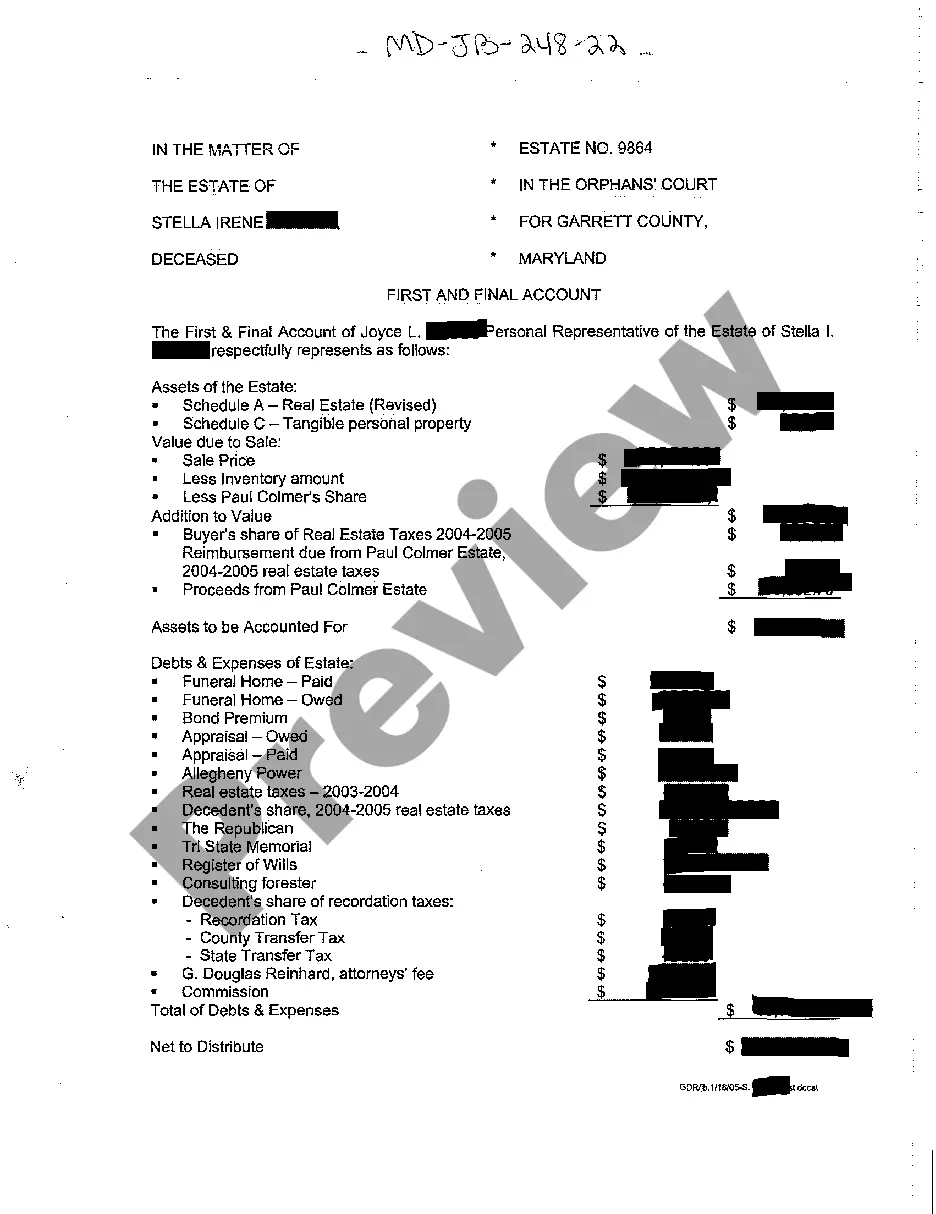

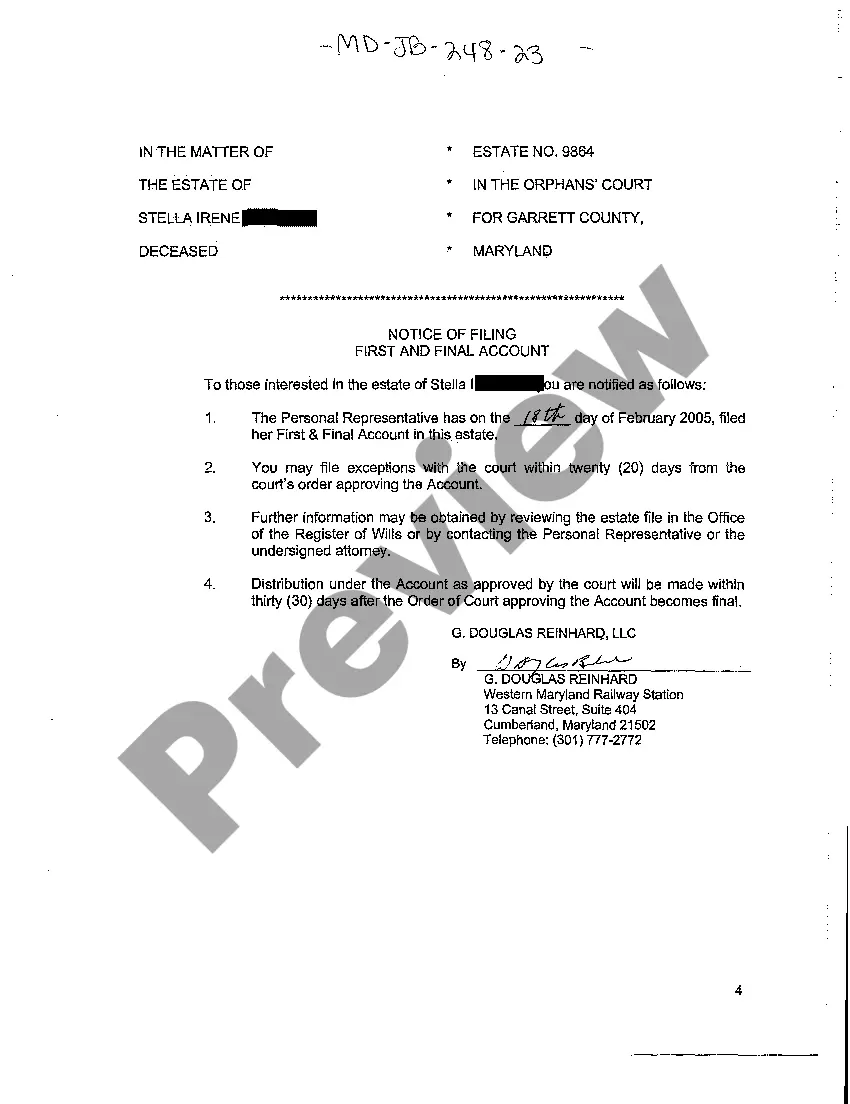

Maryland Notice of Filing First and Final Accounting

Description

How to fill out Maryland Notice Of Filing First And Final Accounting?

Welcome to the premier collection of legal document resources, US Legal Forms. Here, you can discover any template including the Maryland Notice of Filing First and Final Accounting forms and save them (as many as you desire/need). Prepare official documents in mere hours, rather than days or even weeks, without having to spend a fortune on an attorney.

Obtain the state-specific template in just a few clicks and have peace of mind knowing it was created by our qualified attorneys.

If you are already a subscribed user, simply Log In to your account and click Download next to the Maryland Notice of Filing First and Final Accounting you seek. Since US Legal Forms is online, you’ll always have access to your downloaded templates, regardless of the device you’re using. Find them in the My documents section.

Print the document and fill it with your or your company's information. After you’ve completed the Maryland Notice of Filing First and Final Accounting, send it to your attorney for validation. It’s an additional step but a crucial one to ensure you’re fully covered. Join US Legal Forms now and gain access to thousands of reusable templates.

- If you don’t have an account yet, what are you waiting for? Check out our guidelines below to get started.

- If this is a state-specific document, verify its validity in the state where you reside.

- Review the description (if available) to determine if it’s the appropriate template.

- Examine more details with the Preview feature.

- If the document meets all of your requirements, simply click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in your desired format (Word or PDF).

Form popularity

FAQ

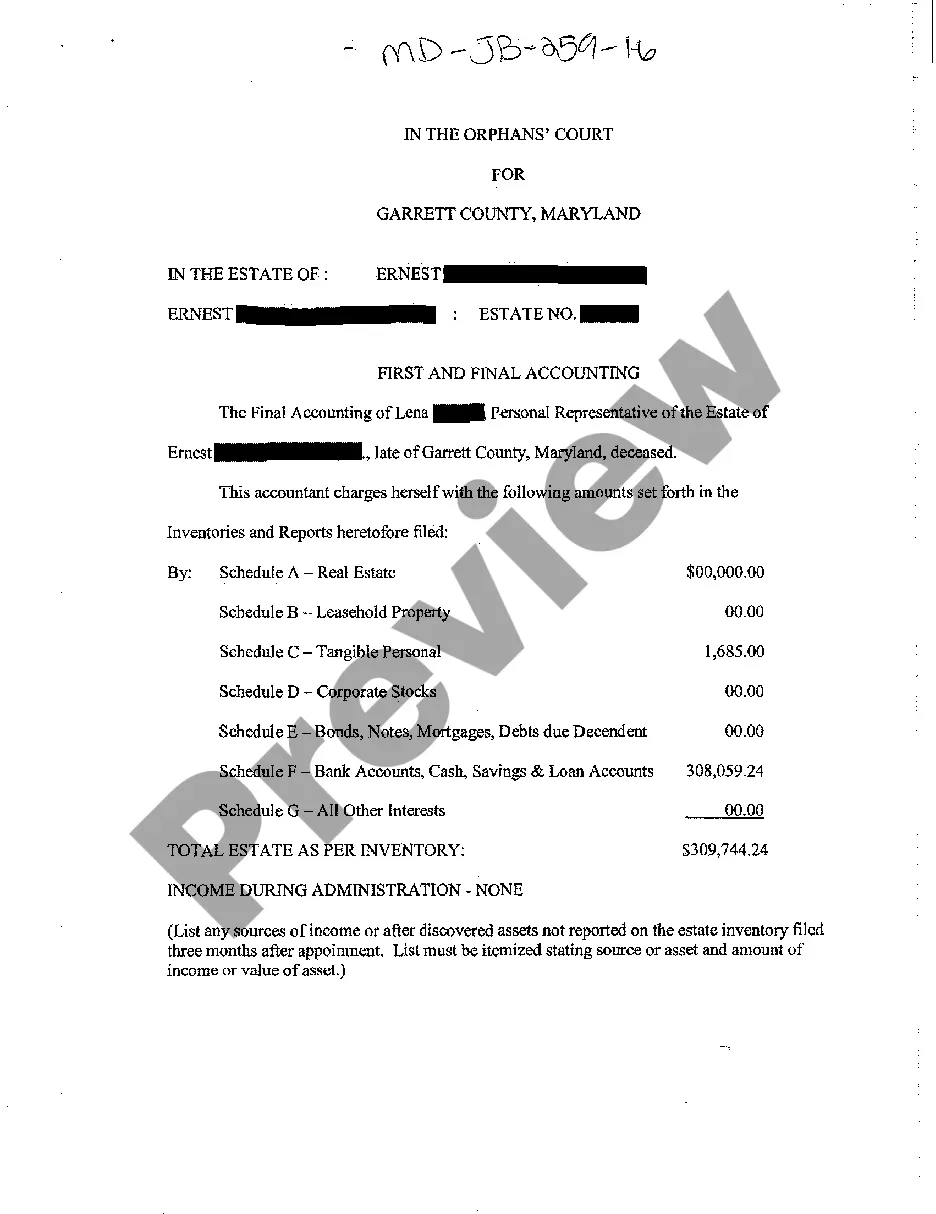

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

An estate account for probate is typically opened with the assistance of your probate lawyer. However, any executor appointed by a probate court is authorized to do so, as well. If you're doing it yourself, it's often most convenient to open the estate account at the same bank as the decedent.

Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Obtain a tax ID number for the estate account. Bring all required documents to the bank. Open the estate account.

Generally, the minimum probate fee for an estate of $75,000 or under is $1500 + 283-500 in court and other miscellaneous costs.

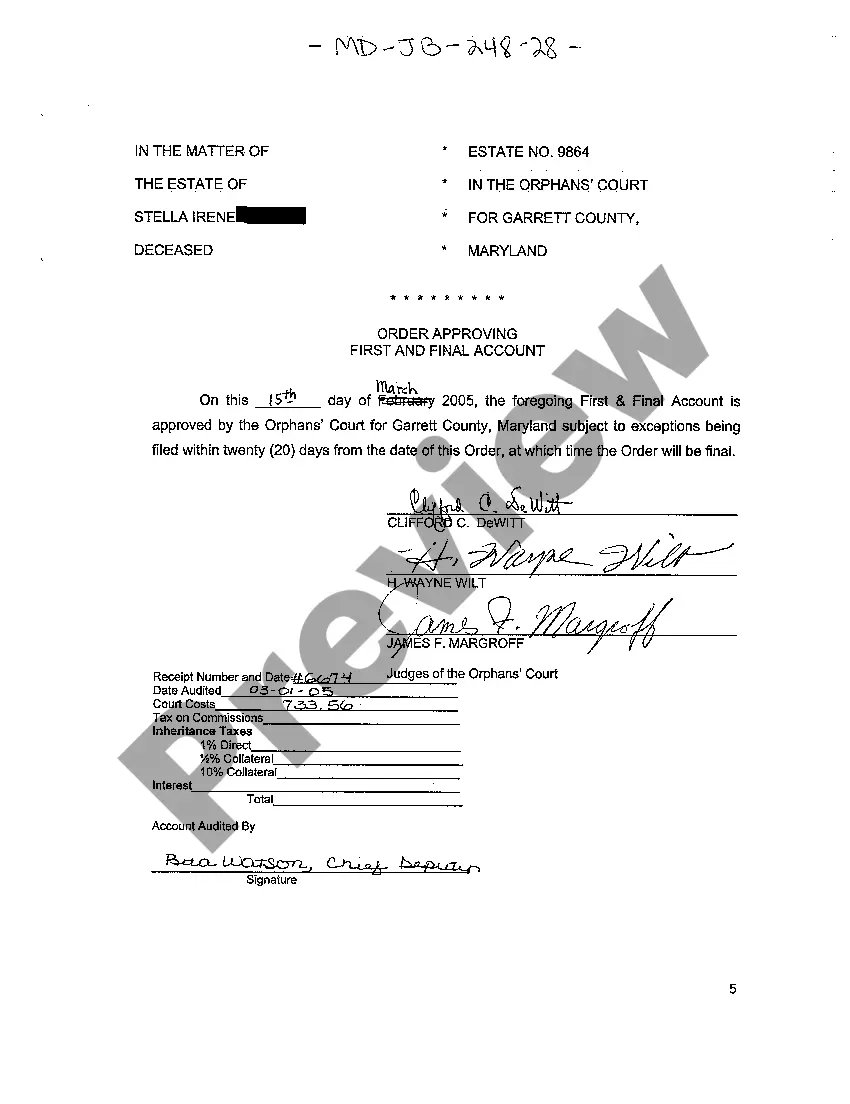

How to Close an Estate in Maryland Probate. Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.

Create an inventory of the deceased person's property and determine the estate size according to Maryland Law. Petition the Maryland Register of Wills to begin the probate process. Prove the will in court. Pay the deceased person's debts and expenses.

Decedent's Last Will and Testament. Death Certificate. Funeral Contract/Bill. Approximate value of assets in the decedent's name alone. Title to decedent's automobiles and/or other motor vehicles.