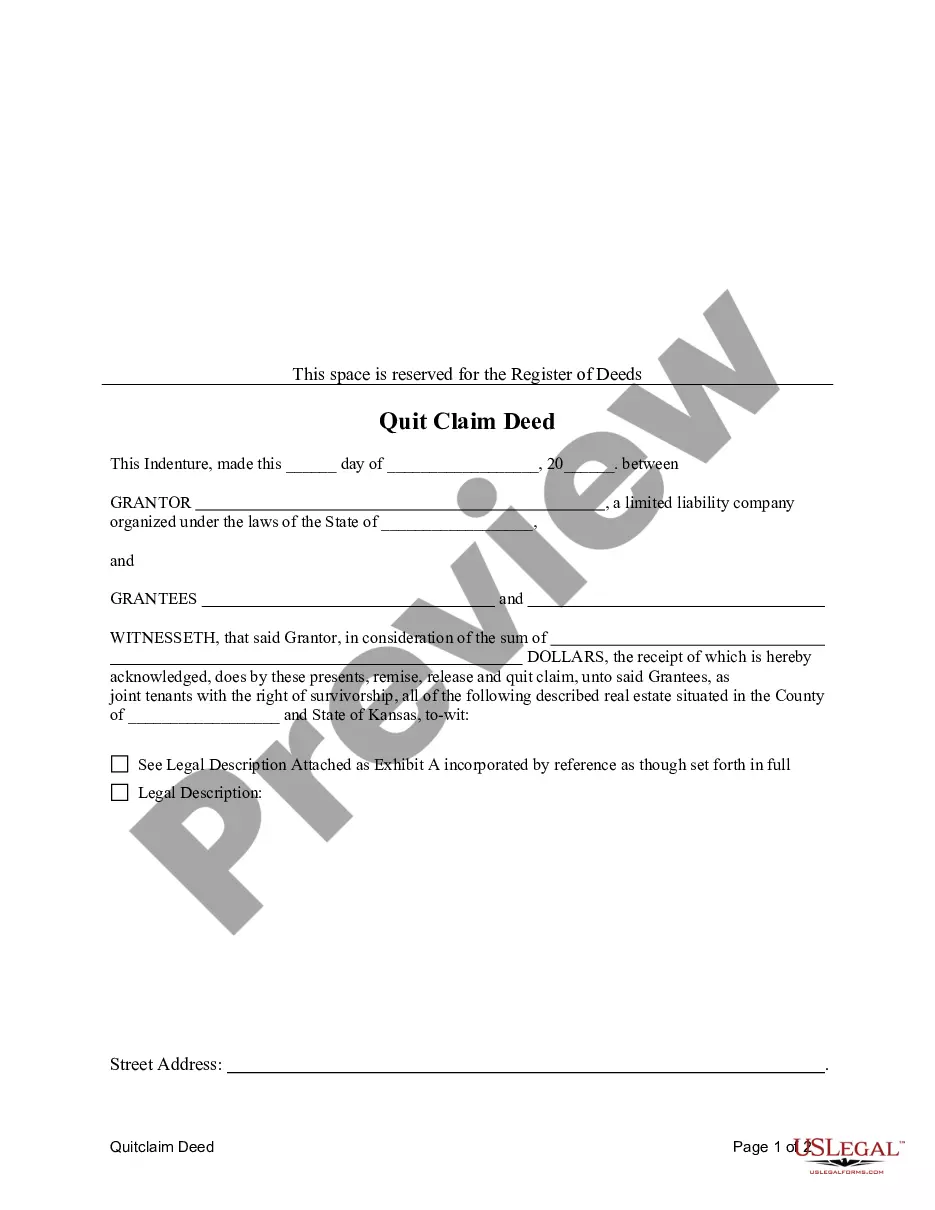

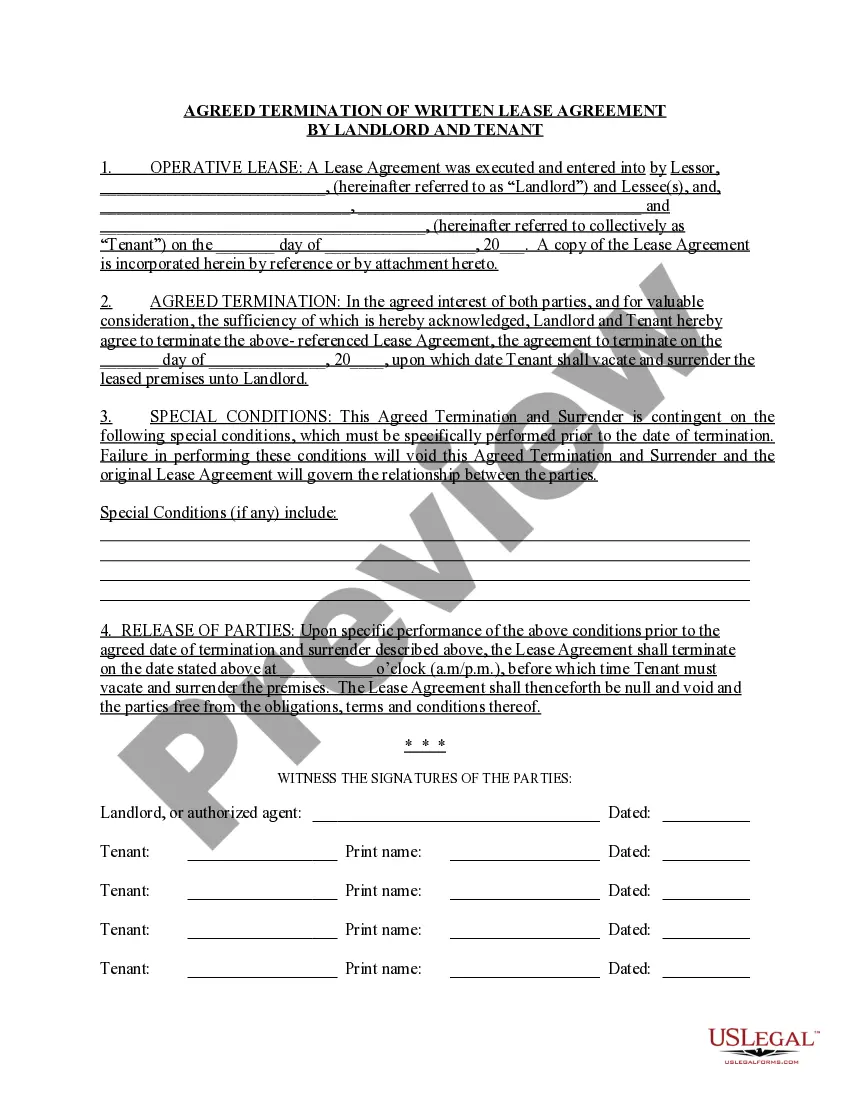

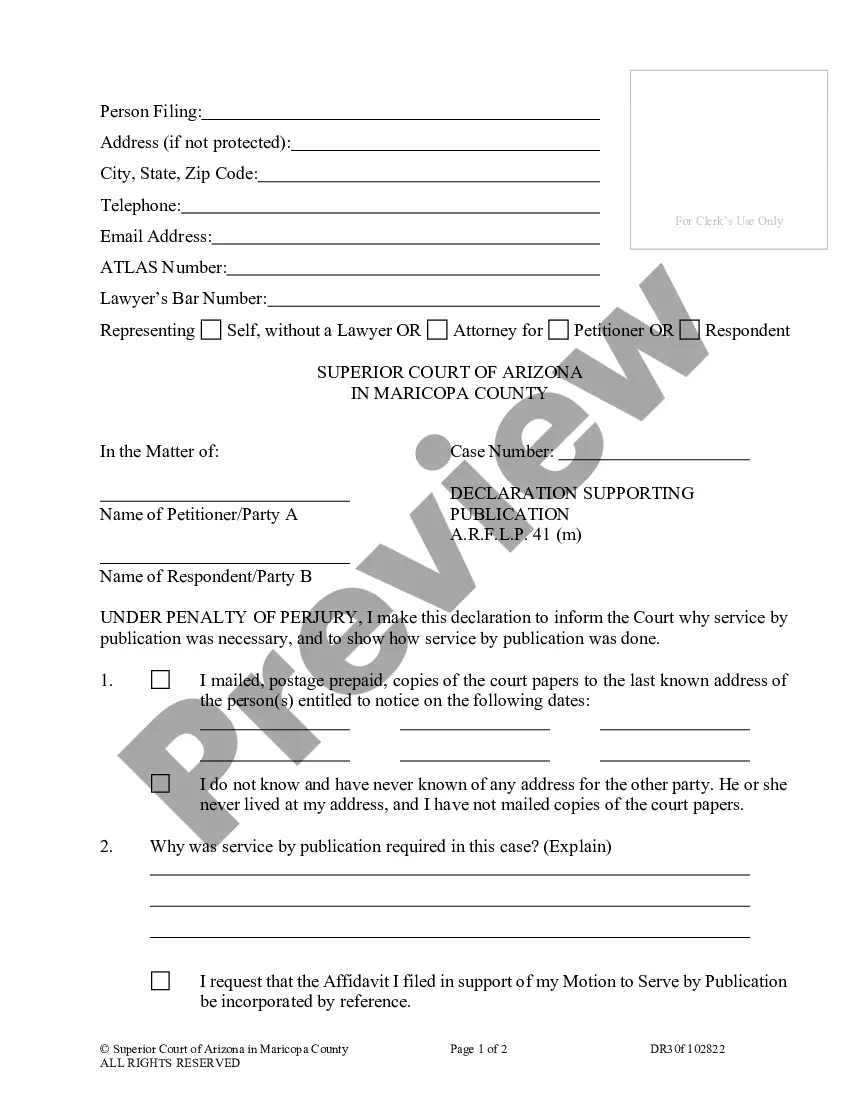

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantees are two Individuals. Grantor conveys and quitclaims the described property to Grantees. The grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

Kansas Quit Claim Deed from Limited Liability Company as Grantor to Two Individuals as Grantees

Description

How to fill out Kansas Quit Claim Deed From Limited Liability Company As Grantor To Two Individuals As Grantees?

Searching for Kansas Quit Claim Deed from Limited Liability Company serving as Grantor to Two Individuals as Grantees documents and completing them can be tricky.

To minimize time, expenses, and effort, utilize US Legal Forms and locate the suitable example particularly for your state in just a few clicks.

Our legal experts prepare every document, so you only need to complete them. It truly is that straightforward.

You can print the Kansas Quit Claim Deed from Limited Liability Company as Grantor to Two Individuals as Grantees form or complete it using any online editor. There’s no need to worry about typos since your template can be utilized, submitted, and printed as many times as you desire. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to save the sample.

- All your saved templates are stored in My documents and can be accessed anytime for future use.

- If you haven't subscribed yet, you need to create an account.

- Review our detailed instructions on how to obtain your Kansas Quit Claim Deed from Limited Liability Company as Grantor to Two Individuals as Grantees sample in mere minutes.

- To acquire a valid form, verify its applicability for your state.

- Examine the form using the Preview feature (if available).

- If a description is provided, review it to understand the specifics.

- Click Buy Now once you find what you're looking for.

- Choose your plan on the pricing page and create an account.

- Decide on your payment method via credit card or PayPal.

- Download the file in your chosen format.

Form popularity

FAQ

Yes, you can prepare.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.