Virginia Promissory Note Contract Without Loan

Description

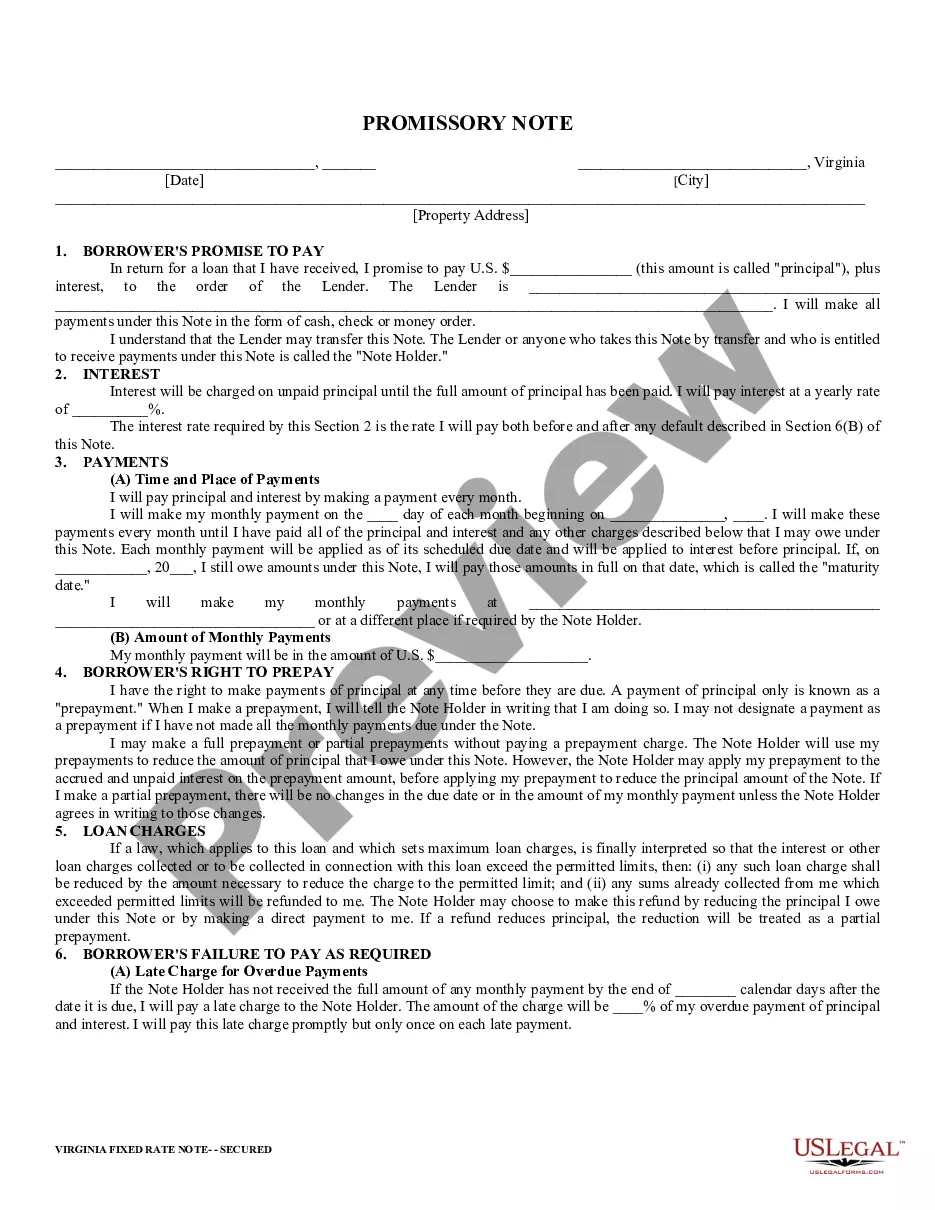

How to fill out Virginia Secured Promissory Note?

Properly prepared official documents are one of the essential safeguards for preventing problems and disputes, but obtaining them without the assistance of a lawyer may require time.

Whether you need to promptly locate an updated Virginia Promissory Note Contract Without Loan or any other templates for employment, family, or business scenarios, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Additionally, you can access the Virginia Promissory Note Contract Without Loan at any time later, as all documents previously acquired on the platform remain accessible within the My documents tab of your profile. Save time and money on creating official documents. Try US Legal Forms today!

- Verify that the form is appropriate for your situation and location by reviewing the description and preview.

- If necessary, search for another example using the Search bar in the header of the page.

- When you find the suitable template, click on Buy Now.

- Choose the pricing option, sign in to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

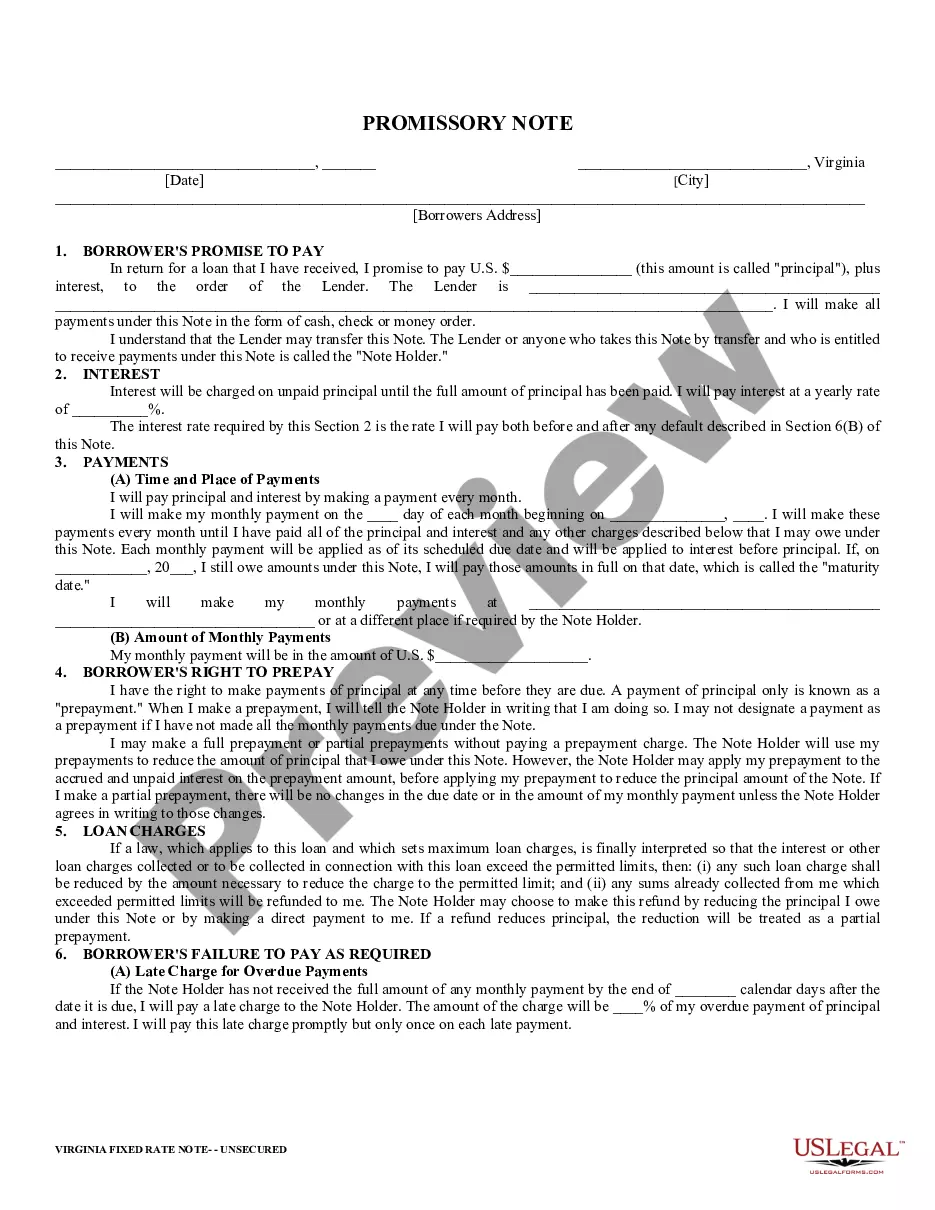

- Choose PDF or DOCX file format for your Virginia Promissory Note Contract Without Loan.

- Click Download, then print the template to fill it out or upload it to an online editor.

Form popularity

FAQ

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

How to Write a Promise to Pay Letter?State the sum that is owed. This should be stated without adding on any interest fees or charges.Total sum.Correct date.Identifying the individual in debt.Identifying the creditor party.Payment dates.Sign and date.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for most promissory notes to be witnessed or notarized in Virginia (promissory notes related to real estate must be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.