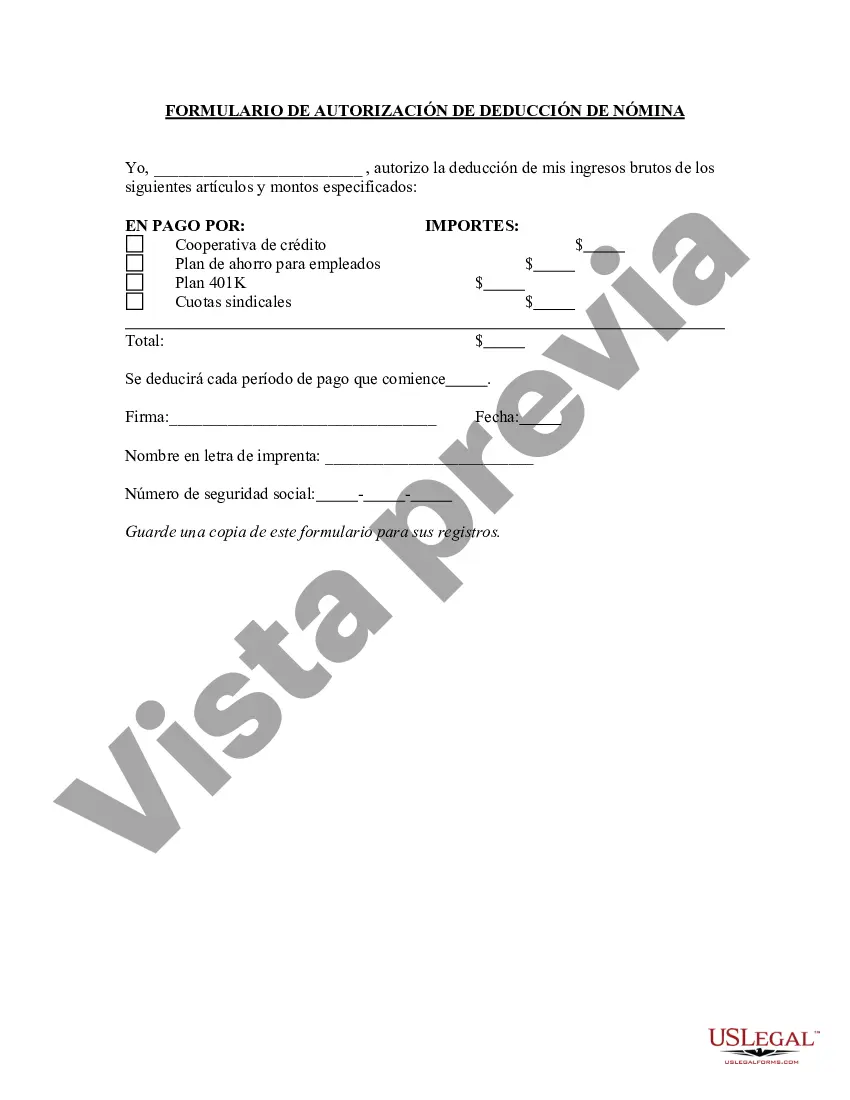

The District of Columbia Payroll Deduction Authorization Form is a document that allows employees in the District of Columbia to authorize deductions from their wages for various purposes. It is an essential tool used by employers to facilitate the deduction process. This comprehensive form ensures that the necessary information is collected and authorized before any deductions are made. The authorized deductions can be for various purposes, such as health insurance premiums, retirement contributions, charitable contributions, union dues, or even loan repayments. The form provides employees with the opportunity to choose which deductions they would like to have subtracted from their wages, ensuring transparency and accountability. The form typically requires employees to provide their personal information, including their name, address, and social security number, as well as their employer's details. In addition to personal information, employees must specify the type of deduction and the amount they wish to have deducted from each paycheck. This ensures that the correct amount is calculated, thus avoiding any errors or discrepancies. Moreover, the District of Columbia Payroll Deduction Authorization Form may include specific fields or sections for particular types of deductions, such as a separate section for health insurance deductions or retirement plan contributions. This allows for clear categorization and streamlined administration of deductions. Different types of District of Columbia Payroll Deduction Authorization Forms may exist depending on the purpose of the deduction. Some common variations may include: 1. Health Insurance Deduction Authorization Form: This form is specifically designed for employees who wish to authorize deductions for health insurance premiums. 2. Retirement Plan Contribution Authorization Form: This form caters to employees who want to contribute to a retirement plan through payroll deductions. 3. Charitable Contribution Deduction Authorization Form: This form is for employees who want to support a charitable organization by authorizing regular deductions from their wages. 4. Union Dues Deduction Authorization Form: This type of form is used by employees who are members of a labor union and want to authorize the deduction of union dues from their pay. By understanding the specifics of each type of District of Columbia Payroll Deduction Authorization Form, employers can ensure compliance with legal requirements and offer employees a convenient and organized process for managing their authorized deductions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out District Of Columbia Formulario De Autorización De Deducción De Nómina?

Are you presently in the situation in which you require paperwork for either business or personal reasons nearly every working day? There are a lot of legitimate record web templates available online, but finding ones you can rely on is not easy. US Legal Forms gives a huge number of form web templates, like the District of Columbia Payroll Deduction Authorization Form, that happen to be written to meet state and federal requirements.

Should you be presently familiar with US Legal Forms web site and also have your account, simply log in. Afterward, you may acquire the District of Columbia Payroll Deduction Authorization Form template.

Should you not offer an account and need to begin using US Legal Forms, follow these steps:

- Obtain the form you will need and make sure it is for that proper metropolis/area.

- Take advantage of the Preview key to examine the form.

- Look at the information to actually have selected the correct form.

- In case the form is not what you are seeking, take advantage of the Look for area to find the form that meets your requirements and requirements.

- Whenever you discover the proper form, just click Buy now.

- Opt for the costs program you desire, complete the specified information to make your money, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and acquire your copy.

Find all the record web templates you might have bought in the My Forms food selection. You may get a more copy of District of Columbia Payroll Deduction Authorization Form any time, if possible. Just click the essential form to acquire or print the record template.

Use US Legal Forms, by far the most comprehensive variety of legitimate forms, in order to save time as well as steer clear of errors. The assistance gives professionally manufactured legitimate record web templates which you can use for a selection of reasons. Make your account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

DC residents pay the highest per-capita federal income taxes in the US. In total, DC residents pay more in total federal income tax than residents of 22 other states, but have no say over how those tax dollars are spent.

8 percent, instead of 6.2 percent, of the first $7,000 they pay to each employee in a calendar year. The Department of Employment Services Tax Division is located at 4058 Minnesota Avenue NE, 4th Floor, Washington, DC 20019. The office is open to the public from am to pm.

1. What do payroll taxes pay for? The federal government levies payroll taxes on wages and uses most of the revenue to fund Social Security, Medicare, and other social insurance benefits. Federal income taxes also go towards things like defense and security.

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

District of Columbia (DC) employers must withhold DC income taxes on wage payments made to DC residents who work in DC. An employee is a DC resident for income tax purposes if certain criteria are met. Nonresidents who work in DC are not subject to withholding.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

If you become a DC resident any time after you have filed a Form D-4A with your employer, you must file a Form D-4, Employee Withholding Allowance Certificate, promptly so that the proper amount of DC income tax can be withheld from your wages.

Newly hired employees must complete and sign both the federal Form W-4 and the state DE 4. The W-4 is used for federal income tax and the DE 4 is used for California Personal Income Tax (PIT). Starting in 2020, allowances are no longer included on the redesigned Form W-4 for PIT withholdings.

District of Columbia Income Tax WithholdingThe District of Columbia law requires employers to withhold state income tax from employee's wages and remit the amounts withheld to the Office of Tax and Revenue.

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.