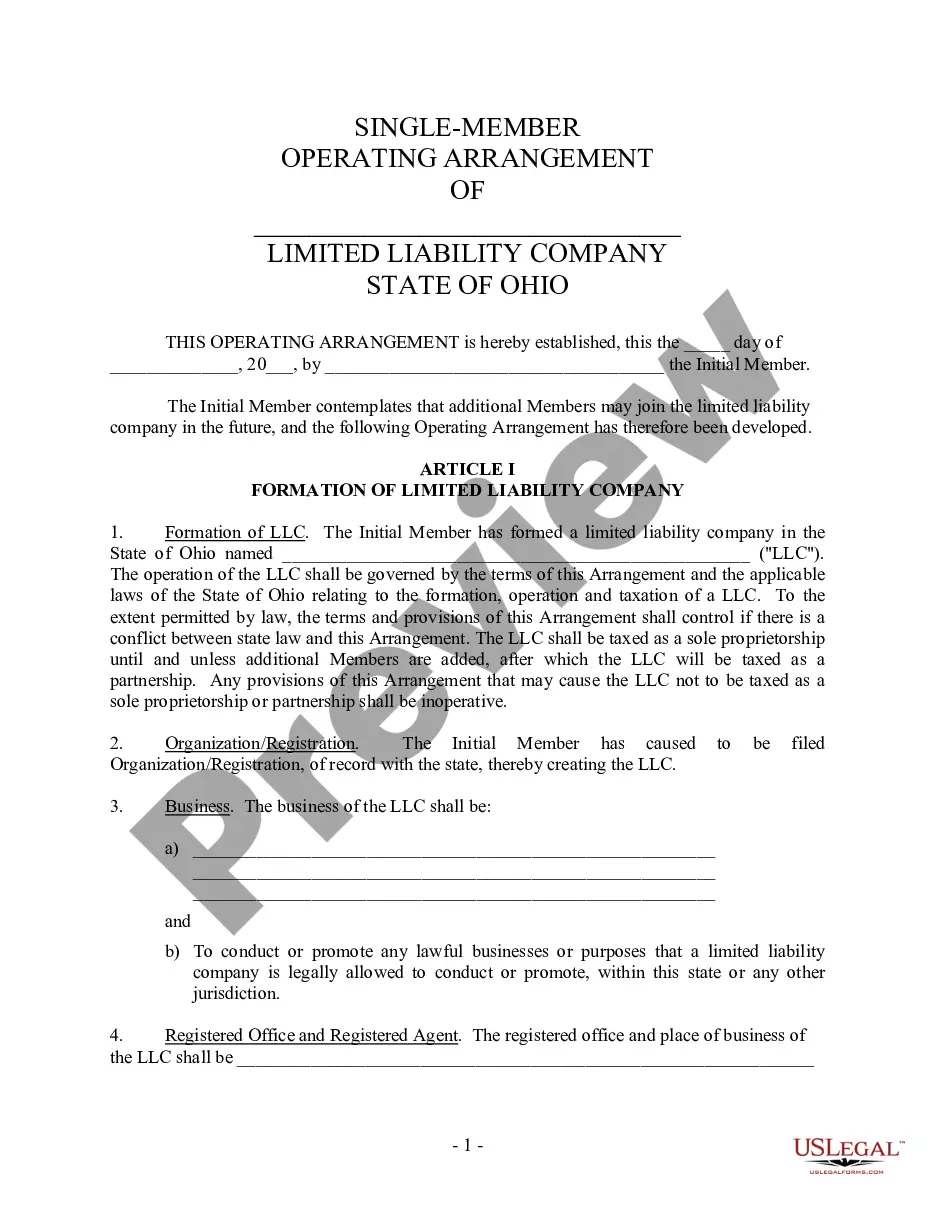

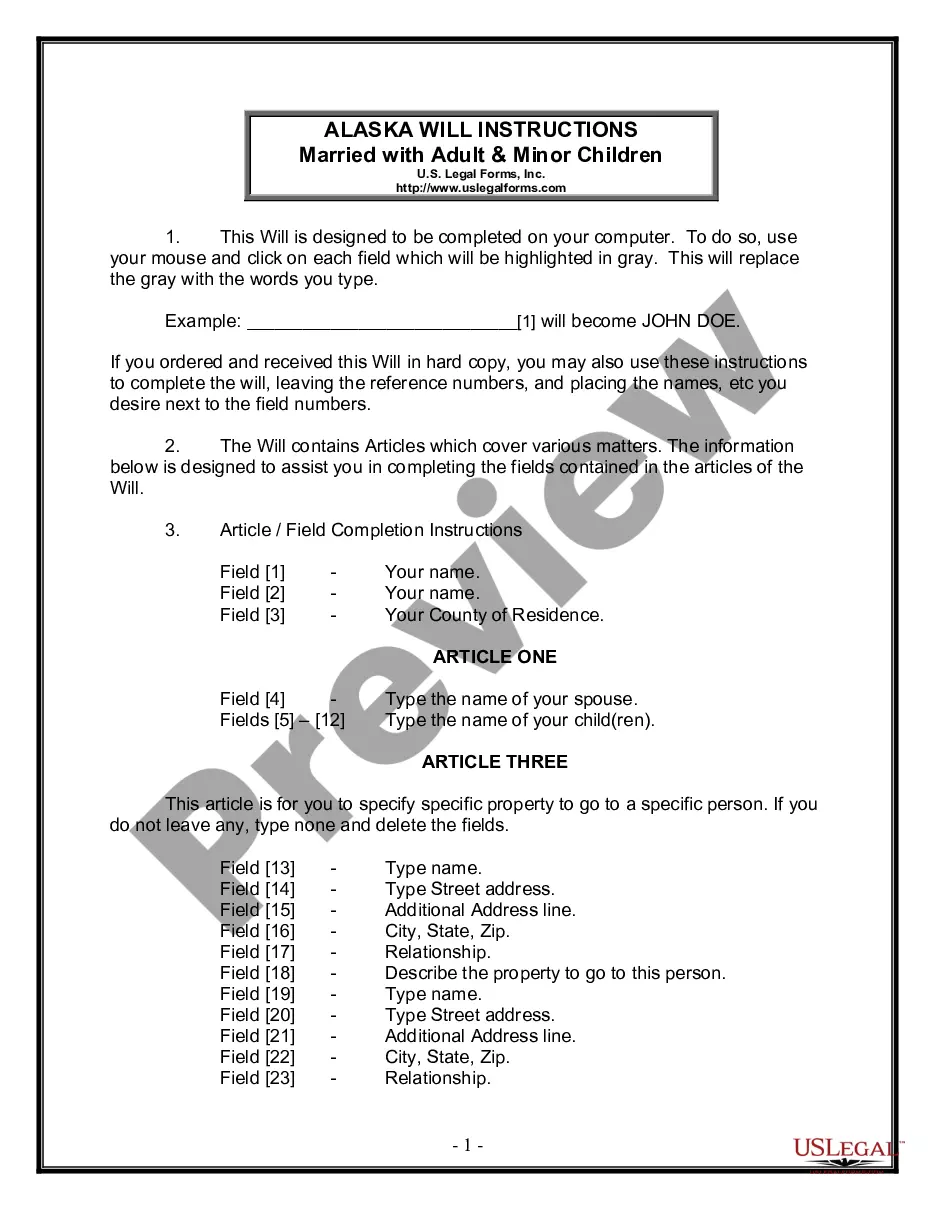

- Read through description and preview the sample.

- Once you’re confident the template is what you need, just click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by card or via PayPal.

- Select a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Michigan Business Credit Application easy and fast.

Form popularity

FAQ

Check your credit scores. Know your annual income. Research available reward options. Understand the rates you'll be paying on your credit card debt. Know the eligibility requirements for the card you select. Apply for the business credit card.

Unlike banks, which operate for profit, credit unions are non-profit cooperatives.Credit unions offer many of the same financial services as banks, including business and personal checking and savings accounts, vehicle loans, personal and business credit cards, mortgages, and business loans.

Small business credit cards provide business owners with easy access to a revolving line of credit with a set credit limit in order to make purchases and withdraw cash. Like a consumer credit card, a small business credit card carries an interest charge if the balance is not repaid in full each billing cycle.

While you might think that your business is in the early days and you don't need a separate credit card, business credit cards can provide important benefits to your company, including rewards you can use for virtually free travel, expense management, and credit to grow your business.

On your business credit card application, your card issuer will request some information about your business financials, including your income and estimated monthly spend. (That's partly how they'll determine your eligibility for the card and, if so, the size of your credit line.)

When you apply for a business credit card especially if it's a small business card your application will likely hinge on your personal credit. This means that when you apply, the card issuer will run a hard check on your credit.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

Own or operate a business. Check your personal credit score. Determine whether you need cards for employees. Choose between rewards and 0% rates. Compare cards based on your intended usage. Apply for the best credit card for your business.

If you want a business credit card for a new enterprise, side hustle or startup, you don't have to wait to establish a business credit history before applying. If you have good credit represented by a credit score of 690 or above you can generally qualify based on your personal credit history.