Illinois Judicial Sale Deed

Description

Definition and meaning

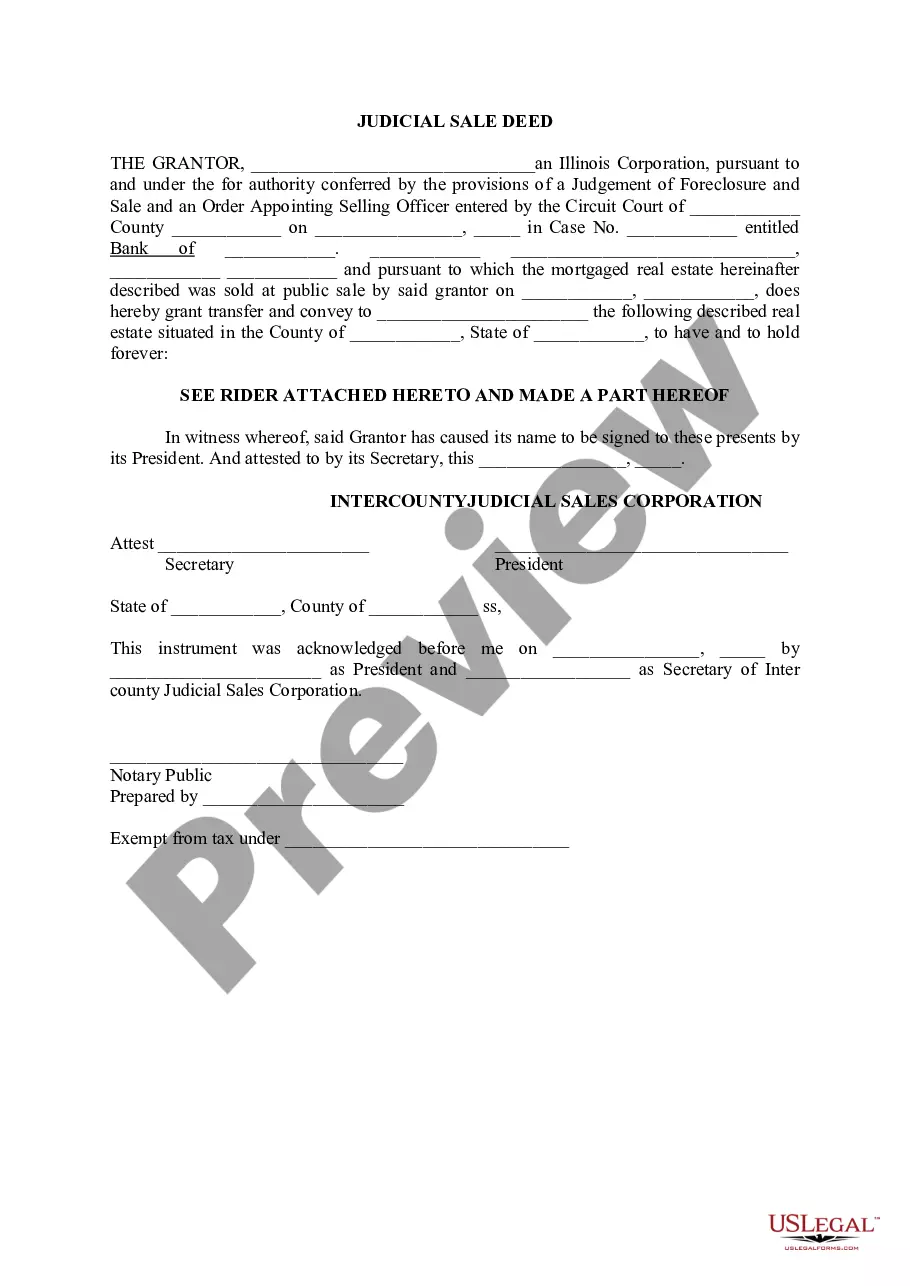

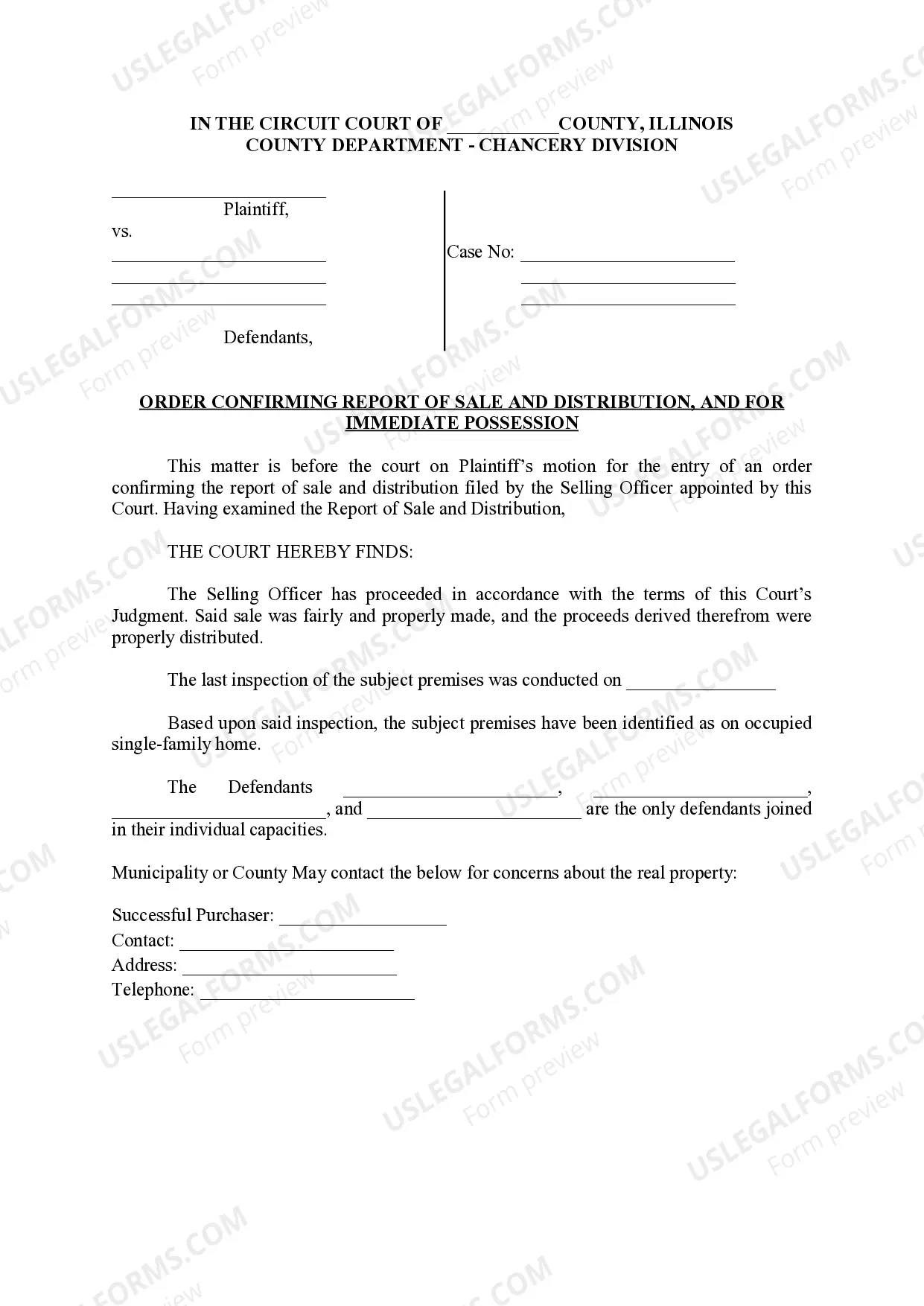

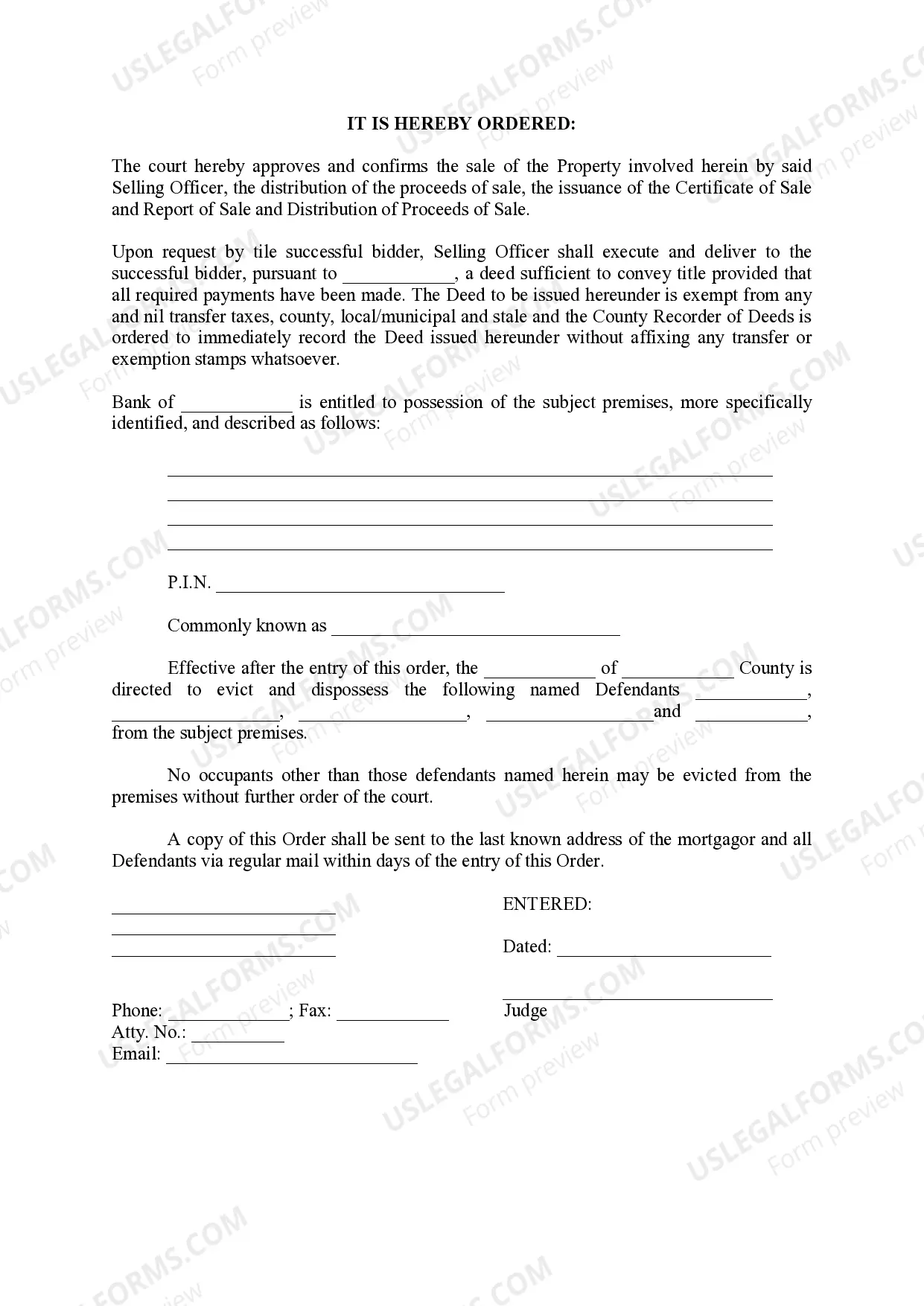

The Illinois Judicial Sale Deed is a legal document used to transfer ownership of a property sold at judicial foreclosure in Illinois. This deed is executed by the selling officer as a result of a court-ordered sale due to foreclosure proceedings. The Judicial Sale Deed conveys the title from the grantor, often a financial institution, to the purchaser, formally recognizing the transfer of property rights.

How to complete a form

To complete the Illinois Judicial Sale Deed, follow these steps:

- Begin with the name of the Grantor, which is typically the financial institution that initiated the foreclosure.

- Provide details of the court case by including the Circuit Court name, county, and case number.

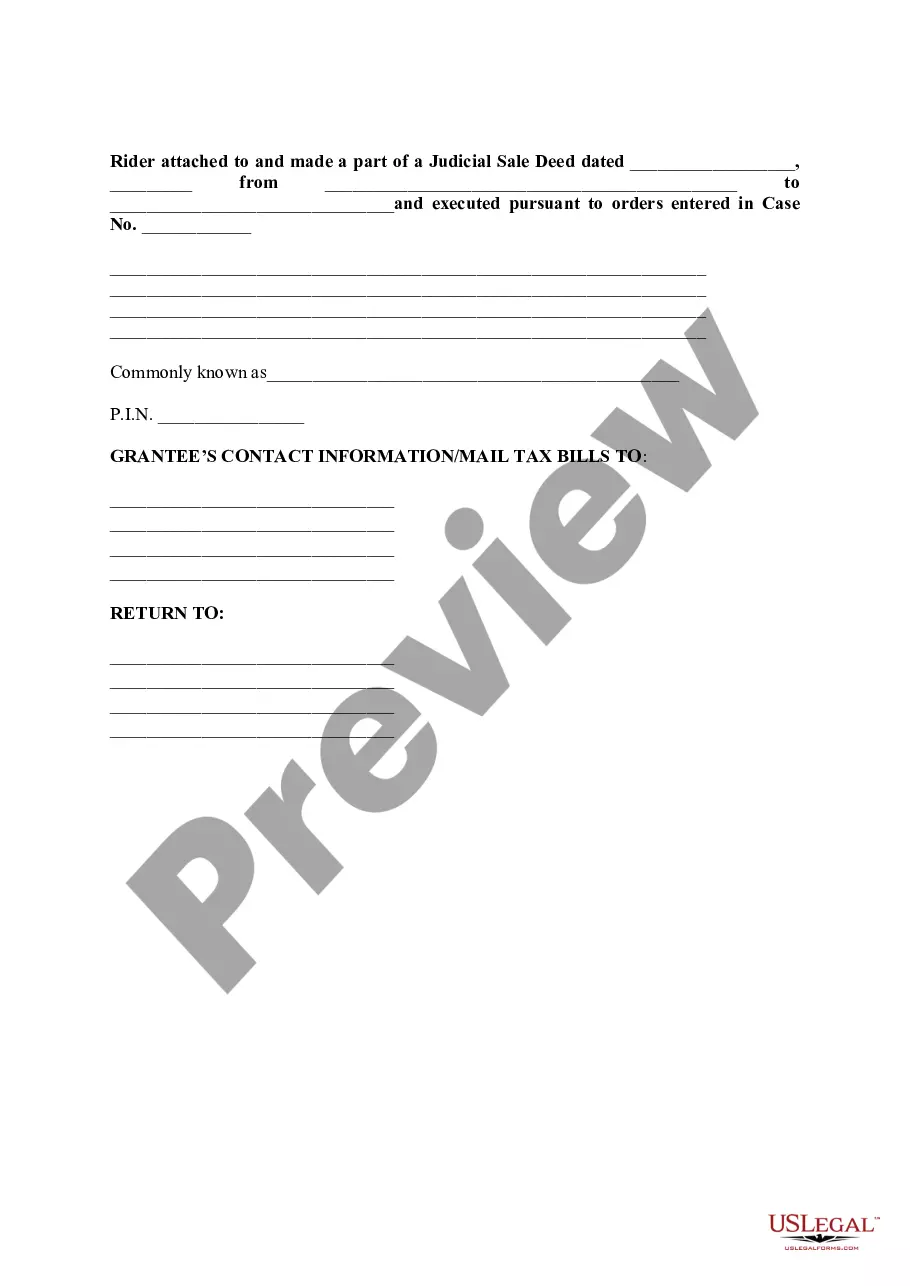

- Clearly describe the property being transferred, including the address and PIN (Property Index Number).

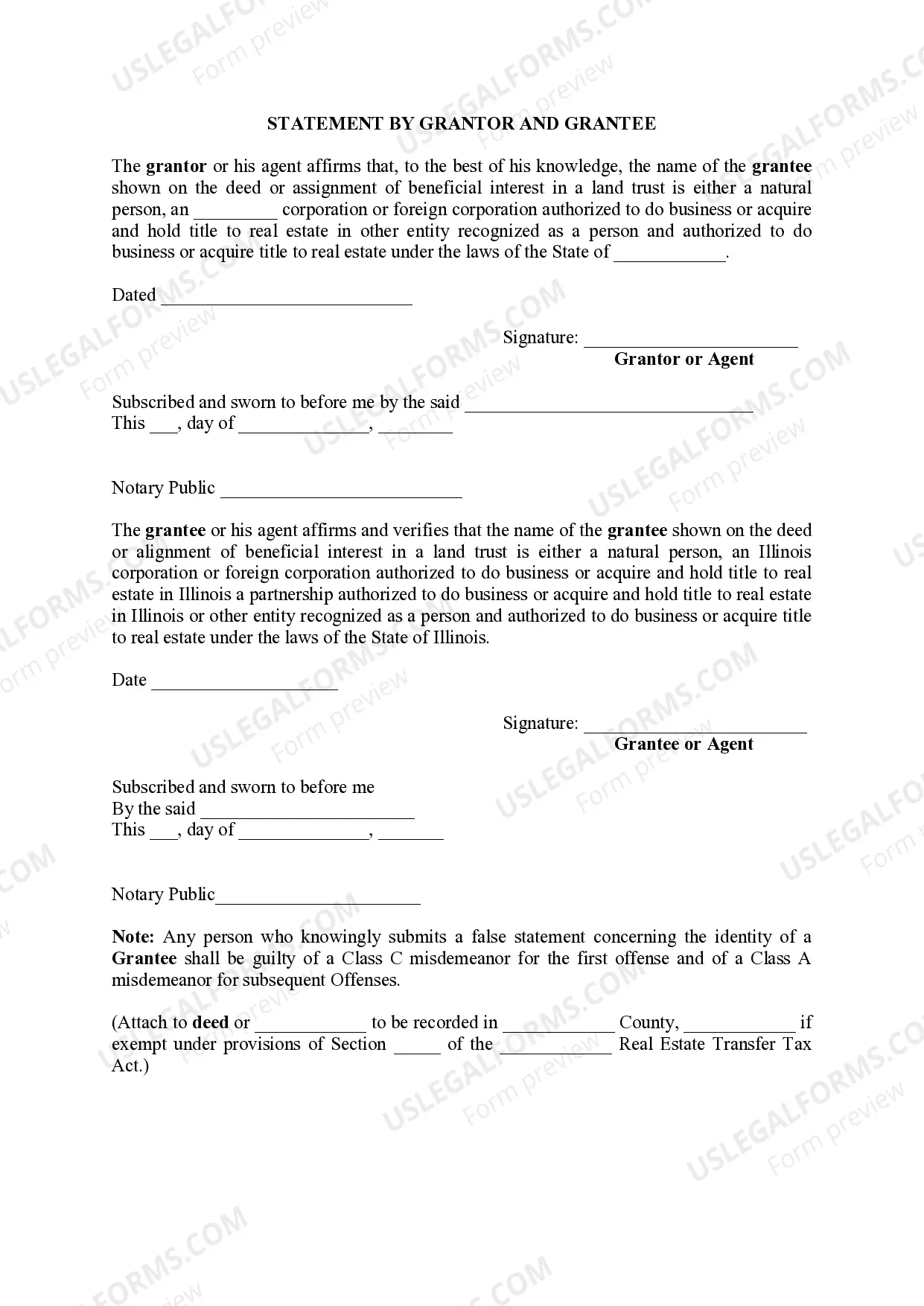

- Sign the document in the presence of a notary public, ensuring proper acknowledgment of identities.

- Attach any necessary riders or additional documents required by the court.

Who should use this form

The Illinois Judicial Sale Deed is primarily used by individuals or entities who have purchased property at a judicial sale. This form is also relevant for attorneys, real estate agents, and financial institutions involved in the foreclosure process, as it formally conveys ownership of the property to the new owner.

Key components of the form

The Illinois Judicial Sale Deed includes several critical components that are essential for its validity:

- Grantor Information: Details about the entity or individual transferring the property.

- Grantee Information: Information regarding the new owner receiving the property.

- Description of the Property: A full legal description of the property, including its address and PIN.

- Execution and Acknowledgment: Signatures of the grantor and witnesses, along with notarization.

Common mistakes to avoid when using this form

When completing the Illinois Judicial Sale Deed, be cautious of these common pitfalls:

- Leaving the property description incomplete or incorrect can lead to legal disputes or challenges in ownership.

- Not obtaining proper notarization may invalidate the deed.

- Failing to include all necessary attachments, such as riders or court orders, can result in rejection by the recorder's office.

What to expect during notarization or witnessing

During the notarization process for the Illinois Judicial Sale Deed, you can expect the following:

- The notary will request identification to verify the identity of the grantor and any witnesses.

- All parties involved must sign the document in the presence of the notary.

- The notary will then affix their seal and signature, indicating that the document has been properly executed.

How to fill out Illinois Judicial Sale Deed?

Utilize US Legal Forms to acquire a printable Illinois Judicial Sale Deed.

Our court-acceptable templates are crafted and frequently updated by qualified attorneys.

Ours is the most extensive Forms library available online and offers economical and precise samples for clients, legal professionals, and small to medium-sized businesses.

Select Buy Now if it's the document you require. Create your account and make a payment through PayPal or by card|credit card. Download the form onto your device and feel free to reuse it multiple times. Use the Search engine if you need to find another document template. US Legal Forms provides a vast selection of legal and tax samples and packages for both business and personal requirements, including the Illinois Judicial Sale Deed. Over three million users have effectively utilized our platform. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- The documents are organized into state-specific categories, with some available for preview prior to download.

- To access templates, users are required to have a subscription and to Log In to their account.

- Click Download next to any form you desire and locate it in My documents.

- For individuals without a subscription, follow these suggestions to easily locate and download the Illinois Judicial Sale Deed.

- Ensure you have the appropriate form pertaining to the state where it is required.

- Examine the form by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

The transfer of title to and possession of a debtor's property to another in exchange for a price determined in proceedings that are conducted under a judgment or an order of court by an officer duly appointed and commissioned to do so. A judicial sale is a method plaintiffs use to enforce a judgment.

As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, unless the borrower has a defense that justifies the delinquent payments.

Once you are delinquent by 120 days or more, your lender can initiate foreclosure proceedings in court. Illinois is a state in which all foreclosures are judicial foreclosures, which means the court system has jurisdiction over the matter.

In a judicial sale, a property for which a lender provided mortgage funds is in foreclosure and wants it sold to recover their investment. They do not technically own the home but they can still force the sale, which makes such a sale different from a traditional seller client relationship.

Foreclosures are usually nonjudicial in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia (sometimes), Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico (sometimes), North Carolina,

The Foreclosure Process In IllinoisIllinois is a judicial foreclosure state, which means that a lawsuit has to be filed and served upon the homeowner, anyone with a recorded lien on the property, and all possible tenants of the property.

Illinois is a judicial foreclosure state, which means that a lawsuit has to be filed and served upon the homeowner, anyone with a recorded lien on the property, and all possible tenants of the property.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

If tax sale properties are not sold at either of these two sales, the property then goes on the repository list and can be sold by private bid. The upset sale is held every year in the fall.If a property is not sold in this sale, it is sold in the judicial tax sale in the spring.