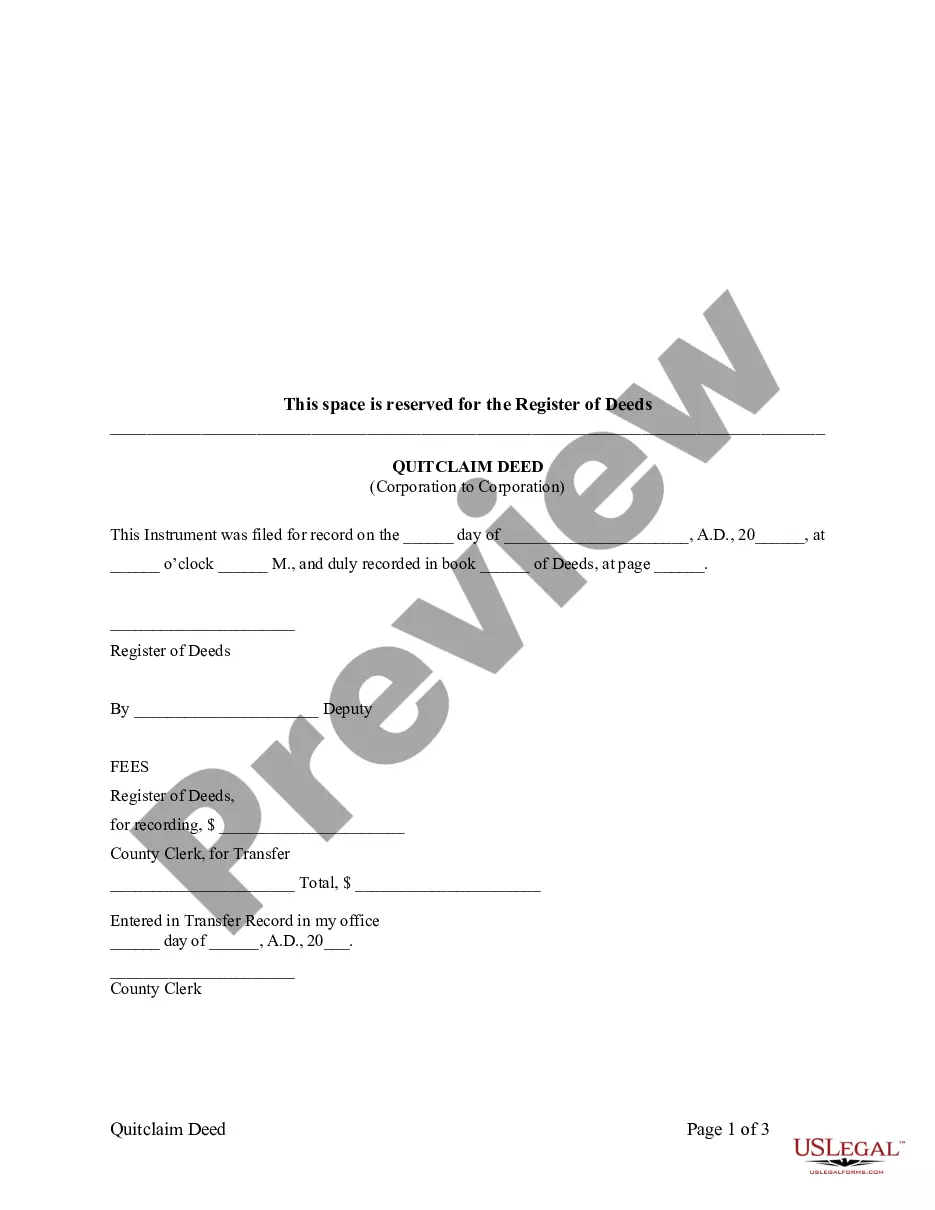

Kansas Quitclaim Deed from Corporation to Corporation

Description

How to fill out Kansas Quitclaim Deed From Corporation To Corporation?

Searching for a Kansas Quitclaim Deed from Corporation to Corporation example and completing them can be challenging.

To save a significant amount of time, expenses, and effort, utilize US Legal Forms and locate the suitable template specifically for your state with just a few clicks. Our legal professionals prepare every document, so you only need to complete them. It's incredibly straightforward.

Log in to your account and return to the form's webpage to download the document. All of your downloaded samples are stored in My documents and are always available for future use. If you haven’t registered yet, you should create an account.

Download the document in your desired file format. You can print the Kansas Quitclaim Deed from Corporation to Corporation template or complete it using any online editor. There's no need to worry about making mistakes because your form can be utilized, sent, and printed as many times as you like. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Examine our comprehensive guidelines on how to obtain your Kansas Quitclaim Deed from Corporation to Corporation sample in a few moments.

- To procure a qualified sample, check its relevance for your state.

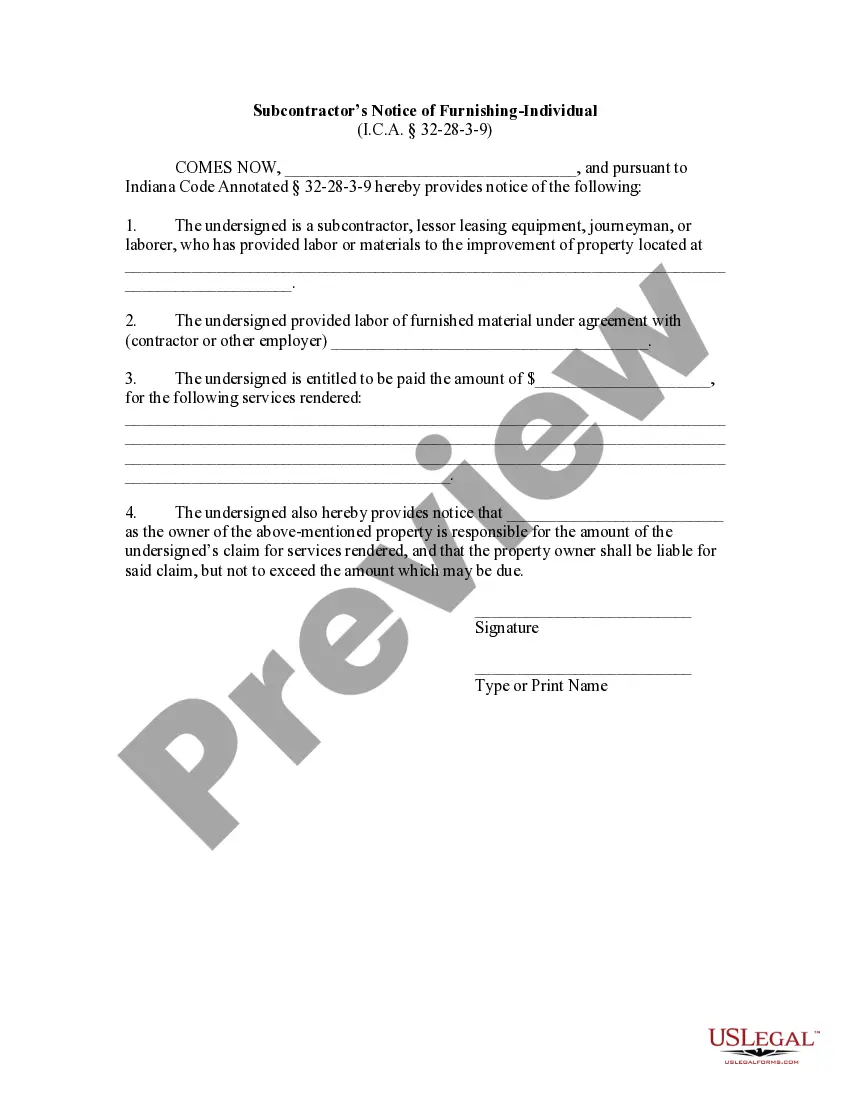

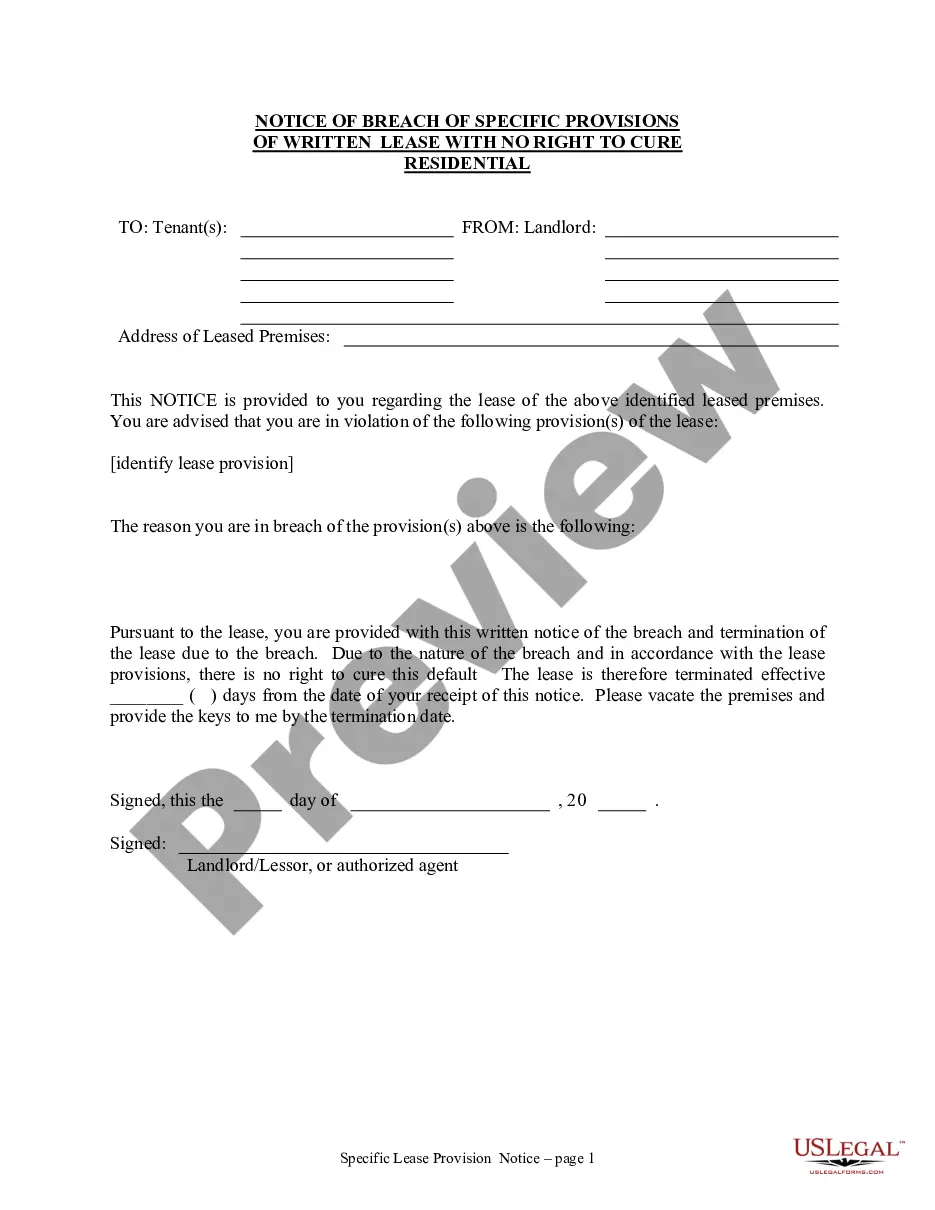

- Review the example using the Preview option (if it’s accessible).

- If there's a description, read it to grasp the essential details.

- Click Buy Now if you discovered what you're looking for.

- Select your plan on the pricing page and establish your account.

- Indicate whether you wish to pay by card or via PayPal.

Form popularity

FAQ

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

They are commonly used to add/remove someone to/from real estate title or deed (divorce, name changes, family and trust transfers). The quitclaim deed is a legal document (deed) used to transfer interest in real estate from one person or entity (grantor) to another (grantee).

Recording A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) A quitclaim deed is required to be authorized with a notary public present.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.