Reciprocal Services involve the situation where companies or organizations provide service to each other. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Reciprocal Services Agreement Regarding Communication Routing Services

Description

How to fill out Reciprocal Services Agreement Regarding Communication Routing Services?

Are you in a situation where you require documents for potential business or personal activities nearly every day.

There are numerous legal document templates accessible online, but finding trustworthy versions isn’t easy.

US Legal Forms offers thousands of form templates, such as the Delaware Reciprocal Services Agreement Regarding Communication Routing Services, which can be downloaded to comply with federal and state regulations.

Once you find the appropriate template, click on Purchase now.

Select the payment plan you wish, fill in the required information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can obtain the Delaware Reciprocal Services Agreement Regarding Communication Routing Services template.

- If you do not have an account and want to start using US Legal Forms, take these steps.

- Find the template you need and ensure it is suitable for your specific area/county.

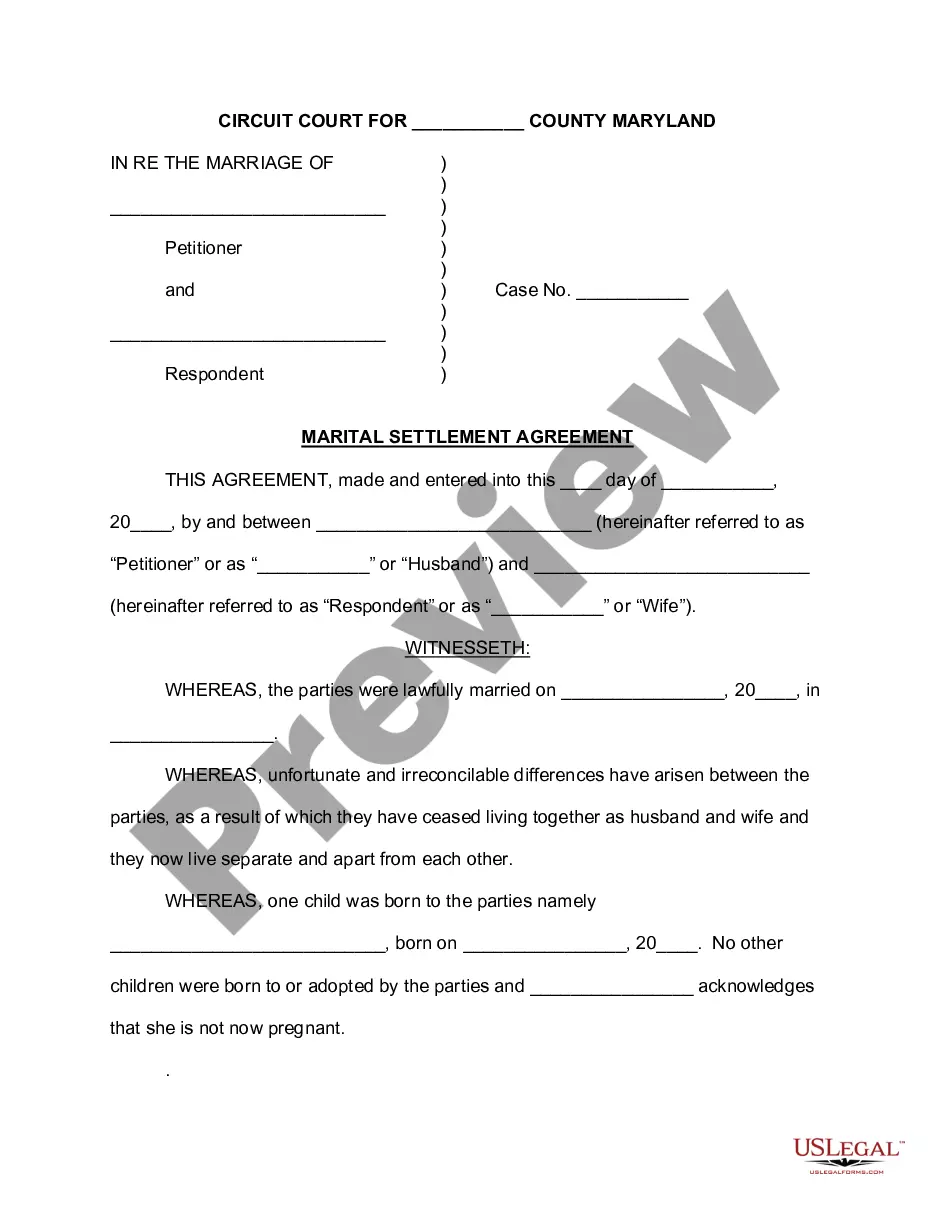

- Use the Preview button to review the template.

- Check the description to confirm that you have chosen the correct document.

- If the document isn’t what you’re looking for, use the Lookup area to find the template that fits your needs.

Form popularity

FAQ

Any individual or business generating taxable income from Delaware sources must file a tax return. This applies to residents and non-residents alike, depending on the nature of their income. For clarity on your filing requirements, referencing the Delaware Reciprocal Services Agreement Regarding Communication Routing Services can provide valuable guidance.

An independent contractor agreement in Delaware outlines the terms of service between a contractor and a business. This agreement defines the nature of the work, payment terms, and mutual obligations. Understanding your rights and responsibilities under this agreement can enhance your business dealings and help you navigate relationships that may involve the Delaware Reciprocal Services Agreement Regarding Communication Routing Services.

Individuals who earn below certain income thresholds or have no Delaware-sourced income are not required to file a tax return in Delaware. This includes non-residents without taxable income from Delaware. However, it is wise to review the implications of the Delaware Reciprocal Services Agreement Regarding Communication Routing Services, which may influence your filing requirements.

Yes, Delaware has reciprocal agreements with several states, allowing residents of those states to avoid double taxation on income earned in Delaware. This is particularly beneficial for workers commuting into Delaware from neighboring states. The Delaware Reciprocal Services Agreement Regarding Communication Routing Services may detail these provisions and help you navigate your tax responsibilities effectively.

Businesses registered in Delaware must file franchise taxes, regardless of whether they operate within the state. This requirement applies to all corporations and some limited liability companies. Understanding the obligations tied to the Delaware Reciprocal Services Agreement Regarding Communication Routing Services can simplify the franchise tax filing process.

Non-residents must file a Delaware nonresident tax return if they gain income from Delaware sources that meets the filing thresholds set by the state. This requirement applies regardless of their primary residence location. The Delaware Reciprocal Services Agreement Regarding Communication Routing Services can help clarify how these returns are structured and filed, ensuring compliance.

resident for Delaware tax purposes is an individual who does not reside in Delaware but may still earn income from Delaware sources. This can include individuals who live in neighboring states and work in Delaware. It's important for nonresidents to be aware of their status to fulfill their tax responsibilities correctly under the Delaware Reciprocal Services Agreement Regarding Communication Routing Services.

Delaware source income includes income generated from activities within Delaware, such as wages from a job based in the state, rental income from properties located in Delaware, and business income from enterprises operating in the state. Understanding what constitutes Delaware source income is critical for non-residents to determine their tax obligations. The Delaware Reciprocal Services Agreement Regarding Communication Routing Services may provide useful insights into these requirements.

Yes, a non-resident is generally required to file a Delaware income tax return if they earn income sourced from Delaware. This includes income derived from services performed or business conducted within the state. To ensure compliance and understand your obligations, consider understanding the Delaware Reciprocal Services Agreement Regarding Communication Routing Services. This agreement can clarify what income may be taxable for non-residents.

Section 17 305 of the Delaware Act discusses the powers of general partners within limited partnerships. It outlines their ability to manage partnership affairs effectively while balancing responsibilities. Understanding this section is crucial for compliance with the Delaware Reciprocal Services Agreement Regarding Communication Routing Services, especially for partnerships. Comprehensive resources are available on uslegalforms to aid in your project.