Maine Reimbursement for Expenditures — Resolution For— - Corporate Resolutions is a legal document used by corporations in the state of Maine to authorize and approve reimbursements for various expenses incurred by employees or directors on behalf of the company. This form acts as a resolution passed by the board of directors or shareholders, outlining the terms and conditions for reimbursement. Keywords: Maine, reimbursement, expenditures, resolution form, corporate resolutions, board of directors, shareholders. Maine Reimbursement for Expenditures — Resolution For— - Corporate Resolutions come in various types, depending on the specific nature of the expenses being reimbursed. Some common types include: 1. Travel Expenses Reimbursement Resolution Form: This type of resolution form is used to authorize reimbursements for travel-related expenses incurred by employees or directors while on official company business. It may cover expenses such as airfare, accommodation, meals, transportation, and other incidental costs. 2. Business Expense Reimbursement Resolution Form: This resolution form is utilized when seeking reimbursement for general business expenses incurred by employees or directors. It typically covers items like office supplies, equipment, professional development courses, memberships, or any other necessary expenses related to the operation of the business. 3. Entertainment and Client Relations Expense Reimbursement Resolution Form: This type of resolution form is specific to authorizing reimbursements for expenses related to entertainment and client relations. It may include costs incurred during business meals, client entertainment events, or similar activities aimed at strengthening business relationships. 4. Legal and Professional Fee Reimbursement Resolution Form: When employees or directors incur legal fees or professional service charges on behalf of the corporation, this resolution form allows for their reimbursement. It covers expenses such as attorney fees, accounting services, consulting fees, or any other professional service directly related to the company's operations. It's worth noting that these are just a few examples of Maine Reimbursement for Expenditures — Resolution For— - Corporate Resolutions. The exact forms and their specific types may vary depending on the individual corporation's needs and policies. It is advisable to seek legal advice or consult an attorney to ensure compliance with relevant laws and regulations in Maine when creating or using such resolution forms.

Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

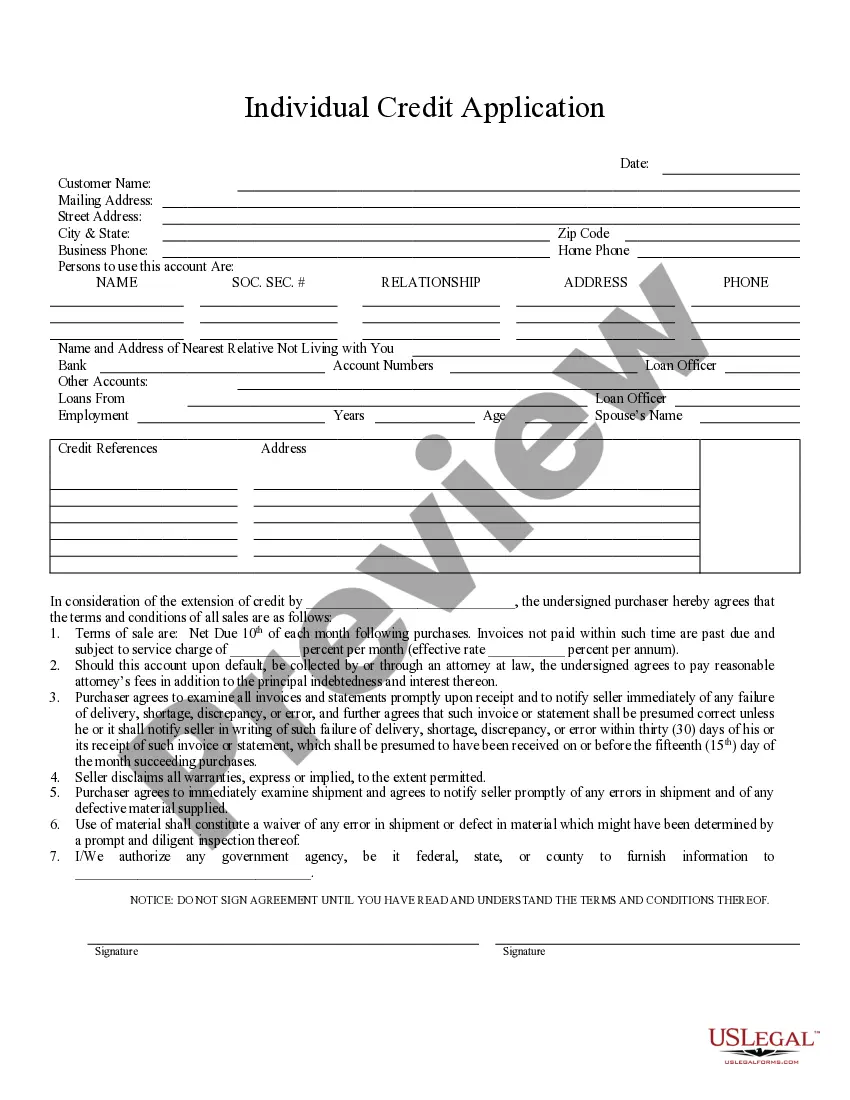

How to fill out Maine Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

Are you in a situation where you frequently require documentation for either business or personal purposes? There are numerous valid form templates available online, but finding reliable ones can be challenging.

US Legal Forms offers an extensive array of form templates, such as the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, designed to comply with state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply sign in. After that, you can download the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions template.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan you prefer, enter the necessary information to set up your account, and pay for the order using your PayPal or Visa or Mastercard. Then select a convenient document format and download your copy.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is tailored for your specific state/county.

- Utilize the Preview button to examine the form.

- Check the details to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search field to locate a form that suits your needs.

Form popularity

FAQ

Typically, a corporate resolution is prepared by a corporate secretary, legal counsel, or another authorized individual within the organization. This person ensures that the document adheres to legal standards and reflects the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions accurately. When using platforms like uslegalforms, you can streamline this process, making it easier to generate compliant resolutions.

Writing a resolution document involves clearly stating the purpose at the top, such as the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. You should provide a detailed explanation of the circumstances surrounding the decision and list out the specific actions to be taken. Be sure to include a section for signatures to validate the resolution. This format supports clarity and aligns with corporate governance standards.

To fill out a corporate resolution form, begin with your company name and the specific date. Then state the decision clearly related to the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. Make sure to include supporting details about participants and any relevant approvals. Conclude with signatures from necessary parties to confirm acceptance of the resolution.

The format of a resolution typically includes a heading that identifies it as a corporate resolution, followed by the date and details of the resolution itself. You should clearly state the intention behind the resolution, which can pertain to the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. Following the body, include space for signatures of the individuals who approve the resolution, ensuring clarity and legality.

To fill out a resolution form, start by providing your company’s name and the date of the resolution. Next, clearly state the purpose of the resolution, ensuring it relates to the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. After that, include specific details, such as any individuals involved and the decisions made. Finally, sign and date the form to officially validate it.

Maine does not automatically grant extensions for filing annual reports. Corporations are expected to file on time to avoid penalties. However, you may request an extension in some specific circumstances, following the proper procedures. For clarity on this process, the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can be a helpful tool.

Yes, Maine requires corporations to file an annual report. This report is due on June 1st each year and must detail information about your business's activities and current status. Failure to submit this report can result in penalties or loss of corporate status. Leveraging the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can simplify this annual obligation.

Some states, such as Delaware and Nevada, do not require annual reports for certain business entities. This allows for more flexibility for businesses operating in those jurisdictions. However, it's important to note that Maine does require annual reports. If you're interested in understanding these differences further, the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can serve as a valuable resource.

Yes, filing an annual report is mandatory for corporations in Maine. The annual report provides updated information about your business to the state, ensuring that your corporate data remains current. Staying compliant is crucial for maintaining your corporate status. Consider using the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions to streamline your reporting process.

To form an S Corp in Maine, you need to first register your business with the state. This involves filing the Articles of Incorporation and ensuring you meet all legal requirements. Once your corporation is established, you can file IRS Form 2553 to elect S Corporation status. Utilizing the Maine Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help you manage your corporate resolutions efficiently.