A Kansas Second Mortgage Promissory Note is a financial agreement between a borrower and a lender that outlines the terms of a loan for a second mortgage in Kansas. The promissory note details the amount of the loan, the interest rate, the repayment schedule, and the consequences of default. There are two types of Kansas Second Mortgage Promissory Note: a fixed-rate note and an adjustable-rate note. With a fixed-rate note, the borrower agrees to pay a fixed-rate of interest over the entire life of the loan. An adjustable-rate note, on the other hand, allows for the interest rate to fluctuate with market conditions. Both types of notes include information about the borrower's creditworthiness, loan amount, collateral, and repayment schedule. Kansas Second Mortgage Promissory Notes are legally binding documents and must be signed by both the borrower and the lender.

Kansas Second Mortgage Promissory Note

Description

How to fill out Kansas Second Mortgage Promissory Note?

If you’re looking for a method to correctly create the Kansas Second Mortgage Promissory Note without enlisting a legal expert, then you’re in the perfect spot.

US Legal Forms has established itself as the largest and most dependable repository of official templates for every personal and commercial scenario. Every document you discover on our platform is designed in accordance with federal and state laws, so you can be assured that your paperwork is in order.

Another significant benefit of US Legal Forms is that you will never lose the documents you acquired - you can access any of your downloaded forms in the My documents section of your profile whenever you need.

- Verify that the document displayed on the page meets your legal requirements and state laws by reviewing its text description or exploring the Preview mode.

- Type the form's name in the Search tab at the top of the page and select your state from the list to find another template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are confident that the paperwork complies with all requirements.

- Log in to your account and click Download. Sign up for the service and choose a subscription plan if you do not already have one.

- Use your credit card or the PayPal option to buy your US Legal Forms subscription. The document will be available for download immediately after.

- Choose the format you prefer for your Kansas Second Mortgage Promissory Note and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

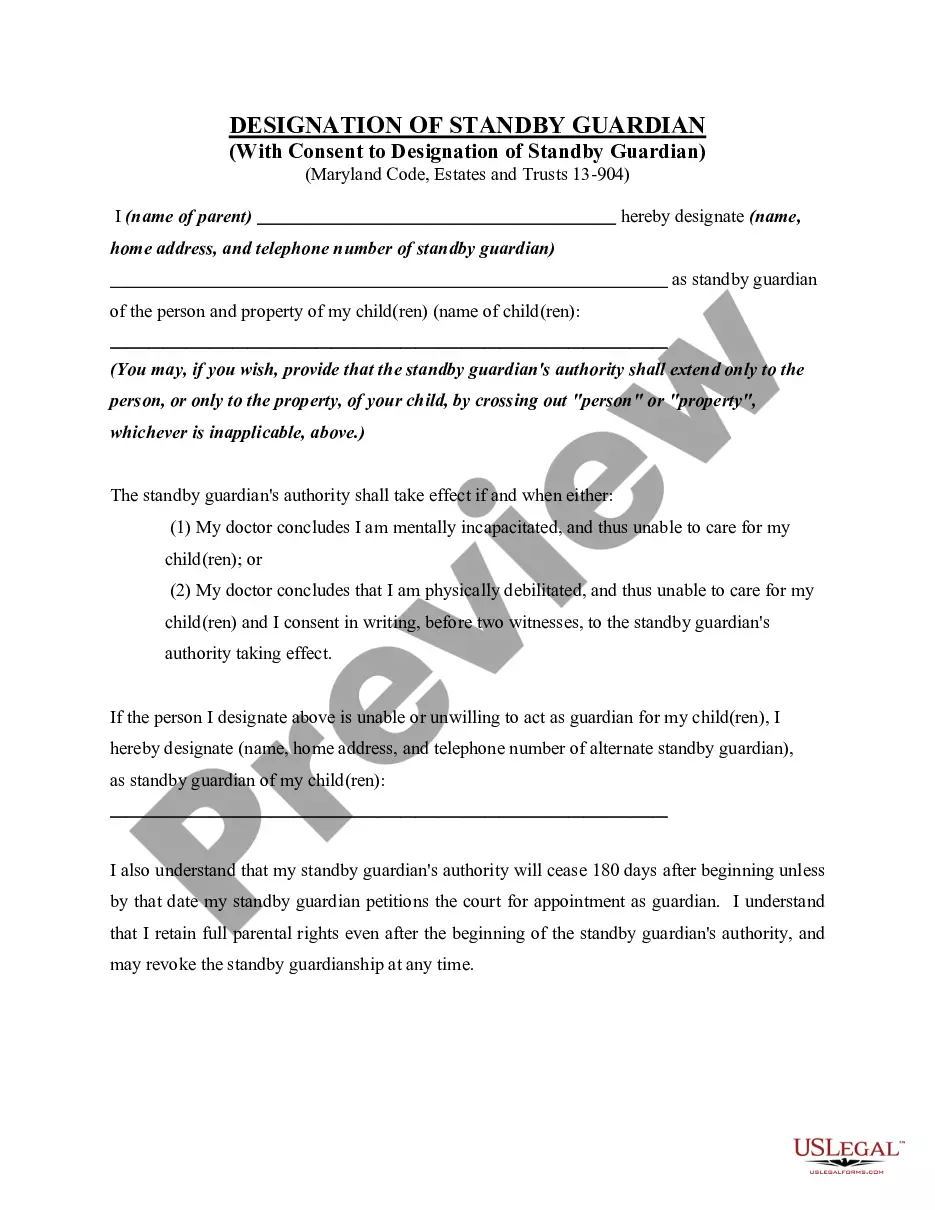

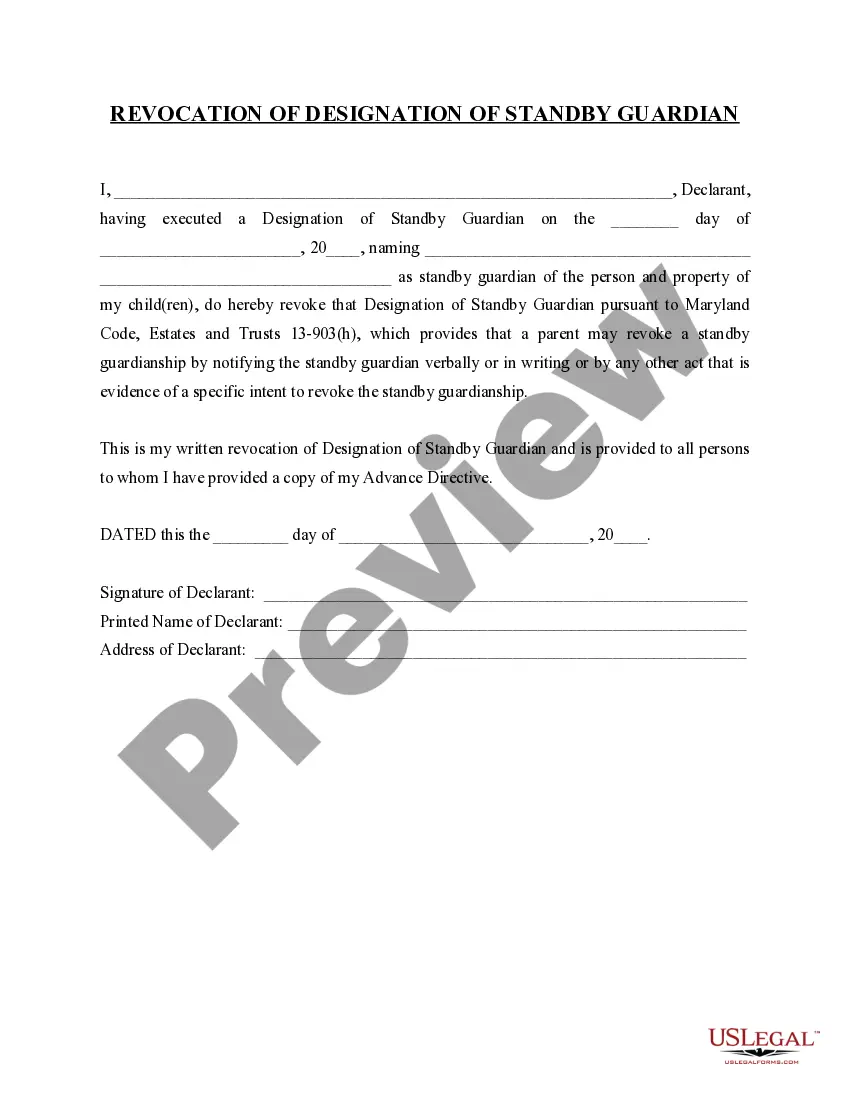

Borrower's promise to pay is secured by a mortgage, deed of trust or similar security instrument that is dated the same date as this Note and called the ?Security Instrument.? The Security Instrument protects the Lender from losses, which might result if Borrower defaults under this Note.

While all mortgage notes are promissory notes, not all promissory notes are mortgage notes. A promissory note is a legally binding promise from a borrower to repay a loan to their lender. A mortgage note is a document that outlines the terms of a mortgage.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

In fact, a promissory note may be a way for someone who is unable to obtain traditional financing to still buy a home through what is called a take-back mortgage. The financing vehicle effectively allows the home seller to loan a buyer money to purchase the home.

A promissory note is not essential for a mortgage loan. The terms of the loan can be effectively written through other legal documents standard to a loan. Whether your mortgage lender uses a promissory note will depend on their preferred forms.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

Only the borrower signs a promissory note, whereas both the lender and the borrower sign a loan agreement. Once the document is signed, it means that the borrower agrees to pay back the loan.