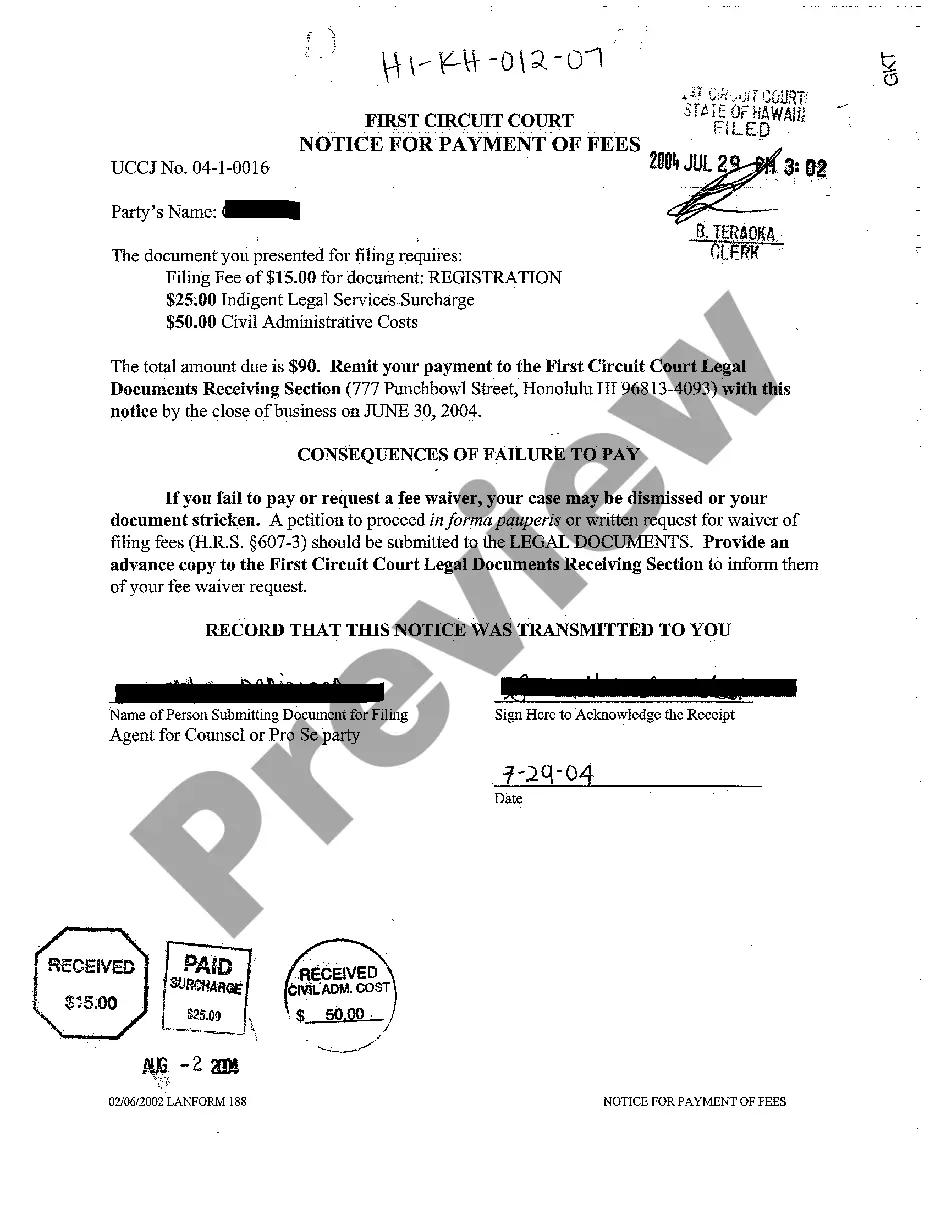

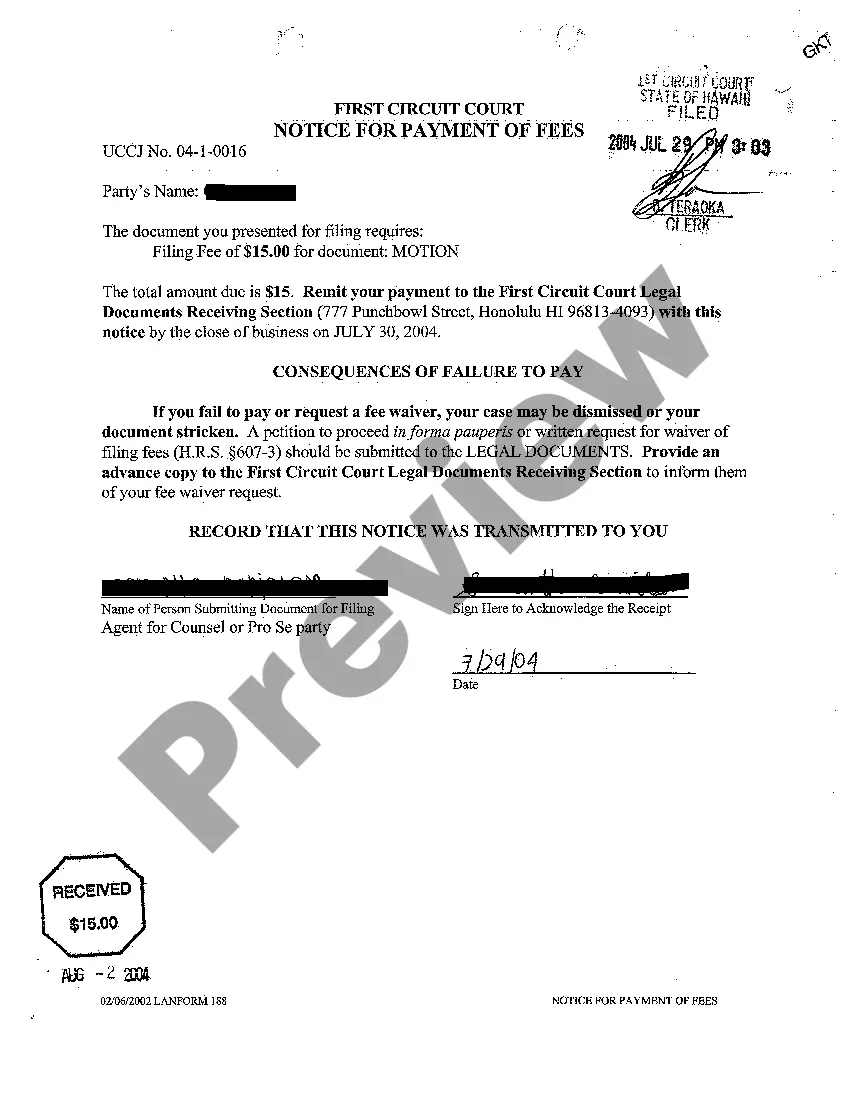

Hawaii Notice for Payment of Fees

Description

How to fill out Hawaii Notice For Payment Of Fees?

Among countless paid and free examples that you find on the web, you can't be certain about their reliability. For example, who made them or if they’re skilled enough to deal with what you require those to. Keep calm and utilize US Legal Forms! Discover Hawaii Notice for Payment of Fees templates developed by skilled lawyers and avoid the expensive and time-consuming procedure of looking for an lawyer or attorney and then paying them to write a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access your previously saved examples in the My Forms menu.

If you are making use of our platform the first time, follow the tips listed below to get your Hawaii Notice for Payment of Fees quick:

- Ensure that the document you find is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

As soon as you have signed up and bought your subscription, you can utilize your Hawaii Notice for Payment of Fees as often as you need or for as long as it remains active in your state. Change it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Establishing a payment plan in Hawaii typically involves contacting the relevant agency listed on your Hawaii Notice for Payment of Fees. They can provide specific information on the payment plan options available to you. You will often need to give details about your financial situation, so be prepared to provide documentation. For added support, visit uslegalforms, where you can find forms and guidance to streamline your application process.

To obtain penalty abatement in Hawaii, you should start by reviewing your Hawaii Notice for Payment of Fees. This document outlines the fees due along with any penalties associated. You can request an abatement by submitting a formal request to the appropriate government agency, explaining your situation and providing necessary documentation. Additionally, consider consulting uslegalforms for resources and templates that can assist you in crafting your request effectively.

In Hawaii, the limit for regular claims court, also known as district court, is $25,000. If your claim exceeds this amount, you must pursue it in circuit court instead. When filing, be aware of the importance of timely notification, including any Hawaii Notice for Payment of Fees if applicable. This ensures that all parties are informed properly and can aid in the smooth handling of your case.

To close an LLC in Hawaii, you must first ensure all debts and obligations are settled. Next, you will need to file a Hawaii Notice for Payment of Fees, which informs the state of your intent to dissolve the LLC. This notice should be sent with the appropriate paperwork to the Department of Commerce and Consumer Affairs. Finally, make sure to cancel any necessary licenses and permits associated with your LLC.

The primary difference between G45 and G49 forms in Hawaii lies in their purposes and usage. The G45 is generally used for filing general excise tax, while the G49 is specifically for reporting tax credits. Understanding the distinctions and details can help you adhere to the requirements outlined in the Hawaii Notice for Payment of Fees. For accurate guidance, consider consulting a tax professional or utilizing the resources offered by uslegalforms.

To mail Hawaii Form G-49, you can send it to the appropriate address indicated on the form. Make sure to verify that you are using the latest address provided by the Hawaii Department of Taxation. Adhering to the details in the Hawaii Notice for Payment of Fees will help ensure your submission is processed without issues. Remember to keep a copy for your records.

An EFT penalty in Hawaii arises when taxpayers fail to make required payments electronically. Missing a deadline or not using the electronic payment method can lead to additional fees. Understanding the Hawaii Notice for Payment of Fees can help you avoid these penalties by ensuring compliance with payment methods. Always check your payment status to stay on track.

The underpayment penalty in Hawaii is incurred when a taxpayer pays less than the required amount of taxes owed. If insufficient payments are made throughout the year, the state will assess a penalty. To avoid this, be aware of the Hawaii Notice for Payment of Fees, as it provides important information regarding your payment obligations. Staying updated can help prevent unexpected penalties.

If you need to mail Form N-20 in Hawaii, address it to the Hawaii Department of Taxation. Make sure you send the completed form to the correct address specified on the form itself. It's important to follow the instructions outlined in the Hawaii Notice for Payment of Fees to ensure your submission is processed promptly. Double-check your mailing address to avoid delays.