Illinois Quitclaim Deed from Individual to Two Individuals in Joint Tenancy

Definition and meaning

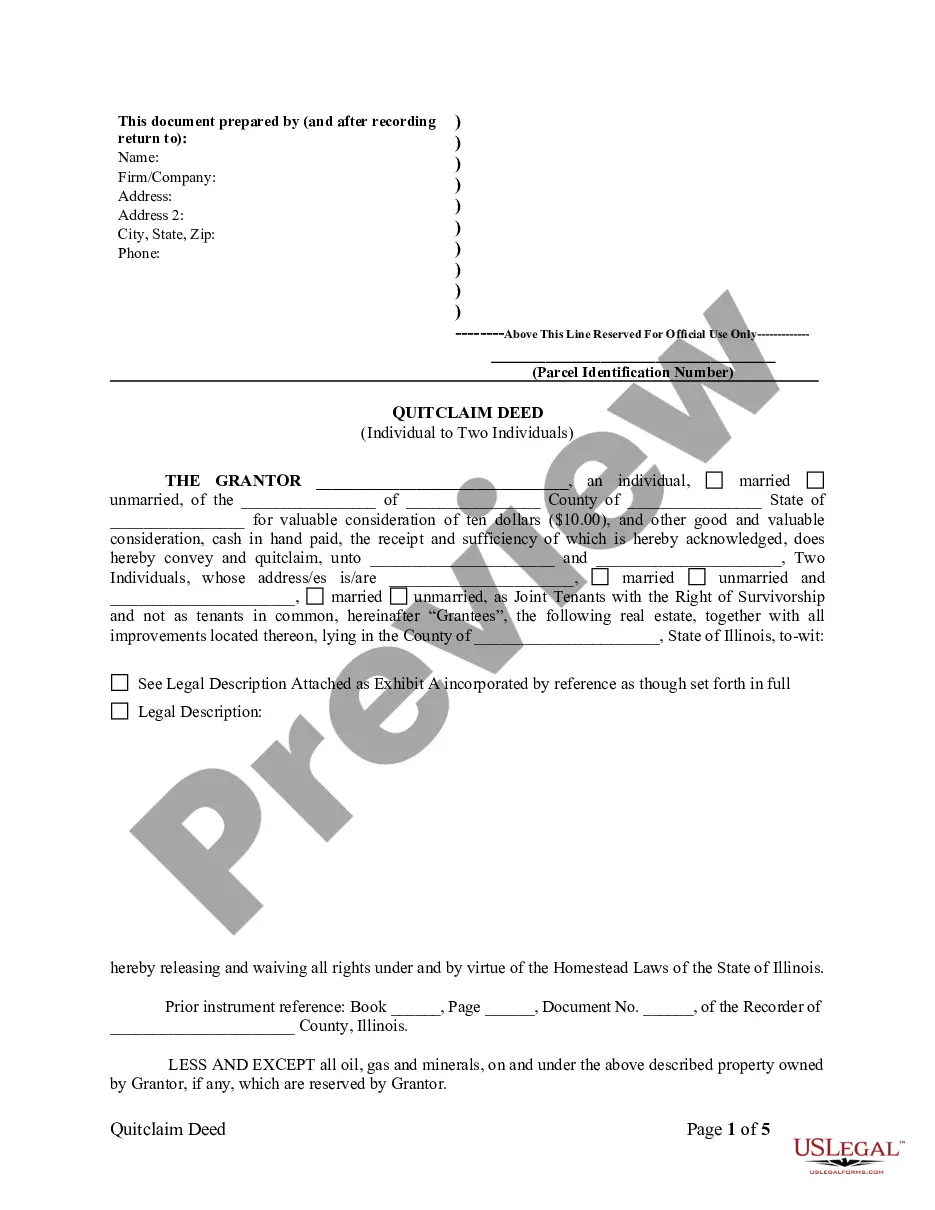

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one individual (the grantor) to another (the grantee). In the case of an Illinois Quitclaim Deed from an Individual to Two Individuals in Joint Tenancy, this document allows the grantor to convey their interest in a property to two grantees who will hold the property as joint tenants. This means that both individuals have equal ownership and rights to the property, along with the right of survivorship, meaning that if one owner passes away, their interest automatically transfers to the surviving owner.

How to complete a form

Completing the Illinois Quitclaim Deed requires careful attention to detail to ensure the transfer is valid. Here are the steps to follow:

- Identify the grantor: Provide the name of the individual transferring the property.

- Identify the grantees: List the names of the two individuals receiving the property.

- Legal description: Include a detailed legal description of the property. This can usually be found in previous deeds or property tax documents.

- Consideration: State the consideration amount, which is typically ten dollars, although a nominal amount is commonly used.

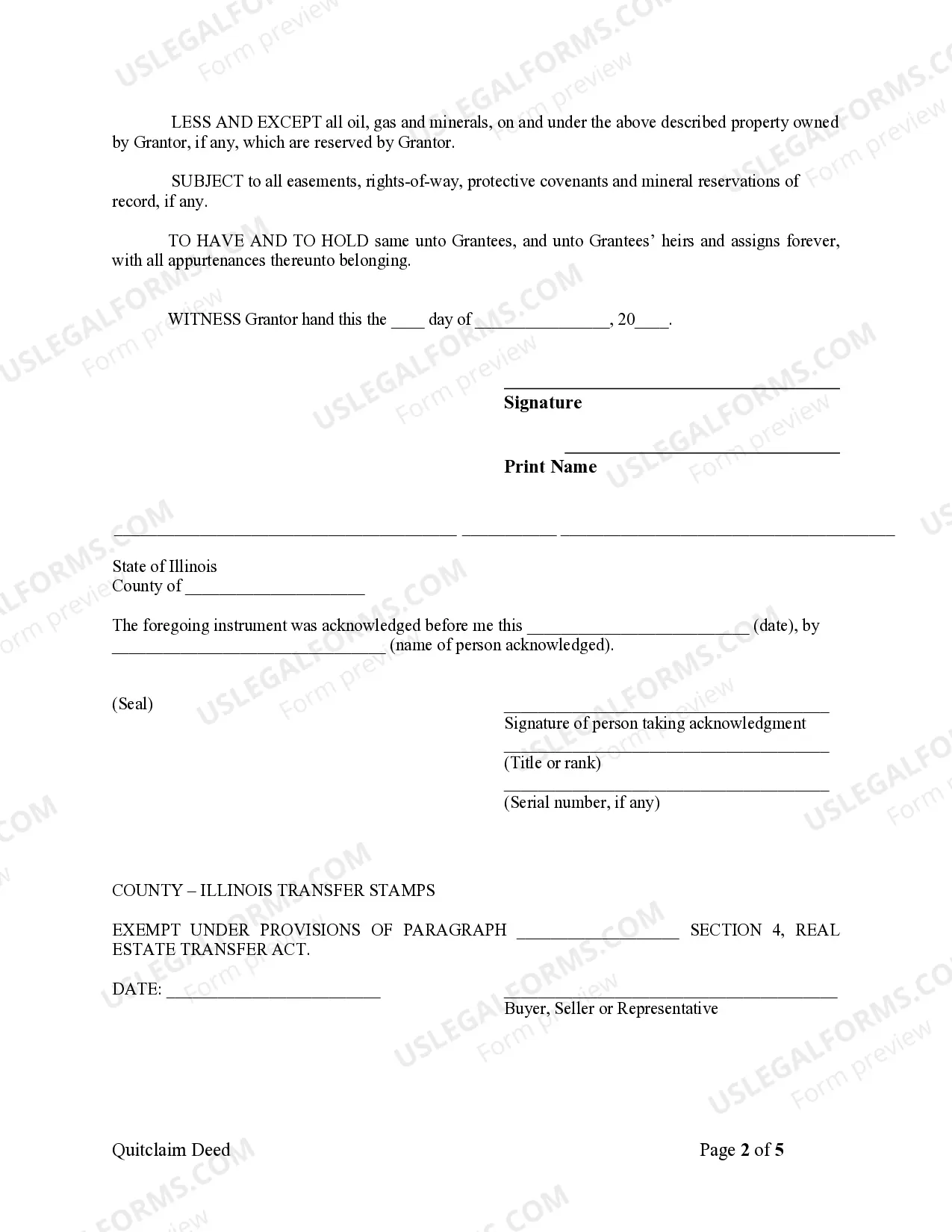

- Signatures: The grantor must sign the deed in the presence of a notary public.

Who should use this form

This form is ideal for individuals looking to transfer real estate ownership to two other individuals who wish to hold the property as joint tenants. It is particularly useful in situations such as:

- Families wanting to pass property to heirs.

- Partners wishing to acquire property together.

- Individuals simplifying estate planning by consolidating property ownership.

Common mistakes to avoid when using this form

Accuracy is crucial when filling out a Quitclaim Deed. Below are common pitfalls to avoid:

- Incorrect property description: Ensure the legal description of the property is accurate and complete.

- Missing signatures: The grantor's signature is essential, and it must be notarized.

- Failure to include all grantees: Both individuals should be listed clearly to avoid future ownership disputes.

What to expect during notarization or witnessing

Notarization is an important step in the Quitclaim Deed process. Here’s what to anticipate:

- The grantor must present valid identification to the notary public.

- The notary will verify the identity and witness the grantor’s signature on the deed.

- After notarization, the notary will affix their seal and signature, which makes the document legally binding.

State-specific requirements

In Illinois, there are specific requirements for executing a Quitclaim Deed:

- The deed must be in writing and signed by the grantor.

- It must include the legal description of the property and the consideration amount.

- Proper notarization is required, and certain counties may have additional recording requirements.

Form popularity

FAQ

For an Illinois Quitclaim Deed from Individual to Two Individuals in Joint Tenancy, a real estate attorney is the best choice. These lawyers specialize in property law and can guide you through the deed preparation and filing process. They can also address any concerns regarding property rights and obligations. Hiring a knowledgeable attorney can mitigate potential legal issues down the road.

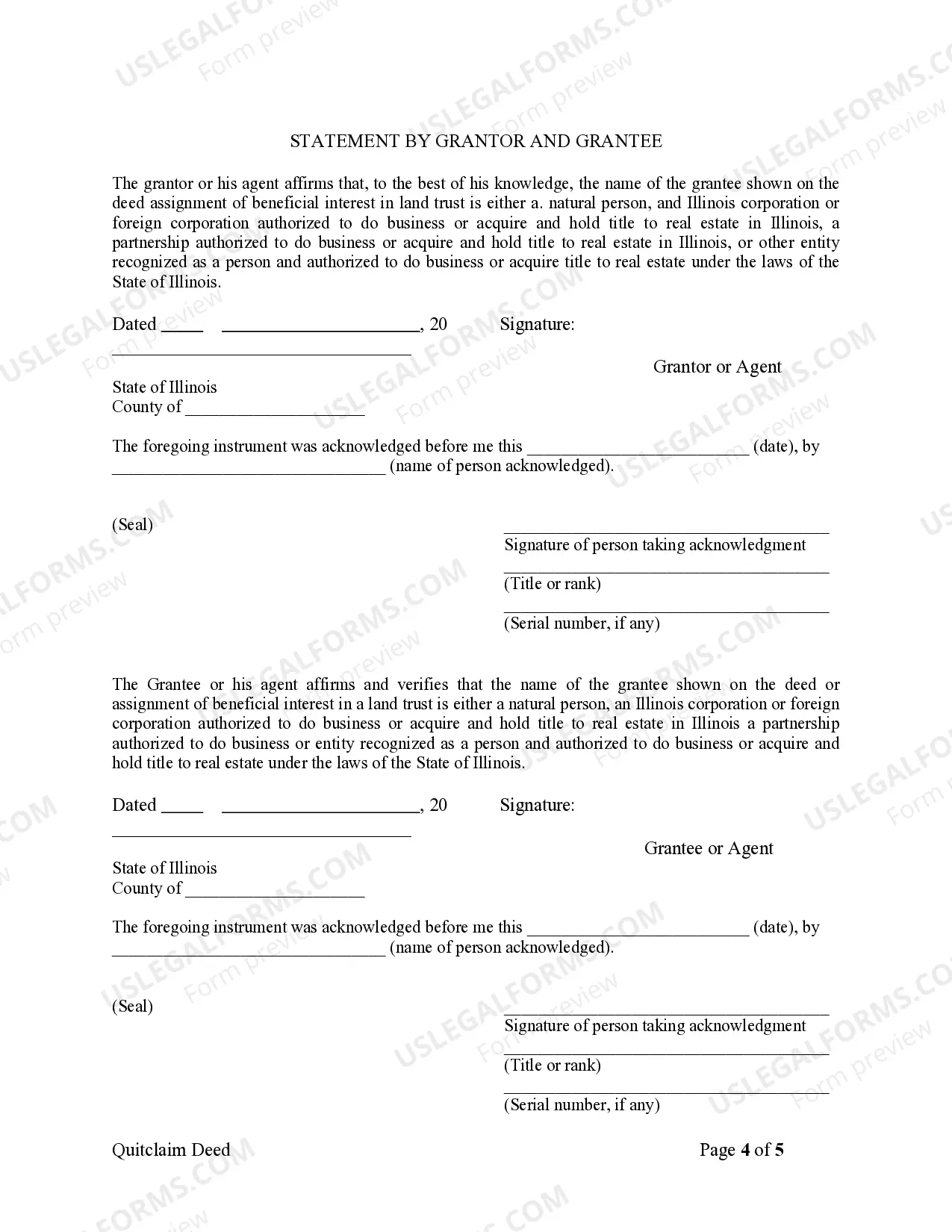

Yes, both parties need to be present for the execution of an Illinois Quitclaim Deed from Individual to Two Individuals in Joint Tenancy. This deed requires the signatures of both the grantor and the grantee to be valid. Their presence helps to confirm the intentions behind the transfer of property. If one party cannot be present, a power of attorney can be utilized.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.A quitclaim deed requires trust on the part of the person receiving the deed, because the person transferring it, also known as the grantor, isn't guaranteeing they actually own the property.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.