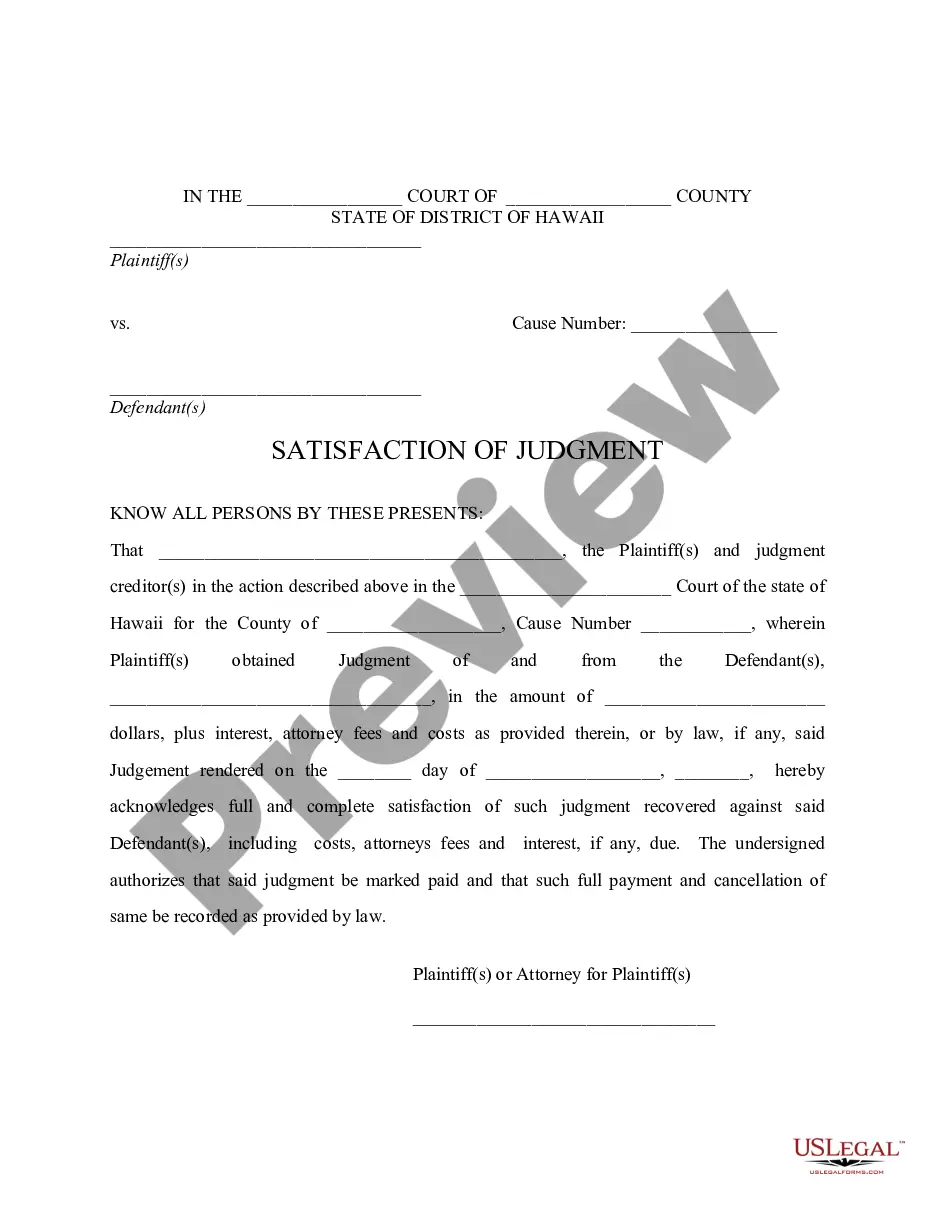

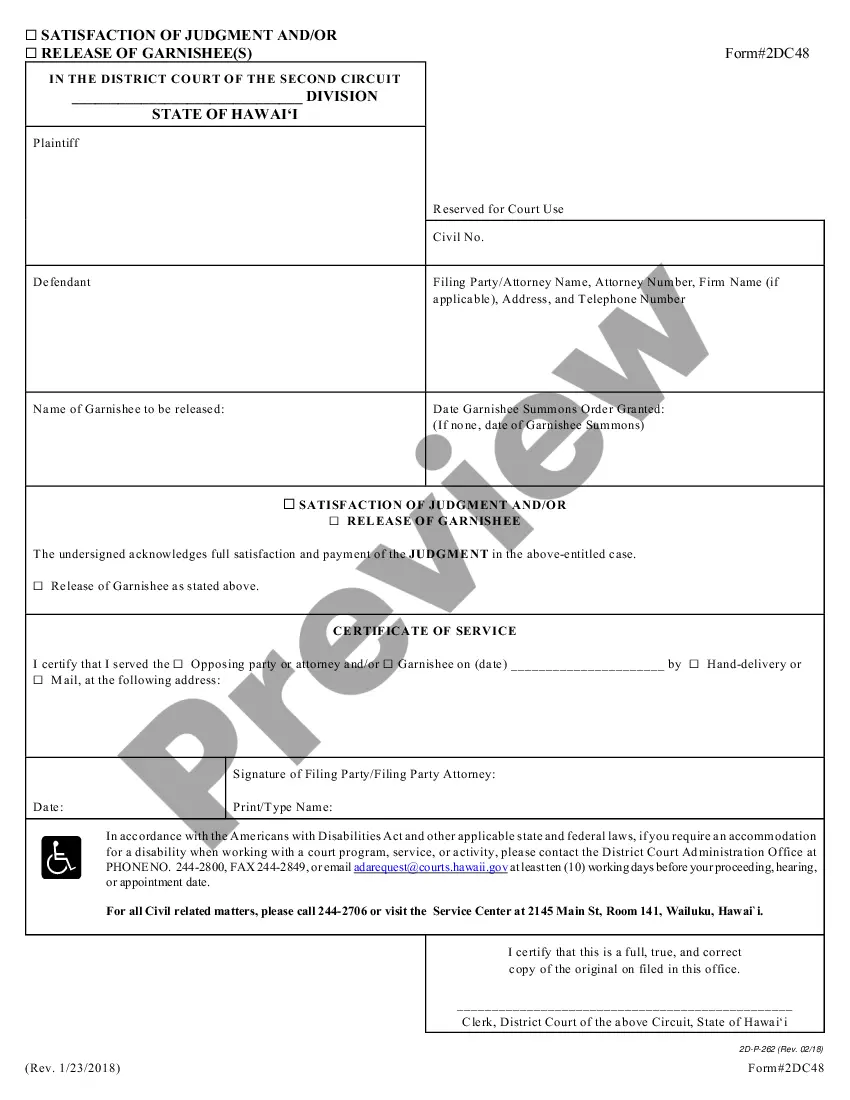

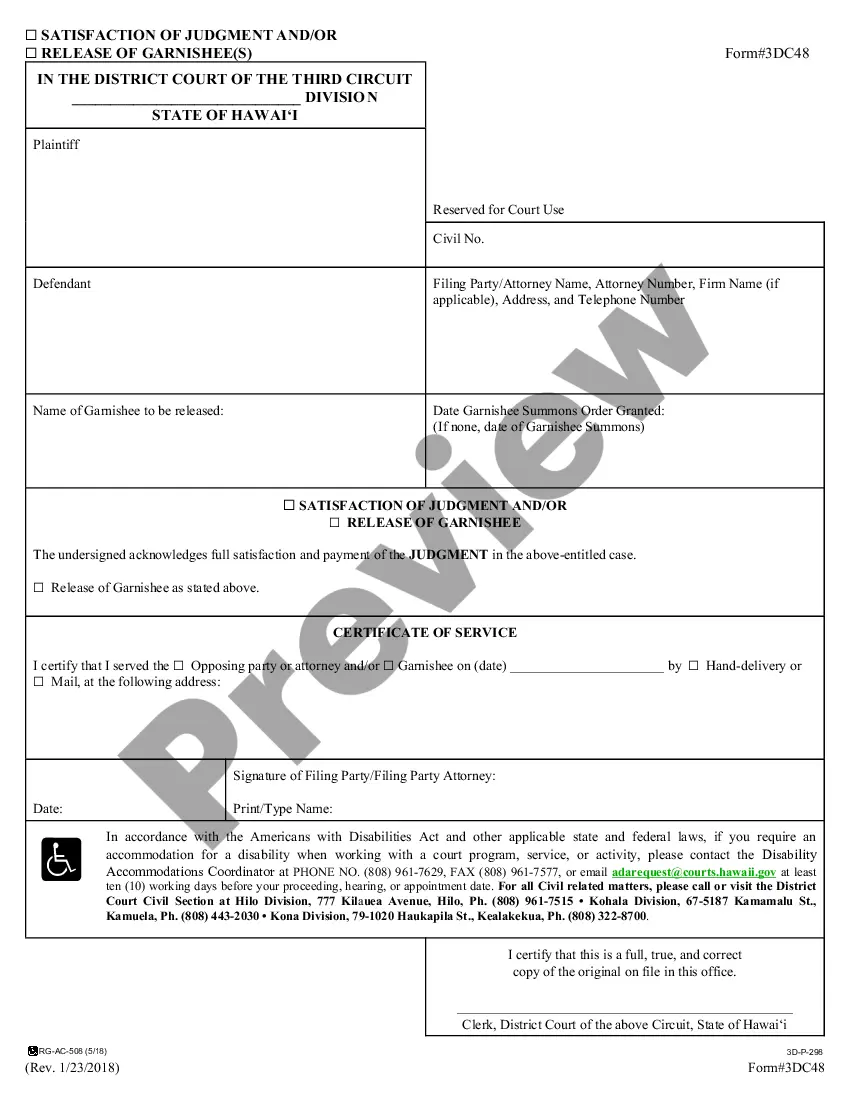

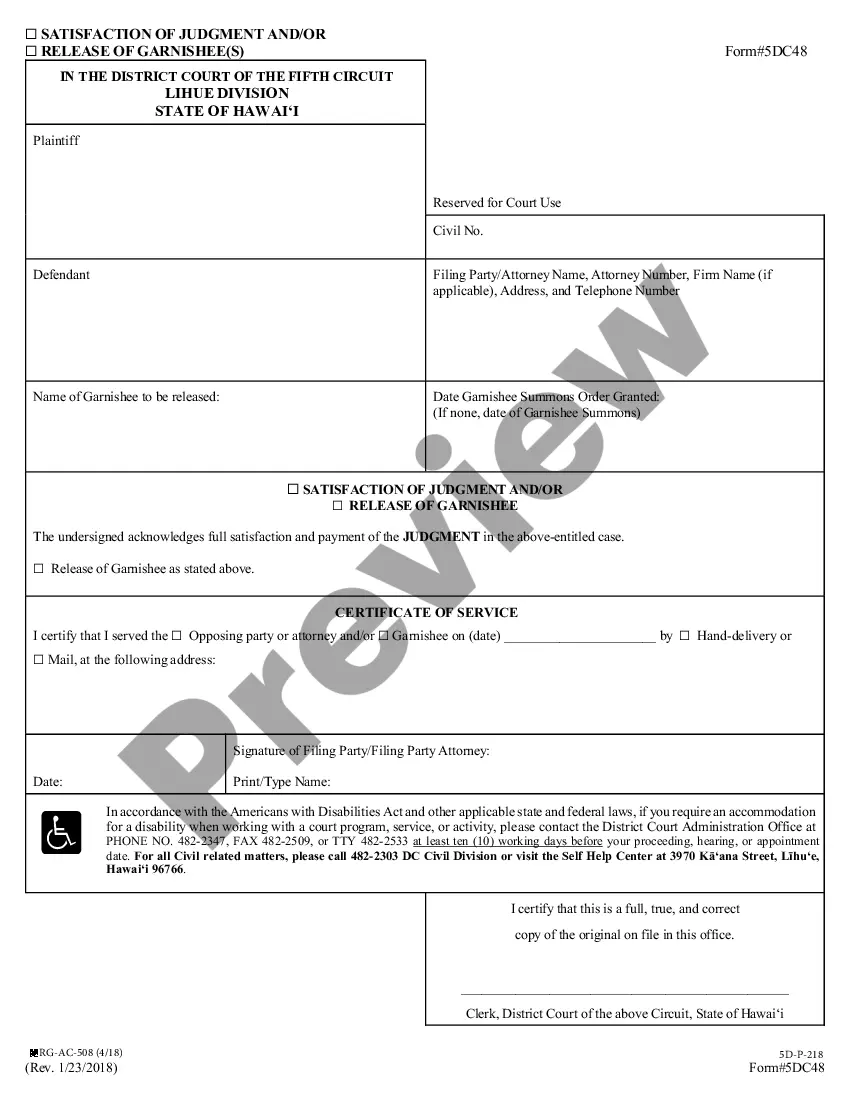

This is a Satisfaction of Judgment. It is used to show the Court that the Judgment Debtor has fully satisfied the Judgment rendered against him/her and he/she no longer is in debt to the Judgment Creditor.

Hawaii Satisfaction of Judgment

Description

How to fill out Hawaii Satisfaction Of Judgment?

Obtain the most comprehensive collection of legal documents.

US Legal Forms serves as a platform where you can locate any form specific to the state within a few clicks, such as examples of Hawaii Satisfaction of Judgment.

There's no need to squander several hours looking for a court-acceptable sample.

Utilize the Preview feature if it's available to examine the document's details. If everything is correct, click the Buy Now button. After selecting a pricing plan, create your account. Make your payment via credit card or PayPal. Download the file to your device by clicking on the Download button. That's it! You need to fill out the Hawaii Satisfaction of Judgment form and verify it. To ensure that everything is correct, contact your local attorney for assistance. Sign up and easily discover more than 85,000 valuable templates.

- Our certified professionals guarantee that you receive current documents consistently.

- To utilize the documents library, select a subscription and create your account.

- If you have already registered, simply Log In and click Download.

- The Hawaii Satisfaction of Judgment template will be automatically saved in the My documents tab (a section for every form you keep on US Legal Forms).

- To initiate a new profile, adhere to the brief instructions provided below.

- If you intend to use a state-specific template, ensure you select the correct state.

- If feasible, review the description to understand all the details of the form.

Form popularity

FAQ

In Hawaii, the time limit to file a lawsuit generally depends on the type of claim you have. For most personal injury cases, you typically have two years from the date of the incident to initiate your lawsuit. If you are dealing with a Hawaii Satisfaction of Judgment situation, it is crucial to understand these timelines clearly. Remember, taking timely action can greatly affect the outcome of your case, so consider using resources like U.S. Legal Forms to navigate the complexities involved.

While a satisfied judgment shows that you have met your obligations, it can still negatively affect your credit report for several years. Credit agencies typically retain this information, indicating past delinquency. However, understanding the Hawaii Satisfaction of Judgment process allows you to manage your financial reputation proactively. Rebuilding your credit focus is essential, and the right resources can assist you in this journey.

To remove a satisfied judgment from your credit report, you will first need to obtain a copy of the satisfaction of judgment document. After that, you can contact the credit reporting agencies to dispute the entry based on this documentation. It is crucial to understand that timely reporting is essential in improving your credit standing. Utilizing tools like uslegalforms can simplify the process and help you achieve a Hawaii Satisfaction of Judgment effectively.

Rule 4 of the Hawaii Rules of Civil Procedure details the requirements for serving a summons and complaint to a defendant. This rule ensures that defendants receive proper notice of legal actions against them, thus safeguarding their rights. Familiarity with these rules is critical, especially if your case involves a Hawaii Satisfaction of Judgment. Legal platforms can help you navigate these procedures with ease.

To satisfy a judgment means that a debtor has fulfilled the court's order, either by paying the debt or through other agreed-upon terms. Once this occurs, the creditor must file a document indicating the satisfaction, which enables the debtor to move forward financially. Understanding the concept of Hawaii Satisfaction of Judgment can significantly benefit you in restoring your credit status. Don't hesitate to use resources like uslegalforms to facilitate the process.

In Hawaii, a judgment typically lasts for ten years. However, it can be renewed for another ten-year period if the creditor takes the necessary steps. This time frame is essential to understand in the context of a Hawaii Satisfaction of Judgment, as the status of your judgment can impact your financial future. Staying informed allows you to manage your obligations effectively.

In Hawaii, a judgment does not automatically fall off after seven years; it lasts for up to ten years. However, if a judgment remains unpaid, creditors may seek to renew it. Therefore, staying informed about your financial obligations is vital to identifying when judgments may no longer apply. USLegalForms can aid you in understanding the Hawaii Satisfaction of Judgment process for your peace of mind.

A default judgment in Hawaii typically lasts for ten years, just like a regular judgment. If no action is taken to renew the judgment, it may become unenforceable after this period. When dealing with default judgments, consider your options and consult with specialists who understand the Hawaii Satisfaction of Judgment. USLegalForms offers materials to assist you in navigating this situation.

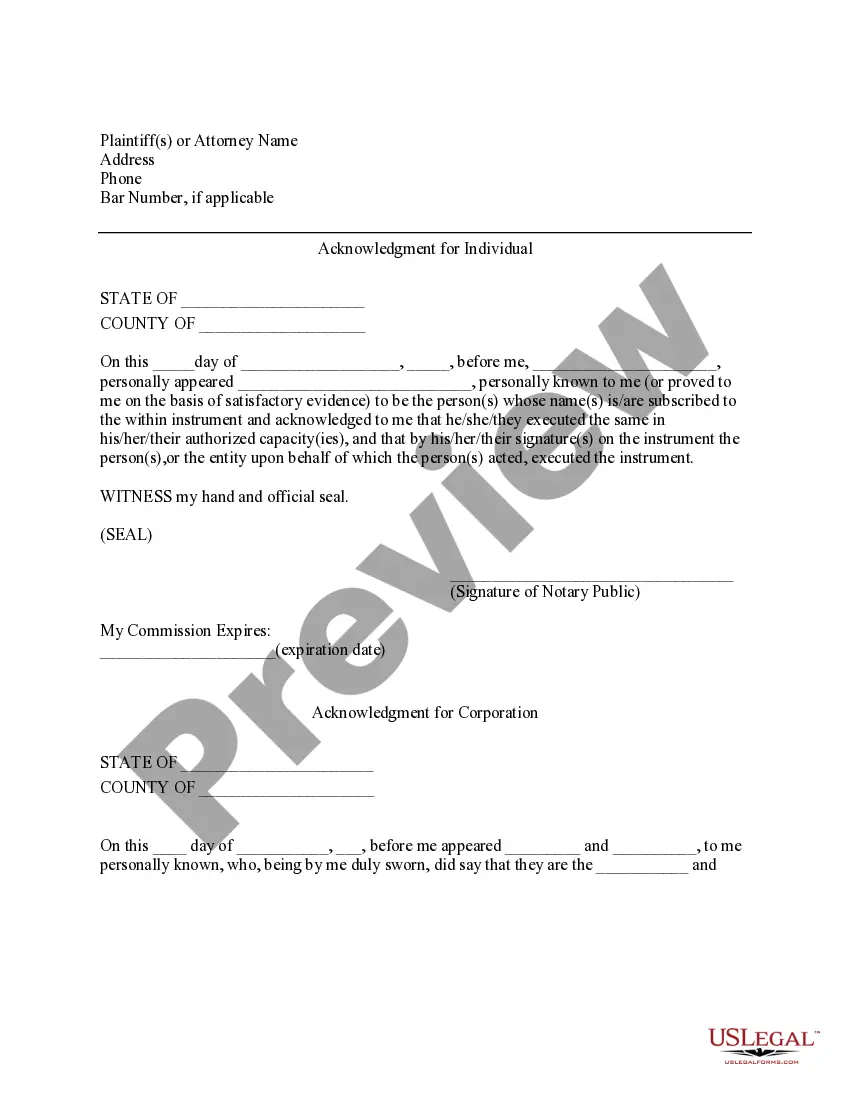

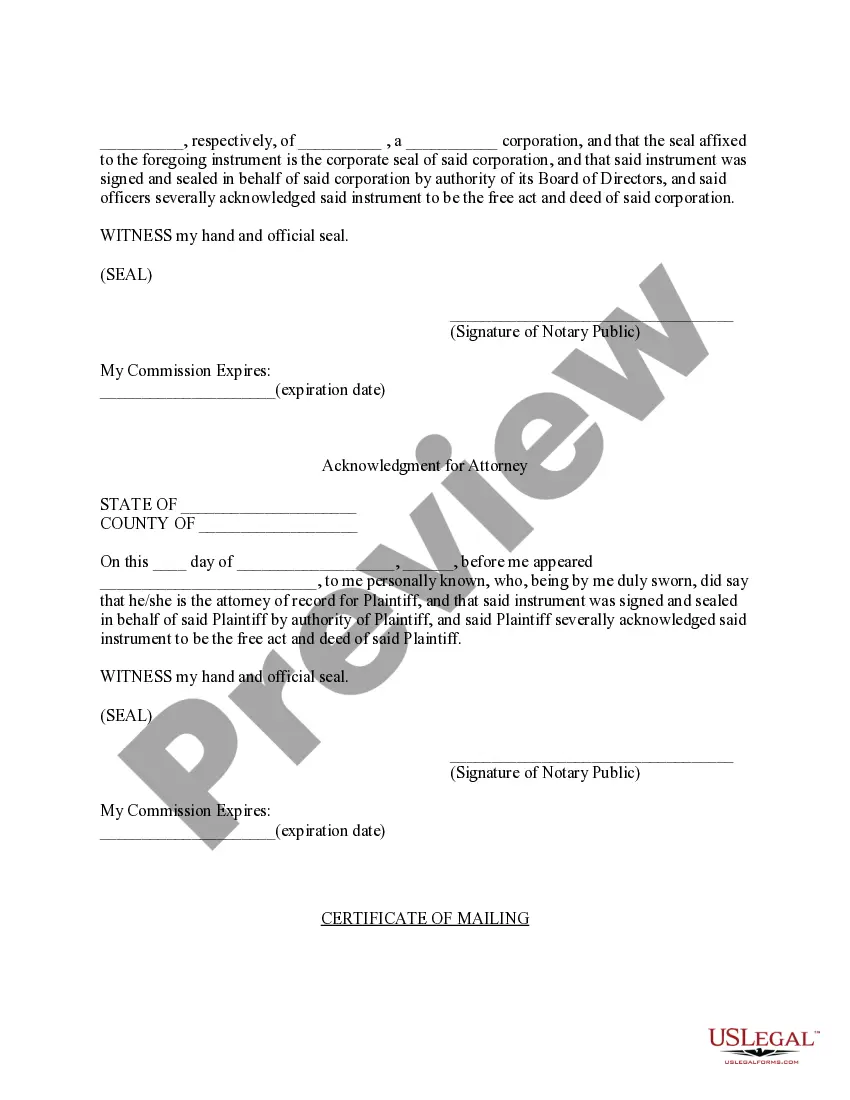

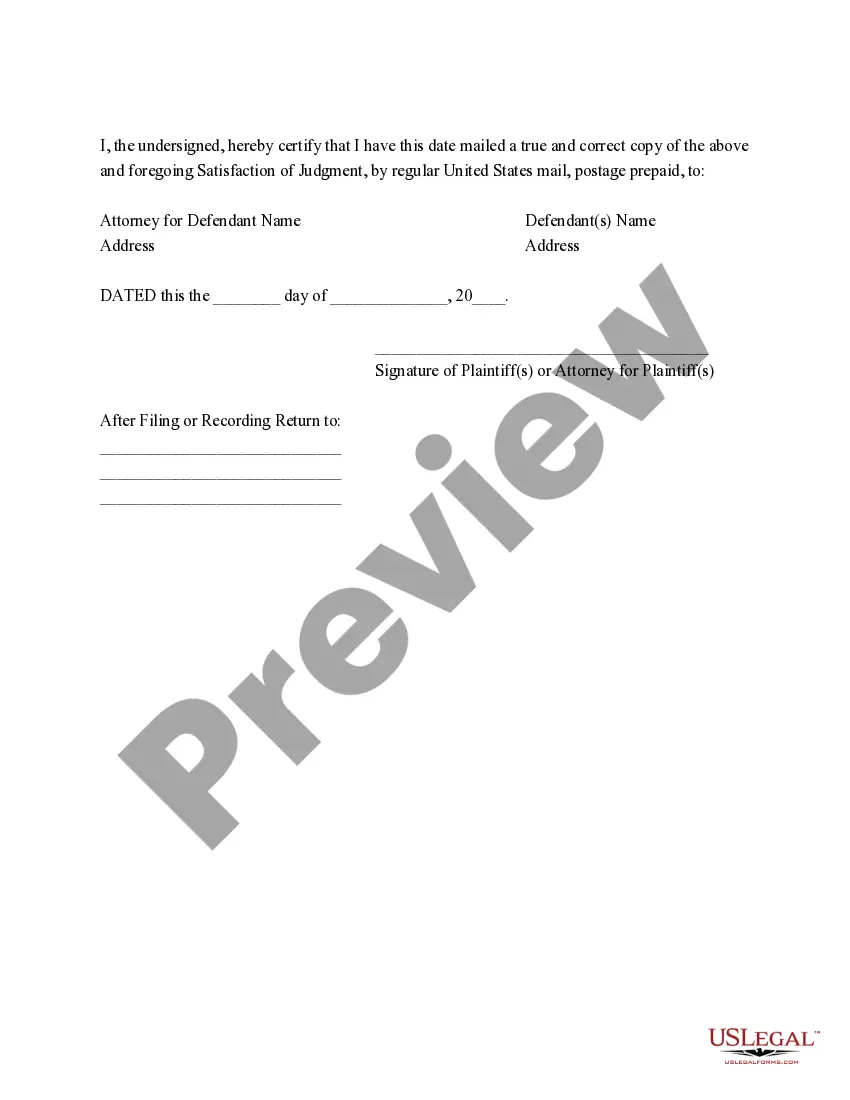

To file an acknowledgment of satisfaction of judgment in Hawaii, first obtain this document from your creditor. Next, you must file it with the court that issued the original judgment. This step ensures that the court records reflect that the debt has been satisfied. USLegalForms can help you find the right templates and guide you through this filing process.

Judgments in Hawaii last for ten years from the date they are entered. This period can be extended if the creditor takes action to renew the judgment before it expires. Knowing the duration of a judgment is crucial for planning your financial future. Use the resources from USLegalForms to stay informed about the laws regarding Hawaii Satisfaction of Judgment.