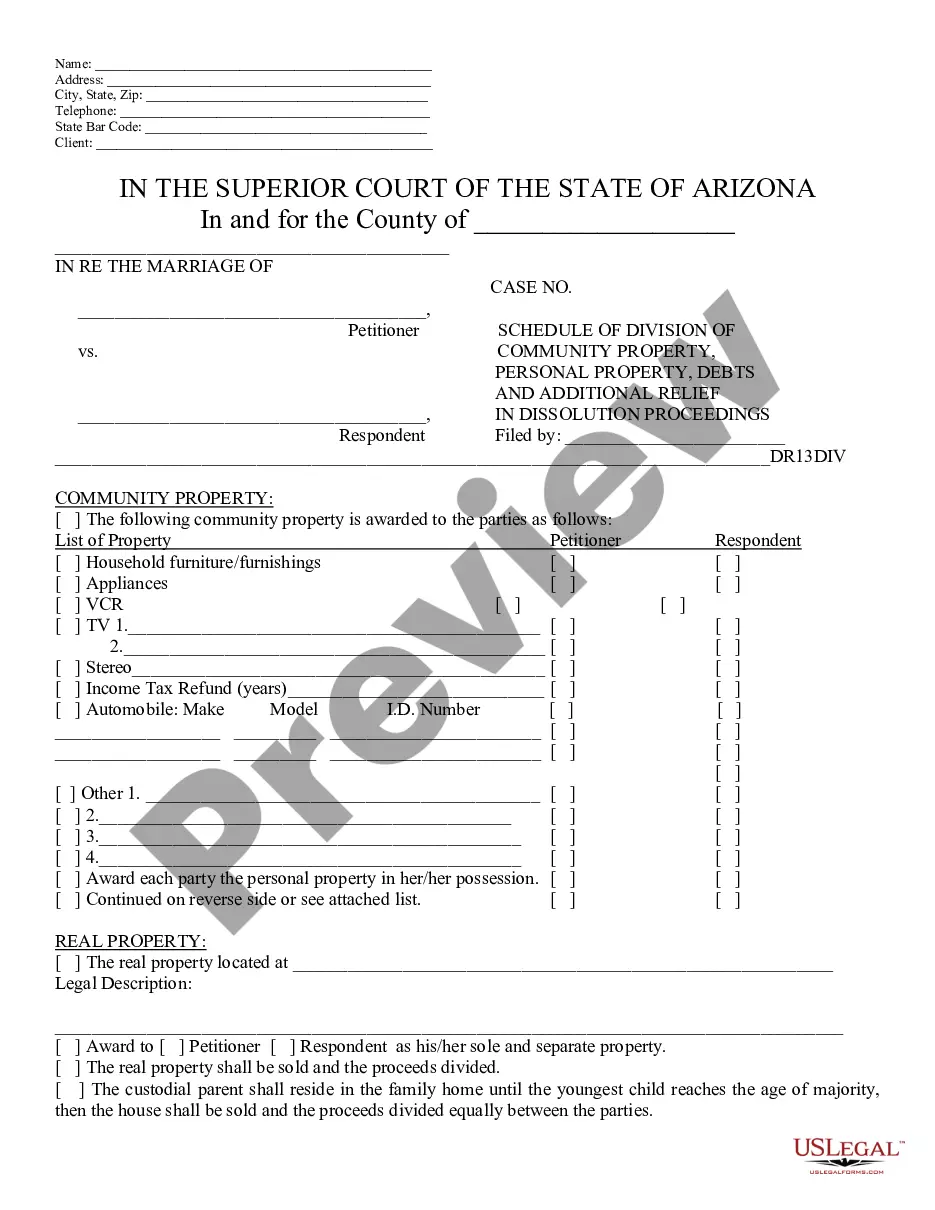

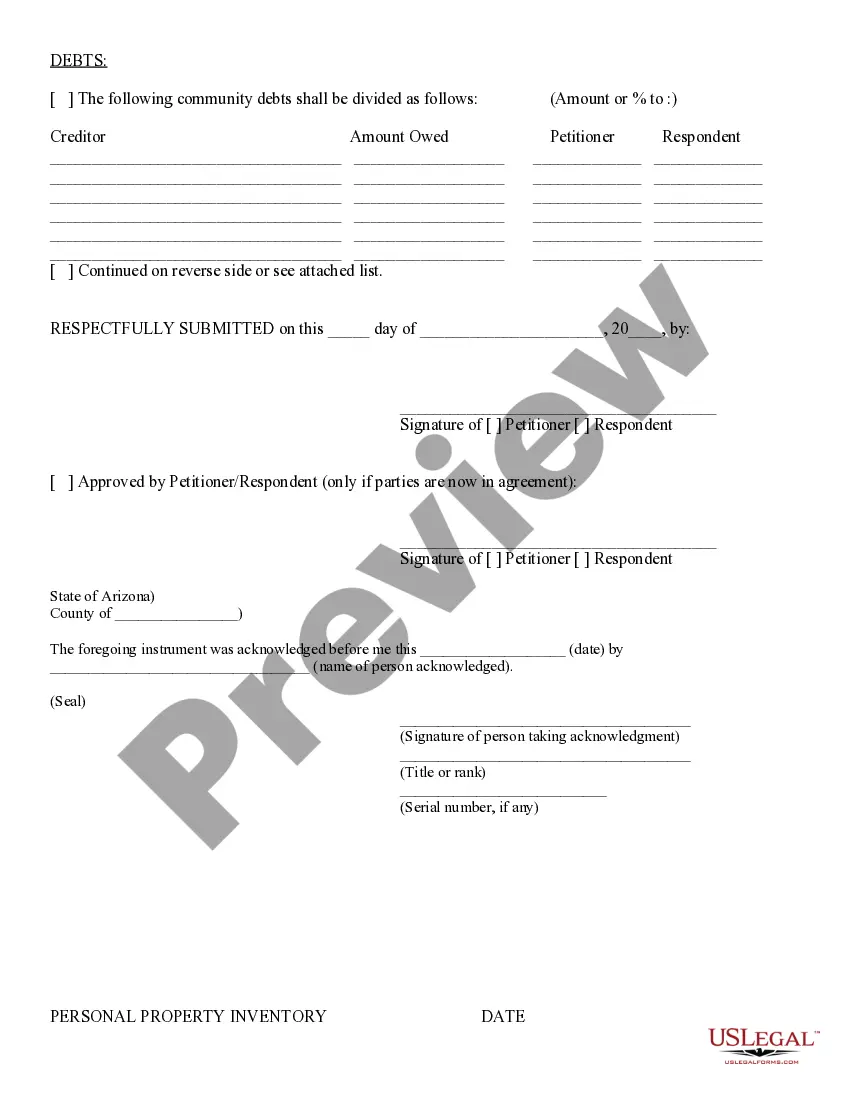

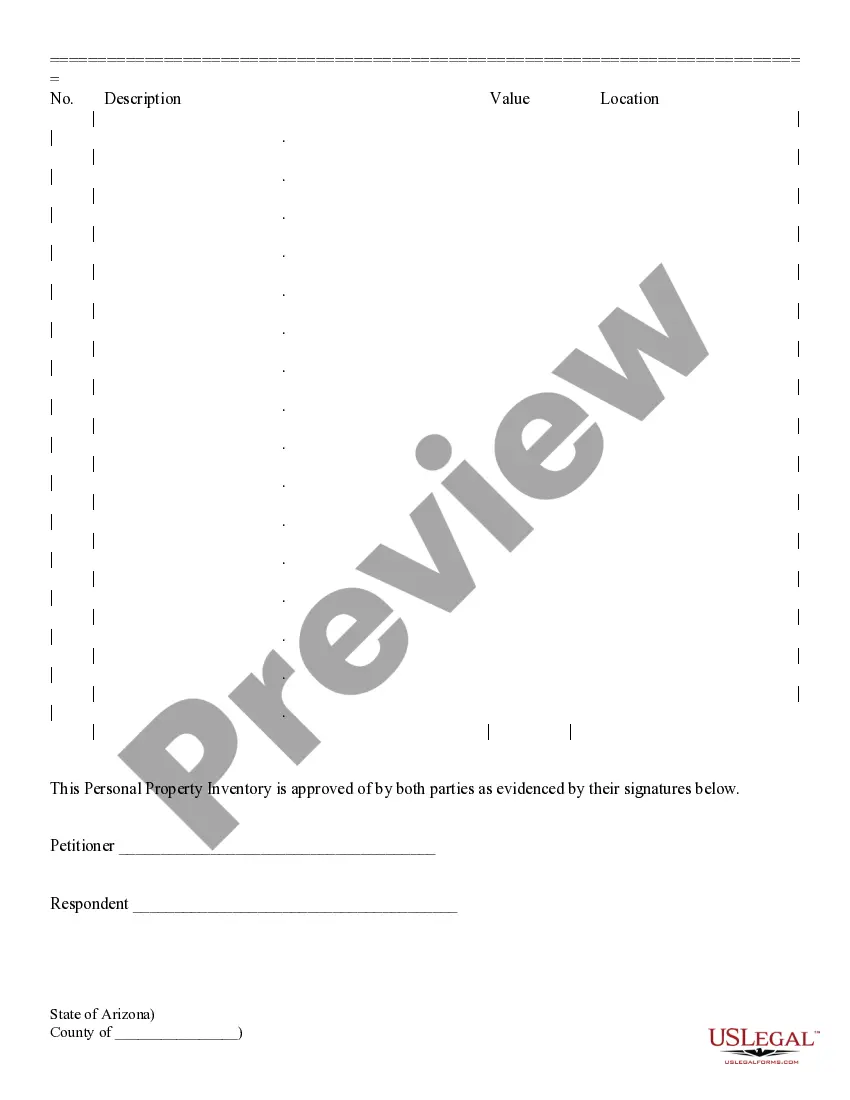

Schedule of Division of Community Property and Additional Relief: The schedule divides all of the assets, debts and property a couple accumulated during their marriage. It further lists exactly what each spouse will be able to take. This form is available in both Word and Rich Text formats.

Arizona Schedule of Division of Community Property and Additional Relief

Description

How to fill out Arizona Schedule Of Division Of Community Property And Additional Relief?

If you are seeking accurate Arizona Schedule of Division of Community Property and Additional Relief templates, US Legal Forms is precisely what you require; find documents crafted and verified by state-certified lawyers.

Using US Legal Forms not only helps you avoid issues related to legal documents; moreover, you save time, effort, and money! Acquiring, printing, and submitting a professional template is far more affordable than hiring a lawyer to do it for you.

And that’s it! In just a few simple clicks, you receive an editable Arizona Schedule of Division of Community Property and Additional Relief. After you set up your account, all future orders will be handled even more effortlessly. When you have a US Legal Forms subscription, simply Log In to your profile and click the Download button available on the form’s page. Then, whenever you need to access this template again, you will always find it in the My documents section. Don’t waste your time sifting through countless forms on multiple websites. Obtain professional documents from one trusted service!

- To get started, complete your registration process by providing your email and creating a secure password.

- Follow the steps below to establish your account and obtain the Arizona Schedule of Division of Community Property and Additional Relief model that fits your requirements.

- Utilize the Preview option or review the file details (if available) to ensure that the template is what you need.

- Verify its compliance with the regulations in your state.

- Click on Buy Now to place your order.

- Select a preferred payment plan.

- Create an account and pay using your credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

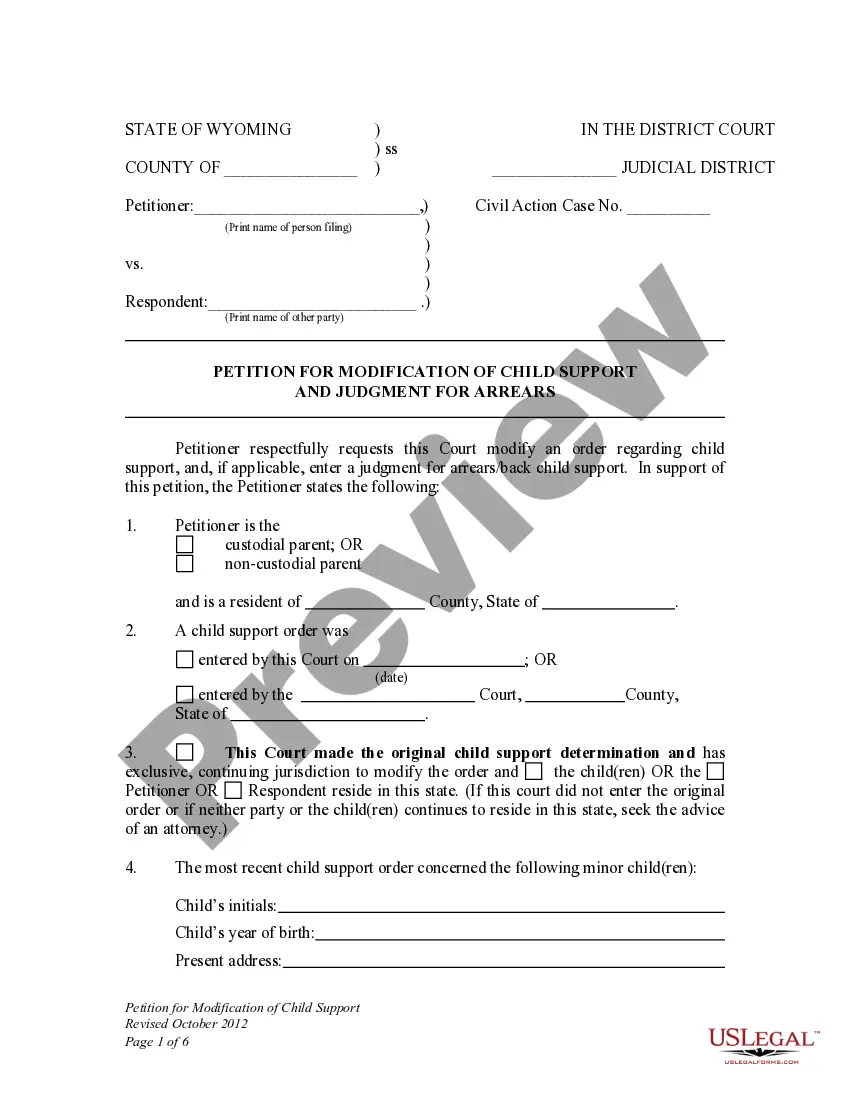

Statute 25-320 in Arizona pertains to the division of community property in divorce cases. It specifies how the courts must approach the equitable distribution of property, ensuring fairness between parties. When navigating these proceedings, the Arizona Schedule of Division of Community Property and Additional Relief can offer essential insights and support.

The Arizona community property statute can be found in Arizona Revised Statutes Title 25. This statute outlines how property acquired during marriage is owned jointly, and it also provides guidelines on the division of property in the event of a divorce. If you need assistance with interpretations of the statute, the Arizona Schedule of Division of Community Property and Additional Relief can guide you through the process.

In Arizona, community property laws primarily apply to married couples. Unmarried couples do not automatically share property as community property unless they have a written agreement. However, if you face issues regarding property division, the Arizona Schedule of Division of Community Property and Additional Relief can help clarify your rights and responsibilities.

The Arizona claim of right form is a legal document that allows a spouse to assert a claim over community property when facing division during a divorce. This form is crucial for properly documenting claims regarding property that might be in dispute. Using the Arizona Schedule of Division of Community Property and Additional Relief can simplify the process and guide individuals in filing necessary claims effectively.

In an Arizona divorce, a wife is entitled to her fair share of community property, which includes assets acquired during the marriage. This can cover real estate, savings accounts, personal property, and even future earnings depending on the situation. The Arizona Schedule of Division of Community Property and Additional Relief outlines her entitlement and helps ensure she receives what she is owed.

Determining who keeps the house in an Arizona divorce often depends on various factors, including both parties’ desires and the financial implications. If the home is classified as community property, it may typically be sold, or one spouse may buy out the other’s share. The Arizona Schedule of Division of Community Property and Additional Relief can provide a structured approach to resolving these property division matters.

In a divorce in Arizona, all community property assets are generally split equally between spouses. This may include real estate, vehicles, bank accounts, and retirement funds accrued during the marriage. The Arizona Schedule of Division of Community Property and Additional Relief details these distributions, ensuring fairness as couples navigate their separation.

In Arizona, community property income includes all the earnings and benefits accumulated during the marriage, regardless of who earned them. This means wages, salaries, bonuses, and even interest from joint accounts are deemed community property. When seeking an Arizona Schedule of Division of Community Property and Additional Relief, it’s vital to recognize that all income generated during the marriage is typically subject to division.

Arizona Form 140A is a simplified version of the individual income tax return used by single filers or couples with very simple tax situations. This form allows taxpayers to report their income and deductions without getting into complexities. Knowing how to use Form 140A can save time and effort, and is related to the overall understanding of filing requirements, including the Arizona Schedule of Division of Community Property and Additional Relief. Make sure to check if it's right for you.

The pension exclusion in Arizona allows qualifying taxpayers to exclude a portion of their pension income from taxable income. This is beneficial for retirees receiving pension benefits from various sources. Understanding how to qualify for this exclusion can play a big role in your overall tax situation, especially when considering the Arizona Schedule of Division of Community Property and Additional Relief. It is a key aspect to consider during tax season.