Delaware Assignment and Transfer of Stock refers to the legal processes involved in transferring ownership of shares from one entity to another in the state of Delaware. The transfer typically involves the assignment of rights and interests associated with the stock being transferred. In Delaware, a popular jurisdiction for business incorporation due to its business-friendly atmosphere, there are different types of Assignment and Transfer of Stock. These include: 1. Stock Assignment: Stock assignment refers to the act of transferring ownership of stocks from one entity to another. This type of transfer can occur due to various reasons, such as mergers, acquisitions, or private transactions. The assignment process involves the documentation of the transfer, which typically includes a stock assignment form or stock transfer agreement. 2. Stock Transfer: Stock transfer is similar to stock assignment, but it often involves the transfer of shares within the same entity or among existing shareholders. This type of transfer may occur when existing shareholders sell or gift their shares to other shareholders or when corporate shares are reallocated among the founders or directors of a company. The transfer is typically documented through a stock transfer form or a stock transfer ledger. 3. Restricted Stock Assignment: Restricted stock assignment involves the transfer of shares that are subject to certain restrictions or conditions set forth by the company. These restrictions may include lock-up periods, vesting schedules, or limitations on transferability. When assigning restricted stock, both the assigning party and the receiving party must comply with the terms and conditions specified in the stock agreement or applicable securities laws. 4. Preferred Stock Assignment: Preferred stock assignment refers to the transfer of shares that carry preferential rights or privileges over common stock. Preferred stockholders often enjoy certain benefits, such as priority in dividend distribution or liquidation proceeds. Assigning preferred stock may require the consent of other shareholders or compliance with specific provisions outlined in the stock agreement. In Delaware, the Assignment and Transfer of Stock are governed by state laws, particularly the Delaware General Corporation Law (DCL). This law provides guidelines and regulations on stock ownership, transfers, and related procedures, ensuring transparency and security in the stock transfer process. In summary, the Delaware Assignment and Transfer of Stock encompasses various types of stock transfers, including stock assignment, stock transfer, restricted stock assignment, and preferred stock assignment. These transfers are regulated by the Delaware General Corporation Law and require proper documentation, compliance with restrictions, and adherence to applicable regulations. Efficient execution of these processes is crucial for maintaining transparency and preserving the legal rights and interests of all parties involved.

Delaware Assignment and Transfer of Stock

Description

How to fill out Delaware Assignment And Transfer Of Stock?

You could spend numerous hours online searching for the official document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can download or print the Delaware Assignment and Transfer of Stock from their service.

If you wish to find another version of your form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Choose the pricing plan that suits you, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of your document and download it to your device. Make modifications to the document if necessary. You can complete, alter, sign, and print the Delaware Assignment and Transfer of Stock. Access and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you possess a US Legal Forms account, you may Log In and click the Obtain option.

- After that, you can complete, modify, print, or sign the Delaware Assignment and Transfer of Stock.

- Every legal document template you acquire belongs to you indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding option.

- If it's your first time using the US Legal Forms website, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/area of your choice.

- Review the form description to ensure you have selected the right document. If available, use the Review option to look through the document template as well.

Form popularity

FAQ

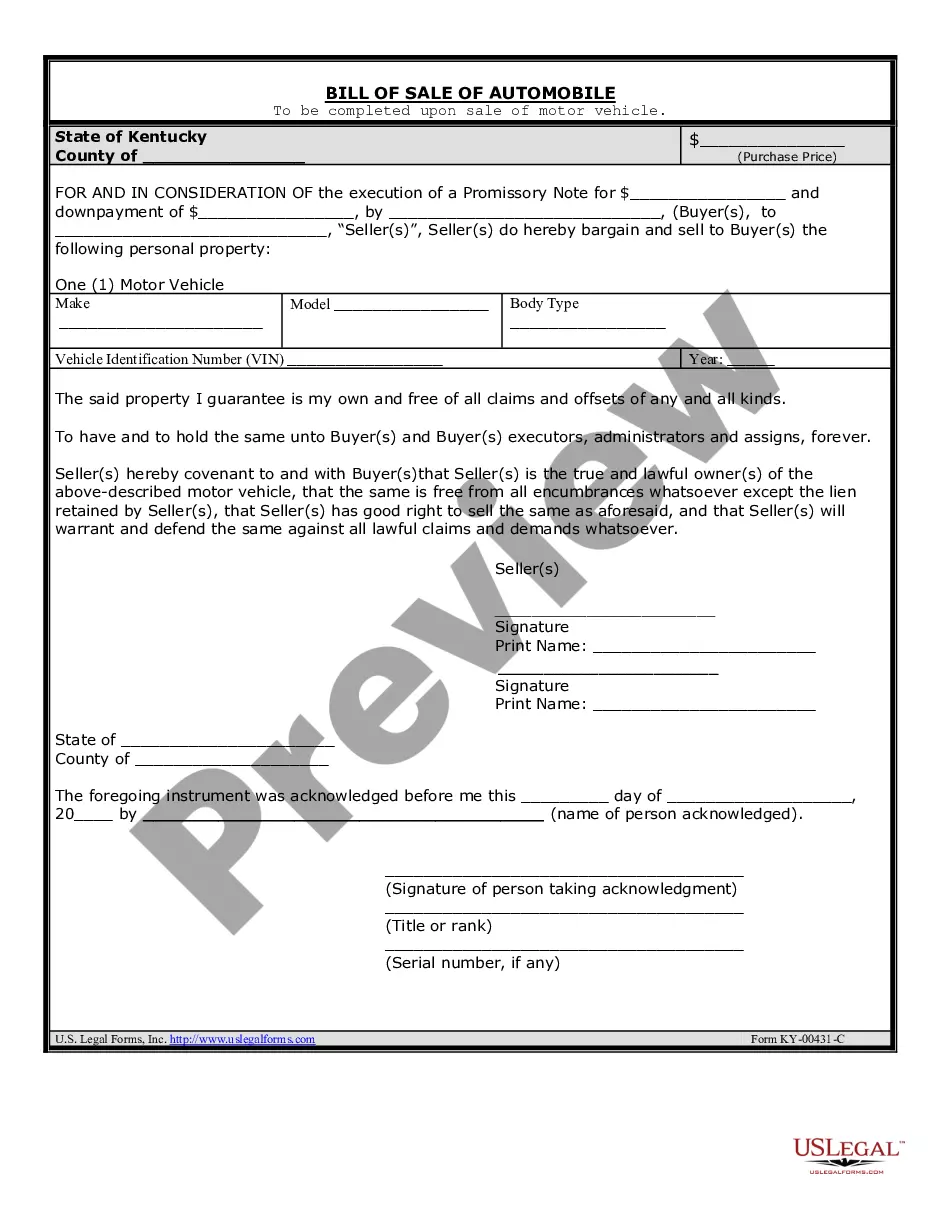

Issuing shares in a Delaware corporation involves filing the appropriate documents with the state and adhering to corporate bylaws. Once approved, you can issue stock certificates to shareholders as evidence of their ownership. Utilizing US Legal Forms can streamline this process, ensuring you follow the correct procedures for Delaware Assignment and Transfer of Stock efficiently.

The 20% rule under the Delaware General Corporation Law (DGCL) states that stockholders may not own more than 20% of a company's stock without board approval if the company has a classified board structure. This rule helps maintain stability in leadership and encourages responsible shareholding. Understanding this rule is crucial in the context of Delaware Assignment and Transfer of Stock, as it can impact share acquisition strategies.

To issue shares in a corporation, start by determining the number of shares you want to authorize. Next, prepare the necessary documents, including the stock certificate and corporate resolutions. You'll need to keep a record, as this ensures compliance and transparency in the Delaware Assignment and Transfer of Stock process. Consider using platforms like US Legal Forms for templates and guidance throughout the process.

To change the number of shares in a Delaware corporation, you must amend your corporation's certificate of incorporation. This involves drafting a resolution, obtaining the necessary approvals, and filing the amendment with the Secretary of State. Remember, accurately documenting these changes is crucial for compliance. For detailed assistance, US Legal Forms offers valuable tools for managing your Assignment and Transfer of Stock effectively.

No, stock certificates are not legally required in Delaware. However, it's beneficial for record-keeping purposes and helps provide a tangible proof of ownership. You can choose to issue certificates if you prefer, but many companies opt for electronic shares for their convenience. US Legal Forms can guide you through deciding the best approach when handling the Assignment and Transfer of Stock.

To increase authorized shares in Delaware, you need to prepare a certificate of amendment to your incorporation documents. This requires approval from your board of directors and, typically, the shareholders as well. Once approved, file the amendment with the Delaware Secretary of State. Consider using US Legal Forms for streamlined documents that address the intricacies of Delaware Assignment and Transfer of Stock.

Changing the number of authorized shares in a Delaware corporation requires an amendment to your certificate of incorporation. The process involves proposing the change in a board meeting and obtaining the majority approval from shareholders. After this, you must file the amendment with the Delaware Secretary of State. By utilizing resources from US Legal Forms, you can effectively navigate the complexities of the Assignment and Transfer of Stock in Delaware.

To issue shares in a Delaware corporation, you need to follow the procedures specified in the corporation's bylaws. First, prepare a resolution to authorize the issuance of shares, then update your corporate records to reflect this action. After that, you will record the details in your stock ledger. Using US Legal Forms can simplify this process and ensure you comply with Delaware laws on Assignment and Transfer of Stock.

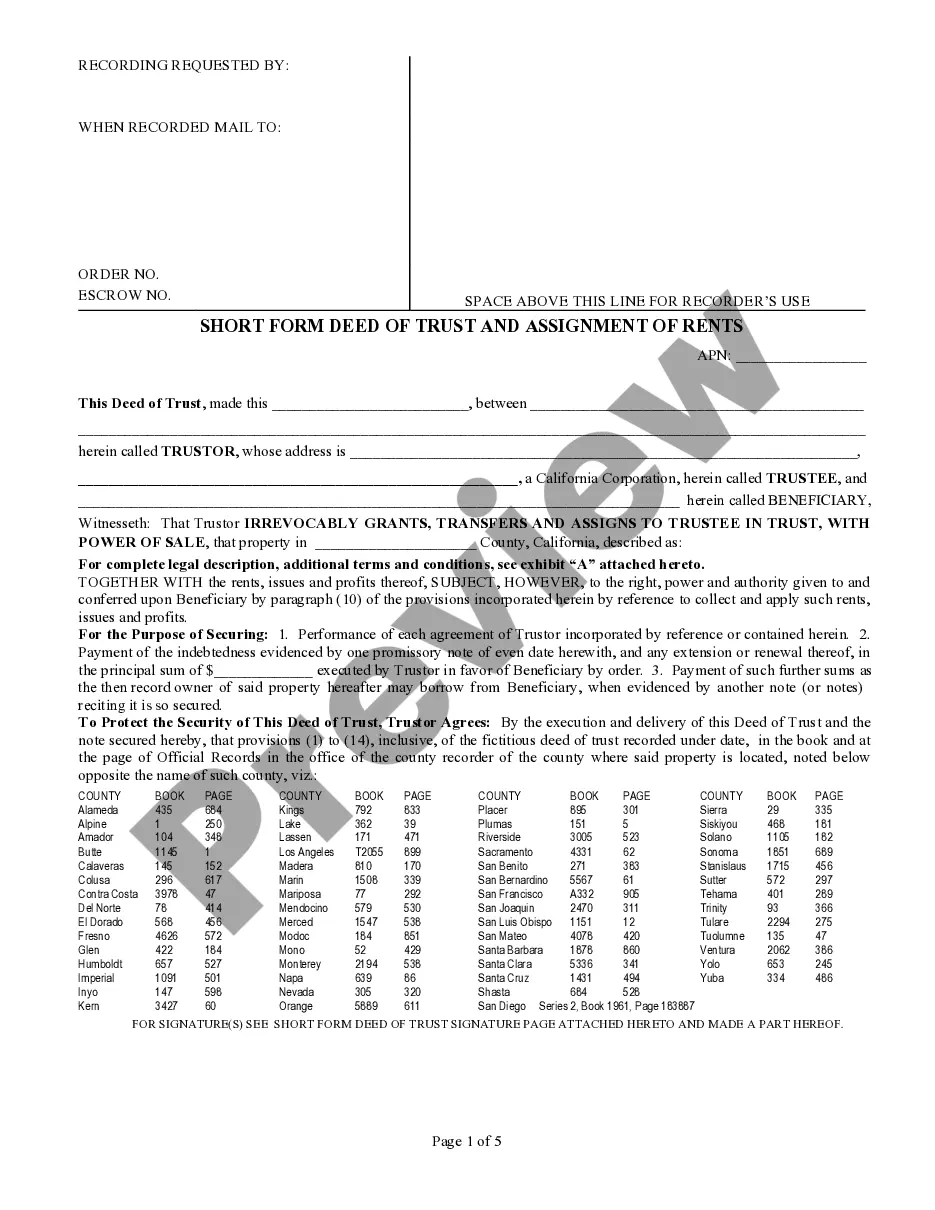

A deed of assignment is a legal instrument that signifies the transfer of rights or interests from one party to another. In the context of shares, it clarifies the responsibilities and rights of the parties involved. For those engaged in the Delaware Assignment and Transfer of Stock, understanding how to draft and execute this deed effectively is fundamental to a smooth transaction.

The deed of assignment and transfer of shares combines elements of both an assignment and a transfer into one document. By using this deed, a shareholder can effectively communicate and execute the handover of shares while meeting Delaware's legal requirements. This dual-function document simplifies the process of Delaware Assignment and Transfer of Stock for stakeholders.