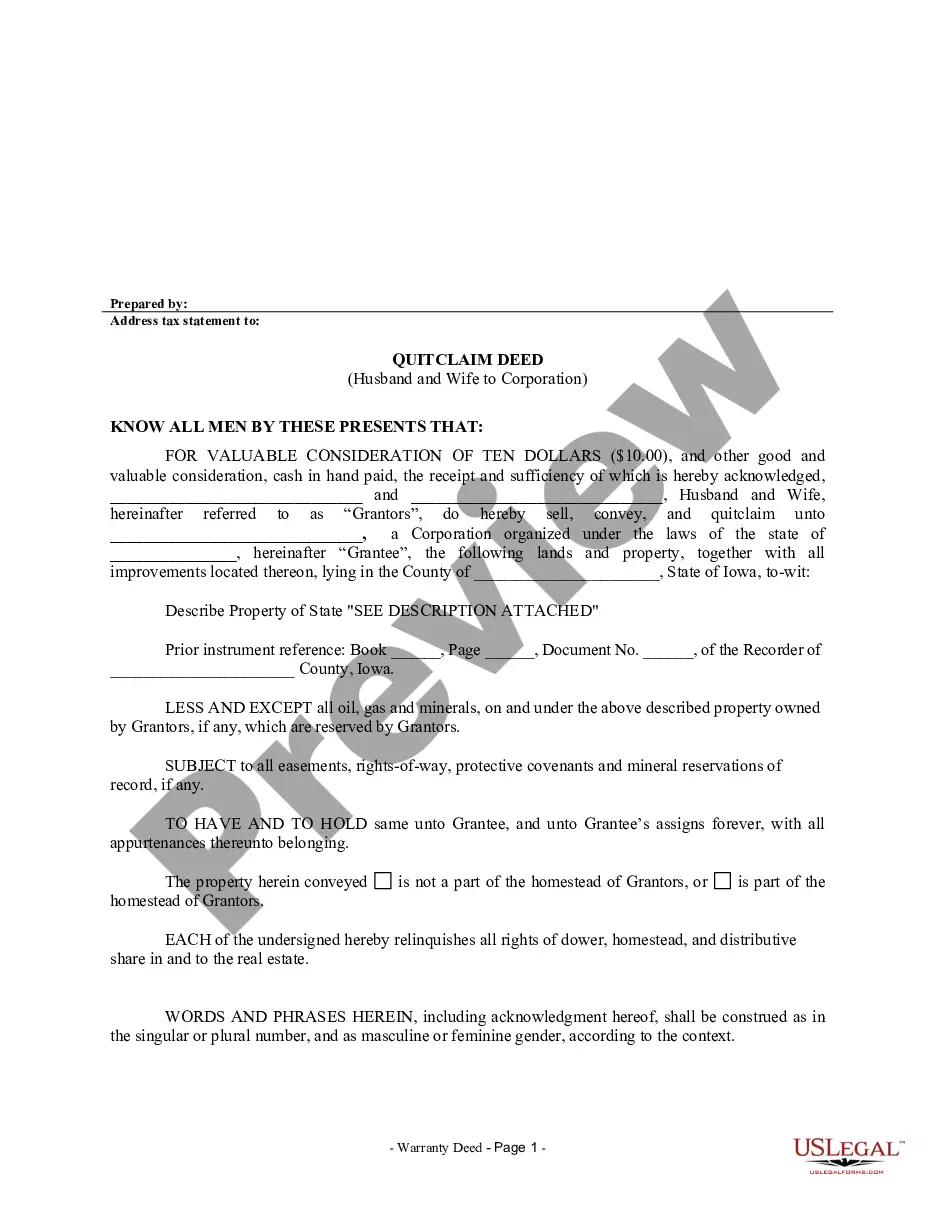

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Iowa Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Iowa Quitclaim Deed From Husband And Wife To Corporation?

Access the largest collection of legal documents.

US Legal Forms offers a platform where you can locate any state-specific form quickly, including samples of Iowa Quitclaim Deed from Husband and Wife to Corporation.

No need to spend hours searching for a court-accepted template. Our certified experts guarantee that you receive current samples consistently.

After choosing a pricing plan, create your account. Pay using a card or PayPal. Download the document to your PC by clicking the Download button. That's it! You need to fill out the Iowa Quitclaim Deed from Husband and Wife to Corporation template and check out. To verify that everything is accurate, consult your local legal advisor for assistance. Sign up and easily explore around 85,000 valuable templates.

- To utilize the forms library, select a subscription and create an account.

- If you have already registered, simply Log In and then click Download.

- The Iowa Quitclaim Deed from Husband and Wife to Corporation sample will be saved automatically in the My documents section (a section for every document you save on US Legal Forms).

- To create a new account, follow the brief suggestions provided below.

- If you plan to use a state-specific document, ensure you select the correct state.

- If possible, read the description to understand all the details about the form.

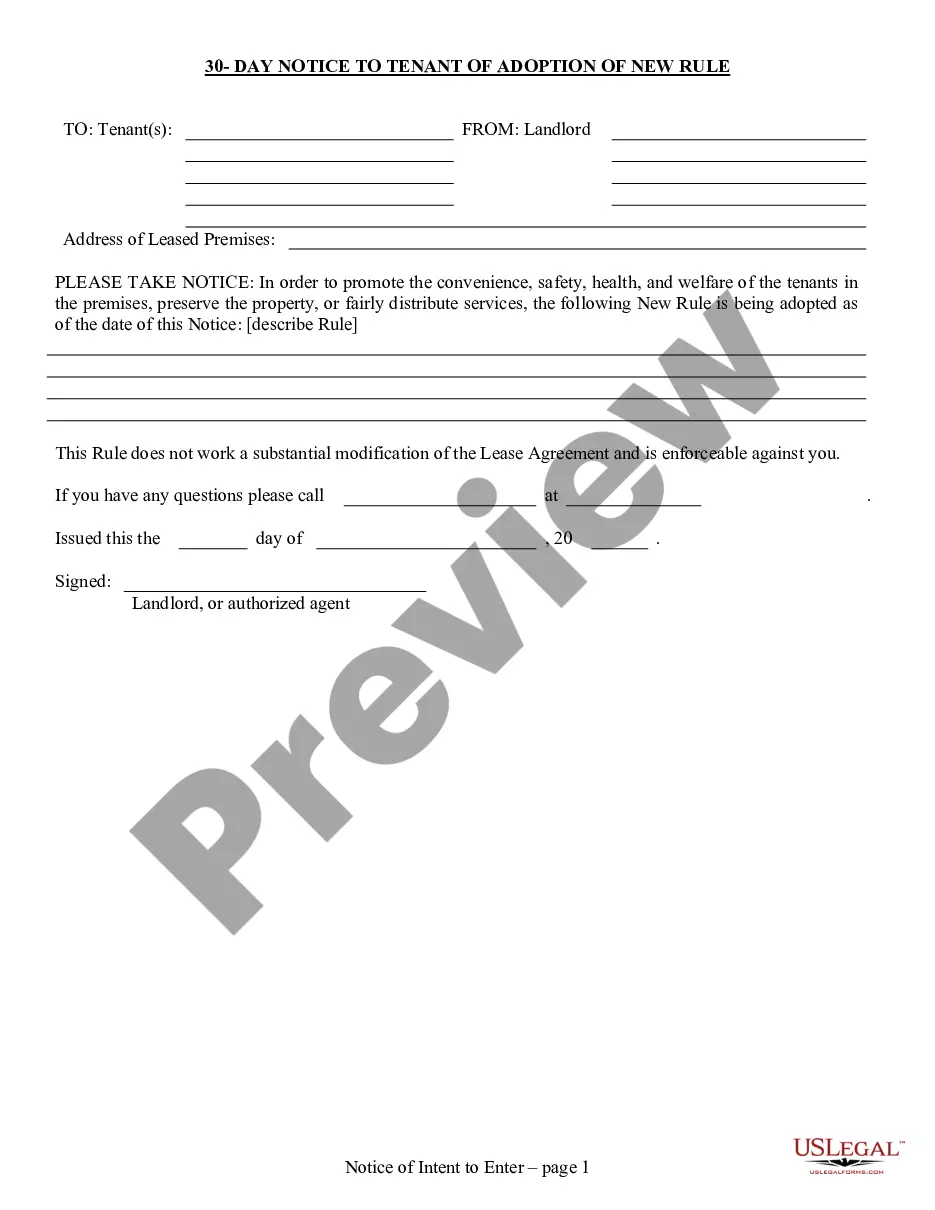

- Make use of the Preview feature if it's available to examine the document's particulars.

- If everything appears correct, click on the Buy Now button.

Form popularity

FAQ

Quitclaim deeds are most commonly used to transfer property between family members or in divorce settlements. However, they also facilitate the process when transferring property from a husband and wife to a corporation, as seen with the Iowa quitclaim deed from Husband and Wife to Corporation. This method allows for straightforward property transfer without lengthy legal proceedings. For those considering such transactions, US Legal Forms provides the necessary templates and guidance.

The primary disadvantage of a quitclaim deed is the lack of warranty. This means that there is no guarantee that the person transferring the property actually holds clear title. When utilizing an Iowa quitclaim deed from Husband and Wife to Corporation, potential buyers should be wary of undisclosed issues. It is always wise to engage legal professionals or reliable services like US Legal Forms for clarity in your transactions.

A quitclaim deed does not override a will. Instead, it functions to transfer property ownership directly without regard to the terms of a will. If a husband and wife use an Iowa quitclaim deed from Husband and Wife to Corporation, this deed will grant ownership to the corporation. Therefore, it is essential to understand how these documents interact with existing estate plans.

The best way to add your wife to your deed is to create and file a quitclaim deed. This process includes filling out the necessary forms and recording them with the county. An Iowa Quitclaim Deed from Husband and Wife to Corporation allows for clear and simple transfer of ownership, making it an effective solution.

Yes, a title company can facilitate a quitclaim deed. They can help prepare the Iowa Quitclaim Deed from Husband and Wife to Corporation and ensure all requirements are met. Using a title company provides an added layer of security and professionalism in managing property transfers.

In Iowa, a quitclaim deed must be signed, notarized, and filed with the county recorder's office. It must include a clear legal description of the property and the current owners' names. Following these rules is crucial for executing an Iowa Quitclaim Deed from Husband and Wife to Corporation correctly.

No, you cannot legally add someone to a deed without their knowledge or consent. Transparency is essential, especially in an Iowa Quitclaim Deed from Husband and Wife to Corporation. Both parties involved must agree to the changes in ownership to ensure the deed's validity.

To fill out a quitclaim deed to add a spouse, start by obtaining the correct form for Iowa. You need to provide information such as the names of the current owners, the spouse’s name, and the property's legal description. Be sure to specify that this is an Iowa Quitclaim Deed from Husband and Wife to Corporation for clear documentation.

Yes, adding a spouse to a deed can be considered a gift, depending on the situation. When you transfer a property interest without expecting payment, it may qualify as a gift for tax purposes. It’s wise to consult a tax advisor to understand the implications of an Iowa Quitclaim Deed from Husband and Wife to Corporation.

A quitclaim deed primarily benefits the individual transferring ownership. In an Iowa Quitclaim Deed from Husband and Wife to Corporation, both spouses can simplify property transfer or clarify ownership interests. This deed is often quick and easy, providing immediate clarity about property rights.