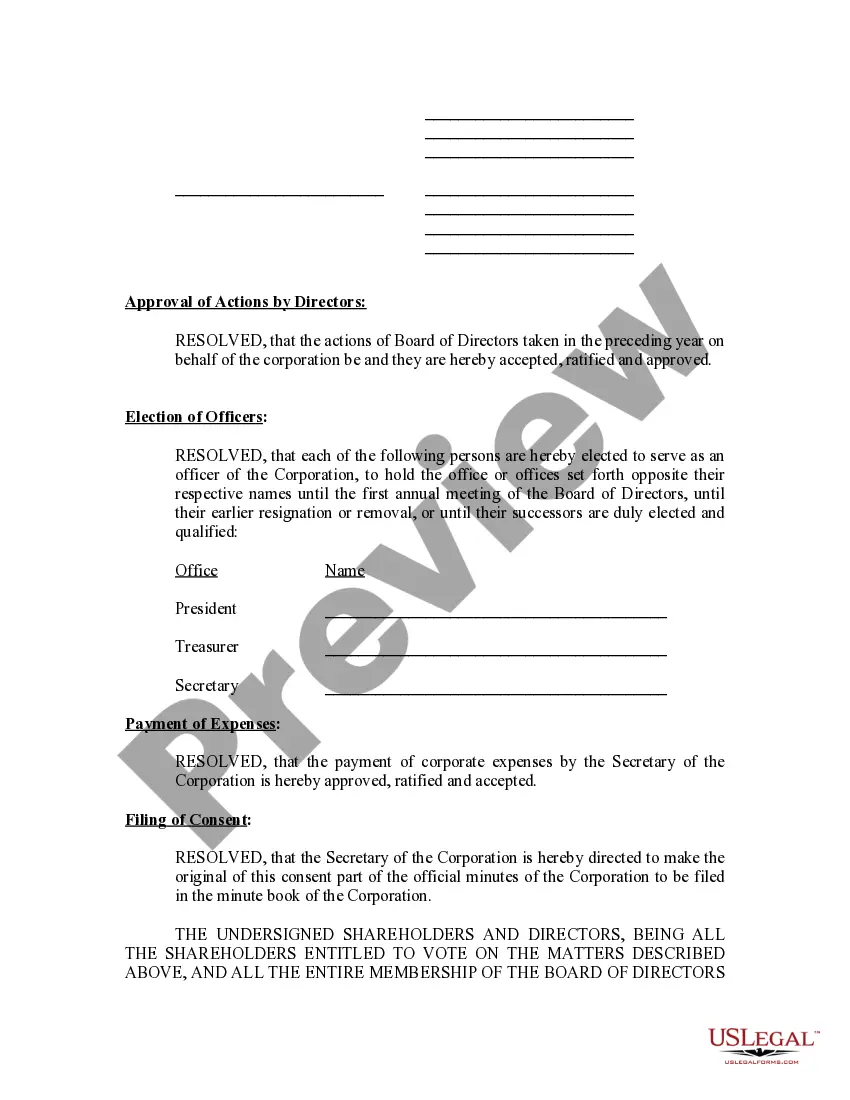

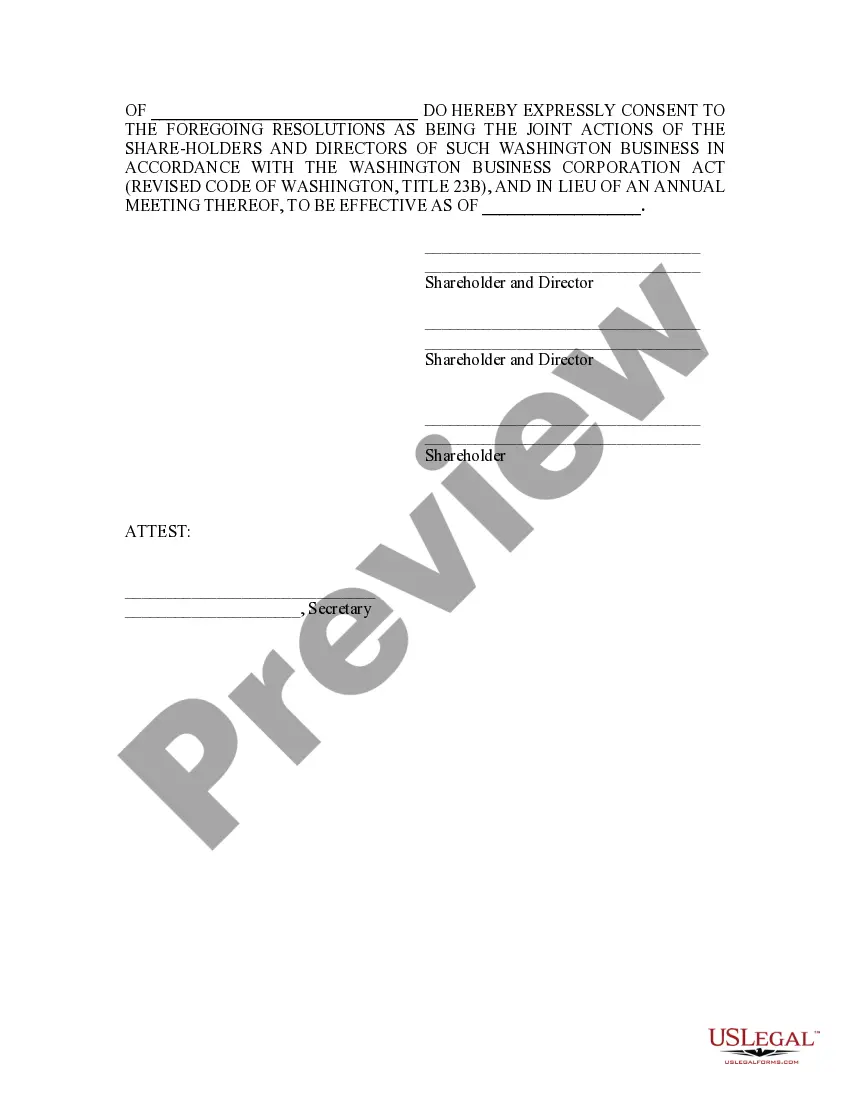

E File Your Annual Washington Meeting Minutes Format

Description

How to fill out Washington Annual Minutes?

It’s widely known that you cannot transform into a legal professional in an instant, nor can you learn to swiftly create E File Your Annual Washington Meeting Minutes Format without possessing a specialized background.

Drafting legal documents is a lengthy endeavor that necessitates a particular education and skill set. So why not entrust the development of the E File Your Annual Washington Meeting Minutes Format to the experts.

With US Legal Forms, one of the most comprehensive legal document repositories, you can discover everything from judicial papers to templates for internal corporate correspondence. We understand the significance of compliance and adherence to both federal and state regulations.

Create a free account and choose a subscription plan to purchase the template.

Select Buy now. Once the payment is finalized, you can download the E File Your Annual Washington Meeting Minutes Format, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to get started with our platform and obtain the document you need in just a few minutes.

- Locate the document you require using the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to ascertain if E File Your Annual Washington Meeting Minutes Format is what you’re looking for.

- Initiate your search anew if you require another form.

Form popularity

FAQ

Your Washington Annual Report can be filed online or by mail. However, if you file by mail, you'll need to contact the Secretary of State's office and request to have a paper form mailed to you. To File Online: On the state website, go to the Annual Reports page.

How much does an LLC in Washington cost per year? All Washington LLCs need to pay $60 per year for the Annual Report fee. These state fees are paid to the Washington Secretary of State. And this is the only state-required annual fee.

Though these minutes do not need to be filed with the state and can instead be kept with your corporate records, they are important documents for protecting your limited liability status and keeping track of the votes and decisions made by your business. In other words, meeting minutes keep you compliant.

Your Washington LLC Initial Report can be filed by mail or it can be filed online. The fee for filing by mail is $10 and the fee for filing online is $30 (the state automatically adds a $20 ?expedited fee? to all online filings).

An Annual Report may be filed within 180 days before the expiration date. Visit our Corporations and Charities Filing System landing page and log in to your account. Once logged in, select ?Business Maintenance Filings? from the navigation bar on the left side, then select ?Annual Report?.