Kansas Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Kansas Complex Will With Credit Shelter Marital Trust For Large Estates?

Attempting to locate Kansas Complex Will with Credit Shelter Marital Trust for Substantial Estates forms and completing them may pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to find the suitable template specifically for your state within moments.

Our attorneys prepare each document, so you merely need to fill them in. It really is that easy.

Select your plan on the pricing page and create an account. Choose to pay via credit card or PayPal. Download the document in your desired file format. You can print the Kansas Complex Will with Credit Shelter Marital Trust for Substantial Estates template or complete it using any online editor. Don’t worry about making mistakes because your form can be used and submitted, and printed as many times as needed. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- Your downloaded templates are stored in My documents and are available at all times for future use.

- If you haven’t registered yet, you need to sign up.

- Review our detailed instructions on how to obtain the Kansas Complex Will with Credit Shelter Marital Trust for Substantial Estates template in just a few minutes.

- To find a suitable template, verify its relevance for your state.

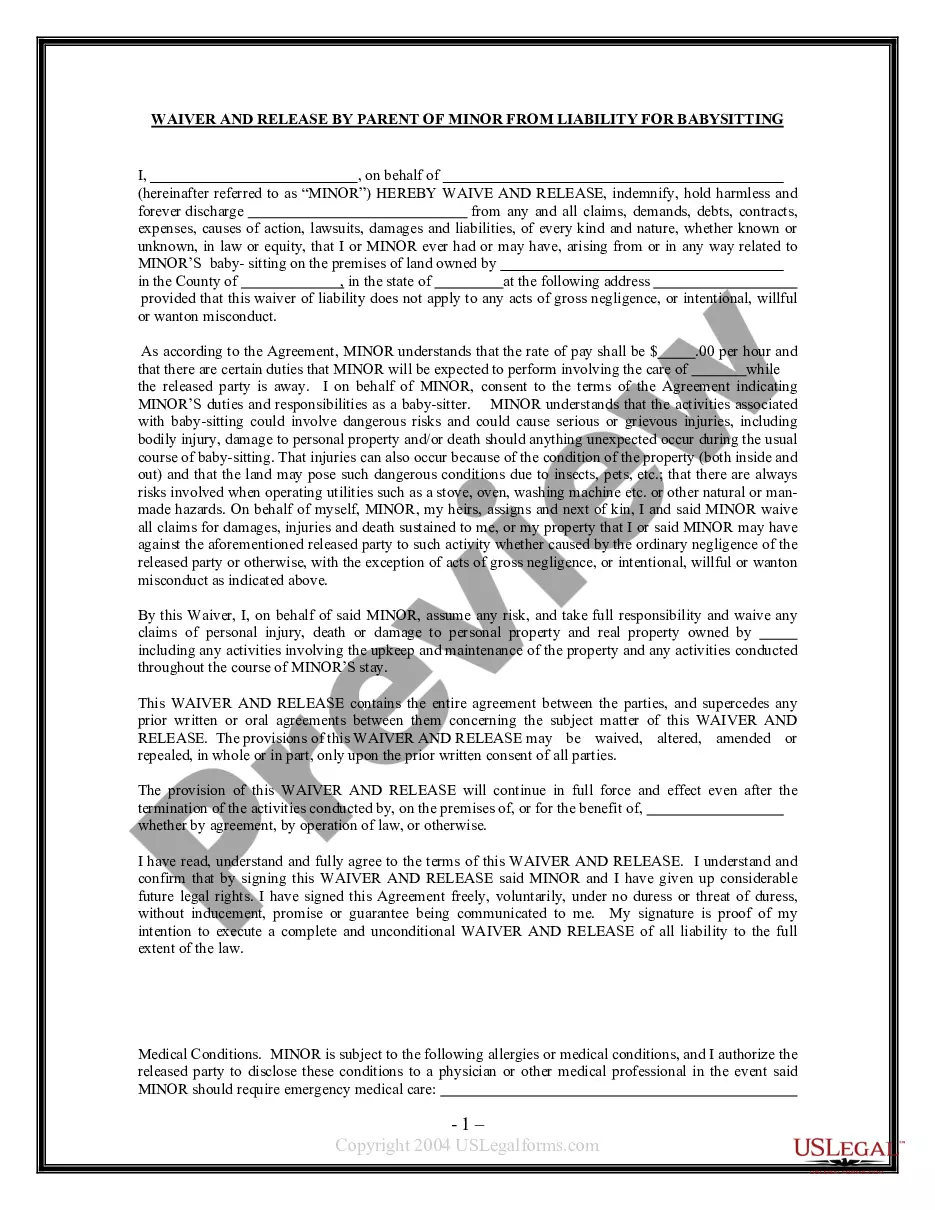

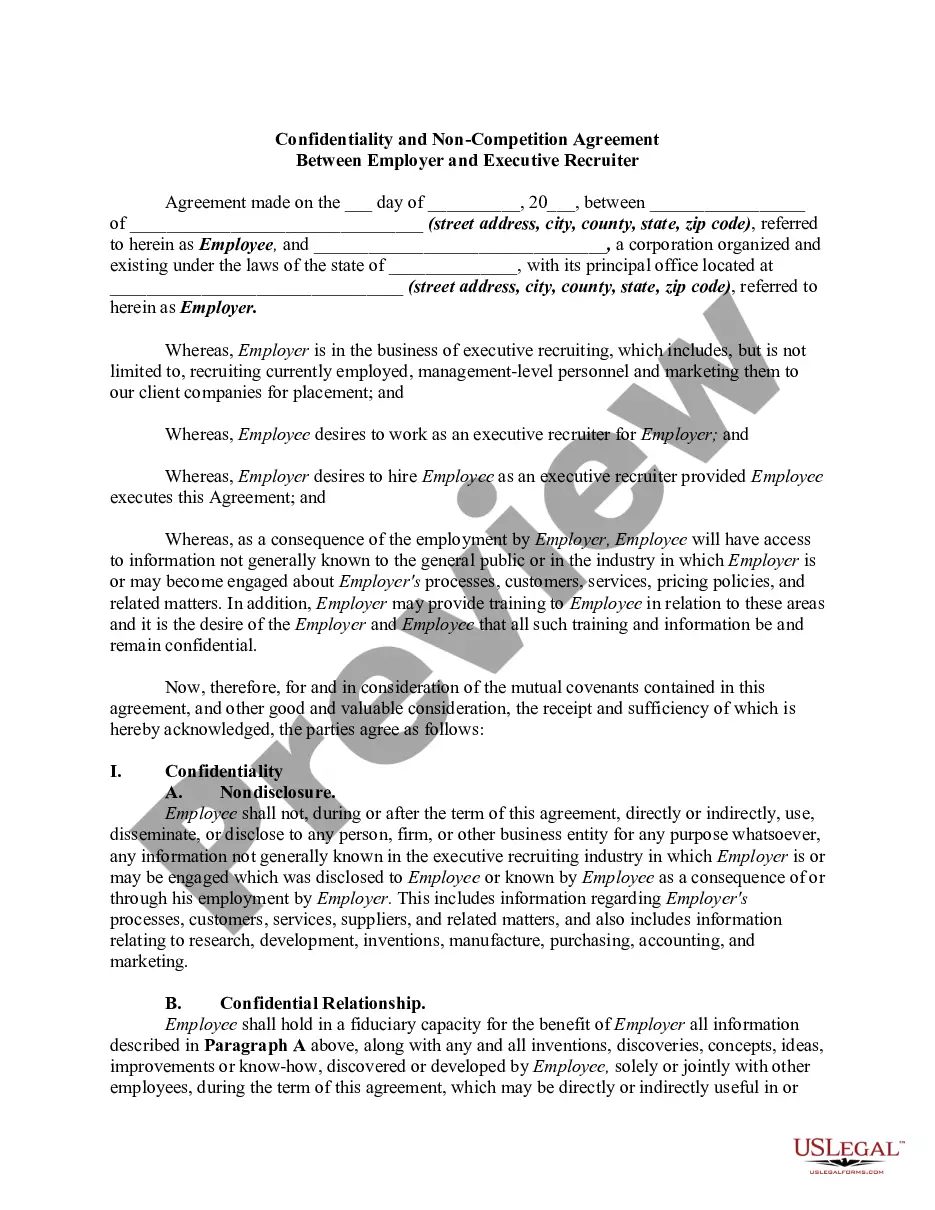

- Examine the sample using the Preview option (if it’s available).

- If there’s a description, read it to understand the specifics.

- Click on the Buy Now button if you found what you're looking for.

Form popularity

FAQ

A credit shelter trust is designed to hold assets up to the estate tax exemption limit, ensuring that these assets are not subject to estate taxes after the death of one spouse. This trust benefits the surviving spouse while preserving wealth for future generations. Implementing this with a Kansas Complex Will with Credit Shelter Marital Trust for Large Estates can enhance your estate planning strategy.

QTIP trusts are put to use in estate planning and are especially useful when beneficiaries exist from a previous marriage but the grantor dies before a subsequent spouse does. With a QTIP, estate tax is not assessed at the point of the first spouse's death, but is instead determined after the second spouse has passed.

A marital trust starts as a revocable living trust. A surviving spouse can be its trustee.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouseunder some arrangements, the surviving spouse can also receive principal payments.

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

You can be trustee of your own living trust. If you are married, your spouse can be trustee with you. Most married couples who own assets together, especially those who have been married for some time, are usually co-trustees.

Trust B is irrevocable, the surviving spouse cannot change its terms. When one spouse dies the survivor must hire a lawyer or an accountant to determine how to best divide the couple's assets between the deceased spouse's irrevocable trust and the surviving spouse's revocable trust.

The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust."

First, in a standard credit shelter trust, there is no step-up in basis at the death of the surviving spouse.Second, the credit shelter trust is a separate taxpayer and requires its own tax return, Form 1041.

Unlike with a QTIP trust, the surviving spouse typically has complete control over a marital trust, including use of the trust assets and final say on designating who the final beneficiaries are. A QTIP trust offers more control to the grantor but less control to the surviving spouse compared to marital trust.