Power of Attorney and designation of representative for UI filing and correspondence

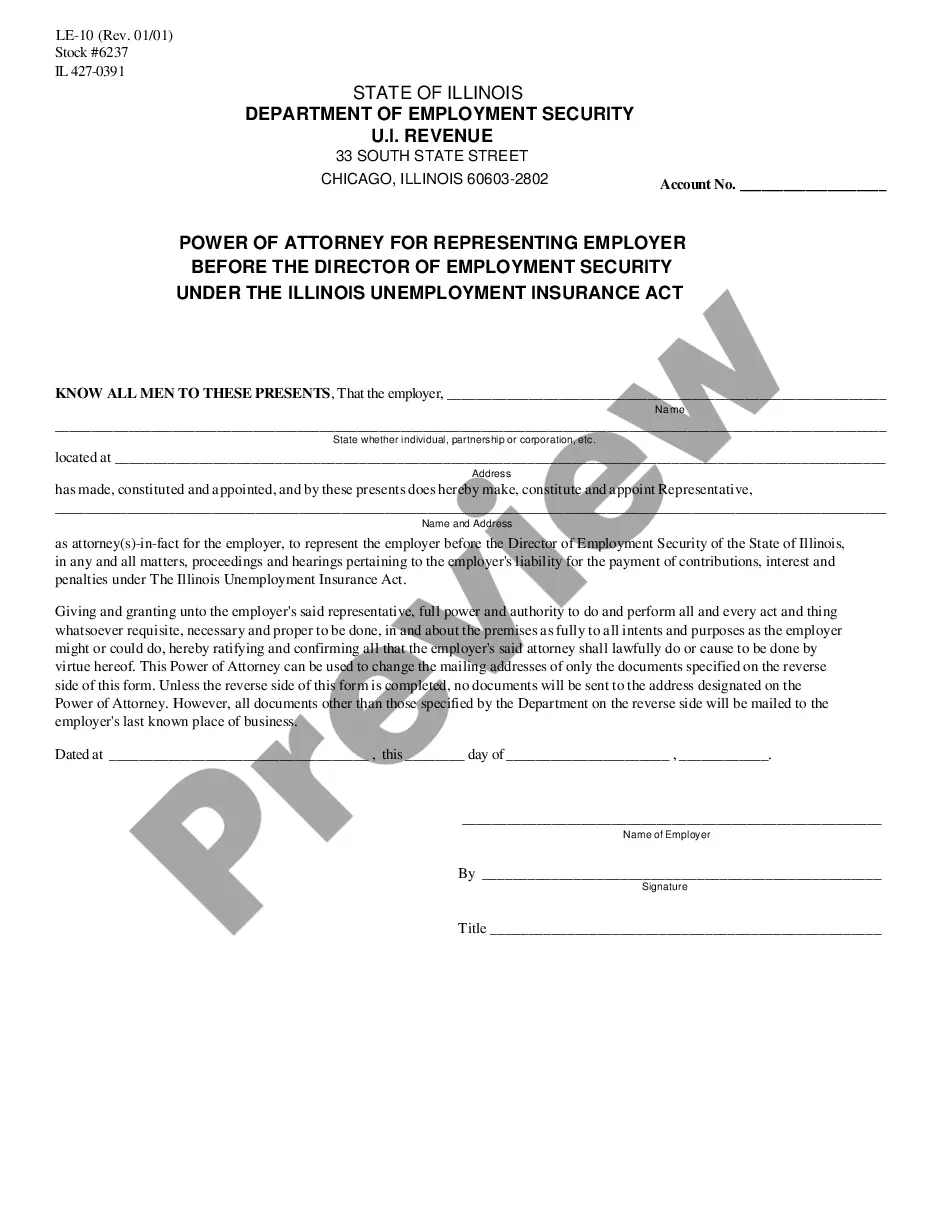

Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois

Description

Definition and meaning

The Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois Unemployment Insurance Act is a legal document that empowers a designated person, known as the attorney-in-fact, to act on behalf of the employer. This document is specifically tailored for cases involving interactions with the Illinois Department of Employment Security regarding contribution payments, interest, and penalties under the Unemployment Insurance Act.

How to complete a form

To successfully complete the Power of Attorney form, follow these steps:

- Fill in the employer's name and explain the type of business entity (individual, partnership, corporation, etc.).

- Provide the business address of the employer.

- Designate a representative by entering their name and address.

- Sign the form to validate the appointment of the representative.

- Date the form accurately to establish its effectiveness.

- Submit the completed form to the Department of Employment Security as required.

Who should use this form

This form is relevant for employers who need to delegate authority to another individual, such as an attorney or a trusted employee, to represent them in matters related to unemployment insurance. This includes anyone who may face legal proceedings or hearings concerning their duties and liabilities under the Unemployment Insurance Act.

Key components of the form

The essential elements of the Power of Attorney include:

- Employer's Information: Name and address of the employer.

- Representative's Details: Name and address of the designated representative.

- Powers Granted: Specific authority granted to the representative regarding employment security matters.

- Signature and Title: Signature of the employer and their title to affirm the form's validity.

- Date: The date on which the form is executed.

Legal use and context

This Power of Attorney is legally binding and acknowledges the representative's authority to act on behalf of the employer for issues related to the Illinois Department of Employment Security. Understanding its legal context helps employers to navigate potential liabilities and ensures compliance with the Unemployment Insurance Act.

Common mistakes to avoid when using this form

To ensure the form's validity and avoid delays, employers should be mindful of the following common mistakes:

- Failing to provide accurate information about the employer or representative.

- Not signing or dating the form properly.

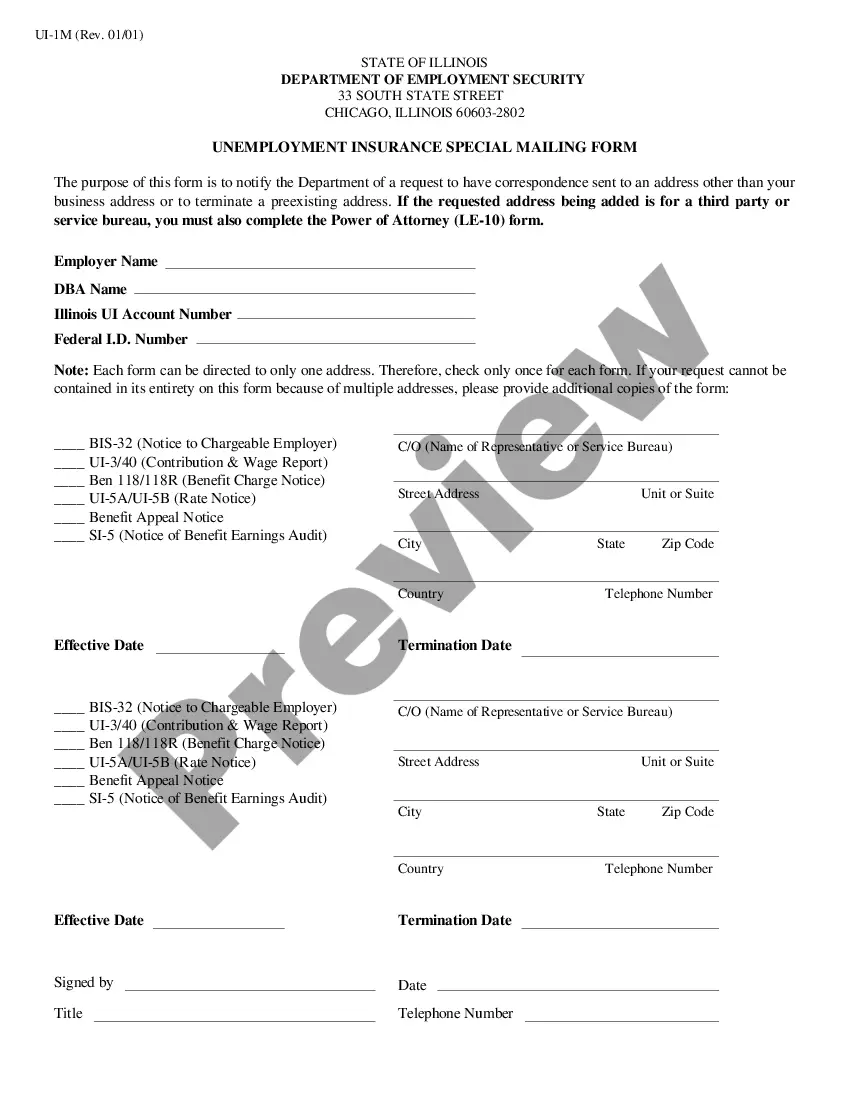

- Leaving out the necessary information on the back of the form related to mailing addresses.

- Providing vague descriptions of the representative's authority.

What documents you may need alongside this one

When submitting the Power of Attorney form, it is advisable to have the following documents ready:

- Any necessary identification for the employer and the representative.

- Copies of prior correspondence with the Department of Employment Security.

- If applicable, other legal documents related to the business entity.

How to fill out Power Of Attorney For Representing Employer Before The Director Of Employment Security Under The Illinois?

Looking for a Power of Attorney to Represent the Employer Before the Director of Employment Security Under the Illinois templates and completing them may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate sample specifically for your state in merely a few clicks. Our attorneys prepare each and every document, so you only need to complete them.

It's truly that straightforward.

You can now print the Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois form or fill it out using any online editor. Don’t be concerned about making mistakes, as your sample can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the sample.

- All of your stored examples can be found in My documents and are available at all times for future use.

- If you haven’t registered yet, you must sign up.

- Review our comprehensive instructions on how to obtain your Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois sample in just a few minutes.

- To acquire a legitimate form, verify its validity for your state.

- Examine the form using the Preview feature (if available).

- If there is an explanation, read it to comprehend the details.

- Click Buy Now if you found what you're looking for.

- Choose your plan on the pricing page and create your account.

- Decide how you would like to pay using a card or via PayPal.

- Download the form in your desired file format.

Form popularity

FAQ

Unemployment Benefits for Railroad Employees. Instructions for Completing Claim for unemployment Benefits (Form (UI-3)

The minimum contribution rate for 2019 is 0.475% (0% plus the 0.475% Fund Building Rate). The maximum contribution rate for 2019 is 6.875% (6.400% plus the 0.475% Fund Building Rate).

Illinois Unemployment Claims customer service phone number is 1-800-244-5631. Live customer service representatives from Illinois Unemployment Claims are available from am to 5pm Monday-Friday, Saturday-Sunday closed. For individuals who have been scheduled for an Appeal hearing you need to dial 1-800-244-5631.

The percentage that an employer pays is dependent on the number employees who claim and receive unemployment benefits from the State of Illinois as a result of being terminated from your business. As the amount of the benefits increase the employer's variable rate will also increase..

The Illinois unemployment-taxable wage base is to be $12,960 for 2021, up from $12,740 for 2020, the state department of Employment Security said Nov. 30.

If you have questions about Unemployment Insurance, please call our Customer Service Center at 800-244-5631. Individuals with a hearing impairment who would like to speak with someone in the Claimant Services Center should dial 711 for the Illinois Relay System.

Step 1: Collect your 1040 tax forms for the 2019 tax year. NOTE: If you do not upload your tax form on the day that you file, then you are required do so within 21 days of the date of filing. Step 2: File a PUA Claim. Step 3: Review your claim before submitting it.

Filing Reports - The Employer's Contribution and Wage Report, IDES Form UI-3/40, must be filed quarterly by each employer subject to the Illinois Unemployment Insurance Act.Change in Status - Check this box to indicate that you no longer have workers in Illinois and want your account terminated.

Within 7-10 days of filing your claim, you will receive a blank debit card and a UI Finding in the mail. The UI Finding will tell you whether you are monetarily eligible for benefits, meaning you have earned sufficient wages in your base period.