Wisconsin Lien Release Form

Description

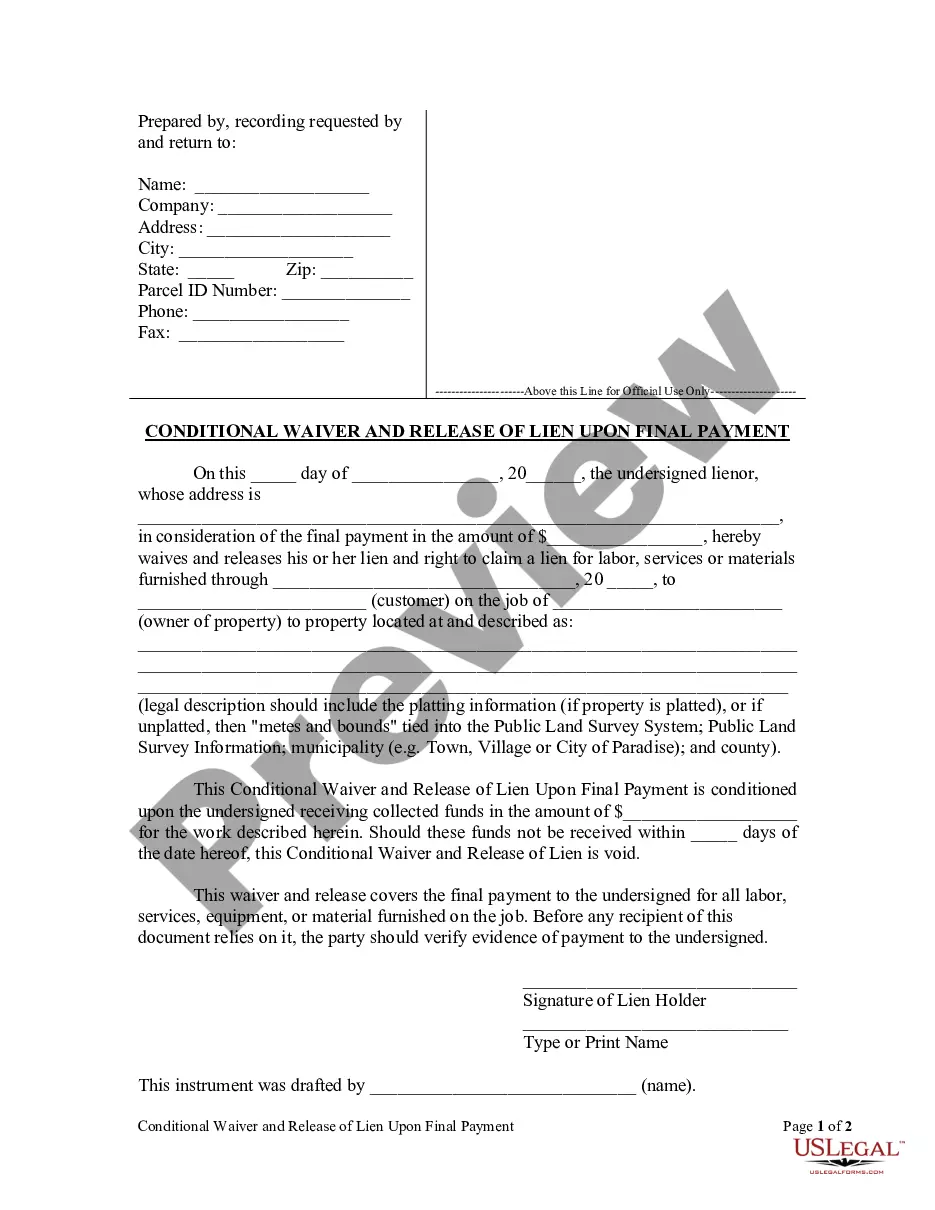

How to fill out Wisconsin Conditional Waiver And Release Of Claim Of Lien Upon Final Payment?

When you are required to fill out the Wisconsin Lien Release Form that adheres to your local state's statutes and guidelines, there can be a multitude of choices to select from.

There's no necessity to examine each form to ensure it fulfills all the legal requirements if you are a subscriber of US Legal Forms.

It is a dependable resource that can assist you in obtaining a reusable and current template on any topic.

Utilizing US Legal Forms makes obtaining correctly drafted official documents straightforward. In addition, Premium users can also benefit from the robust integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a compilation of over 85k ready-to-use documents for business and personal legal situations.

- All templates are validated to comply with each state's regulations.

- Thus, when you download the Wisconsin Lien Release Form from our platform, you can be assured that you possess a valid and up-to-date document.

- Acquiring the necessary sample from our platform is extraordinarily simple.

- If you have an account already, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile to keep access to the Wisconsin Lien Release Form at any time.

- If it's your first time using our library, please follow the guide below.

- Browse the recommended page and verify it for alignment with your standards.

Form popularity

FAQ

A "Confirmation of Security Interest (Lien) Perfection" (form T084 or MV2076), which the lending institution should send to you. 200bOr, an original letter (copy or fax to customer is not acceptable) from your lender on their letterhead releasing the lien. The letter must:25e6describe the vehicle by make.

What about electronic titles? On July 30, 2012, when a lien is listed against a vehicle, lien holders are encouraged to receive titles electronically through a service provider. If a lien holder chooses to receive electronic titles, a paper title would not be issued to the lender or owner until the lien is satisfied.

On July 30, 2012, Wisconsin joined other states in becoming a title to lien holder (lender) state. This means that any title with a lien (loan) listed on or after July 30, 2012, will be sent to the lien holder rather than the owner.

Use form 9400-623 if you are primary owner on record and you want to add or remove an owner to the certificate of title or if you want to add a lien (i.e. to request a lien notation). Form 9400-193. Use form 9400-193 if you want to transfer title of the boat and you are removing the primary owner on record. Fee.