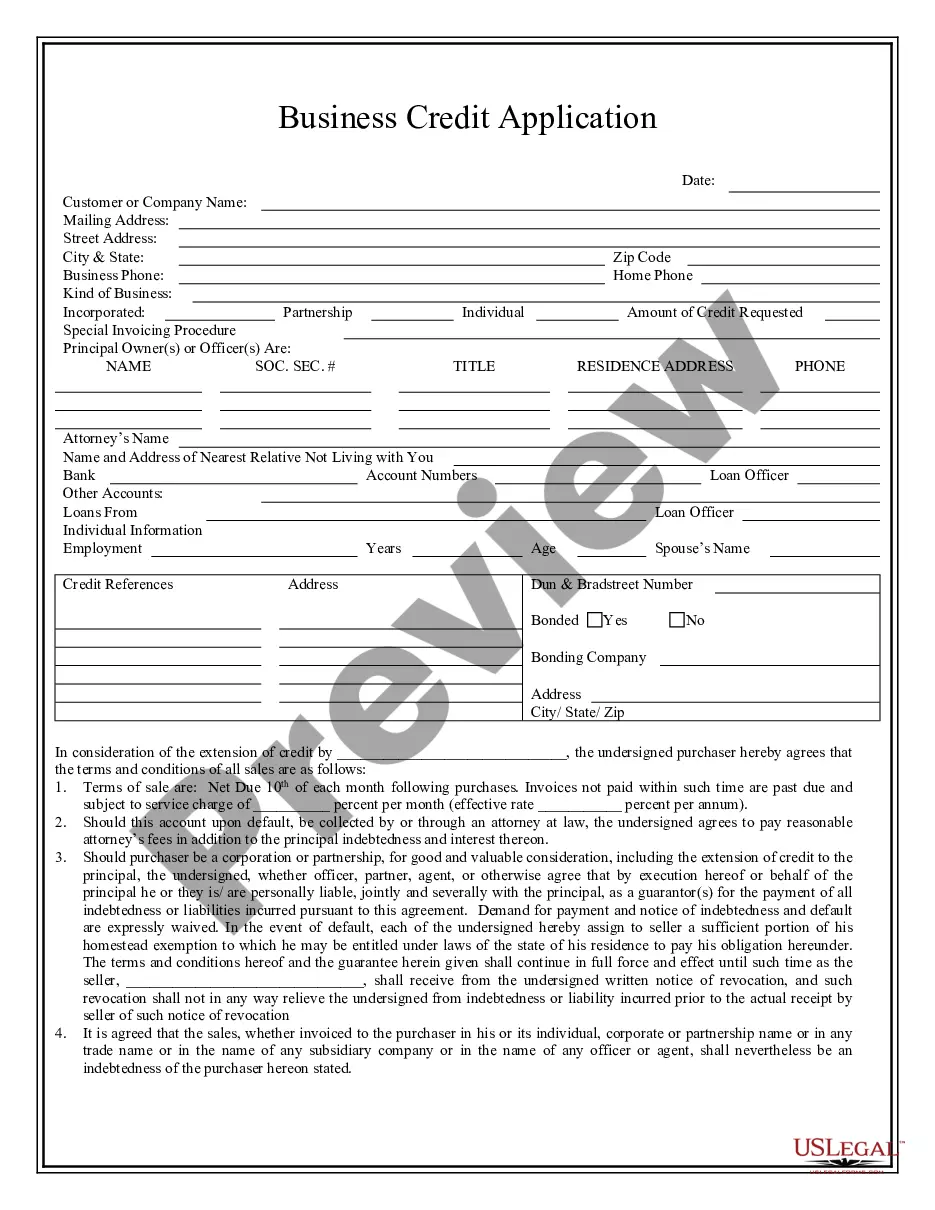

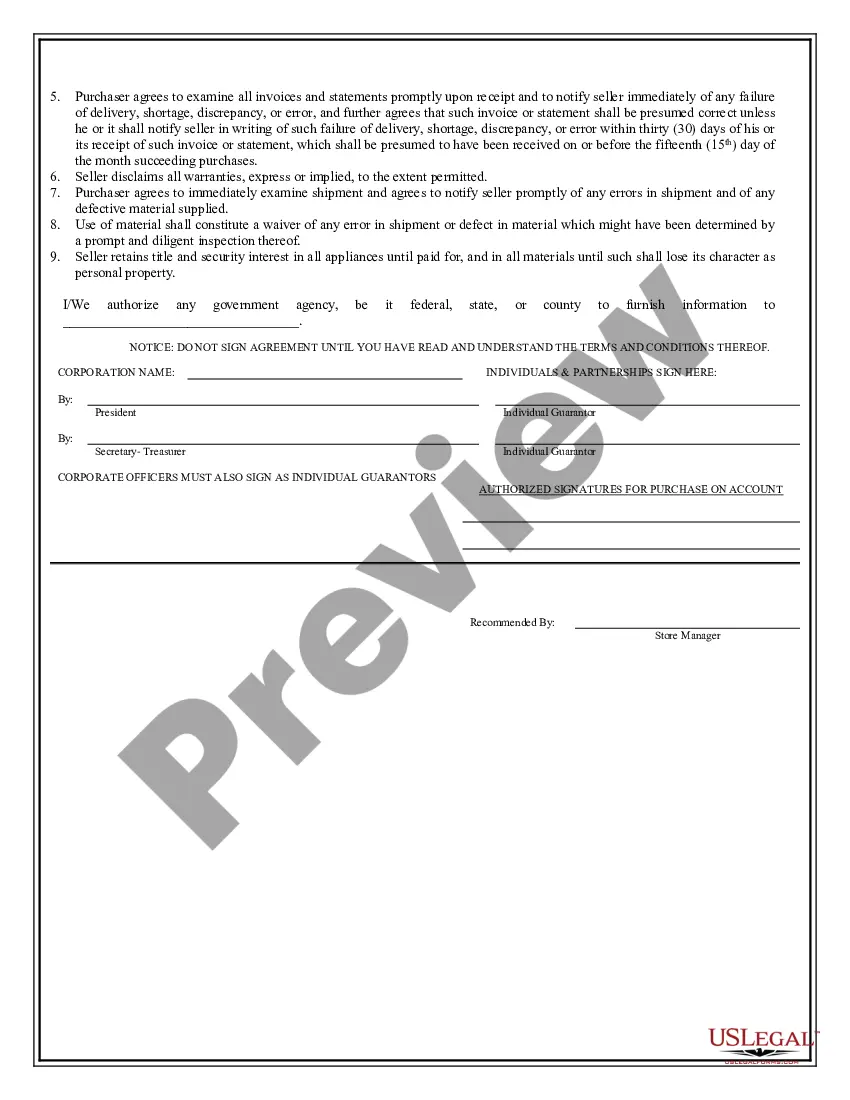

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Kentucky Business Credit Application

Description

How to fill out Kentucky Business Credit Application?

Looking for a Kentucky Business Credit Application example and completing it could pose a challenge.

To conserve considerable time, expenses and effort, utilize US Legal Forms and locate the appropriate example specifically for your state in merely a few clicks.

Our attorneys prepare all documents, so you just need to fill them out. It is truly that simple.

If there's a description, read it to understand the key points. Click Buy Now if you found what you're seeking. Choose your plan on the pricing page and create an account. Decide if you'd like to pay with a credit card or via PayPal. Download the example in the desired format. Now you can print the Kentucky Business Credit Application document or complete it using any online editor. There’s no need to worry about making errors since your template can be utilized and submitted, and printed as many times as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in.

- to your account and return to the form's page and preserve the example.

- All of your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t subscribed yet, you must register.

- Check out our detailed instructions on how to obtain your Kentucky Business Credit Application example in a few minutes.

- To secure a valid form, verify its suitability for your state.

- Examine the sample using the Preview option (if it’s available).

Form popularity

FAQ

To obtain a Kentucky llet account number, you must register your business with the Kentucky Department of Revenue. This process typically involves submitting an application and providing the necessary business documentation. Completing the Kentucky Business Credit Application can streamline your tax registration process, ensuring you access all available benefits for your business in Kentucky.

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

A credit application is a form used by potential borrowers to get approval for credit from lenders.The information provided on credit applications is regulated, and laws such as the Truth in Lending Act provide consumer protection and transparency.

Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line. Interest and Attorney's Fees. Confirm that the Customer's Name is Correct.

The present Unit on 'Process of Credit Application' covers various aspects like features and conditions for credit sales, identifying credit checks and getting authorisation, describing the process of credit requisitions, demonstrate the techniques for determining creditworthiness.

Two other goals for a credit application are to limit credit risk and to get a better understanding of a customer's business. The credit application is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit sales and/or fraud.

Business credit is the ability of a business to qualify for financing. Businesses have credit reports and scores just like people do.Your business credit report may be used by lenders, creditors, suppliers, insurance companies and other organizations evaluating a credit or insurance application or business deal.

#1: Establish business credit. #2: Use good trade references. #3: Review your personal and business credit scores. #4: Know the line of credit's purpose. #5: Organize your financial records. #6: Prepare your business plan. #7: Fill out the application correctly.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.