No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

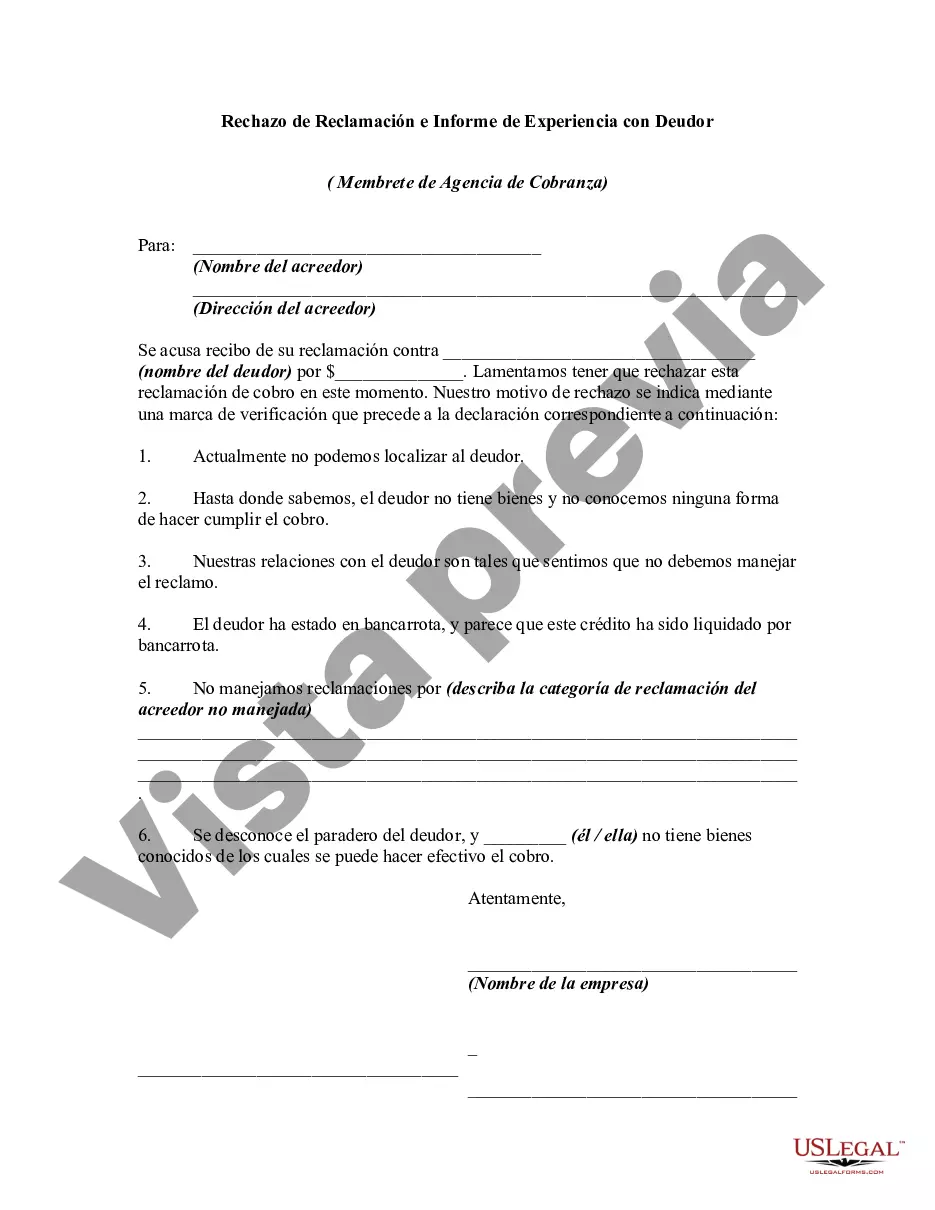

Maryland Rejection of Claim and Report of Experience with Debtor is a legal process whereby a creditor documents their rejection of a claim made by a debtor and reports their experience with the debtor. This process is typically initiated when a debtor fails to fulfill their financial obligations, leading to the creditor's dissatisfaction with the debtor's performance or inability to repay their debts. There are several types of Maryland Rejection of Claim and Report of Experience with Debtor: 1. Maryland Rejection of Claim: This type of rejection occurs when a creditor disputes a claim made by a debtor regarding a debt owed. The creditor submits the rejection to the appropriate legal channels, citing reasons such as lack of evidence or disagreement over the owed amount. 2. Report of Experience with Debtor: In this case, a creditor uses this report to document their firsthand experience with a debtor who has failed to meet their financial obligations. The report may include details of missed payments, late payments, or any other relevant information regarding the debtor's repayment behavior. 3. Maryland Rejection of Claim due to Fraud: This rejection type is specific to cases where a creditor believes that the debtor has engaged in fraudulent activities or has intentionally provided false information to deceive the creditor. The rejection is submitted along with evidence supporting the fraudulent behavior or false claims made by the debtor. 4. Maryland Rejection of Claim and Report of Experience with Debtor in Bankruptcy Proceedings: This type of rejection and report is filed when a debtor has entered into bankruptcy proceedings or has been declared bankrupt. Creditors utilize this procedure to document their experience with the debtor during the bankruptcy process, emphasizing any irregularities, non-compliance with court orders, or fraudulent actions of the debtor. Keywords: Maryland, rejection of claim, report of experience, debtor, legal process, creditor, financial obligations, dissatisfaction, repayment behavior, disputed claim, missed payments, late payments, fraud, false information, bankruptcy proceedings, court orders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.