Massachusetts Warranty Deed from One Individual to Two Individuals

What is a Massachusetts Warranty Deed?

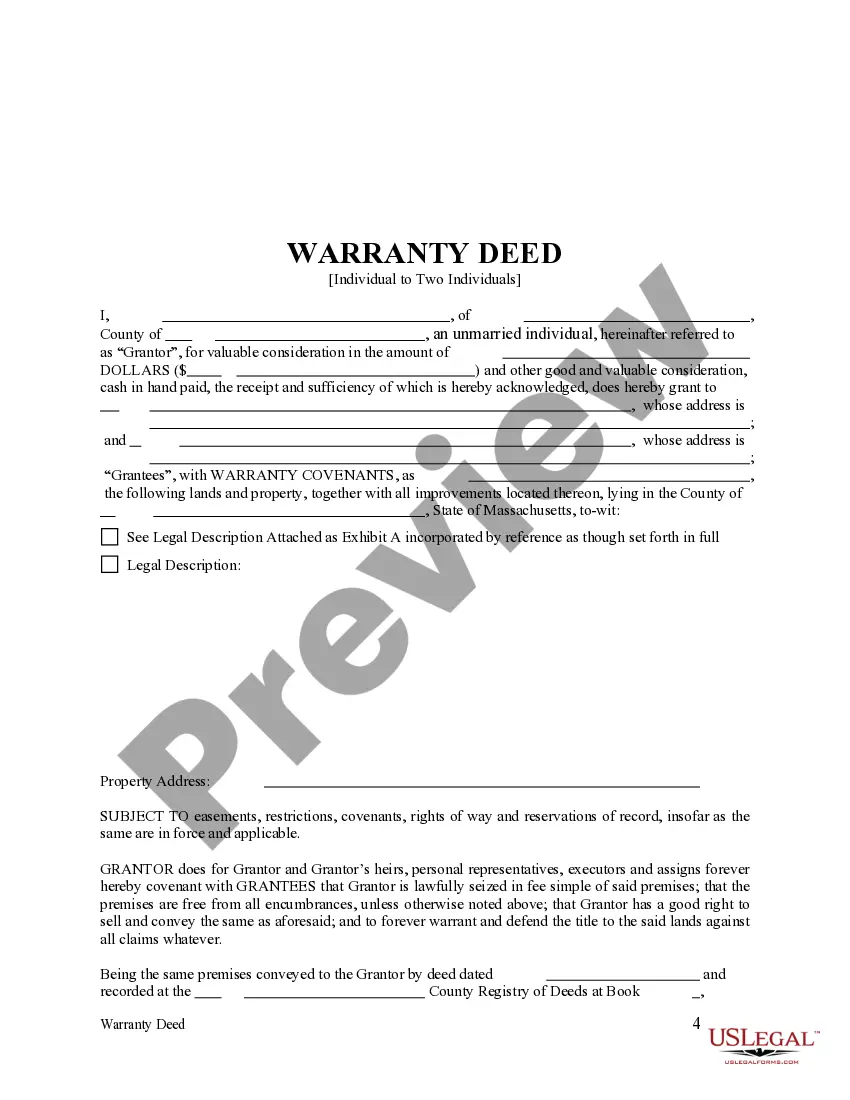

A Massachusetts Warranty Deed is a legal document used to transfer property ownership from one individual, known as the Grantor, to two individuals, referred to as Grantees. This deed guarantees that the Grantor holds clear title to the property, free from any encumbrances, unless otherwise stated. It ensures that the Grantees will receive the property with warranty covenants, providing them legal assurance against future claims.

Step-by-Step Guide to Completing the Form

To properly fill out the Massachusetts Warranty Deed, follow these steps:

- Begin by entering the name and address of the Grantor.

- Specify the amount of consideration paid for the property.

- List the names and addresses of the Grantees.

- Include a legal description of the property, often attached as an exhibit.

- Indicate how the Grantees will hold the property: as Tenants in Common, Joint Tenants with Right of Survivorship, or Tenants by the Entirety.

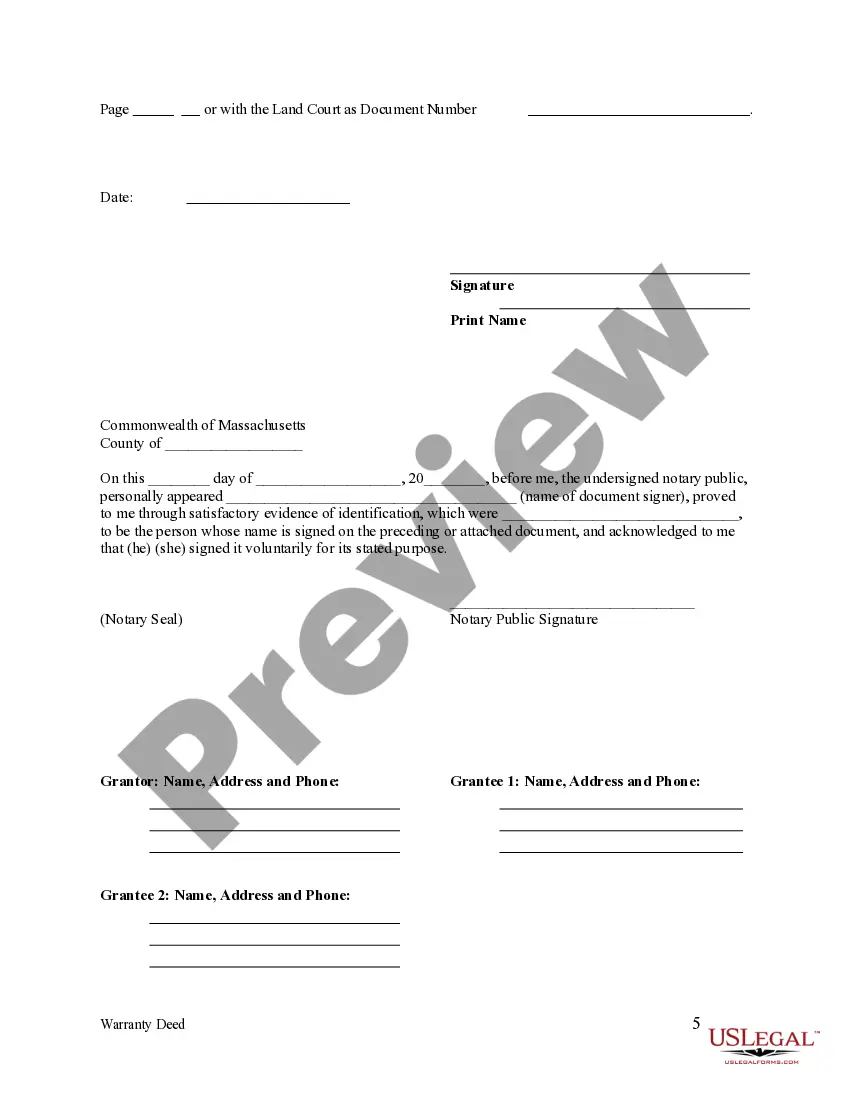

- Sign and date the deed in front of a notary public.

Ensure all information is accurate to avoid potential legal disputes later on.

Who Should Use This Form?

This form is ideal for individuals wishing to transfer ownership of real estate in Massachusetts, especially when the transfer is from one person to two others. It is commonly used by property owners who want to ensure that multiple parties have clear, legal title to the property. Whether you're transferring property to family members, friends, or business partners, this deed can facilitate that process efficiently.

Key Components of the Warranty Deed

The Massachusetts Warranty Deed includes several critical elements:

- Identification of Parties: Clearly states who the Grantor and Grantees are.

- Consideration: Specifies the amount paid for the property.

- Legal Description: Provides a detailed description of the property being transferred.

- Recognized Tenancy: Indicates how the Grantees will hold the property.

- Signature and Notarization: Confirms the authenticity of the document and the parties involved.

Common Mistakes to Avoid

When completing the Massachusetts Warranty Deed, be mindful of the following common mistakes:

- Failing to include a detailed legal description of the property.

- Not specifying how the Grantees will hold the property.

- Incorrectly identifying parties involved in the transaction.

- Neglecting to have the deed notarized, which is essential for legal validity.

- Leaving blank fields that may lead to confusion or legal issues in the future.

What to Expect During Notarization

Notarization is a critical step in finalizing the Massachusetts Warranty Deed. During this process, you will present the completed deed to a notary public, who will verify your identity and witness your signature. The notary will then affix their signature and seal, validating the document. It's important to bring a valid form of ID and to sign the deed in the notary's presence to avoid any issues with the deed's authenticity.

Form popularity

FAQ

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Today's question is is it possible to deed real estate to someone without them knowing it? Strictly speaking, the answer is no. Because it does not meet the acceptance element of a valid deed transfer. Us lawyers must learn to speak in elements because it governs everything that we do.

It will not protect against title issues that arose prior to the time the seller took occupancy. Consequently, it offers less protection to buyers, and more protection to sellers, than a general warranty deed, which is the most common option for selling or buying a property.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

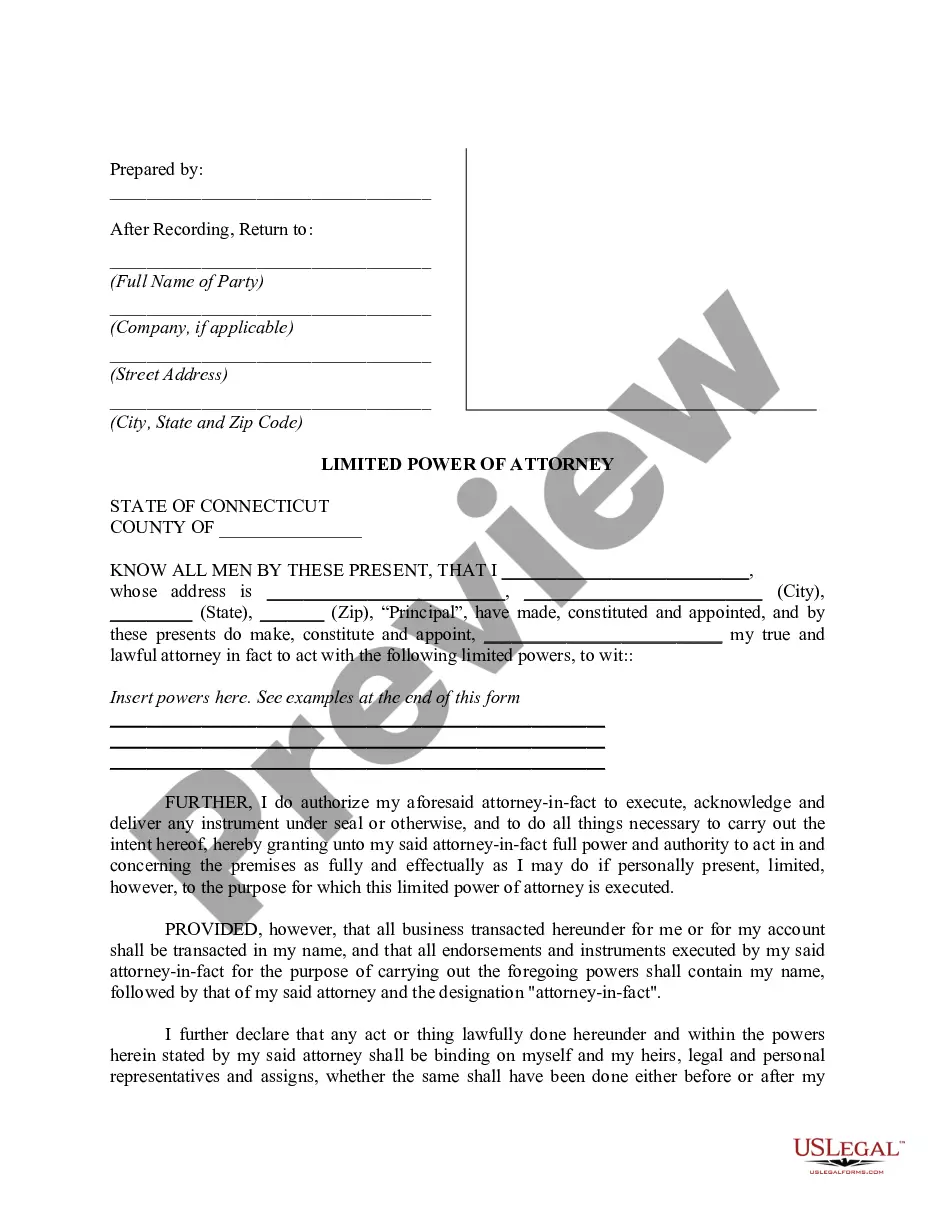

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

It will depend what state the property is in. For example, the minimum fee payable when changing the title to have someone removed from a property title in NSW is $133.48. This fee must be paid to the NSW Government Land & Property Information Department.