Louisiana Closing Statement

Description

Key Concepts & Definitions

Closing statement: In various contexts such as legal trials, real estate transactions, and public speaking, a closing statement is the final opportunity to make an argument, summarize key points, or conclude a deal. It is pivotal in persuasion and concluding discussions with clarity and impact.

Step-by-Step Guide to Crafting an Effective Closing Statement

- Identify Your Key Message: Decide on the core message you want to convey or the conclusion you wish the audience to draw.

- Summarize the Main Points: Briefly recap the main arguments or details that support your key message.

- Address Counterpoints: Acknowledge and counter any opposing arguments to strengthen your position.

- Call to Action: Include a specific call to action if appropriate, guiding the audience toward the desired behavior or decision.

- Practice Your Delivery: Rehearse your statement to ensure smooth delivery and maximum impact.

Risk Analysis

- Lack of Preparation: A poorly prepared closing statement can weaken your position and leave your argument unpersuasive.

- Overloading Information: Including too much information can confuse the audience and dilute the main message.

- Negative Tone: A confrontational or negative tone can alienate the audience and reduce the effectiveness of your statement.

Key Takeaways

To maximize the impact of a closing statement, it should be concise, well-prepared, and aligned with the overall goal or argument. Practicing the delivery and tailoring the tone to the audience can significantly enhance effectiveness.

Best Practices

- Keep It Brief and Focused: Limit your closing statement to the essential points to keep the audience engaged.

- Use Persuasive Language: Choose words that are persuasive and resonate emotionally with the audience to enhance the impact of your message.

- End with a Strong Sentence: Conclude with a powerful and memorable sentence to leave a lasting impression on the audience.

How to fill out Louisiana Closing Statement?

Greetings to the largest legal documents library, US Legal Forms. Here you can obtain any template such as Louisiana Closing Statement templates and retain them (as many as you desire/require). Prepare official documents in just a few hours, instead of days or even weeks, without needing to spend a fortune on a lawyer.

Acquire your state-specific example in a few clicks and feel confident with the assurance that it was crafted by our state-certified legal experts.

If you’re already a registered user, just Log In to your account and click Download next to the Louisiana Closing Statement you wish. As US Legal Forms operates online, you’ll typically have access to your downloaded documents, no matter the device you’re using. Locate them within the My documents section.

Print the document and complete it with your/your business’s information. After filling out the Louisiana Closing Statement, forward it to your legal professional for validation. It’s an extra measure but an essential one to ensure you’re fully protected. Register for US Legal Forms today and gain access to a large number of reusable templates.

- If you don't possess an account yet, what are you waiting for.

- Review our instructions below to get started.

- If this is a state-specific document, verify its legitimacy in your region.

- Check the description (if available) to ensure it’s the correct template.

- See more detailed content with the Preview function.

- If the template meets your requirements, click Buy Now.

- To establish an account, choose a pricing plan.

- Utilize a credit card or PayPal account for registration.

- Save the template in your preferred format (Word or PDF).

Form popularity

FAQ

According to data from ClosingCorp, the average closing cost in Louisiana is $3,365 after taxes, or approximately 1.68% to 3.37% of the final home sale price.

According to data from ClosingCorp, the average closing cost in Louisiana is $3,365 after taxes, or approximately 1.68% to 3.37% of the final home sale price.

Closing costs are fees and expenses you pay when you close on your house, beyond the down payment. These costs can run 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

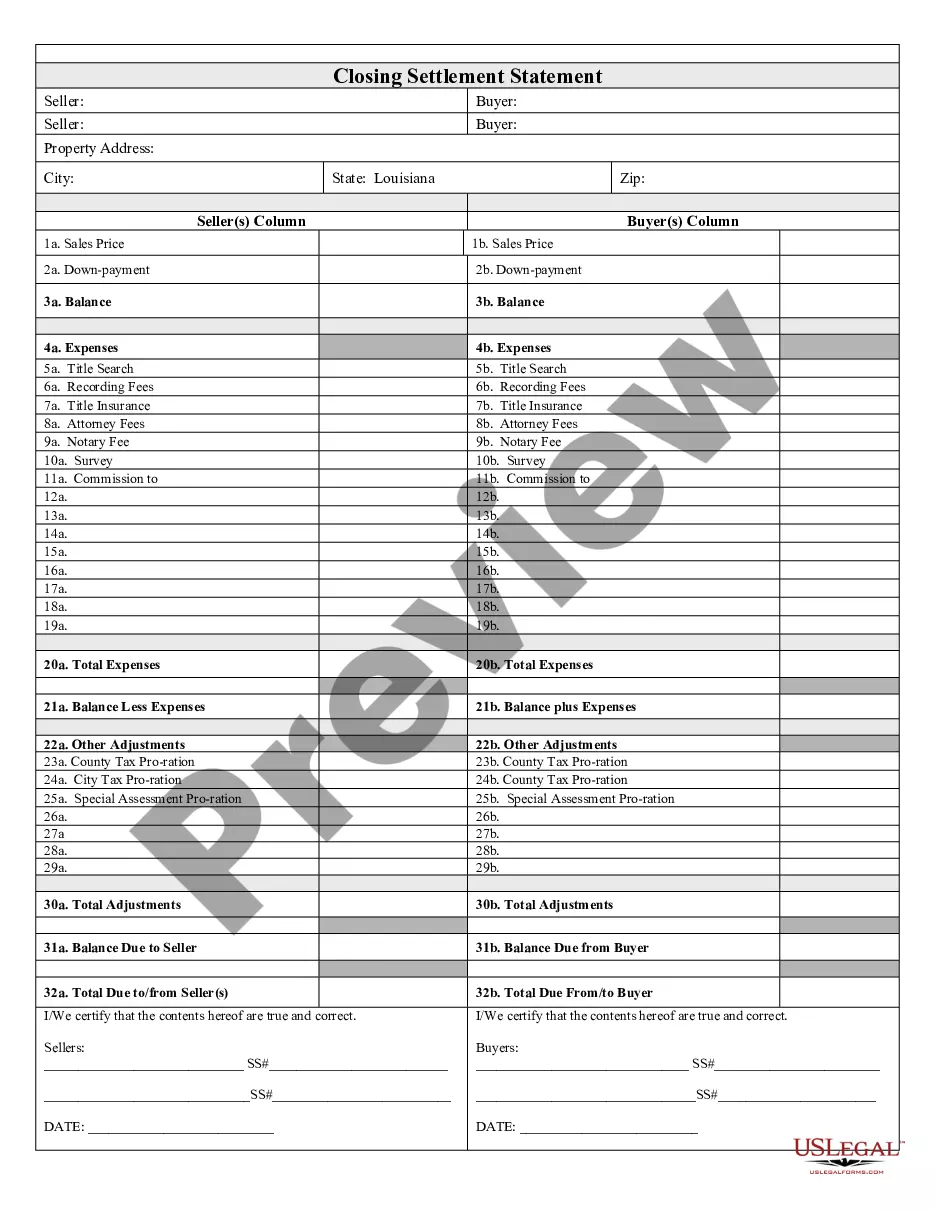

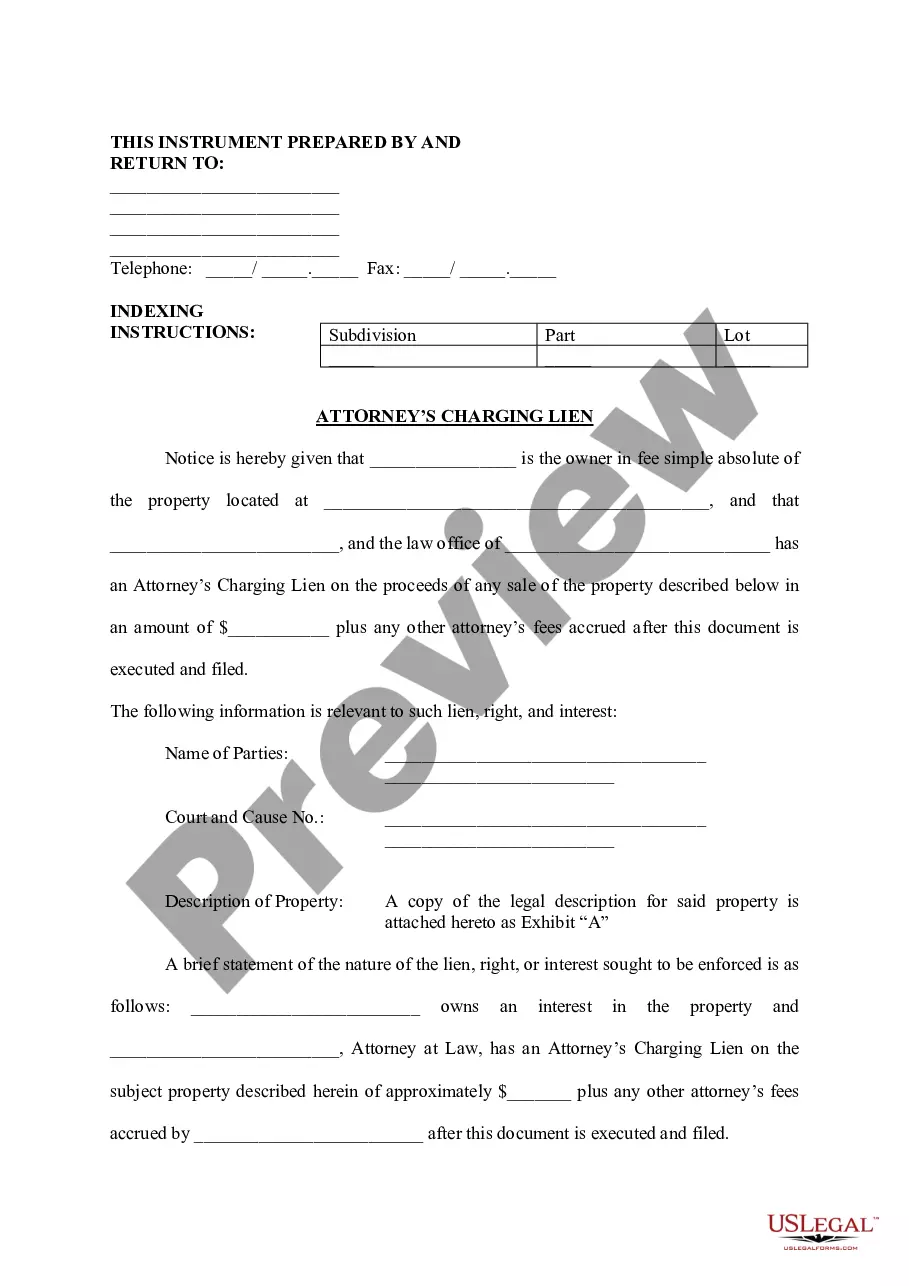

A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market. The HUD-1 settlement statement is a type of closing statement used in reverse mortgages.

Louisiana is a community-property state. Attorneys conduct closings. Conveyance is by warranty or quitclaim deed. Mortgages are the security instruments.

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.

Total closing costs to purchase a $300,000 home could cost anywhere from approximately $6,000 to $12,000 or even more. The funds can't typically be borrowed because that would raise the buyer's loan ratios to a point where they might no longer qualify.

According to lines 235 to 237 of the Louisiana Residential Agreement to Buy or Sell, SELLER's title shall be merchantable and free of all liens and encumbrances except those that can be satisfied at Act of Sale. All costs and fees required to make title merchantable shall be paid by SELLER.

The deed and mortgage documents are filed with the county recorder and these become public record. 3feff You can always obtain copies of these from the recorder's office or from a title company. Most documents are digitized in some form, especially those related to the transaction.