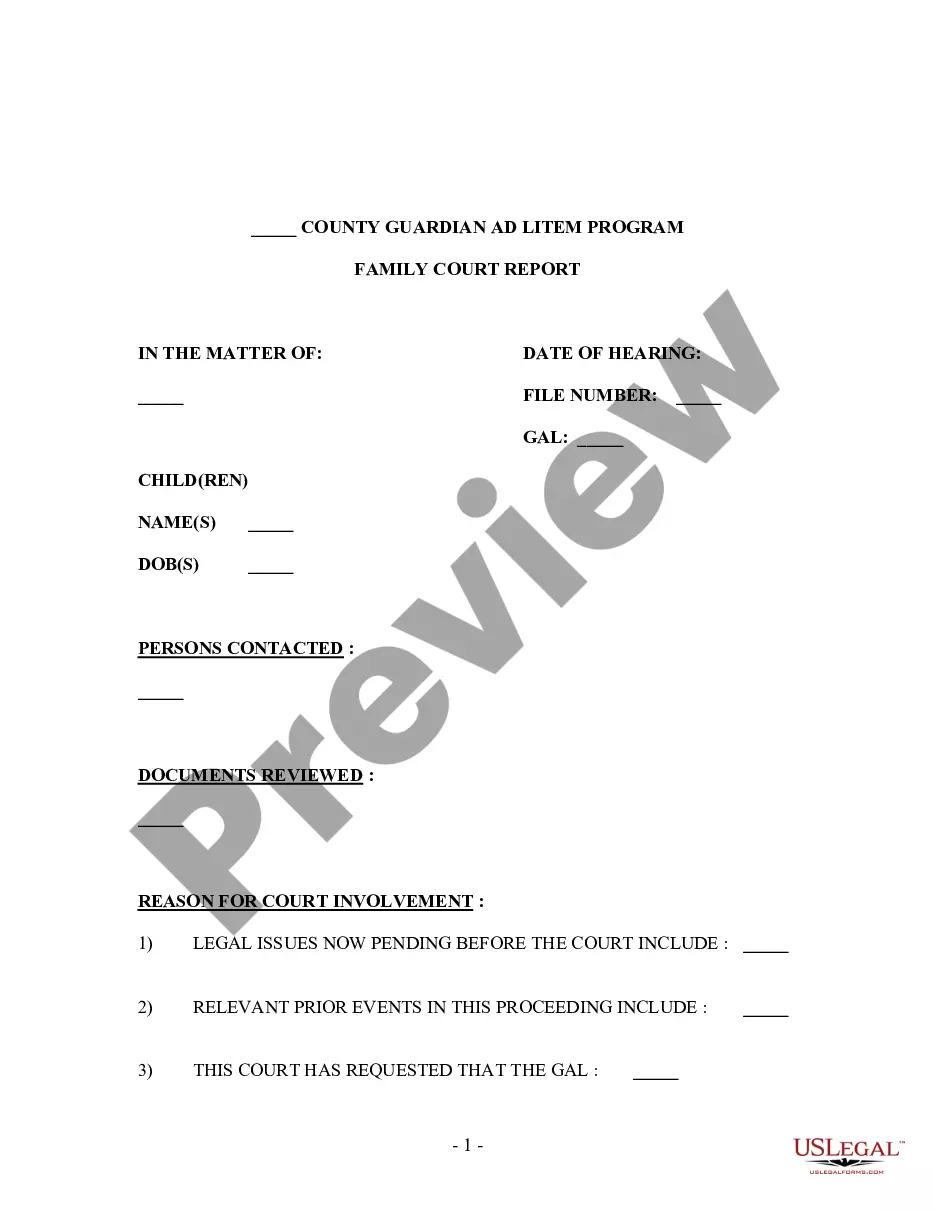

Massachusetts Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

While using the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Massachusetts Guaranty without Pledged Collateral in moments.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

If you are happy with the document, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your information to create an account.

- If you have a monthly subscription, Log In to download the Massachusetts Guaranty without Pledged Collateral from the US Legal Forms library.

- The Obtain option will appear on every form you view.

- You can access all previously saved forms under the My documents tab in your account.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have picked the correct form for your locality/region.

- Click the Preview option to review the form’s details.

Form popularity

FAQ

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

An advance payment guarantee acts as collateral for reimbursing advance payment from the buyer if the seller does not supply the specified goods per the contract. A credit security bond serves as collateral for repaying a loan. A rental guarantee serves as collateral for rental agreement payments.

A secured personal loan is backed by collateral. If the borrower defaults, the lender can collect the collateral. For this reason, secured loans tend to offer better rates than unsecured loans.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport. Unlike a co-signer, a guarantor has no claim to the asset purchased by the borrower.